- The Economist – After a golden decade, fintech faces its first true test

Rising interest rates and a slowing economy will shock the business model

Many listed fintechs have seen their market capitalisation crash by more than 75% since July 2021; private firms are being forced into “down rounds” that value them at less than their previous worth. In recent weeks a sorry cast of multi-billion-dollar fintechs, from Klarna, a “buy now, pay later” (bnpl) firm, to Wealthsimple, a trading app, have announced layoffs. In total, fintechs have sacked about 5,500 employees since May 1st, according to Layoffs.fyi, a website, compared with none last year.

Summary

Comment

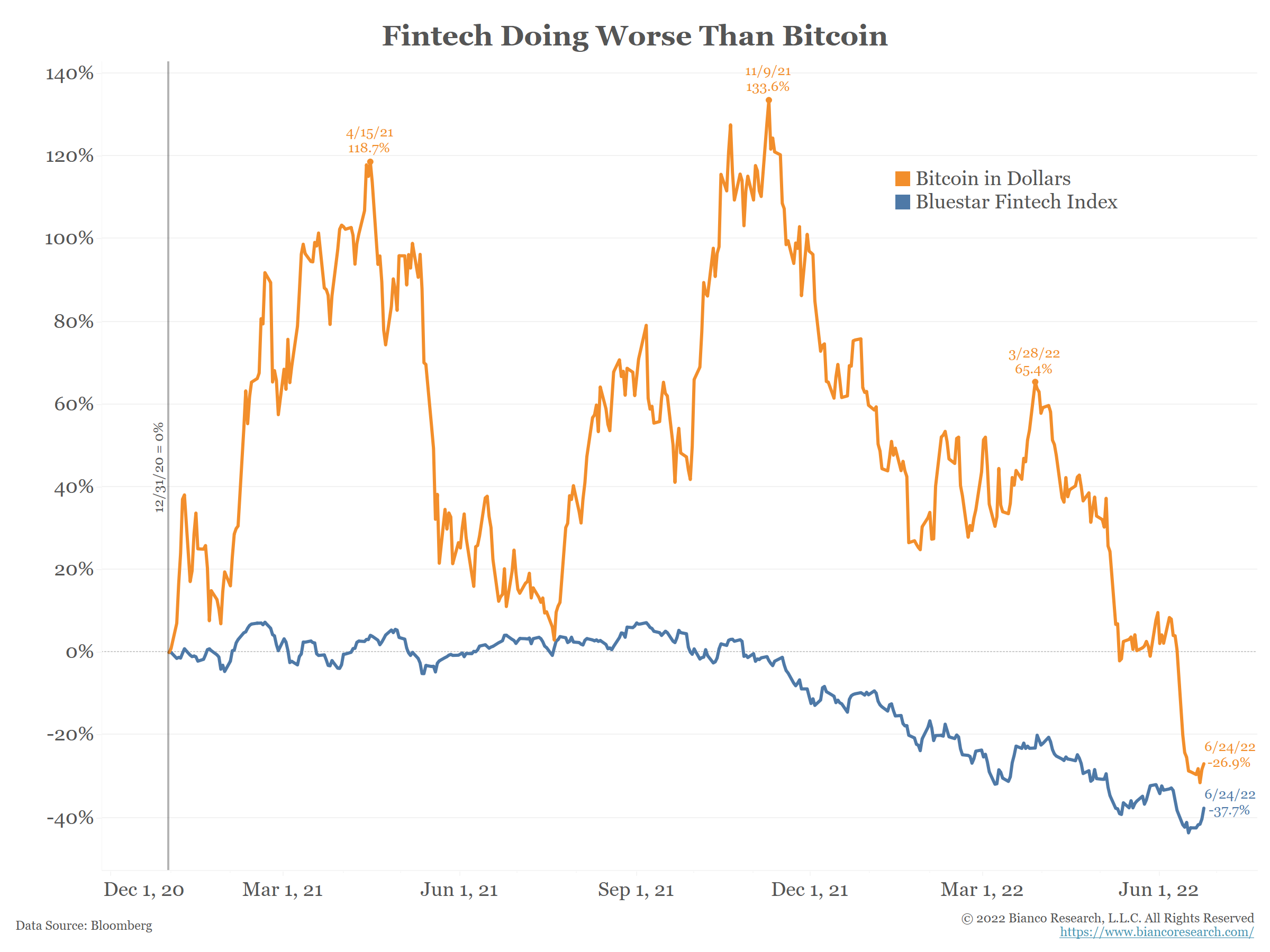

As the chart above shows, fintech stocks (blue) and crypto (orange) have suffered huge losses over the last 18 months. One seeks to change the financial system using its existing payment rails (fintech). The other (crypto) seeks to change the financial system by creating new payment rails.

The losses go beyond fintech and crypto. The entire financial sector has been a terrible investment option for 15 years.

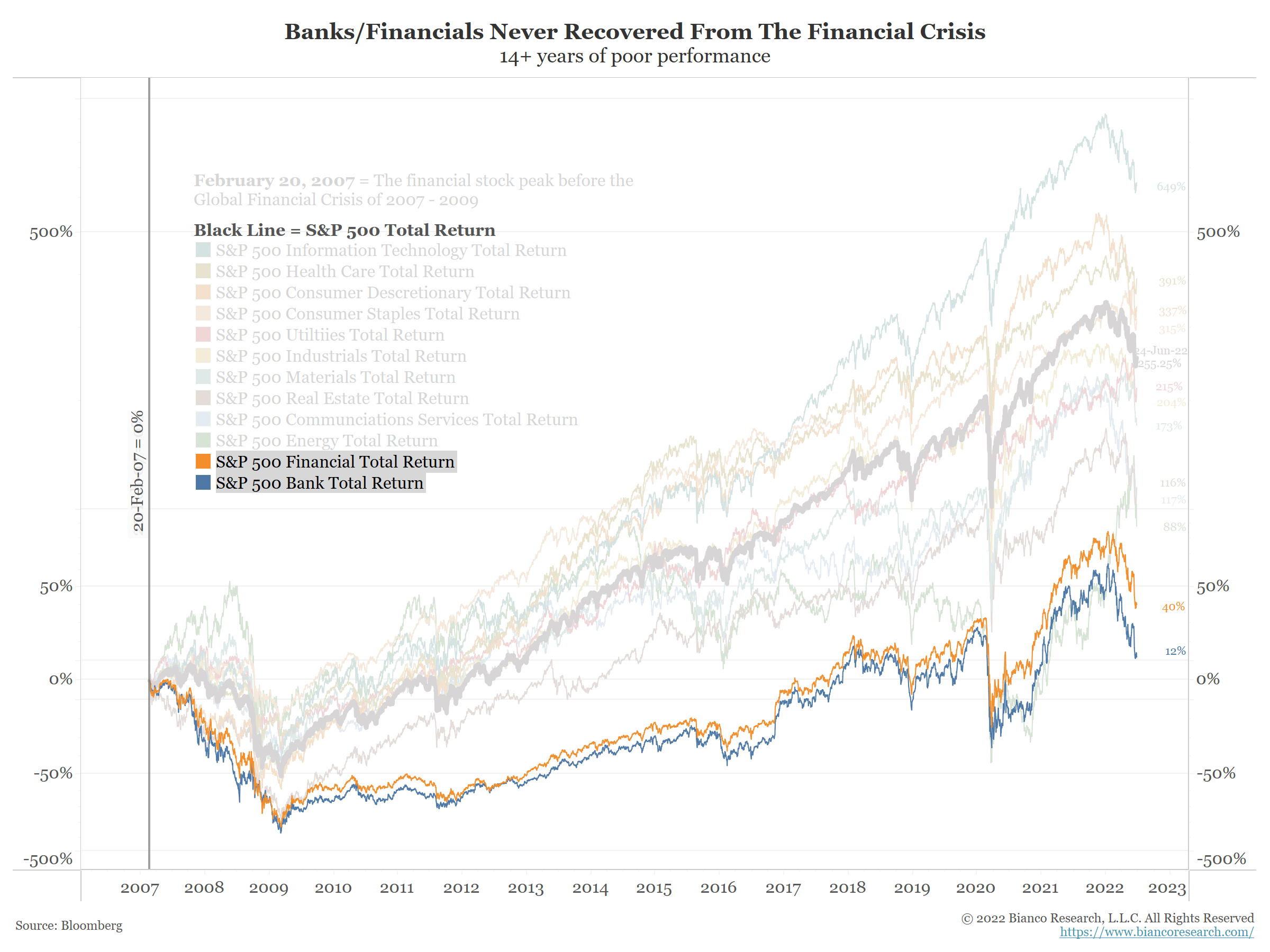

The chart below starts on February 20, 2007, the S&P 500’s high before the global financial crisis. It shows the cumulative total return for the 11 sectors of the S&P 500 and the Index (black).

Highlighted are the financial sector index (orange) and the bank index (blue), a large subset of the financial sector index.

Note the financial sector recorded the worst return among the 11 sectors. The financial sector’s largest industry group, the Bank Index, is doing worse. In fact, the total return of the banking index has been roughly 12% over the last 15 years.

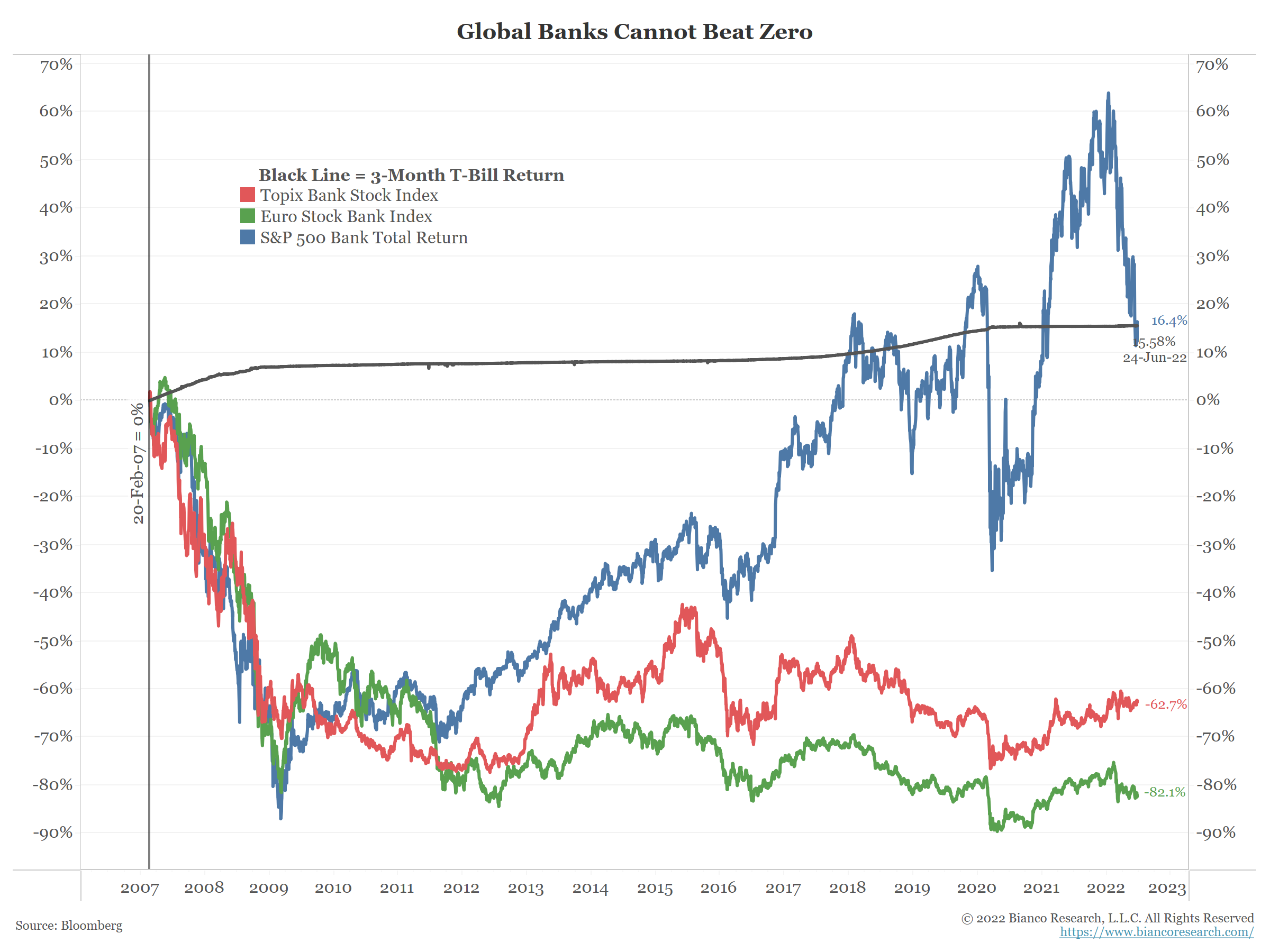

The next chart shows the last 15 years of US (blue), Japanese (red), and European (green) bank returns. As a group, they are vastly underperforming 3-month bills, which spent the vast majority of this period yielding zero. Bank stocks’ horrific performance gets far worse away from the US.

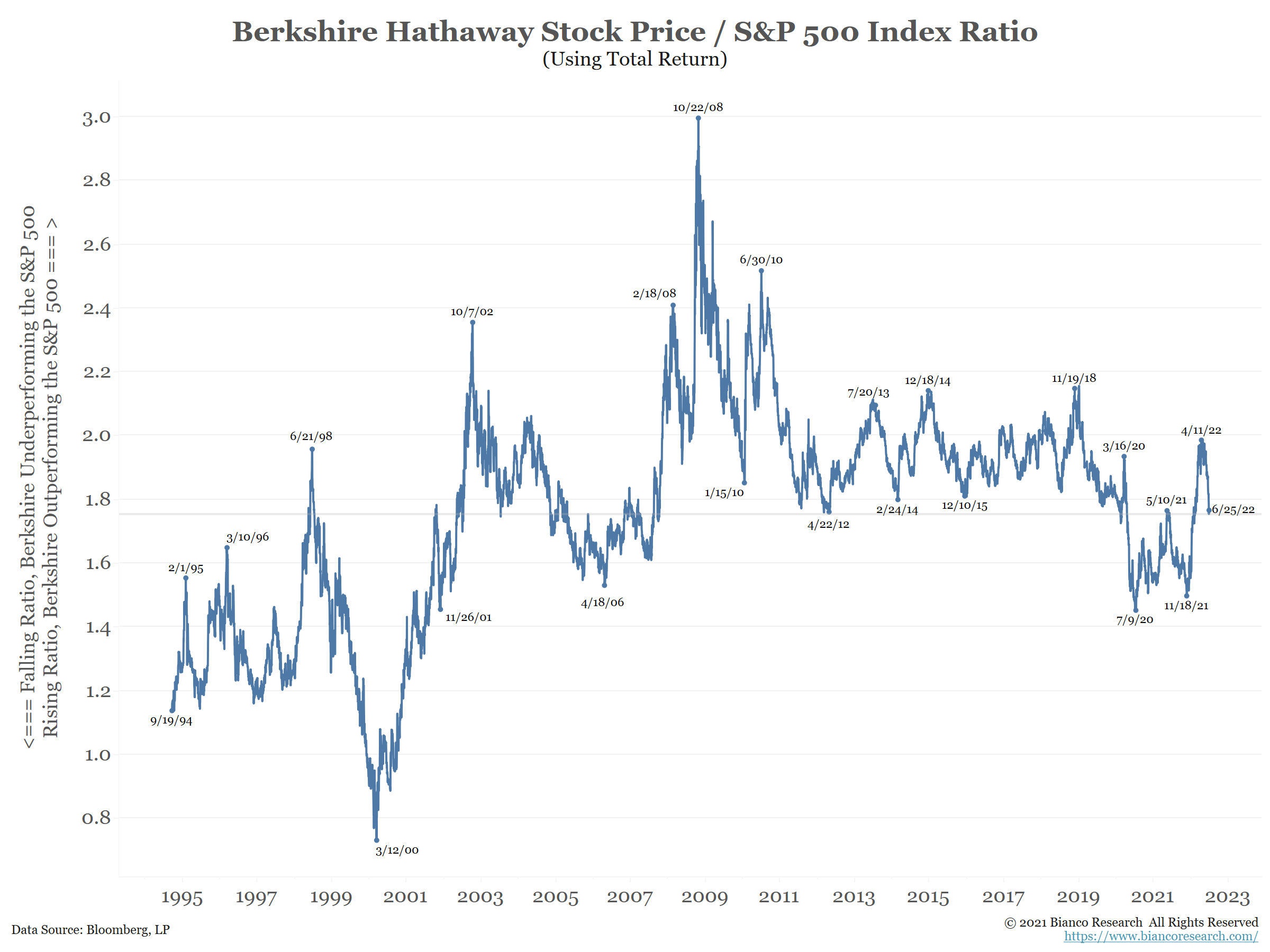

Another indication of how poorly the financial sector has been doing has been the performance of Berkshire Hathaway/Warren Buffett. Count us among those who think he is one of the greatest investors ever, if not the greatest. He has made his reputation/fortune by favoring financial stocks.

The next chart shows the total return ratio between Berkshire Hathaway’s stock and the S&P 500. The ratio is back to early 2000 levels, if not 1990s levels. This means Berkshire has not outperformed the broad S&P 500 Index for the last few decades.

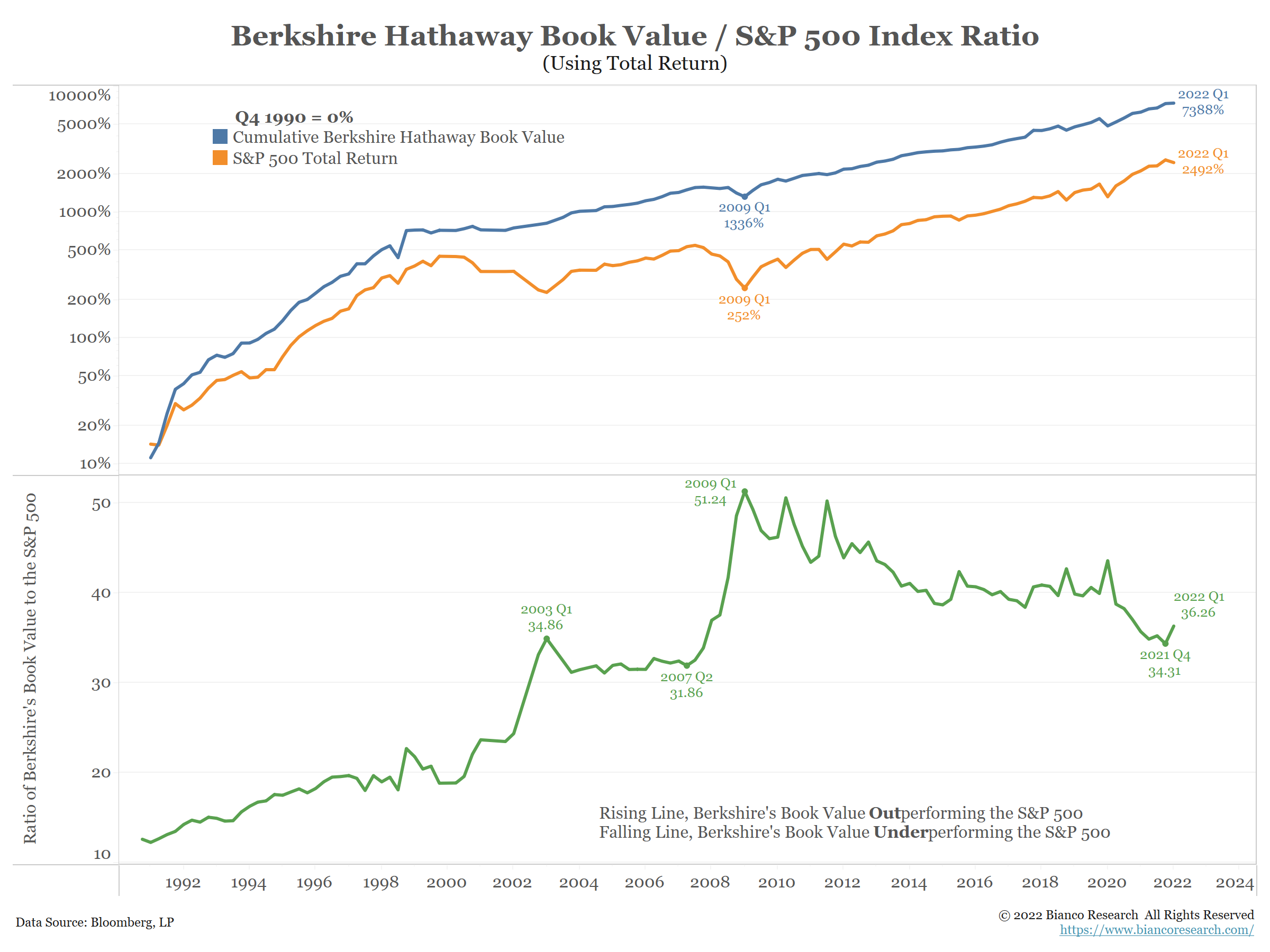

Another way to show this is to compare the cumulative total return of Berkshire’s book value (blue) to the total return of the S&P 500. Berkshire’s cumulative book value is the sum return of Buffett’s picks.

The bottom panel shows the ratio between the two. It peaked in Q1 2009, the bottom of the stock market during the financial crisis. Since that period the ratio has been falling, signifying that Berkshire’s holdings, which again are heavily weighted toward financial stocks, have been underperforming the broad average, now going on more than 13 years.

Conclusion

Financial stocks have been a killing field for investors. Now fintech and crypto are equally as bad. What is the message here?

We believe they are telling us that the current financial system is not meeting the needs of a 21st-century digital economy. It is ripe for disruption.

The two areas that appear ready to disrupt it, fintech and crypto, are struggling. Yet traditional financial stocks are not rebounding. So, we believe the market is suggesting that disruption is needed and is unsure where it will come from.