- The Financial Times – Trump faces choice between upheaval and continuity at the Fed

Donald Trump must choose between embracing continuity or propelling the world’s most important central bank into a potentially market-jarring change of direction when he decides on the next Federal Reserve chair. The Fed’s future leadership was one of the uncertainties lurking behind a largely benign global economic backdrop during meetings of central bankers and finance ministers in Washington over the weekend. Two of the candidates to be the chair of the Fed from February, governor Jay Powell and incumbent Janet Yellen, would be likely to continue following a monetary policy strategy that has been laid out with meticulous detail over recent years. By contrast, John Taylor and Kevin Warsh, both outside candidates and Stanford academics, are vocal critics of that approach…Some economists caution against exaggerating the prospects of a radical change. It is, for example, by no means inevitable that Mr Warsh would pursue aggressive rate increases. If he continues to embrace the idea that Mr Trump’s reforms will lift the longer-term trajectory of the economy without igniting inflation, it might justify a relatively easy stance on monetary policy. Roberto Perli of Cornerstone Macro points out that there is a “strong consensus” within the broader Fed system behind a gradual series of rate increases towards a low terminal rate, and he suspects that whoever takes over as Fed chair will not be able to suddenly overturn it.

Comment

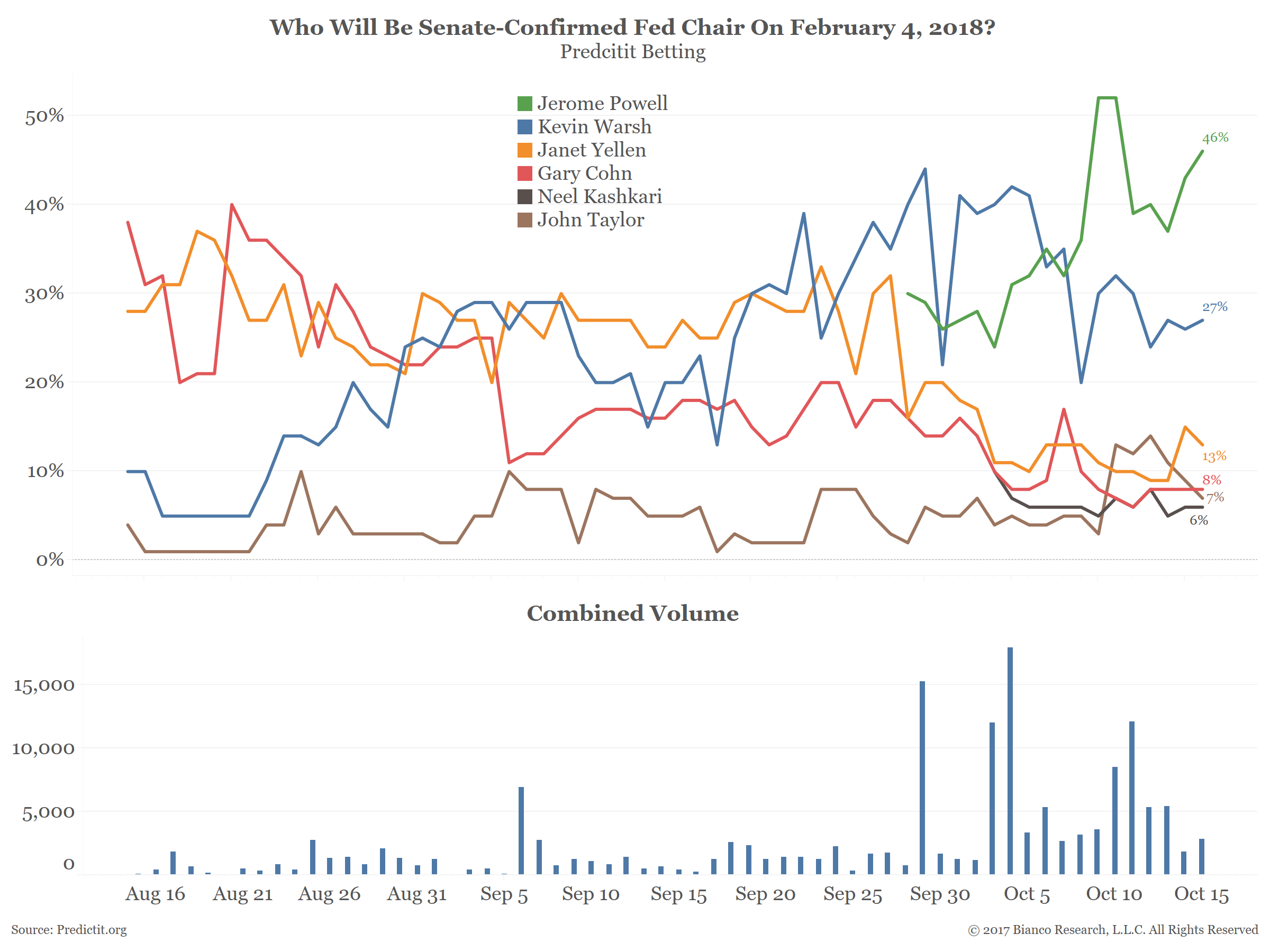

Jay Powell continues to lead the betting market, which we believe is an aggregation of consensus opinion. However, note that he has not closed above 50% in any meaningful way. No one else has either in the last three months.

This suggests that while Powell is leading, nobody has established themselves as a clear favorite.