- Bloomberg View – Tim Duy: Fed Must Look at Soft Data to Justify a Rate Hike

Note that the divergence between markets and the Fed appears to have been more a matter of increasing confidence in the outlook than one of dramatic change in the outlook itself. The hard data was not sending a strong signal that the Fed should revise upward its forecast (although the February employment report may give such a signal). With the central bank’s basic forecast intact, it seemed reasonable that it could still afford patience. In recent weeks, however, we have seen an increasing gap between “hard” and “soft” survey data. For the Fed, however, the combination of the soft data, improving external conditions, the possibility of fiscal stimulus and buoyant financial markets is sufficient to pull forward the next rate hike in the absence of a marked change in the forecast. Everyone on the Open Market Committee can see a greater upside risk for their forecasts. And with the economy hovering near what officials believe to be full employment, a shift in even just the balance of risks is sufficient to pull forward the next rate hike. They fear that further delay will set the stage for a rapid increase in hikes later that ultimately ends in recession. What does a rate hike in March mean for the rest of the year? If the economic forecasts of FOMC participants remain little changed, then arguably we should expect that the median rate projection of three 25 basis-point rate hikes for 2017 also remains unchanged.

Comment

As we concluded in a post on Tuesday:

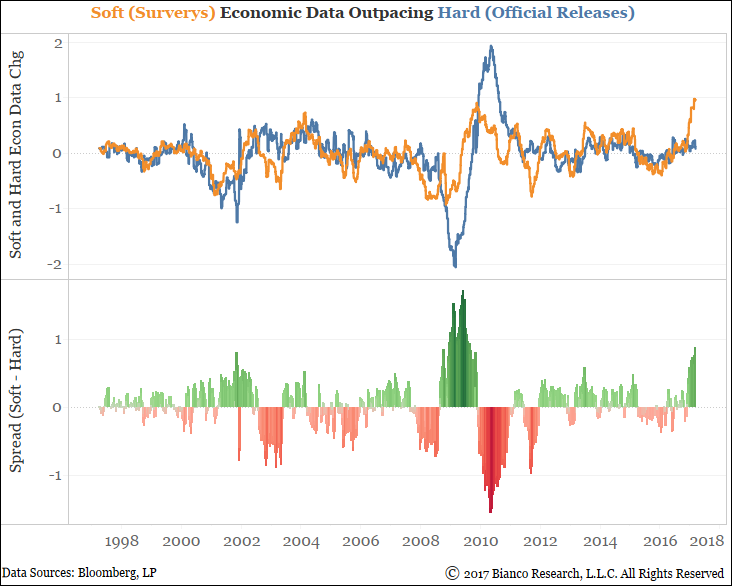

Soft economic data is increasingly out-pacing hard in the U.S. since Trump’s win spurred a substantial burst in business confidence. Soft economic data has historically been a leader, however failure by economic growth to play catch-up would not bode well for risk assets.