<Click on graphic for larger image>

- Barron’s – Oil Prices: Four Experts Size Up the Energy Market

Four experts explain what’s ahead and highlight the best investment opportunities in the energy sector.

Perhaps the biggest surprise of 2014 was the sharp decline in oil prices. Black gold fell almost 60% from its summer peak of $107 to a low of $44 in January, before enjoying a nice bounce to a recent $53. The reverberations—good and bad—are being felt around the world, from the oil kingdoms of the Middle East to Argentina, Russia, and here in the U.S. The downturn will be the first big test of the U.S. oil-production renaissance. New technologies, such as horizontal drilling and the ability to draw oil from shale rock, have enabled companies to extract more oil from new places faster than anyone expected. In fact, they have led to a 41% reduction in U.S. imports since 2007. But with the benefits have come some negatives. Increased production, coupled with slower-than-expected growth in demand has led to today’s sharply lower oil price. What’s good news for consumers, however, can be problematic for producers. Only companies that can slash expenses and were wise enough not to take on too much debt during the boom times stand a chance of prospering today.

Comment

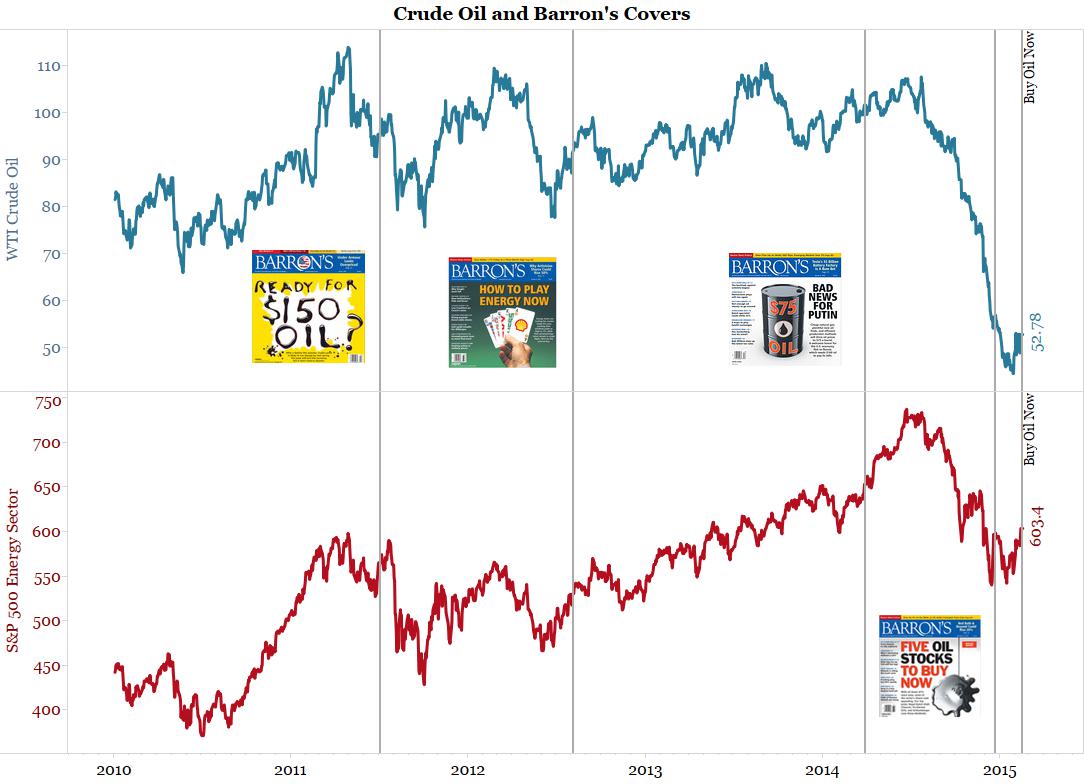

Dec 22, 2104___ Mar 31, 2014___Aug 6, 2012__ Jul 4, 2011

<click on covers to read the stories>

<Click on chart for a larger image>

To cover their bets, the latest Barron’s also included the following story on oil stocks. Not only does it conflict with the current cover, but it makes the direct opposite case of the December 22, 2014 cover which recommended the same stocks mentioned below.

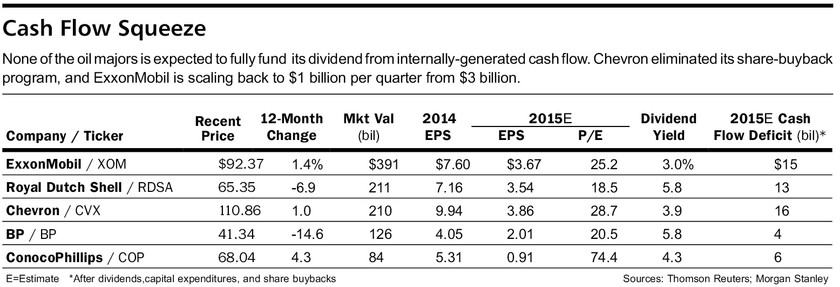

- Barron’s – Andrew Bary: Avoid Big Oil: Exxon, Chevron, Conoco and Royal Dutch

Exxon, Chevron, Conoco and Royal Dutch: There’s little upside for their shares if oil rallies.

Be careful about Big Oil. Most of the major energy stocks, including ExxonMobil, Chevron, ConocoPhillips, and Royal Dutch Shell, have showcased their historically defensive characteristics during the sharp downturn in crude-oil prices since last fall. The shares generally are little changed since mid-October, even though crude (as measured by West Texas Intermediate) has fallen 35%, to $53 a barrel from $82. The top international energy outfits are widely held by individual investors, who prize them for their secure dividend yields and financial strength. Longstanding holders probably should sit tight, but there seems little reason to commit new money to these stocks now. They may offer little upside if oil rallies, and the shares could be vulnerable if oil trades anywhere close to current levels—or even declines—during the rest of 2015. Another negative: Domestic natural-gas prices have been weak, falling 26% since October to $2.80 per million British thermal units.

Why bring this up? We have argued oil is a busted bubble. One sign that something was a bubble is a refusal to acknowledge the crash. This reminds us of housing in 2007 when prices were crashing and everyone was acting like it was business as usual.

As we have argued, oil will not bottom until there is a change of behavior and production is cut. This is a long way off.

Barron’s likes oil … again!

Below are all the previous Barron’s covers devoted to oil over the last four years. Other than the $75 oil cover (which was spun as bad news for Putin) Barron’s has been unabashedly bullish on oil and remains that way after a 60% decline in crude.

Don’t you have to sell first before you can scream buy?