- The Financial Times – OECD warns of need to escape global ‘low-growth trap’

Static forecasts signal disconnect between business upswing and real economy outlook

A strong upswing in business and consumer confidence and buoyant financial markets are not enough to pull the world out of a “low-growth trap”, the OECD said on Tuesday as it released its latest forecasts.The Paris-based club of mostly rich nations noted that it had not revised up its growth forecasts from those in November so there was now a troubling disconnect between buoyant financial market valuations and real economy prospects.

Comment

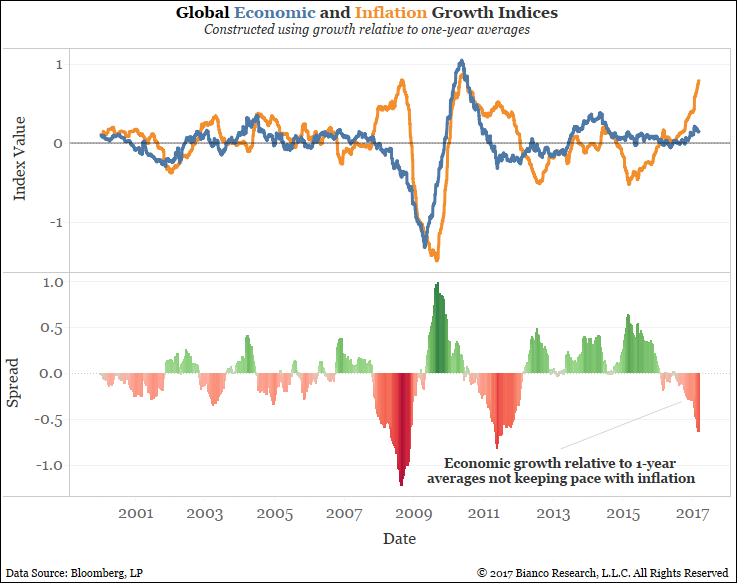

The chart below shows global economic (blue) and inflation (orange) growth indices in the top panel. These are constructed using growth rates relative to one-year averages across major data releases. Their spread is shown in the bottom panel.

Economic growth is improving relative to one-year averages, albeit at a tepid pace. As we have discussed, concerns are growing inflation is exceeding economic growth at an increasing pace. Similar conditions have NOT been a recipe for success for equity markets.

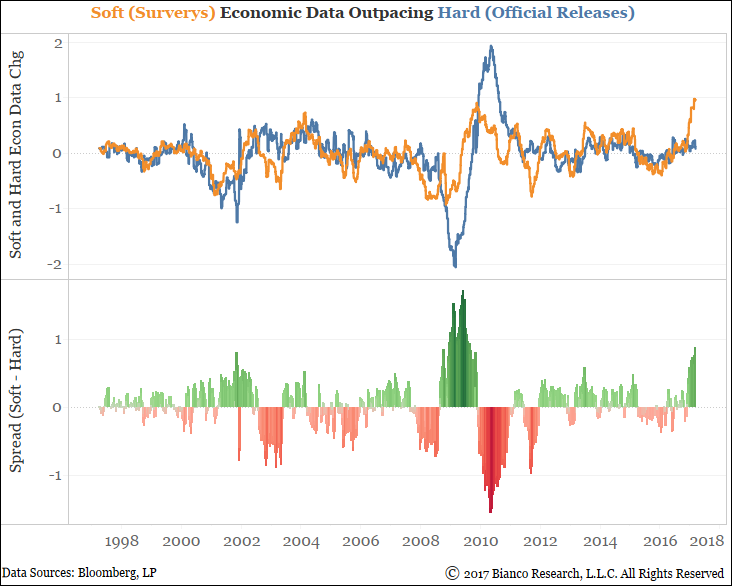

The chart below shows soft U.S. economic data (e.g. business and consumer confidence) in orange and hard U.S. economic data (e.g. payrolls and industrial production) in blue. Their spread is in the bottom panel.

Soft economic data is increasingly out-pacing hard in the U.S. since Trump’s win spurred a substantial burst in business confidence. Soft economic data has historically been a leader, however failure by economic growth to play catch-up would not bode well for risk assets.