Summary

Comment

Last week we showed the most recent wave of global economic growth from 2017 through early 2018 has slowed with only 41% of major economies (35 in total) producing above-average data changes. Past instances had been followed by higher global volatility and lower U.S. Treasuries.

But, the opposite has thus far transpired with long-end U.S. Treasuries breaking out to the upside and global risk only modestly on the rise.

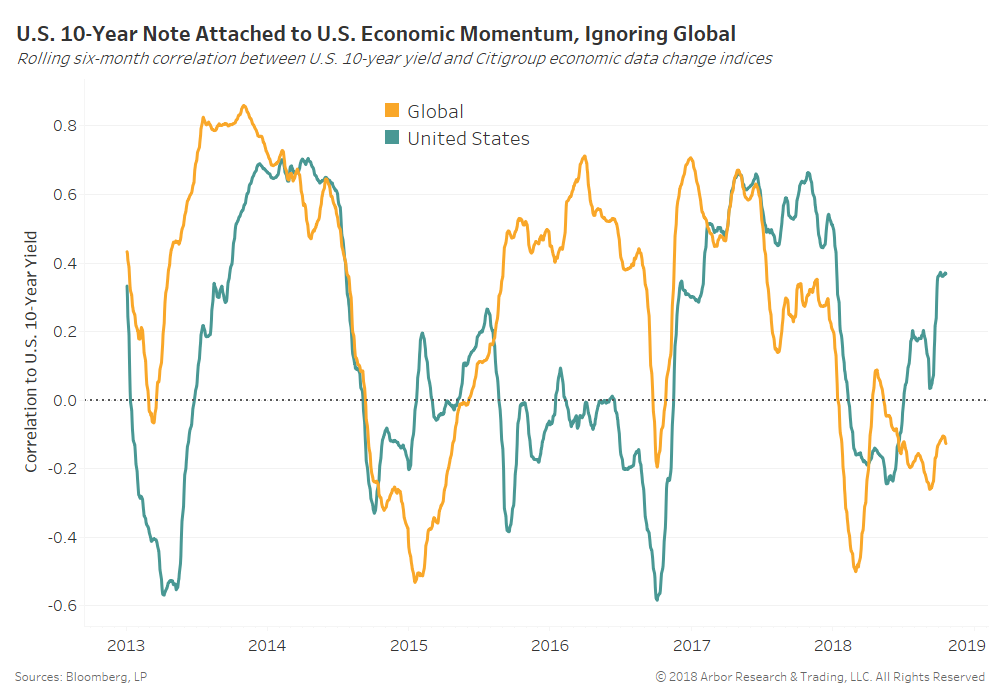

U.S. 10-year notes, the world’s most-watched safety zone of choice, has disconnected from global economic data. Instead, bond investors have reacted almost exclusively to U.S. economic data since the summer of 2018.

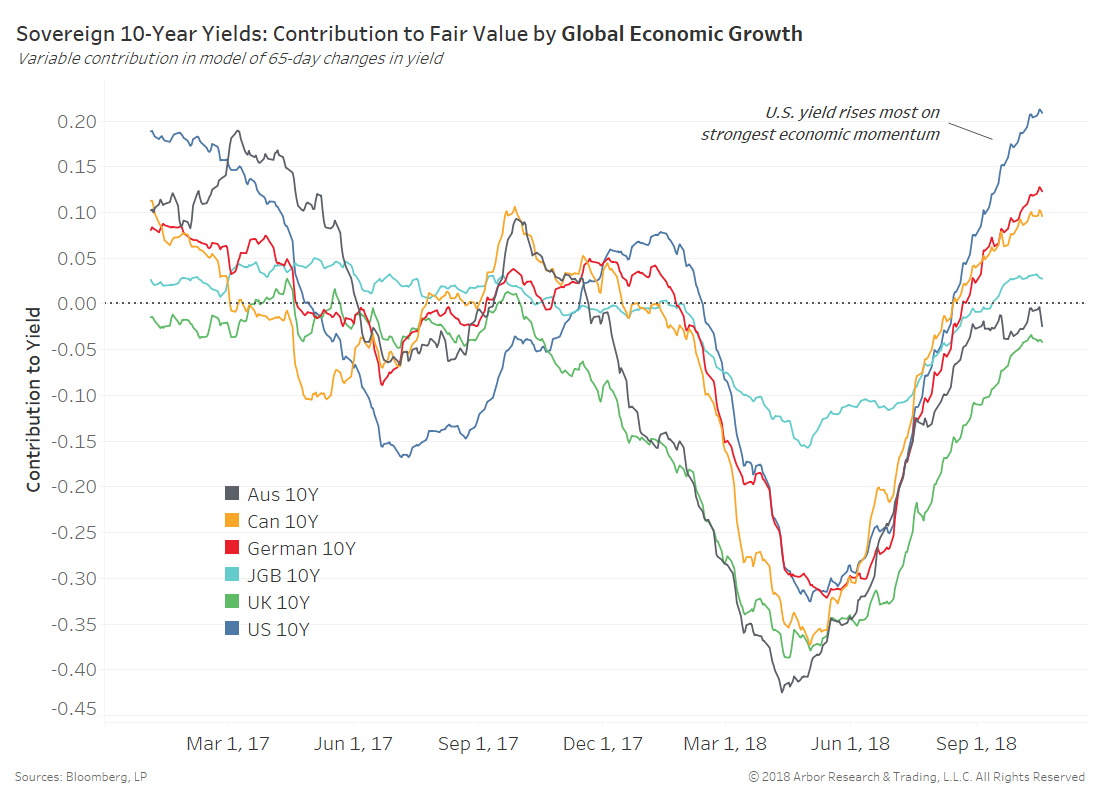

The chart below shows the contribution of global economic growth measures to 65-day changes in each sovereign 10-year yield. We produce fair value estimates using a model combining the real-time benefits of alternative data like Google search trends with traditional economic data.

Stronger economic growth has pushed U.S. 10-year yields over 20 bps higher the past three months, the most among developed economies.

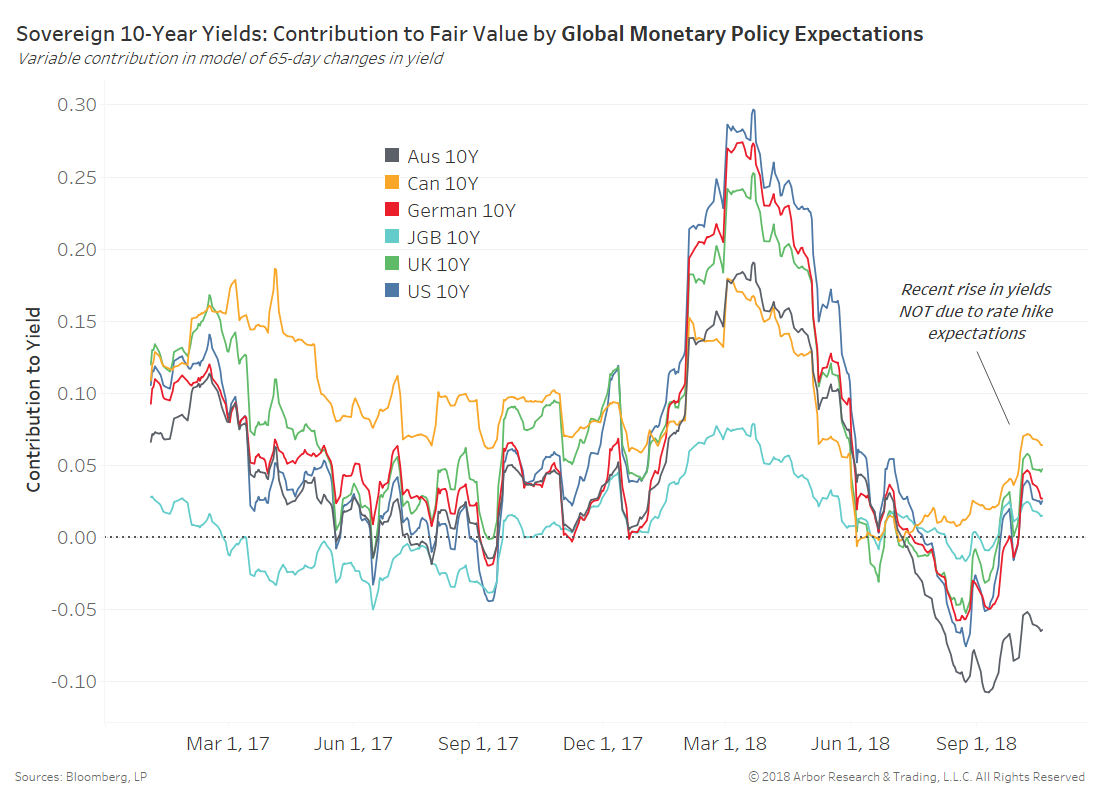

The next chart shows the contribution of global monetary policy expectations to developed sovereign 10-year yields. Rising rate hike expectations helped fuel higher yields in January and February 2018, but little bump has occurred in recent weeks.

In other words, the majority of the U.S. 10-year yield’s breakout is due to bond investors acknowledging stronger realized economic growth and not inflation or a quickened pace of tightening.

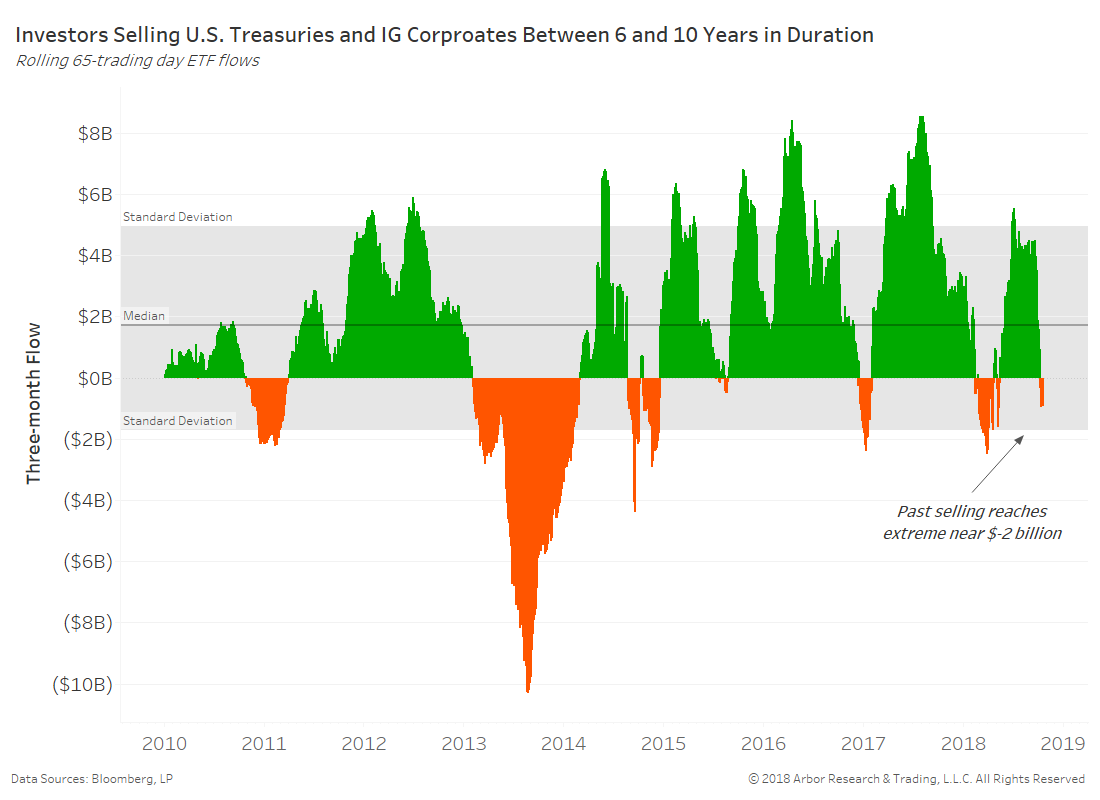

Investors have been shedding any U.S. Treasury or investment grade corporate ETF with a duration above three years. The 65-day flow of these ETFs has turned negative and on pace to reach similar amounts of past bearish cycles near $2 billion.

ETF flows have been a more reliable contrarian indicator than futures positioning. We are watching for ETF flows to reach past similar extremes to become convinced in the contrarian trade.

Most importantly, U.S. inflation expectations have refused to break out along with nominal yields. A much deeper degree of selling will not occur unless investors commit to rising inflation and wages.