- Bloomberg – Fed Eyes Rates as Asset-Price Tool in Break With Hands-Off Past

Strategy echoes approach backed by Fed chair contender Warsh

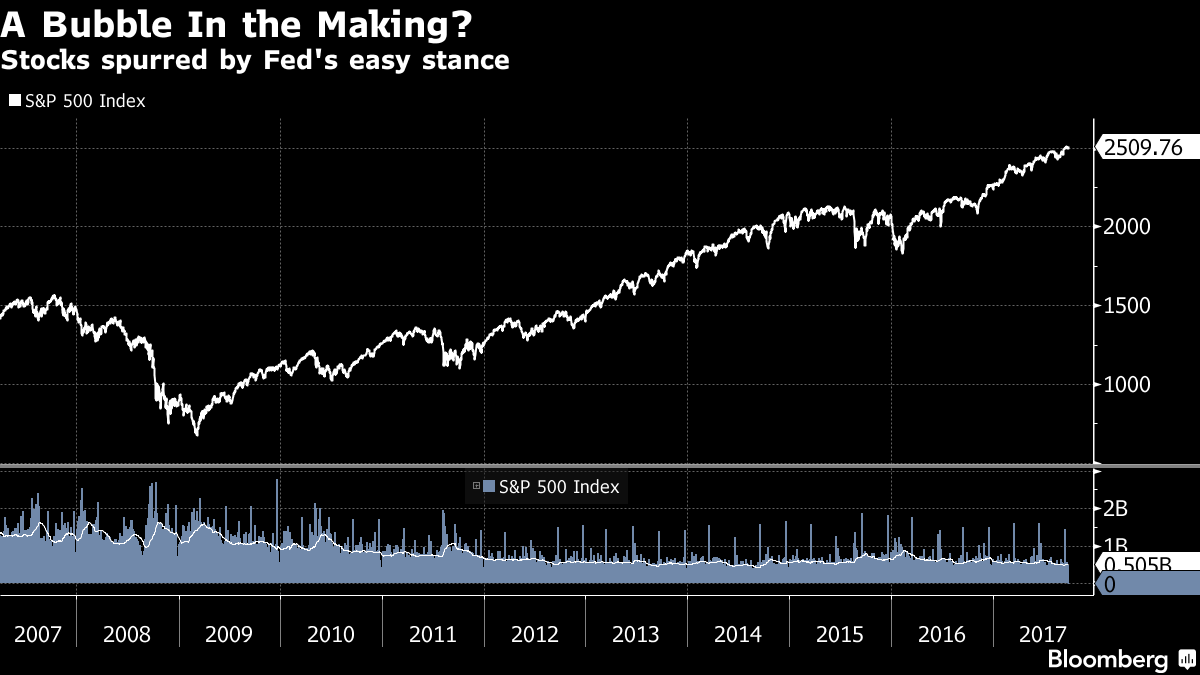

Federal Reserve policy makers are embarking on a subtle shift in strategy with potentially big implications for investors: using interest rates as a tool to contain the knock-on effects of lofty stock and asset prices on financial stability and the economy. The sharpened focus on asset values evident in Fed officials’ public and private remarks suggests the central bank will be more inclined to raise interest rates than otherwise, even if inflation is low. It also means that financial markets can no longer expect — in the words of Allianz SE chief economic adviser Mohamed El-Erian — the Fed to be their BFF, or best friend forever, providing them with unstinting support.

Summary

Comment

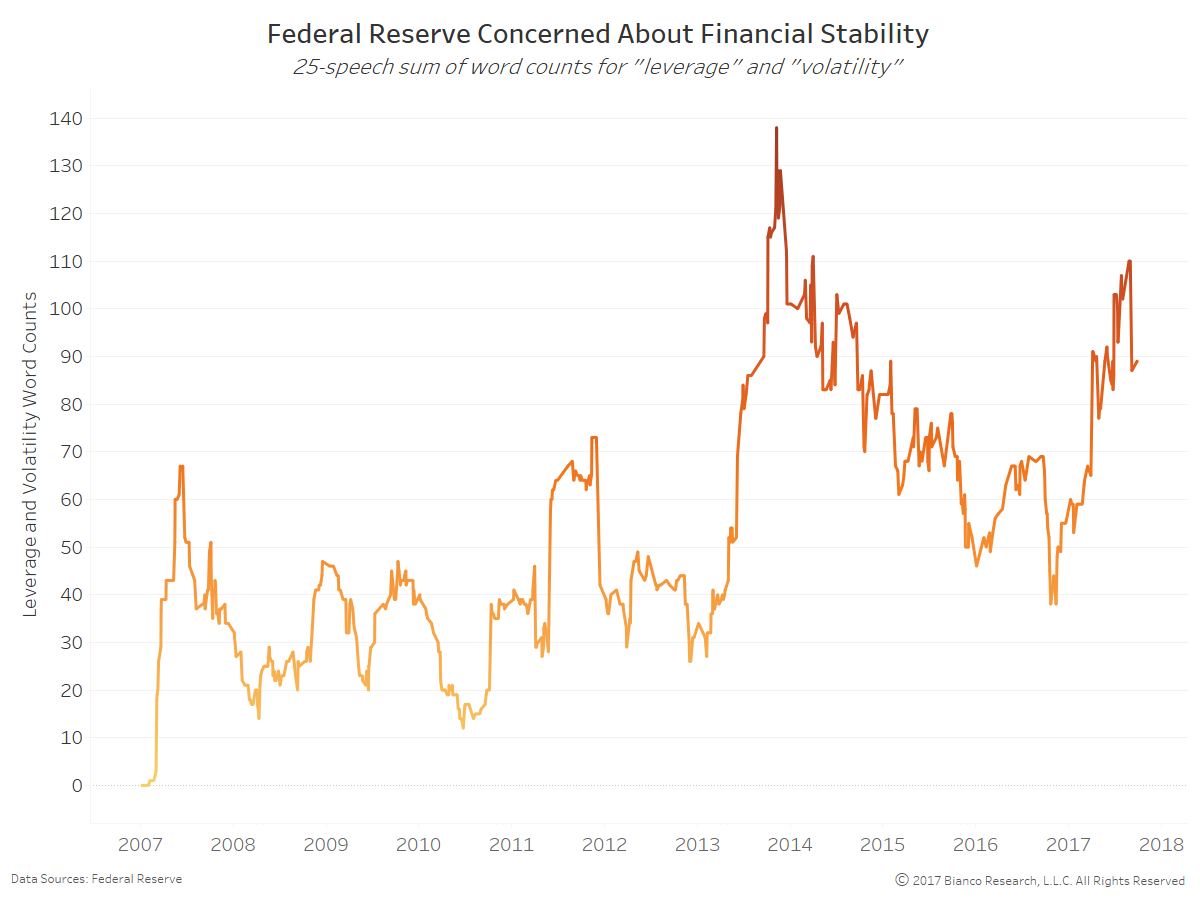

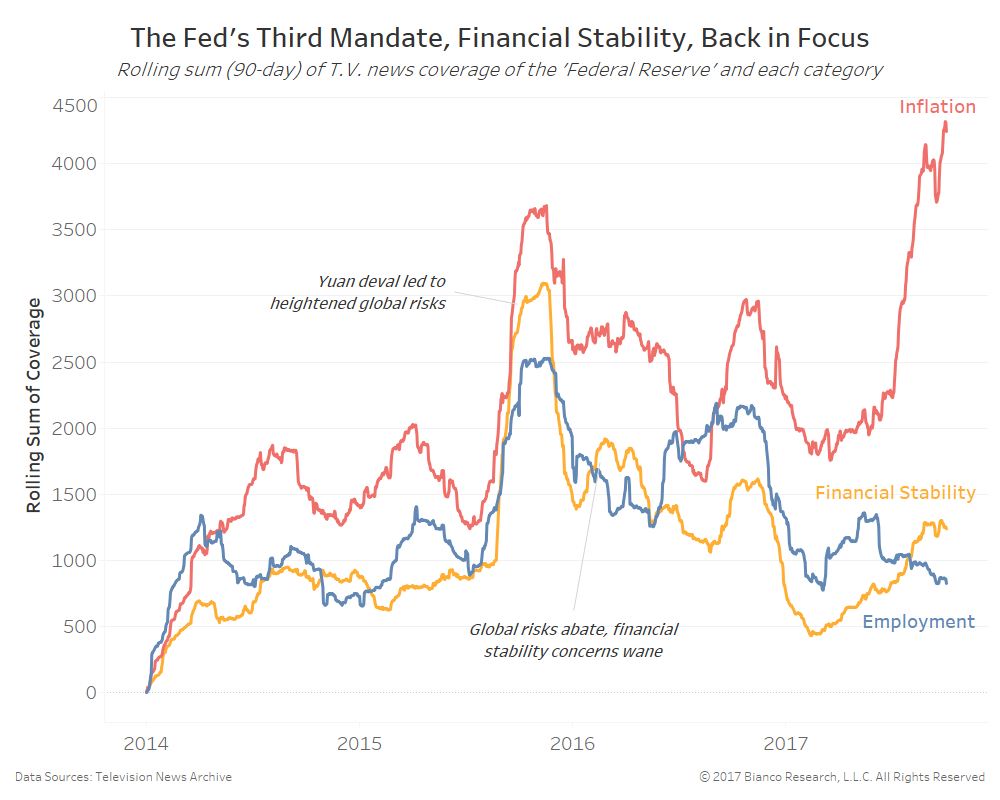

The next chart shows the rolling sum of T.V. news programming including ’employment,’ ‘inflation,’ and ‘financial stability’ while discussing the Federal Reserve. These frequencies offer a ranking of the Fed’s two mandates of stable prices and full employment along with the so-called third mandate of financial stability.

Financial stability (yellow) has become a greater concern over and beyond employment (blue) heading into the fall of 2017.

Rising probabilities of Kevin Warsh taking the reigns of the Federal Reserve (33%, Predictit) could heighten the focus on financial stability. Warsh’s recent speeches call for greater acknowledging of the financial cycle, namely finance, money, and credit.

Financial conditions have oddly eased following each of the past four rate hikes, providing greater cover for continued tightening. Our best explanation for easing conditions in the face of tightening policy is grounded in the reversal rate.

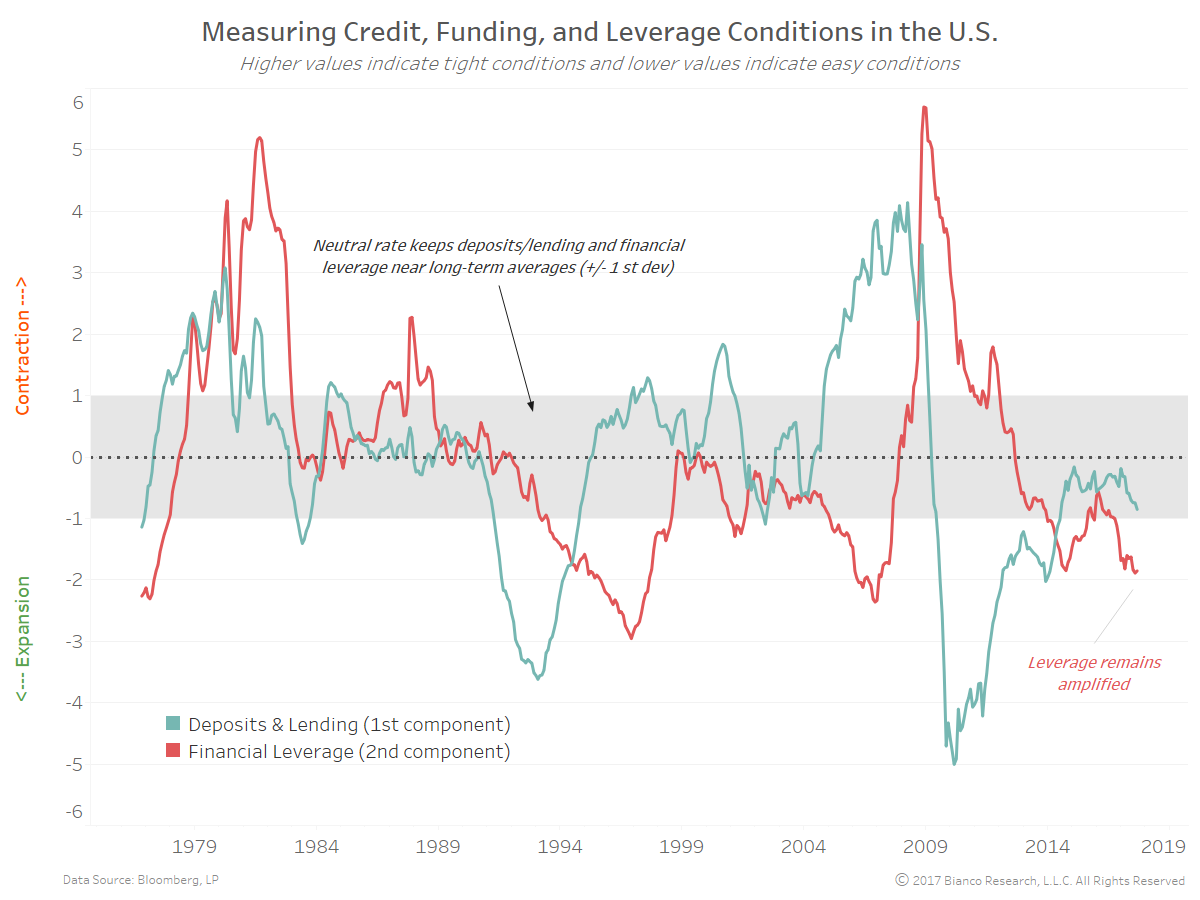

The chart below breaks financial conditions into deposits/lending growth (blue) and financial leverage/volatility (red). The gray-shaded area represents equilibrium defined as +/- 1 standard deviation from long-term averages. Values above this band are contractionary, while below too expansionary.

Financial leverage and volatility are indeed well outside normal ranges, potentially offering ammo for Warsh and others arguing for needed tightening even during languishing inflation.

We define the reversal rate as the fed funds target rate needed to foster balanced deposits/lending growth AND financial leverage/volatility.

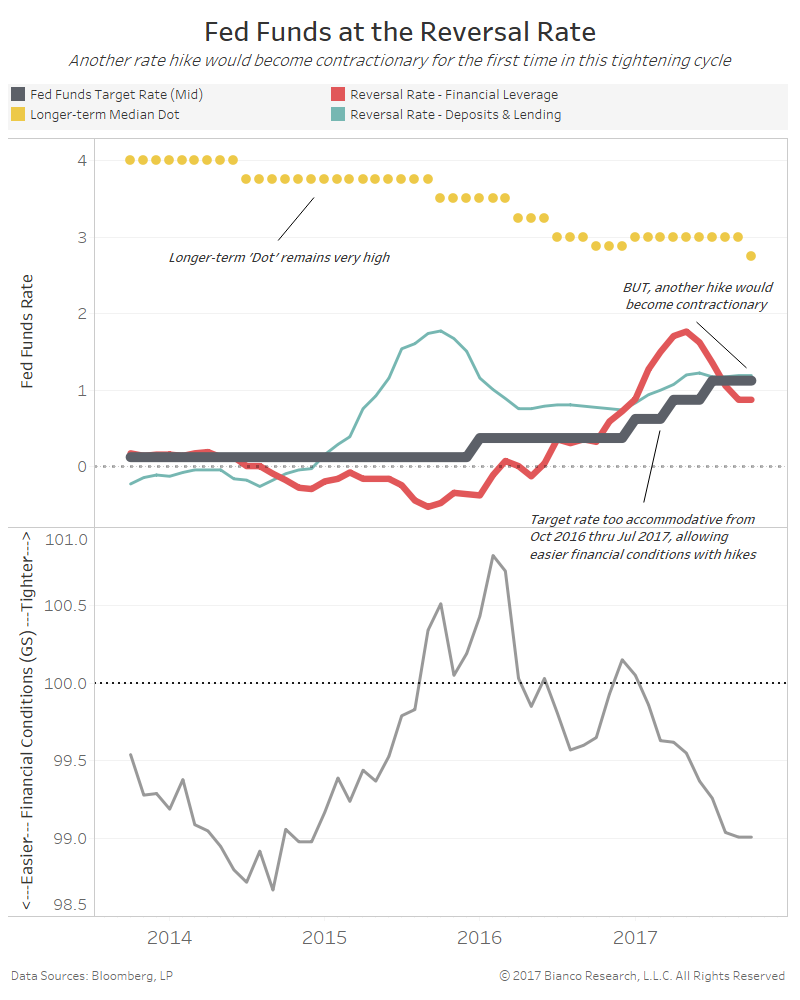

The top panel in the chart below shows the fed funds target rate (dark gray), longer-term median dots (yellow), and reversal rates according to financial leverage/volatility (red) and deposits/lending (blue). The relation of the fed funds target rate to the reversal rates indicates whether or not the policy is too accommodative or tight. Reversal rates are determined by the fed funds rate producing better than 50% probabilities of balanced financial conditions given economic conditions.

The fact the fed funds rate resided below the reversal rates from October 2016 through July 2017 is the best explanation we have seen for why financial conditions have eased. BUT, these reversal rates are now straddling 1%, meaning another hike would likely be contractionary for the first time in this tightening cycle.

The reversal rate is most sensitive to changes in inflation. Core PCE at 1.3% year-over-year is keeping the reversal rate from rising toward the Fed’s longer-term dots currently at 2.75%. We believe market participants are aware of this issue, causing a significant gap in expected hikes. Markets are pricing in ~1.8 hikes versus the Fed’s four through 2018.

Will the Fed lose its conviction in the event financial conditions do finally tighten and the yield curve flattens to fresh lows?