- The Wall Street Journal – High-Yield Jitters Lead Some Advisers to Sell ETFs

An interest-rate rise could trigger an exodus, they say, and they are trying to get out first

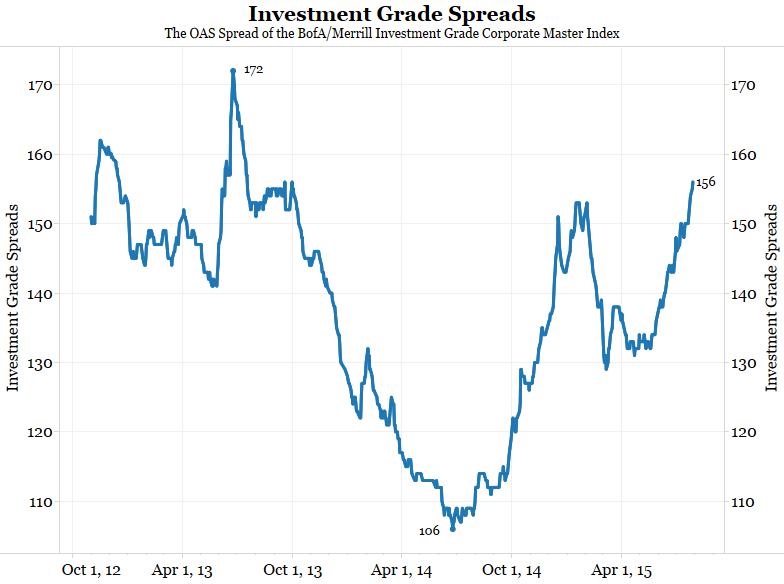

Some financial advisers have been trimming their clients’ exposure to high-yield bond exchange-traded funds or cutting it altogether in recent months. They are worried that an interest-rate rise could trigger a rush for the exits that might exacerbate current liquidity issues in the market for below-investment-grade debt. After seven years of low rates, “we are in uncharted water” as to how quickly the Federal Reserve will raise rates and how quickly that will affect the value of current income holdings, says Michael Johnson, a broker with Raymond James Financial Services Inc., in Elm Grove, Wis. He says he wants to proceed carefully “and have a life vest nearby.” Low interest rates have driven investors to take on added risk in their hunt for yield. It is easy to see why they have been drawn to high-yield bond ETFs, which can yield more than 5%, compared with just 2% for an ETF investing in seven- to 10-year Treasurys. Nearly $26 billion flowed into high-yield bond ETFs from 2008 through 2014, according to Thomson Reuters Corp. ’s Lipper unit. Another $1.09 billion has flowed into the funds this year through July 22, bringing their assets to $37.8 billion, Lipper says. Those investors have flooded in as Wall Street securities firms have had to rein in their risk-taking, including their bond buying, as a result of the Dodd-Frank Act. Their reduced involvement has raised fears that buyers could dry up if a short-term interest-rate increase by the Federal Reserve prompts bond investors to flee.

Comment

<Click on chart for larger image>

<Click on chart for larger image>

<Click on chart for larger image>

<Click on chart for larger image>

<Click on chart for larger image>

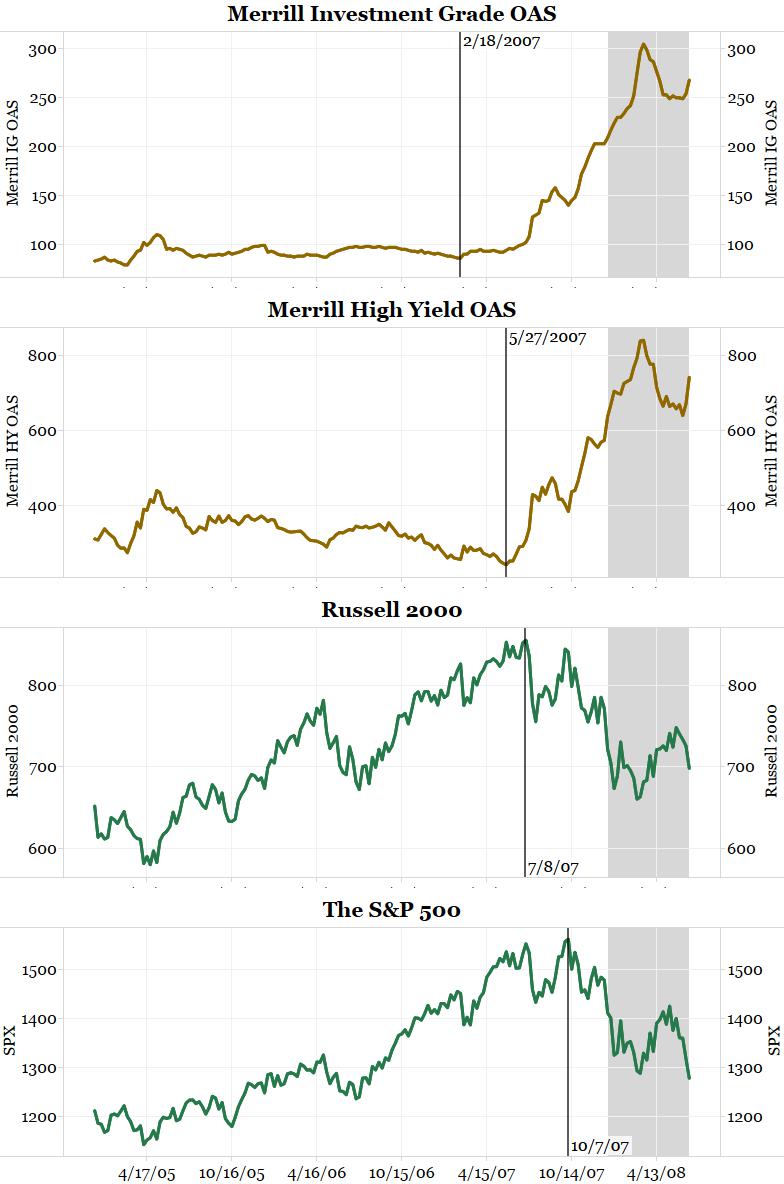

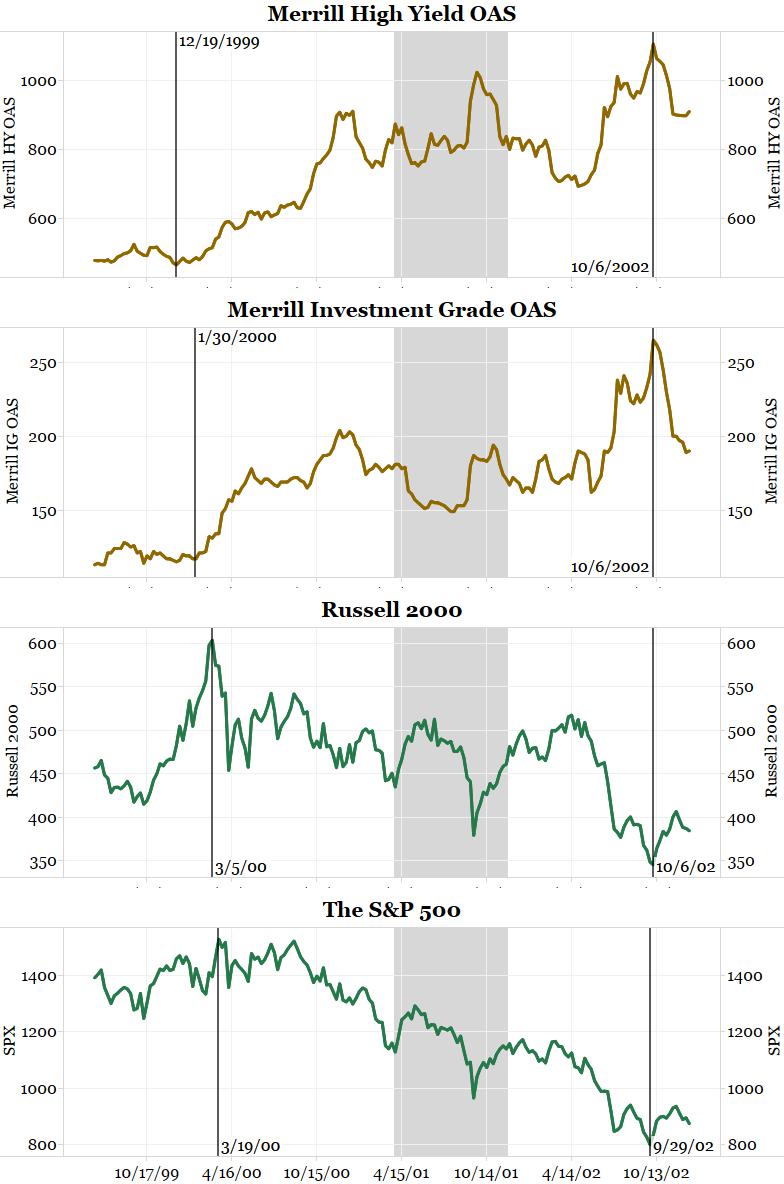

Finally, the last chart shows the markets around 2001. In 1999 credit spreads hit their narrows months before stocks and the 2001 recession (shaded area).

<Click on chart for larger image>

<Click on table for larger image>

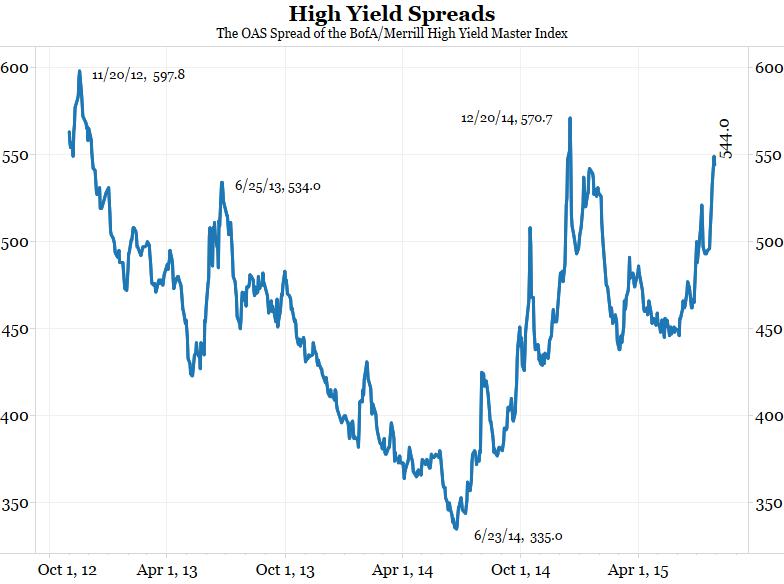

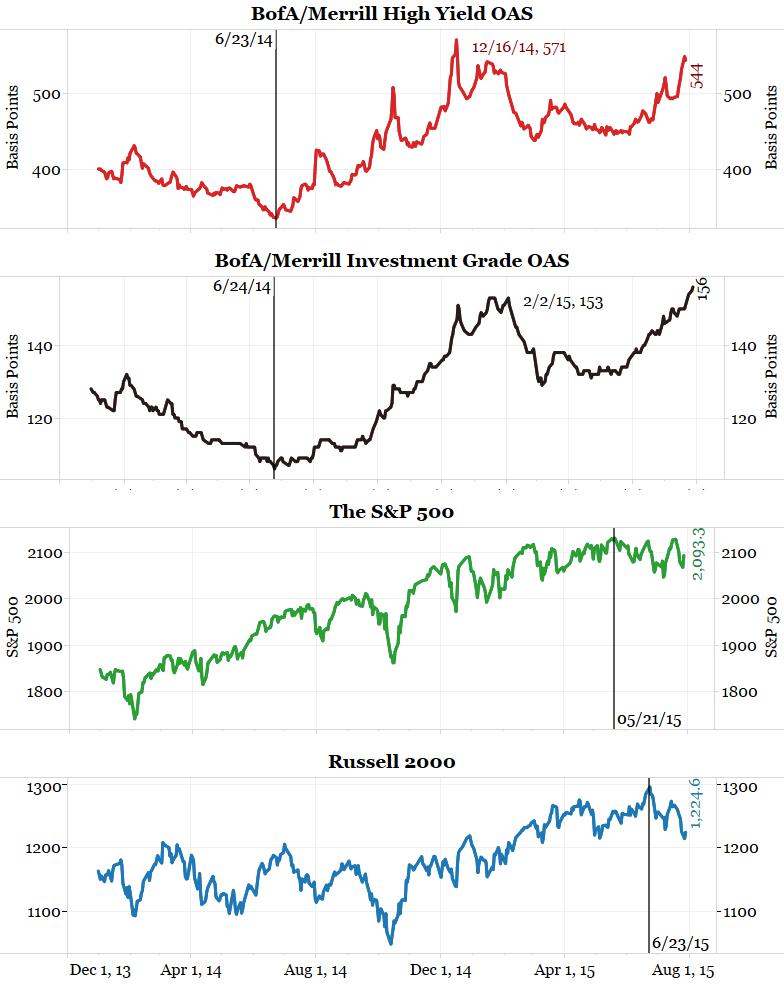

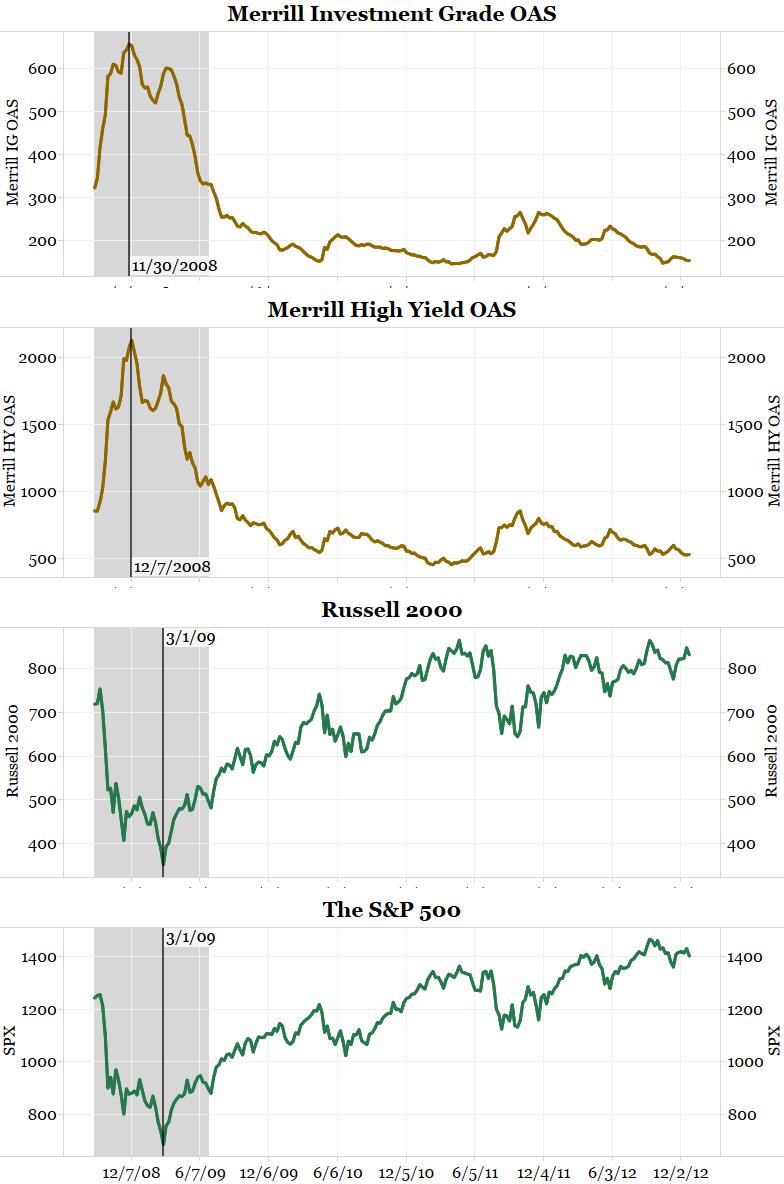

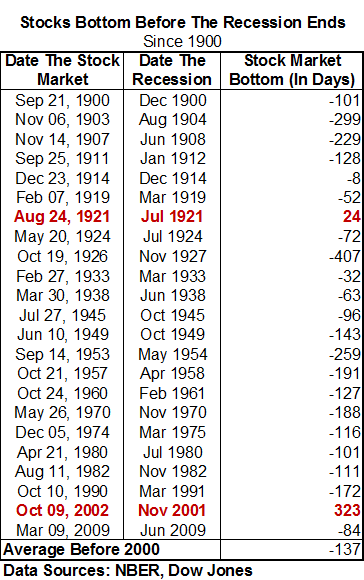

Credit spreads led both equities and the economy over the last two recessions and the last four economic turns. The fact that credit spreads bottomed over a year ago and continue to widen could be considered a warning sign for both the economy and the stock market.