Summary

Comment

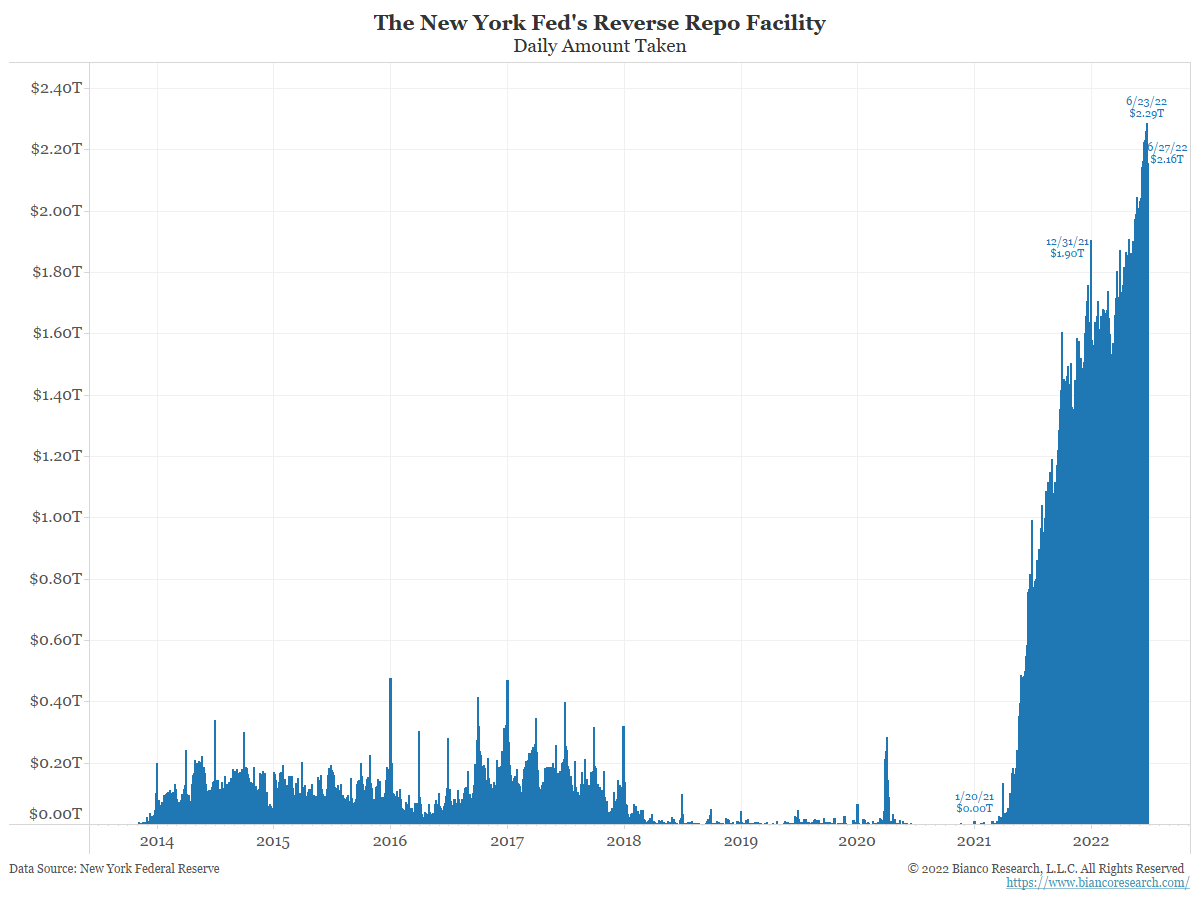

Last month we detailed the Federal Reserve’s reverse repo (RRP) facility:

Reverse repo drains cash from the banking system. The cash still exists, but its use as collateral in the financial system is restricted.

So the Fed is draining money via QT, and their reverse repo facility is another way to drain money, possibly creating a double tightening. This has never happened at this scale before and we are unsure of its potential impact.

As the chart above shows, the RRP facility continues to grow, reaching $2.29 trillion late last week.

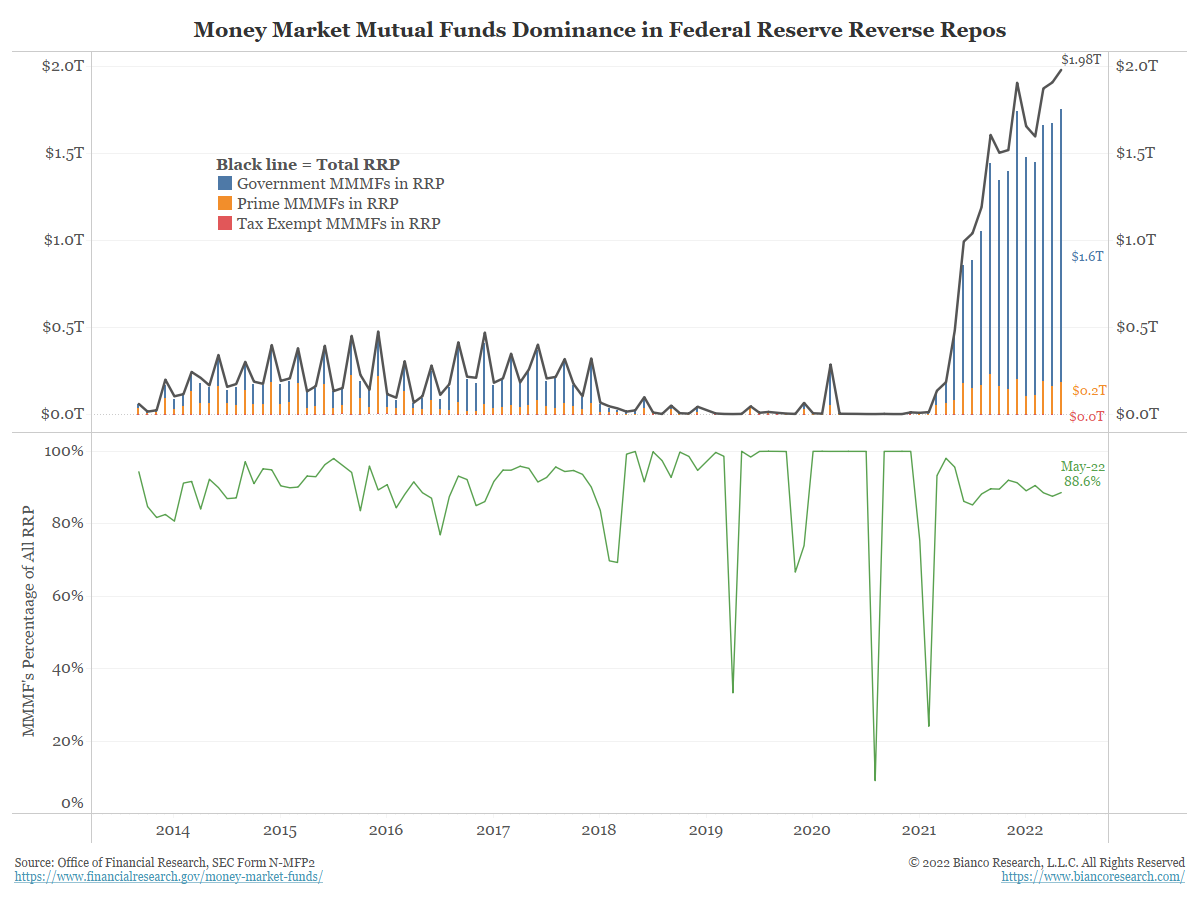

While the Fed does not offer details on who is using its reverse repo facility, money market funds are required to disclose their holdings in their monthly SEC filings. Their holdings of reverse repo are shown in the chart below.

The black line shows the total reverse repo (RRP) held by money market funds. The colored bars further break down this amount by government funds, prime funds, and tax-exempt funds. The bottom panel (green) shows the percentage of RRP held by money market funds.

As of May 31, 2022, 88.6% of all RRP was held by money market funds.

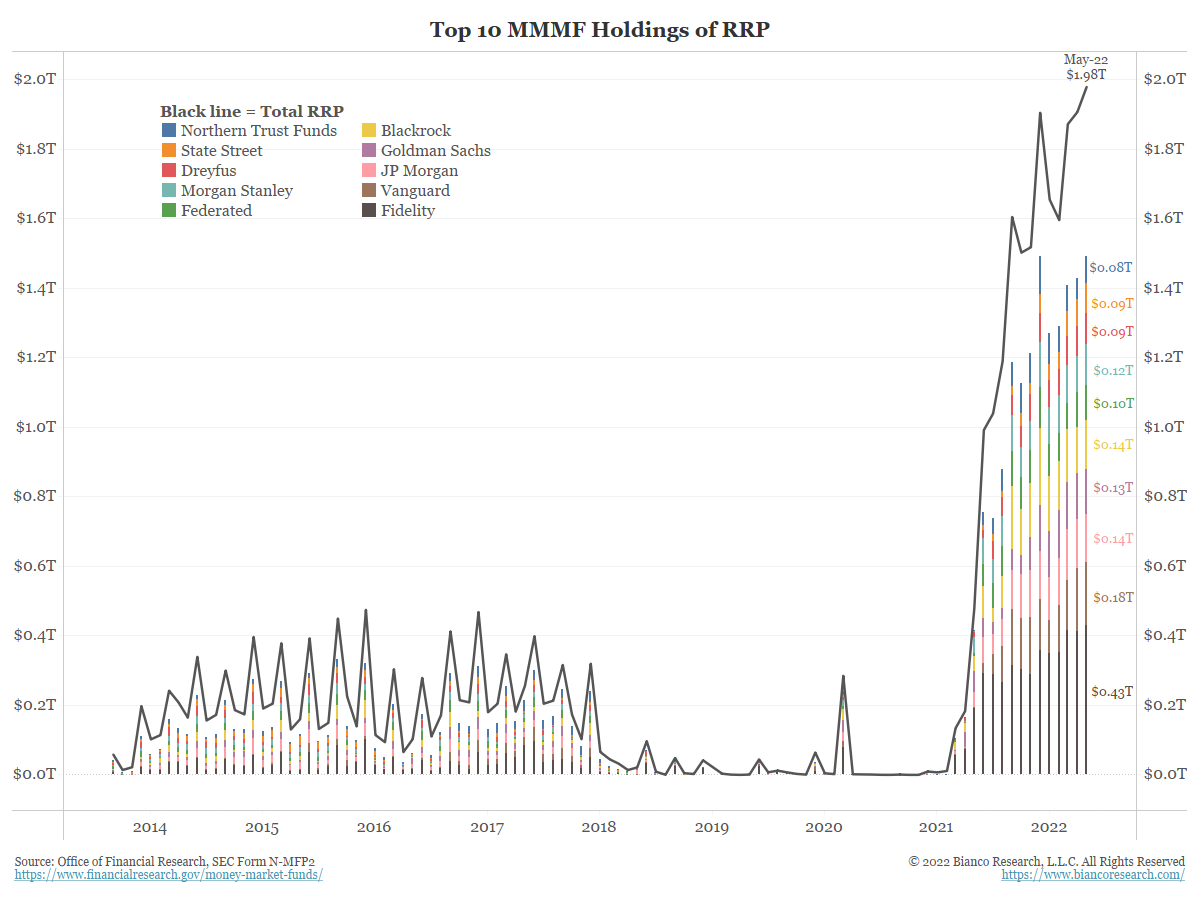

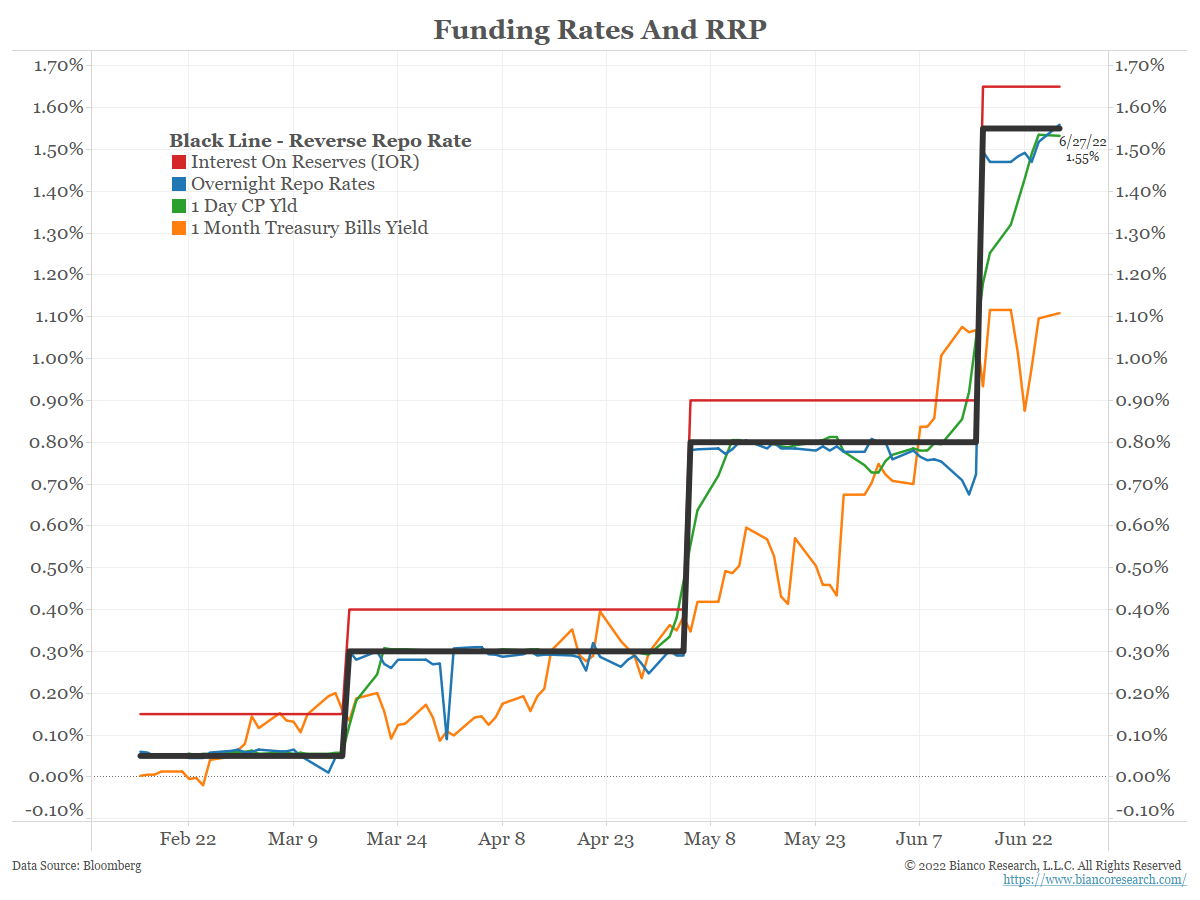

The next chart shows various short-term interest rates. If 88.6% of all RRP is held by money market funds, who owns the other 11.4%? See the red line that shows interest on reserves (IOR).

IOR is now 1.65%, set 10 basis points below the upper-end of the current federal funds rate (currently 1.75%). IOR is 10 basis points above the RRP rate of 1.55%, which is set 20 basis points below the upper end of the current federal funds rate.

Banks have a higher-rate option via IOR, so their usage of the Fed’s reverse repo facility is effectively zero. That means GSEs effectively account for the other 11.4% of repo holdings.

Since only some money market funds are eligible for the Fed’s reverse repo facility, those that are not eligible have been aggressively bidding for a reduced supply of 1-month T-bills.

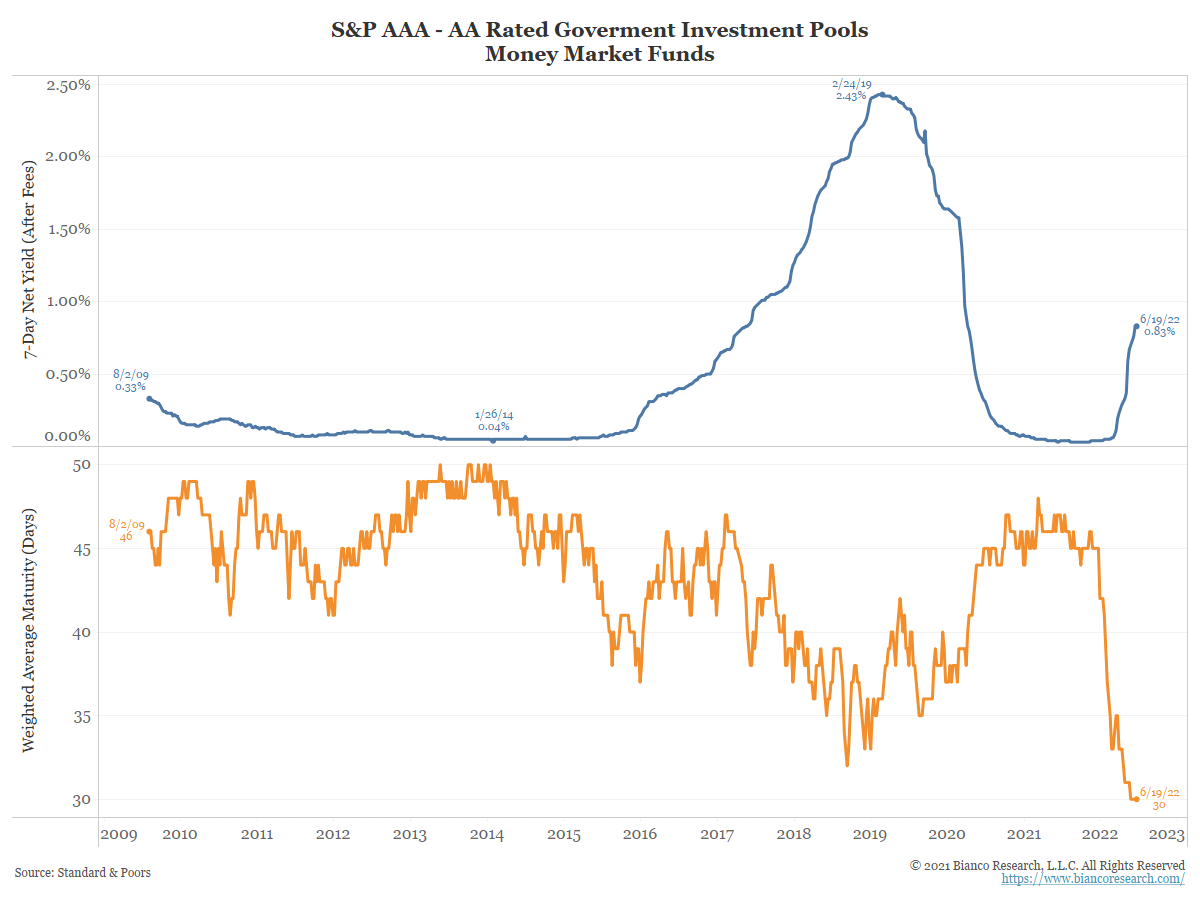

Why don’t these funds extend maturities to the 3-month bill that is yielding over 1.1%?

Money market funds do not technically sell. They let securities mature and reinvest. So with the Fed clearly telegraphing more 75-basis point rate hikes coming in July, money market funds have shortened their maturities (bottom panel) to get their holdings to mature as fast as possible so they can reinvest at a higher yield.

And with the Fed’s aggressive hiking, higher yields are coming!

What’s Next For RRP?

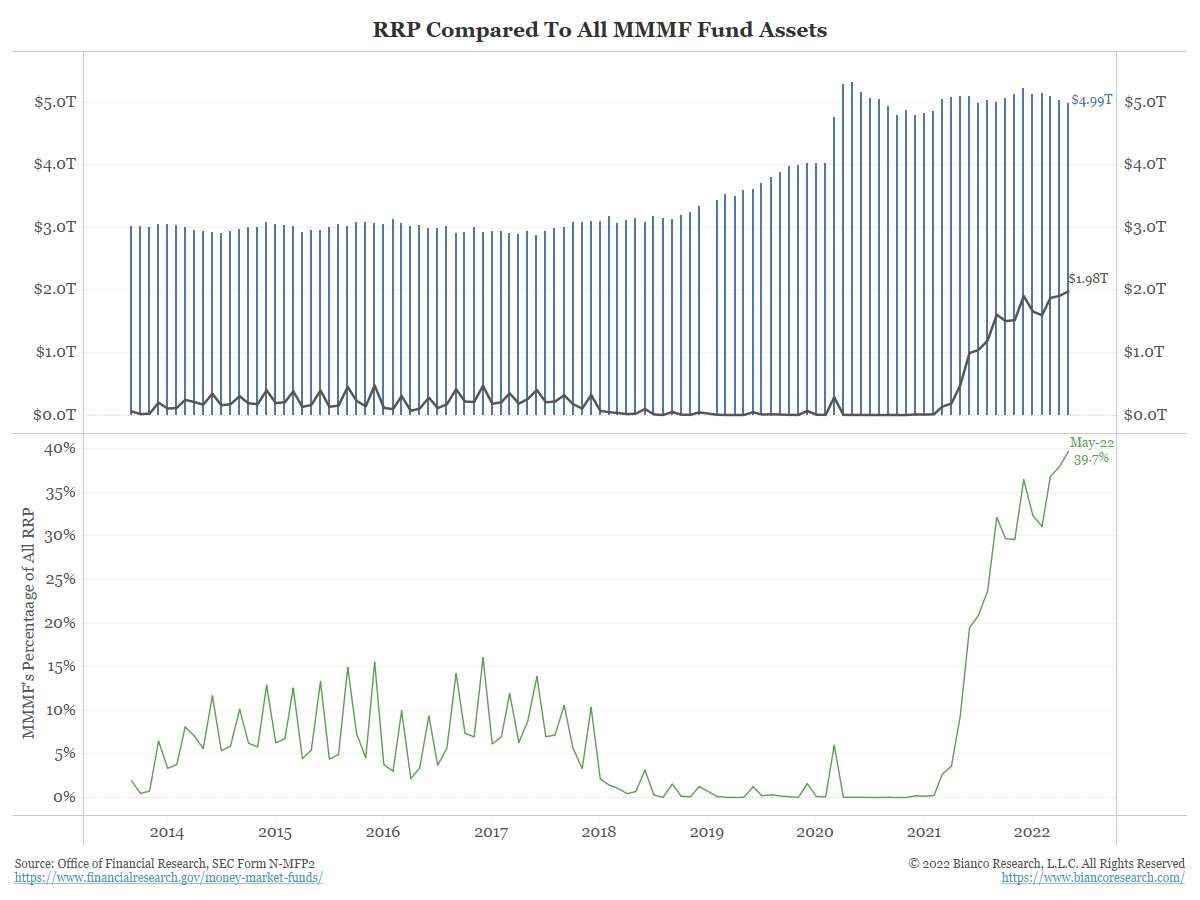

To date, usage of the Fed’s reverse repo facility has grown because the rate offered is competitive or better than many market rates.

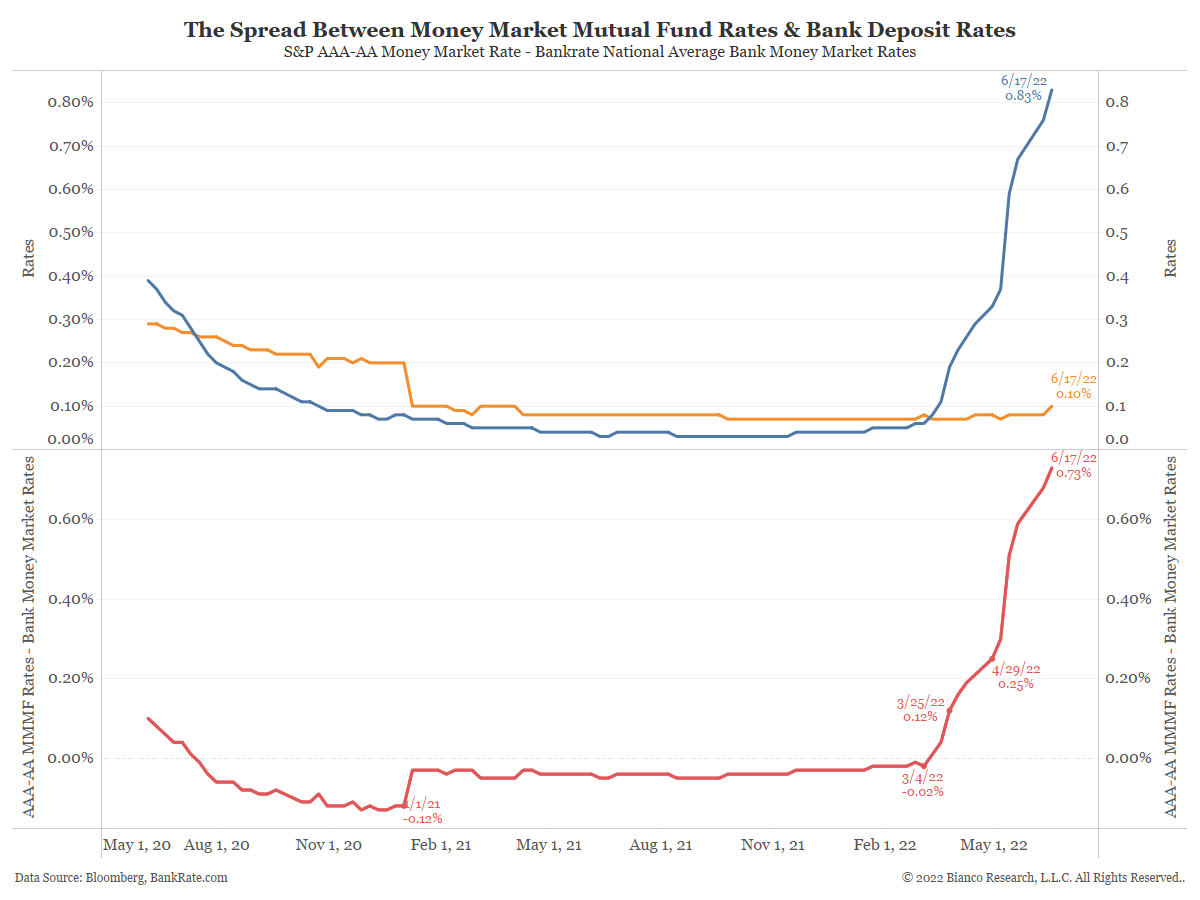

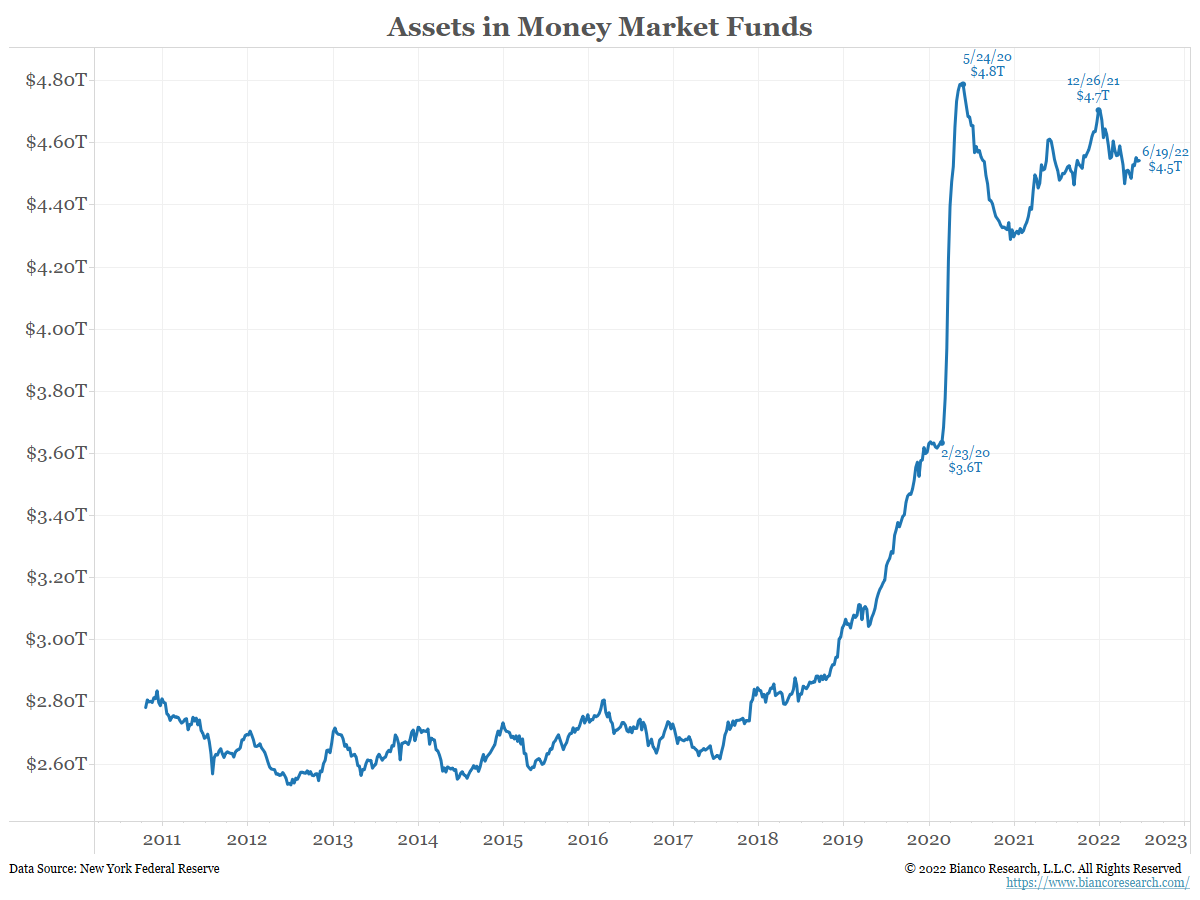

In the coming weeks/months, we could see cash shift away from banks and toward money market funds. As the next chart shows, money market rates (blue) exceed bank deposit rates (orange) by the largest margin in years (red).

Banks are flush with reserves after 13 years of QE and do not need more cash, so they continue to offer near 0% on bank accounts. Money market rates are dictated by market rates and the RRP rate. These rates are going up at least 1% in the next couple of months as the Fed hikes by 75 basis points in July and possibility again in September. The spread (red) below should blow out much wider in the coming weeks/months.

Conclusion

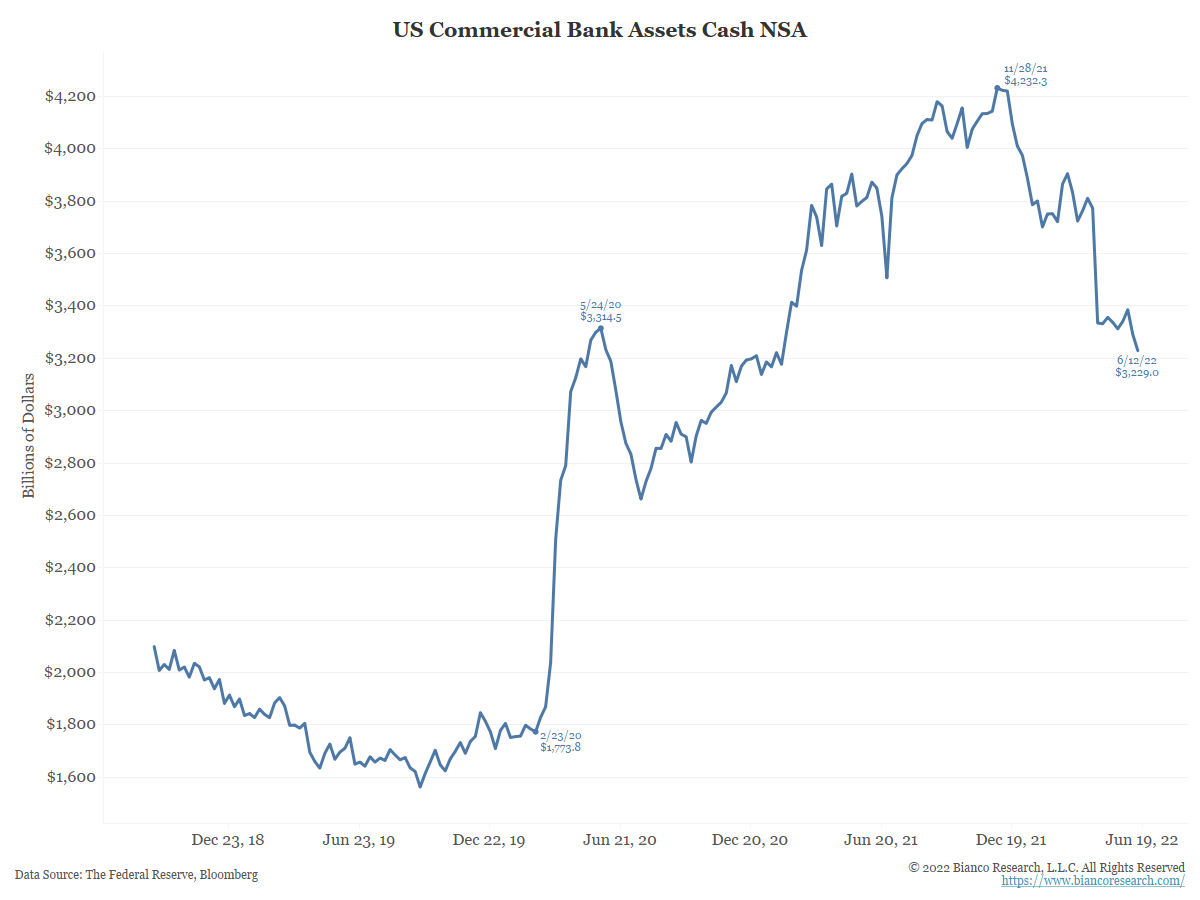

Many correctly fret the Fed’s tightening will have an adverse impact on the economy and/or markets. A possibly larger consideration is the potential draining of money away from banks and into money market funds.

Reverse repo drains cash from the banking system. The cash still exists, but its use as collateral in the financial system is restricted.

So as the Fed is hiking rates, the spread between money market rates and bank deposits grows. More money will leave the banking system for money market rates and then find its way into the Fed’s RRP.

The reverse repo facility is another way to drain money, possibly creating a double tightening. This has never happened at this scale before and we are unsure of its potential impact.