Summary

Comment

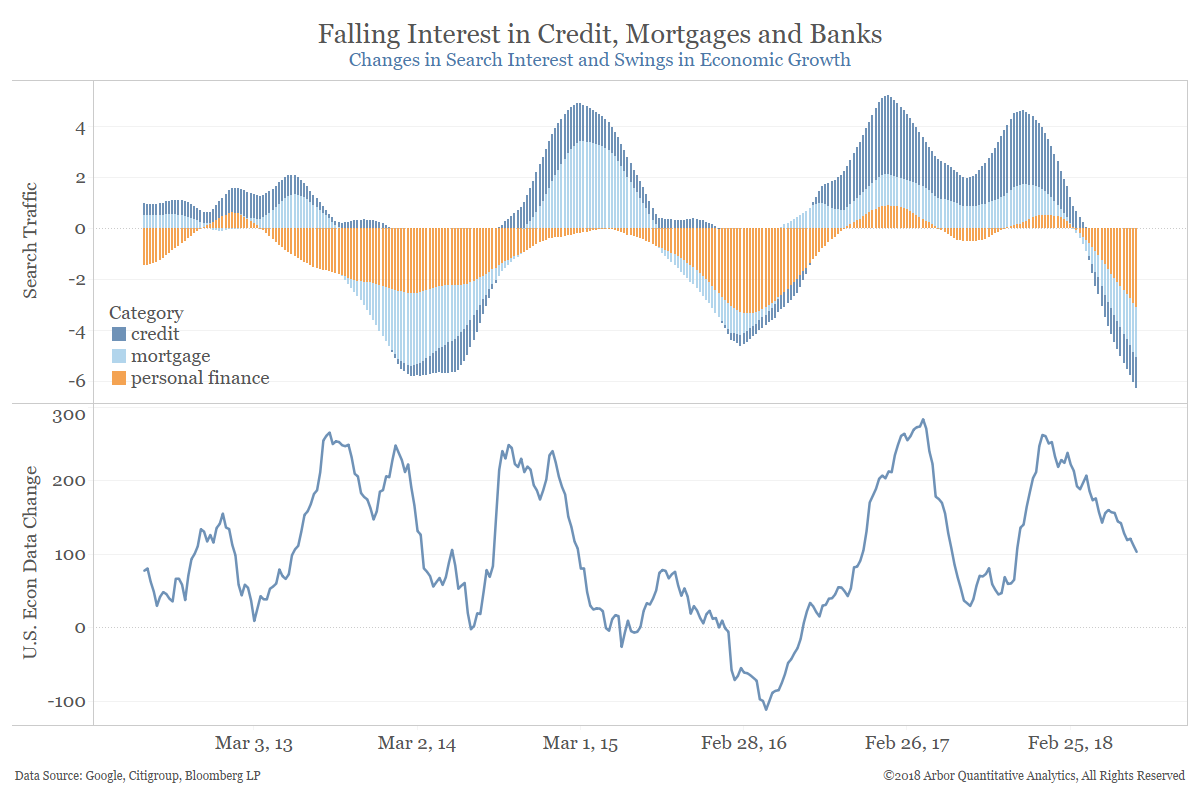

There are some common threads running through many of the recent themes we’ve discussed. One emergent feature in the global Google search trends is an accelerating fall in search interest related to credit, mortgages and personal finance (major banks). The chart below shows six-month changes in seasonally adjusted search interest over time for these three categories we created. The bottom panel shows Citigroup’s economic data change index, which measures U.S. economic growth against its one-year average.

Search interest for mortgages, credit, and personal finance began to see declines versus six-months prior in mid-March. The pace of decline accelerated through June and again this month. The two prior instances since 2012 which saw similar disinterest in borrowing and banking were accompanied by economic growth returning to or falling below its one-year average. Consumer disinterest in banking and credit may be an emerging threat to growth.

The Google search trends are influential components in our fair value models for a wide range of financial markets. Along with changes in economic data and surprise indices, financial market performance, central bank expectations, fund flows and volatility measures, these trends in search interest provide a closer to real-time look at activity. Declines in credit, mortgage, and personal finance categories are key drivers for a few major asset classes.

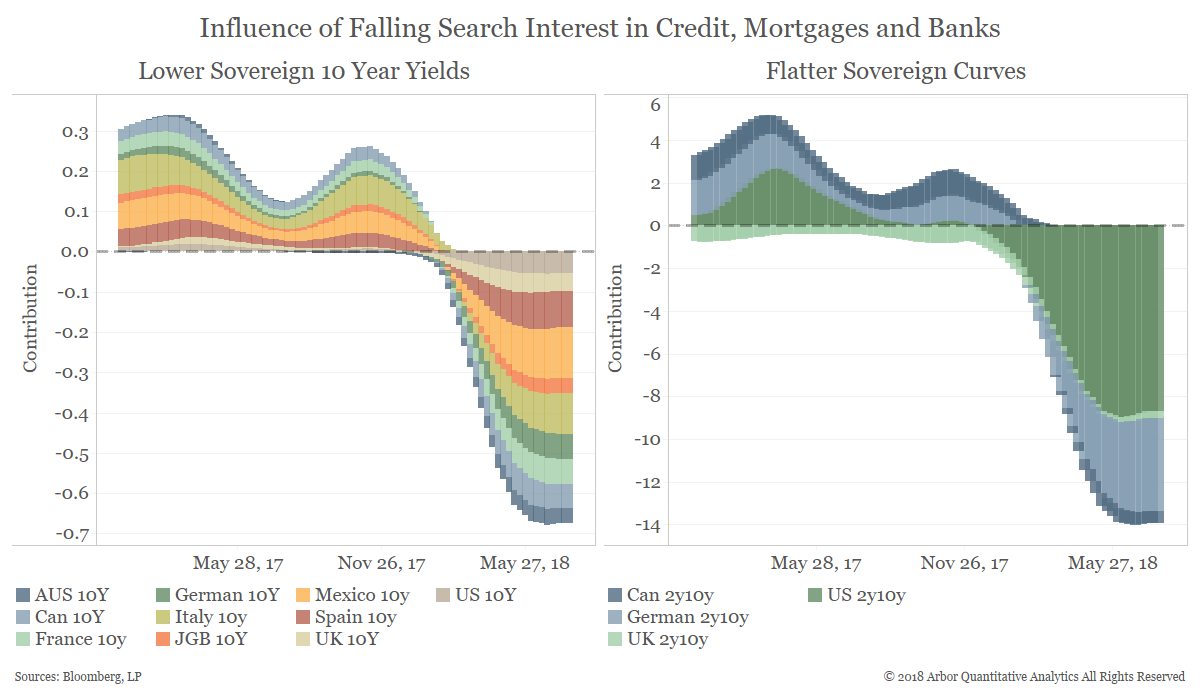

Influence on Sovereign Yields and Spreads

The charts below show how the changes in search interest for credit, mortgages and personal finance influence fair value estimates for sovereign 10-year yields and sovereign yield curves (2y10y spreads). The sharp declines in interest related to banking and borrowing favor lower sovereign yields across the globe. The effect is stronger for France, Italy, and Mexico.

The declines also pull our fair value estimates for sovereign 2y10y spreads lower, particularly for the U.S. but also for Germany and Canada.

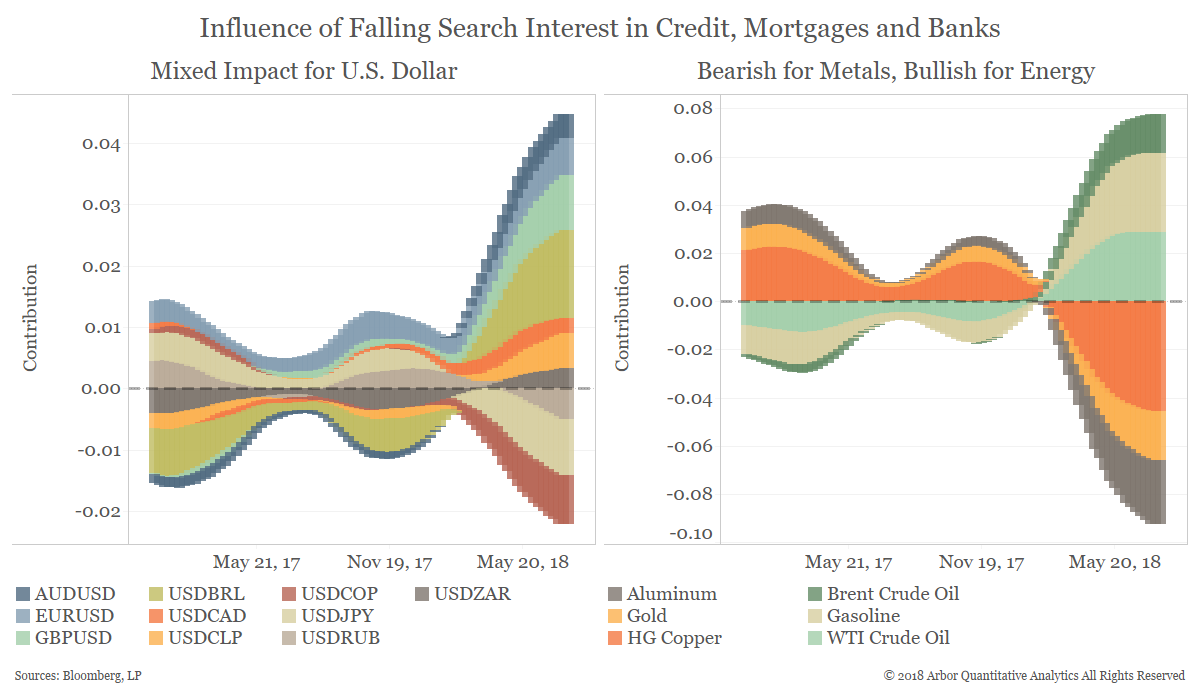

Influence on Forex and Commodities

The next charts show the influence of falling search traffic on the U.S. dollar against a range of currencies and on energy and metals prices. On balance, the sharp decline in search interest for borrowing and banking pulls our fair value estimates lower against the Australian dollar, euro, pound and yen, all the developed market currencies we included. Among emerging market currencies, the change in search interest point to a stronger U.S. dollar against the Brazilian real and Chilean peso, but a weaker dollar against the South African rand and ruble.

Among commodities, the mostly weaker dollar is bullish for Brent, unleaded gasoline and WTI crude oil. The influence is bearish for aluminum, copper and gold.

Conclusion

The accelerating decline in search interest for borrowing and banking is a potential threat to the pace of economic growth in the U.S. Its influence is significant across several major asset classes, favoring lower sovereign yields, flatter sovereign curves and dollar weakness against other developed-market currencies.