- Bloomberg – Dimon Says Prepare for 4% Yields, Potential Volatility Rise

U.S. borrowing may jump to $400 billion a quarter, Dimon says

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said it’s possible U.S. growth and inflation prove fast enough to prompt the Federal Reserve to raise interest rates more than many anticipate, and it would be wise to prepare for benchmark yields to climb to 4 percent. “It might force the 10-year up” if the Fed boosts short-term rates more than expected, Dimon said in an interview with Bloomberg Television’s Stephen Engle in Beijing, referring to the yield on 10-year Treasury notes. “You can easily deal with 4 percent bonds and I think people should be prepared for that.”

Summary

Comment

The chart below shows Citigroup Data Change indices for the U.S., Eurozone, Asia Pacific, BRICs, and Latin America. The Eurozone’s realized economic data is tumbling during what is usually a favorable seasonal period.

U.S. economic data is beginning to roll over, but remains above one-year average growth rates. A return to improving growth and wages would support a continued rise in U.S. 10-year yields toward 3.5% and possibly 4.0%.

But, an end to global synchronized growth will likely produce headwinds for the U.S. economy. The next chart shows the correlation of U.S. 10-year yields to economic data changes by region. We lag economic data changes since releases reflect the prior month’s data.

Investors placed heavy focus on U.S. economic data (highest correlation) throughout 2017 given substantial policy changes. This game changed in 2018 with U.S. economic data quickly taking a back seat to emerging markets like the BRICs and Asia Pacific. Yields have become very attached to the ebb and flow of economic growth across emerging markets.

Whether or not these emerging market economies roll over along with the Eurozone will likely impact the path of U.S. 10-year yields, making a quick ascent very difficult to accomplish.

The next chart shows frequencies of words regarding “global” and “concerns” within official Federal Reserve speeches. Global concerns reached an all-time peak in the spring of 2016, shortly after the yuan devaluation spurred heightened global risks.

However the Fed’s focus on global growth has returned to its long-run average. The use of words like “concern” and “uncertainty” have evaporated, reaching the lowest frequencies since pre-crisis. We believe low concern reflects diminished likelihood of deflationary forces returning in the years ahead. For the Fed, the skew for growth and inflation are pointing higher.

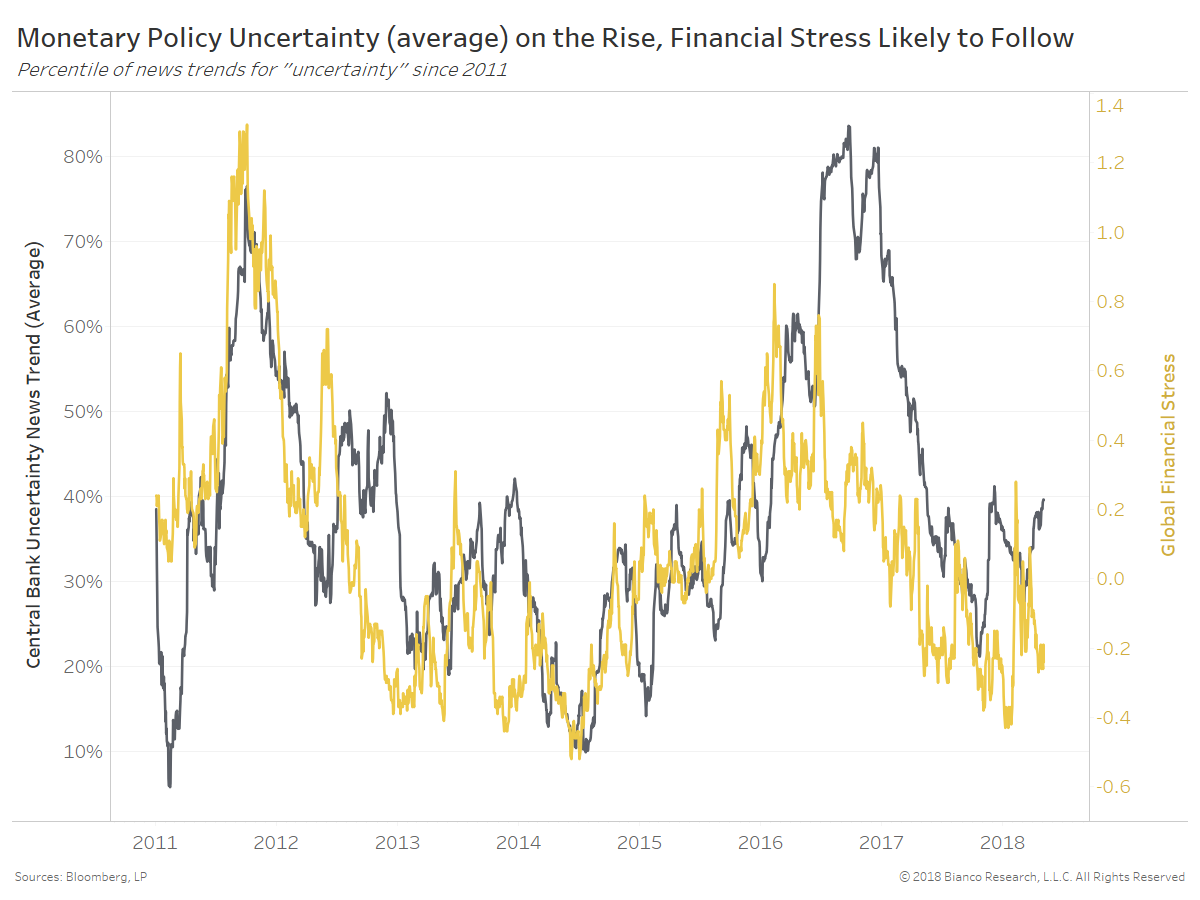

Yesterday we updated a chart of news trends for “uncertainty” across major central banks. The chart below shows this composite of uncertainty (black line) along with BofA’s Global Financial Stress index (yellow).

Uncertainty bleeding from peripherals (e.g. Argentina) to major central banks would likely induce higher financial stress, meaning higher volatility.

Our fair value estimate (blue) for U.S. 10-year yields are shown below, which reside well below current yields near 2.95%. Waning economic data across the G10 and BRICs are helping drive down this fair value estimate. The expected reward-to-risk for a shift lower in yields is 1.5-to-1 (-24 versus +16 bps).

Bottom line: Economic data changes must rebound to keep foreign demand for U.S. Treasuries subdued. For now, risks are rising slowing economic growth overseas will make its way to U.S. shores.