- Fortune.com – It’s Time to Just Kill the Volcker Rule

Last week, federal regulators proposed softening the Volcker rule. The nearly 400-page proposal tries to ease the rule’s restrictions on bank trading practices, based largely on bank size. The approach, while rational, is really just an exercise in nibbling around the edges. It would be far better—and simpler—if Congress were to just eliminate the rule completely. A regulation mandated by Dodd-Frank, the Volcker rule partially bans proprietary trading by banks. The idea behind the rule—a longtime pet project of former Fed Chair Paul Volcker—sounds perfectly sensible: Banks with access to federal deposit insurance and the Fed’s discount window should not be allowed to make risky bets for their own profits. That idea is flawed, however, because it fails to recognize that U.S. commercial banks make risky bets—with insured funds—for their own profits all the time.

Summary

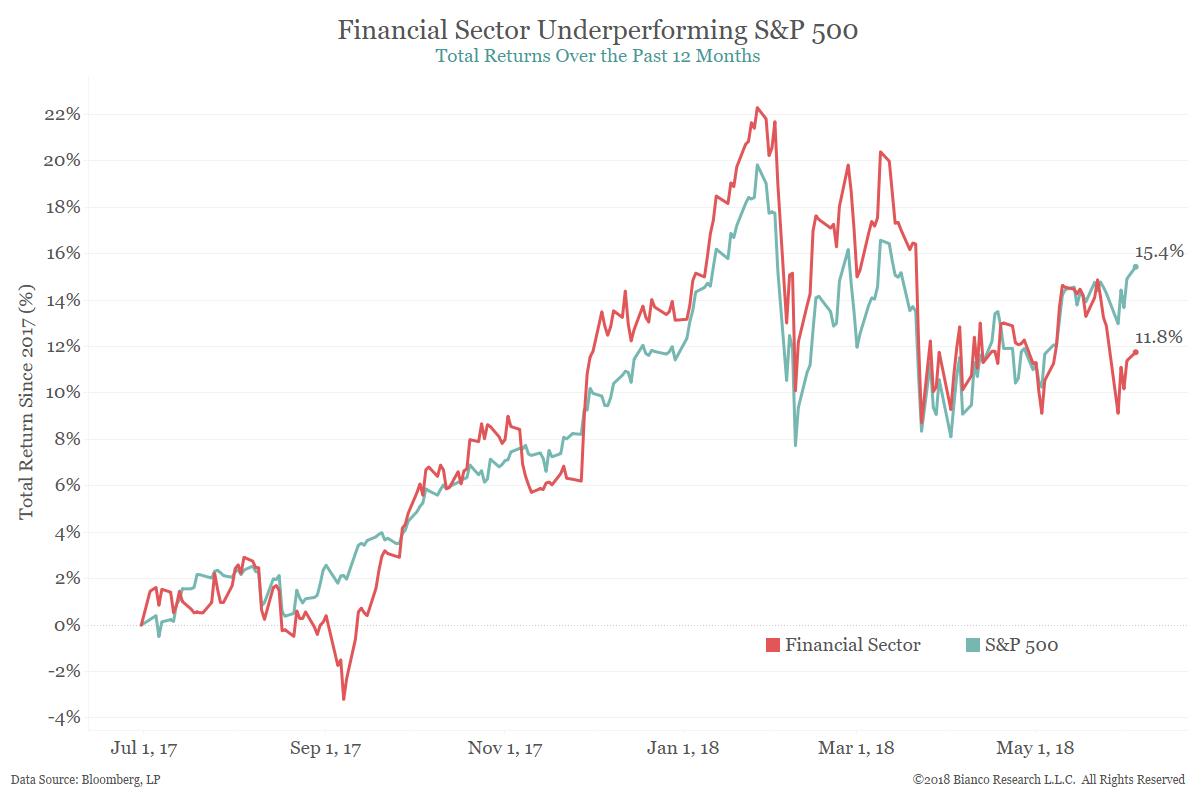

Last week’s news that the Fed endorsed a roll-back of the Volcker rule helped financial equities find their footing. The outlook for the sector remains shaky, however, and cyclical equity performance in the U.S. is limited to the technology sector. Whether the roll-back delivers will have important implications for Treasury yields.

Comment

Turmoil in Europe struck the financial sector particularly hard and has been a drag on the recovery. As the chart at the top of the post shows, the financial sector has lagged the broader S&P 500 by 3.6% since the rebound. The sector has fallen out of favor with ETF investors as well. The chart below shows net ETF flows for U.S. equity sector funds in May. Financials saw the largest net outflows ($743 million) by a wide margin, followed by consumer discretionary funds, another cyclical sector.

Last month we discussed an alternative to the BofA Merrill Lynch fund flows index for gauging a shift into a risk-off environment. One idea was the spread between risk-adjusted returns between cyclical (technology, consumer discretionary, financials) and non-cyclical (consumer staples, real estate, utilities). Despite the technology sector’s enthusiastic rebound, the underperformance of the other two cyclical sectors has this ratio on the threshold of outperformance by non-cyclical sectors. Prior shifts toward non-cyclical outperformance were long-lasting prior to 2017, and reliably accompanied by falling Treasury yields.

The return spread above isn’t the only indicator that flashed a warning signal last week. We use total returns for financial sector equities to forecast changes in the spread between the U.S. 10-year and 2-year Treasury yields. Financial sector underperformance, exacerbated by concerns in Italy and Spain, pointed toward 2y10y flattening to new lows. The rebound has seen expectations for the 2y10y spread stabilize, but the outlook for net interest margins remains shaky.

We noted in our credit update yesterday that tighter financial conditions appear to be biting as the Fed prepares to hike rates again this month. Expectations for renewed flattening in the 2y10y spread would hit just as the sector endured the fourth consecutive month of tighter financial conditions. This is the first such instance since August 2015.

Conclusion

Many are hoping that a relaxation of the Volcker rule will provide the financial sector a much-needed boost. Whether the rule changes deliver may have much wider implications. Deteriorating performance of cyclical equities outside the technology sector has us on the brink of a shift toward outperformance of non-cyclical equities. Falling Treasury yields tend to accompany these shifts and would bring more pain to the financial sector.