-

Bloomberg.com – Fannie, Freddie Say Capital Cushion Is Substantial

Fannie Mae and Freddie Mac, the largest U.S. mortgage-finance companies, defended their finances and said they have enough capital to weather the housing slump and help bolster the home loan market. Fannie Mae “has access to ample sources of liquidity, including access to the debt markets,” Chuck Greener, a spokesman for the Washington-based company said in a statement today. In a separate release, McLean, Virginia-based Freddie Mac said it’s “adequately capitalized, highly liquid and an essential part of the nation’s housing system.” Shareholders have lost at least 74 percent this year on escalating concern that Fannie Mae and Freddie Mac, which own or guarantee about half the $12 trillion in home loans outstanding, don’t have enough capital. The worries increased this week, prompting the government to consider options including having regulators take over one or both companies, said Joshua Rosner, an analyst with Graham Fisher & Co. Inc., who met with officials in Washington yesterday.

Comment Last Friday after the close, both Fannie and Freddie made statements saying they were properly capitalized and had enough liquidity. On Bloomberg TV Thursday we were interviewed alongside Eileen Fahey of Fitch and she reiterated the view that they were properly capitalized. Senator Chris Dodd (D-CT) said it again this morning on CNBC.

If everyone keeps saying these two companies are properly capitalized, why does the market think otherwise?

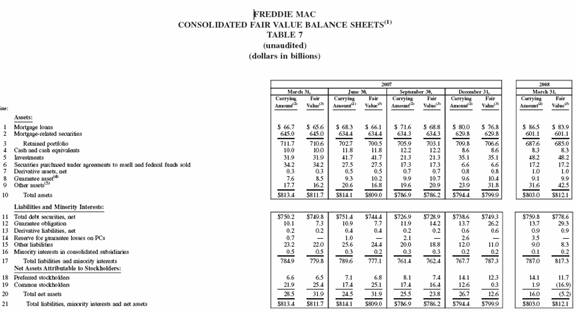

We believe the answer lies in Fannie and Freddie’s financial statements themselves. Recall that both Fannie and Freddie were involved in an accounting scandal. As part of the settlement with their regulator OFHEO, they were required to present a “fair value” balance sheet (a balance sheet marked at market prices and not at their “model prices”). Below we show these balance sheets and link to their financial statements.

<For a larger readable, click on statement>

<Original is here, page 52>

<For a larger readable, click on statement>

<Original is here, page 33>

To be fair, the section displaying these balance sheets (which the link takes you too) has pages of notes and explanations which attempt to say they are meaningless.

When looking at them, one can see why they would want you to believe they are meaningless. They present Fannie Mae and Freddie Mac in a bad light.

According to Fannie Mae’s “fair value” balance sheet (first graphic above), “net assets” (net equity) collapsed to $12.2 billion on March 31, 2008 from $35.8 billion on December 31, 2007. Given the worsening housing situation, this fair value balance sheet could show a negative equity position as of June 30, 2008 when it is released later this quarter.

Freddie Mac’s position is far worse (second graphic above). As the summary below shows, Freddie was at a negative equity position on March 31, 2008.

Let us repeat, Freddie Mac was insolvent by this measure on March 31, 2008. Q1 financial statements detailing this were released on May 14. So, it is not a secret and technically it is not new. What appears to be new is the epiphany the market had in the last several weeks. See a chart of Freddie Mac’s stock, it plummeted from about $27 on May 14 to $7.75 on Friday.

Maybe the emotional move is not the selling of the last two weeks. Maybe it was the optimism about these companies until two weeks ago. If so, regulators and company officials need to explain why the market is wrong to use the fair value balance sheet as a “leading indicator” of their upcoming financial statements. So far, they have not touched this topic.