- Bloomberg.com – Yellen Maintains Outlook for First Interest-Rate Rise in 2015

Federal Reserve Chair Janet Yellen said she still expects to raise interest rates this year and repeated that the subsequent pace of increases will be gradual. “I expect that it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy,” Yellen said in her first public remarks since the June meeting of the Federal Open Market Committee. “But I want to emphasize that the course of the economy and inflation remains highly uncertain, and unanticipated developments could delay or accelerate this first step,” she said in the text of a speech Friday in Cleveland. Yellen, 68, is moving the Fed cautiously toward its first interest-rate increase in almost a decade as she weighs conflicting pressures at home and from abroad. While improving economic data in the U.S. may push the Fed to consider tightening as soon as September, risks from Greece and China could prompt a delay. In her only mention of Greece in her prepared remarks, Yellen said the situation in that country “remains unresolved.” Fed policy makers in June forecast two quarter-point rate increases this year. The pace of tightening next year will be more gradual than they expected in March, the latest forecasts show. Since the June meeting, the labor market has shown further gains, along with housing and manufacturing, adding to evidence the economy is overcoming a first-quarter slump…The Fed chair devoted a large section of her speech to explaining how labor markets still haven’t met her criteria for full employment. The unemployment rate stood at 5.3 percent in June. “A significant number of individuals still are not seeking work because they perceive a lack of good job opportunities,” she said. “While the labor market has i mproved, it still has not fully recovered.” Yellen said the share of workers in part-time jobs who would prefer full-time work “remains higher that it would be in a full-employment economy.” She said there have been “some tentative hints” of a pick-up in wages that “may indicate that the objective of full employment is coming closer into view.”

Comment

<Click on chart for larger image>

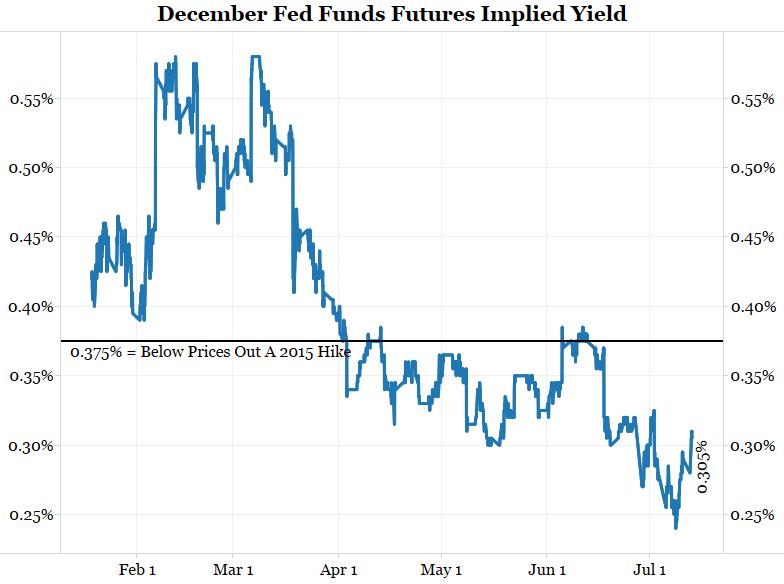

As we have been arguing all year, something is amiss. The market prices in a different reality from the Fed. Could these groups have different views of the economy?

What Is A Bad Economy?

At its September 13, 2012 FOMC meeting the Fed said:

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. The Committee is concerned that, without further policy accommodation, economic growth might not be strong enough to generate sustained improvement in labor market conditions. Furthermore, strains in global financial markets continue to pose significant downside risks to the economic outlook. The Committee also anticipates that inflation over the medium term likely would run at or below its 2 percent objective.

To support a stronger economic recovery and to help ensure that inflation, over time, is at the rate most consistent with its dual mandate, the Committee agreed today to increase policy accommodation by purchasing additional agency mortgage-backed securities at a pace of $40 billion per month. The Committee also will continue through the end of the year its program to extend the average maturity of its holdings of securities as announced in June, and it is maintaining its existing policy of reinvesting principal payments from its holdings of agency debt and agency mortgage-backed securities in agency mortgage-backed securities. These actions, which together will increase the Committee’s holdings of longer-term securities by about $85 billion each month through the end of the year, should put downward pressure on longer-term interest rates, support mortgage markets, and help to make broader financial conditions more accommodative.

In other words, the economy was so bad in September 2012 that the Fed initiated an open-ended commitment of $85 billion of bond buying a month to boost growth.

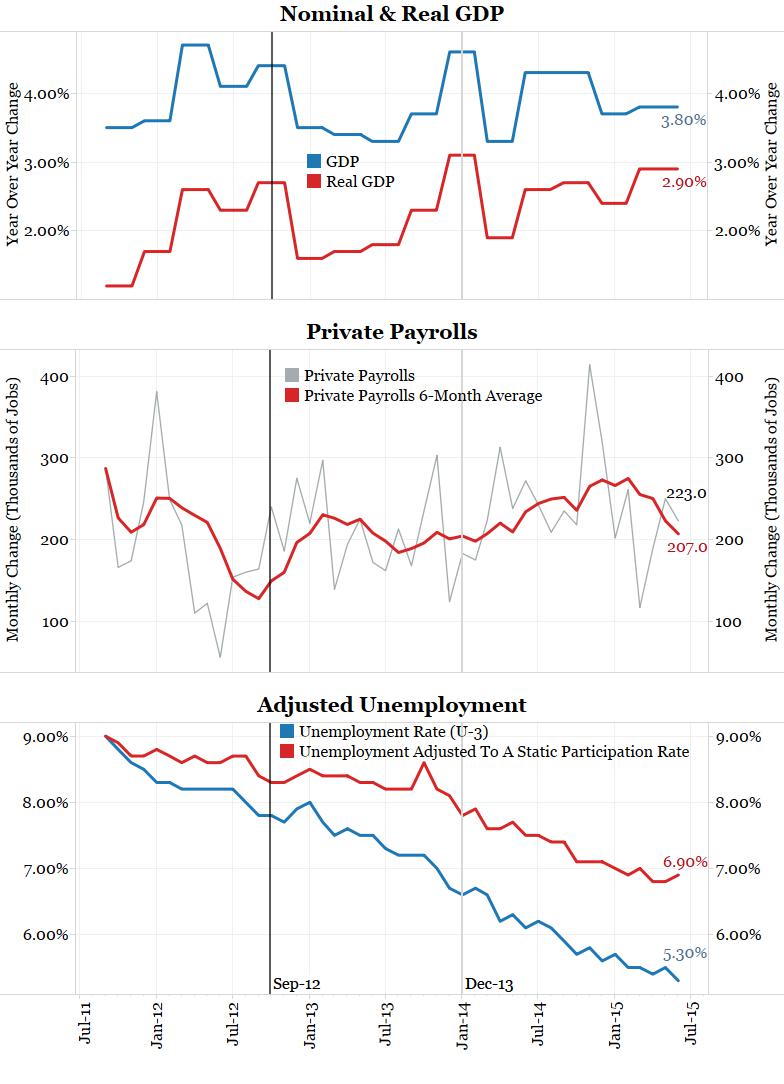

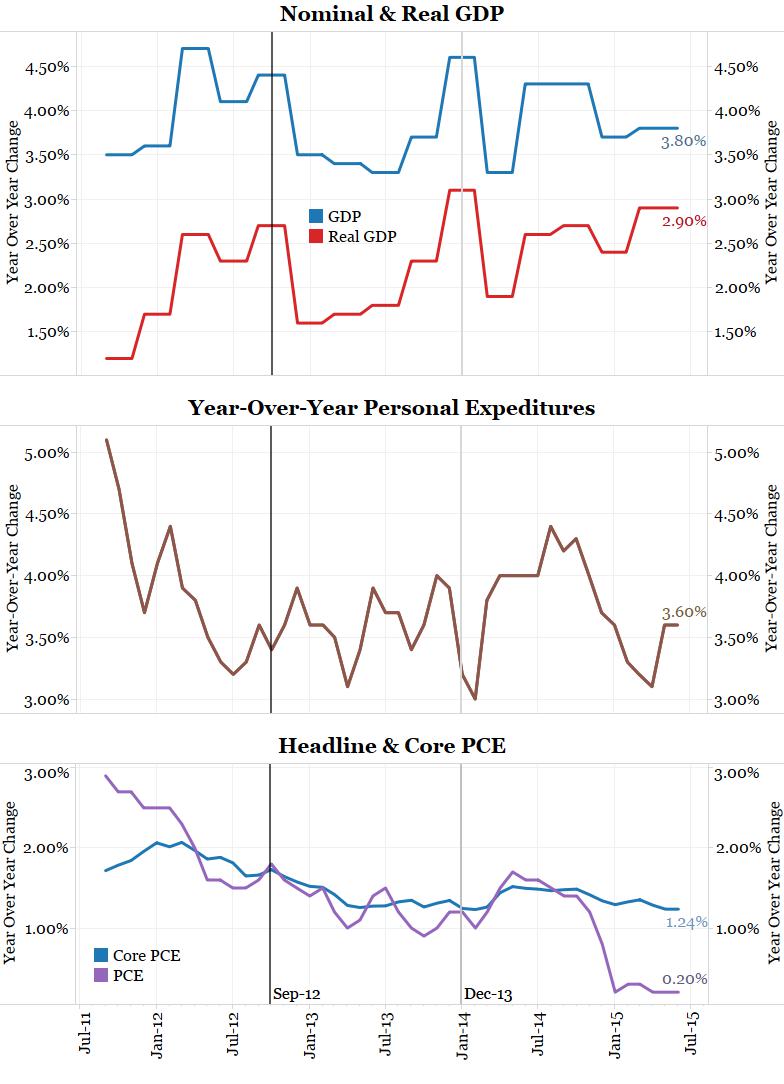

So how bad was the economy in 2012? The next two charts show some broad measures of the economy since 2011. Both charts show nominal and real GDP in the top panel as a reference. The black vertical line on the left marks September 2012. The gray vertical line on the right marks December 2013, when the Fed said things were so much better that they announced the start of the taper.

<Click on chart for larger image>

<Click on chart for larger image>

What did the Federal Reserve see in the economic landscape that improved over this span of time? GDP growth rates are lower now. Inflation is lower. Personal expenditures were roughly the same. Payroll growth is roughly the same. In other words, the economy was roughly the same then as it is now.

The one big exception is the unemployment rate. As the bottom panel in the middle chart above shows, the unemployment rate is down a lot (blue line), but half of its fall is due to the drop in the participation rate. The red line adjusts the unemployment rate for a static participation rate.

If one wants to make the case that the fall in the unemployment rate is the reason the Fed is removing the punch bowl, we can understand the argument. However, Yellen addressed this in her speech on Friday:

As I noted, the national unemployment rate has declined markedly during the economic recovery. But it is my judgment that the lower level of the unemployment rate today probably does not fully capture the extent of slack remaining in the labor market–in other words, how far away we are from a full-employment economy.

Yellen seems to be discounting the fall in the unemployment rate. If so, we are left wondering why the Fed is so intent on raising rates.

Financial Stability

We do not believe the economy has changed enough since 2012 to warrant a completely different outlook from the Fed. If they supported open-ended QE in 2012, the economy should dictate the same policy now. We believe the Fed wants to raise rates for other reasons – ones they cannot say out loud.

Those other reasons are what the Fed terms “financial stability.” They understand QE distorts markets, so they want to normalize before things get out of hand.

The Fed cannot vocalize this without admitting their policy artificially propped the markets over the last several years, so they instead focus on data dependency. The problem, however, is they want us to believe that the economic stats shown above are now materially better than they were in 2012.

As the fed funds chart above shows, the markets don’t buy the Fed’s line of reasoning. They do not see the material economic changes since 2012. Additionally, markets like easy policy. So the markets are not pricing in hikes at the pace the Fed is suggesting.

Because of this divide, Fed officials like Yellen will continue to point to a 2015 rate hike in their speeches in the hopes the markets finally follow suit. If the markets refuse to budge, will the Fed fight the markets and hike anyway? The Fed’s actions in the post-crisis era suggest they will not fight the markets:

- As QE1 came to a close, they claimed there would be no more QE

- As QE2 came to a close, they claimed there would be no more QE

- They claimed Operation Twist would end on September 30, 2012 only to see it extended

- Calendar guidance was offered and abandoned

- Forward guidance was offered and largely abandoned

- Economic thresholds were offered as guideposts:

- First the Fed said it would raise rates once the unemployment rate dipped under 7%

- Then it was 6.5%

- Then it was “well below” 6.5%

- Then it was “considerable period” that Yellen mistakenly defined as “about six months”

- Then it was “patient” which Yellen defined as “about two meetings”

- Then it was “meeting-to-meeting”

- Currently it is “data dependent”

When it comes to Fed policy, we believe the market marches to its own (dovish) beat and tells the Fed what it wants. The Fed tries to influence the market via speeches, the FOMC statements, the SEP and minutes. But as the list above shows, the market typically gets its way. In the end we believe the Fed is so worried about financial stability that they will cave to market opinion. This is why taking the Fed at face value is a dicey proposition at best. Following market pricing is more accurate.