Summary

Comment

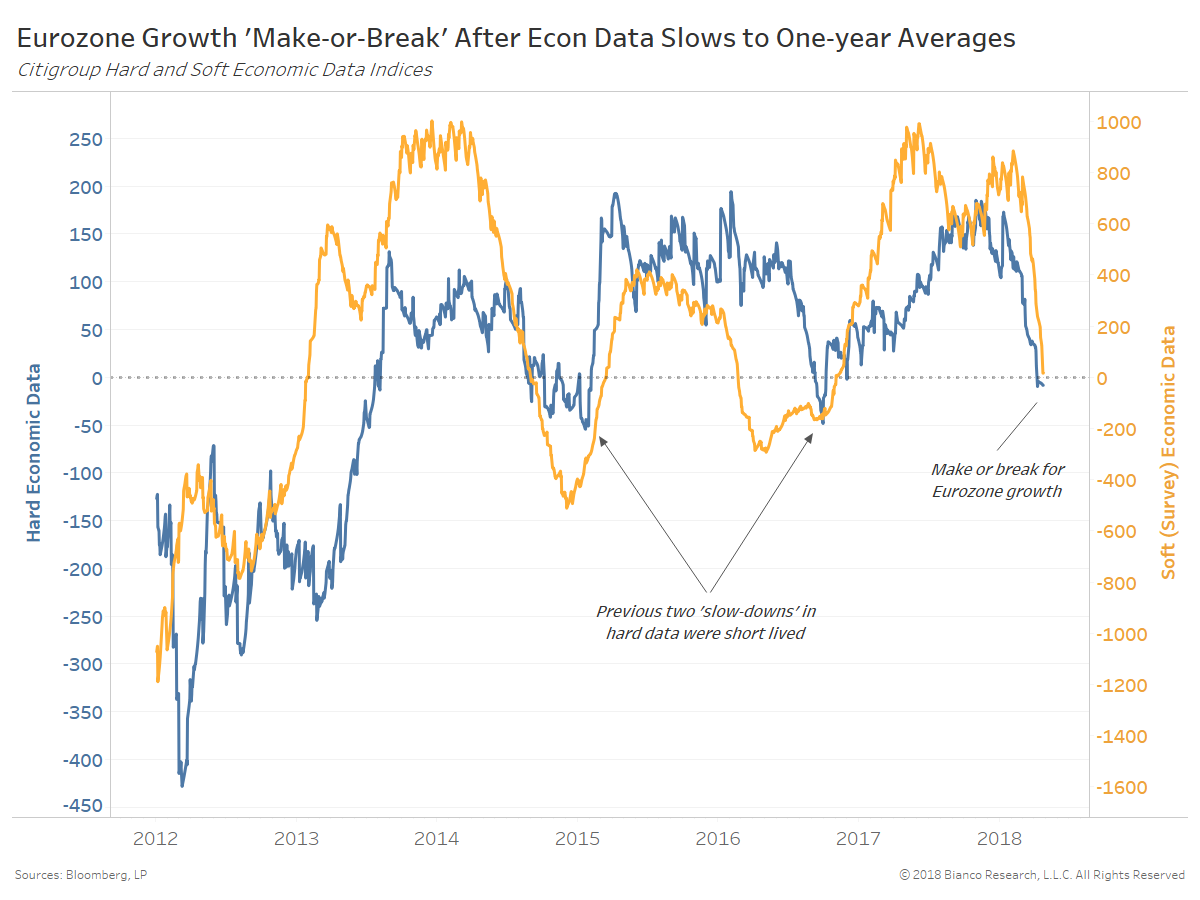

The Eurozone’s hard (official) and soft (survey) economic data have slowed after solid growth throughout 2017. The chart below shows Citigroup hard (blue) and soft (orange) economic data change indices retreating to one-year average growth rates (i.e. zero).

The Eurozone economy has proven resilient following previous soft patches beginning late summer in both 2014 and 2016. But, Draghi’s hope for rising inflation on the heels of concerted economic growth is again on shaky ground.

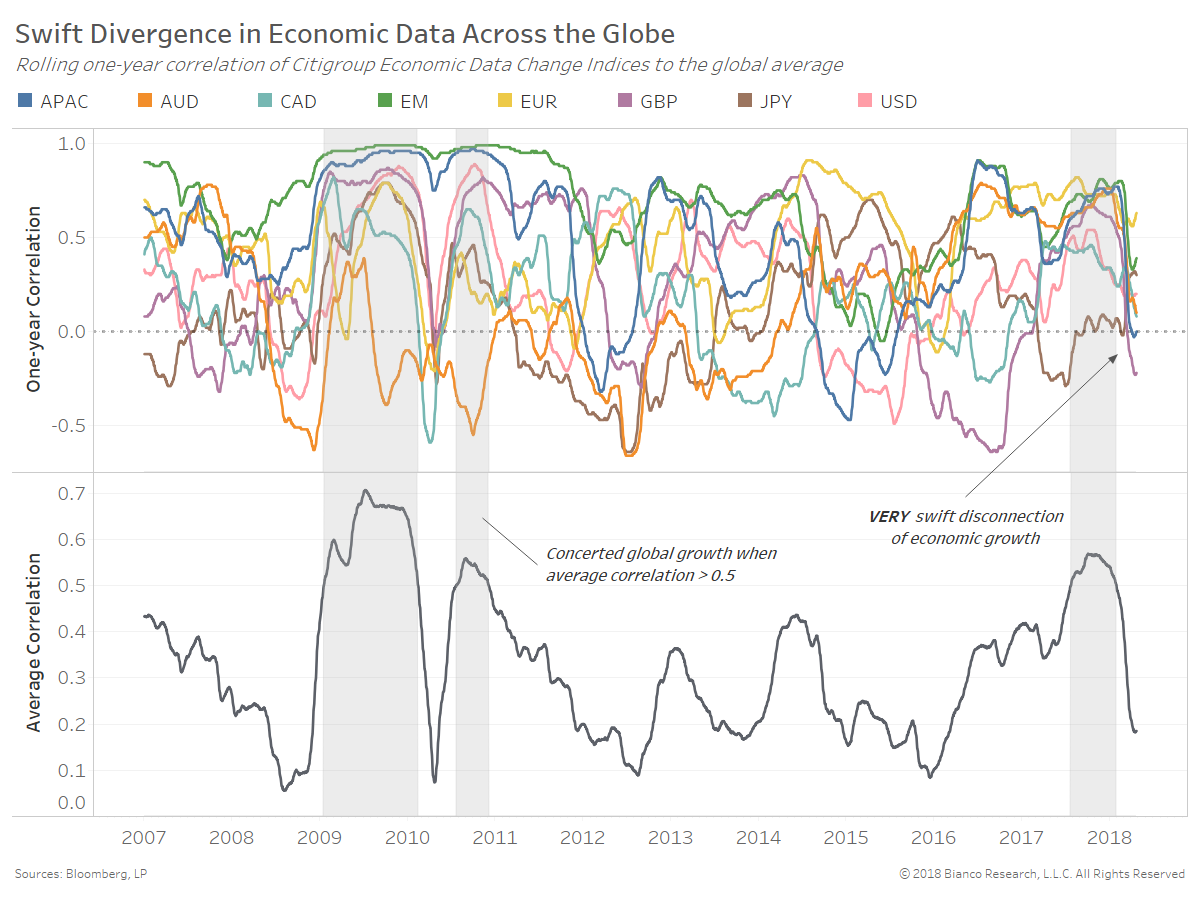

The period of ‘concerted global growth’ has ended with economies having diverged in Q1 2018. The chart below shows the rolling one-year correlation of each economy’s data changes to the global average. We have shaded periods when the average correlation pushed above 0.5, indicating a coordinated global economic event.

The average correlation of economic data changes dropped from 0.57 in October 2017 to a paltry 0.18 in April 2018.

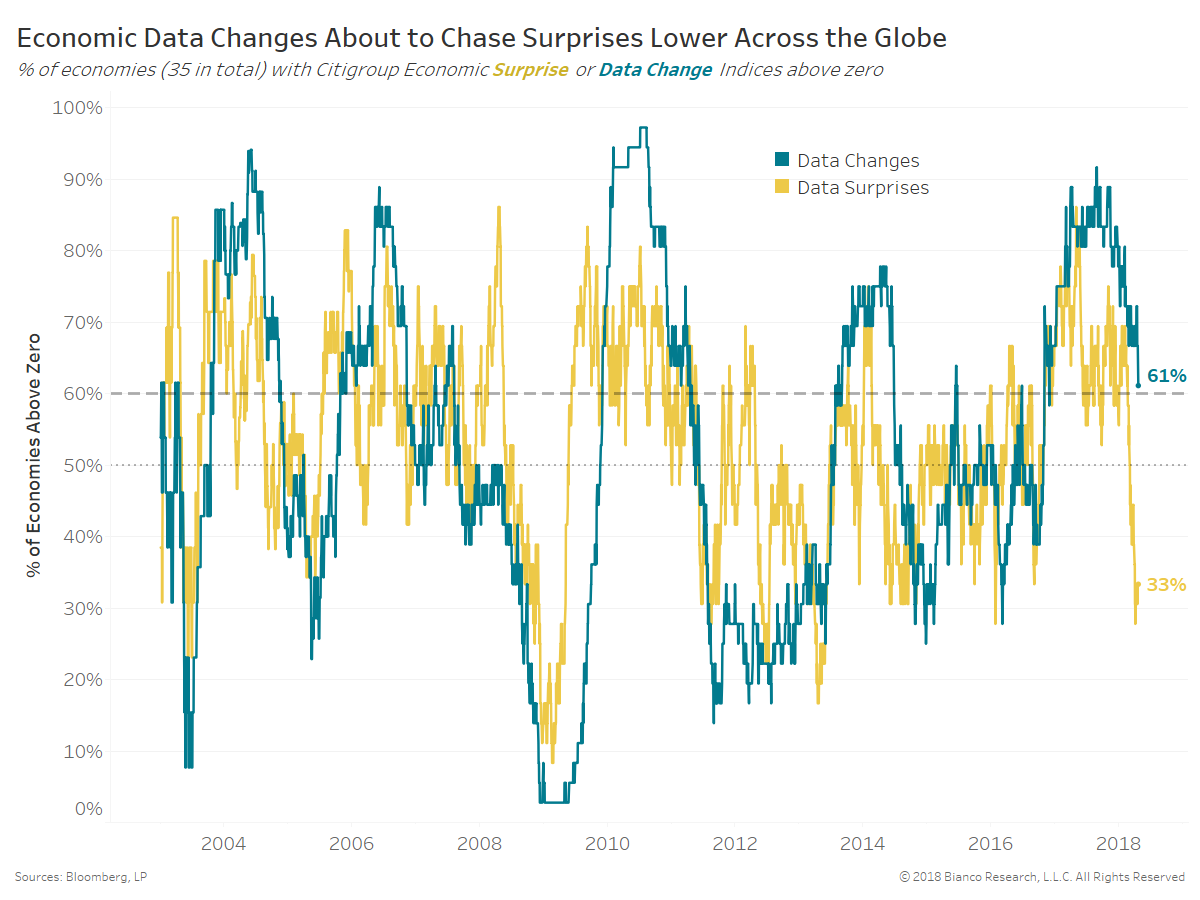

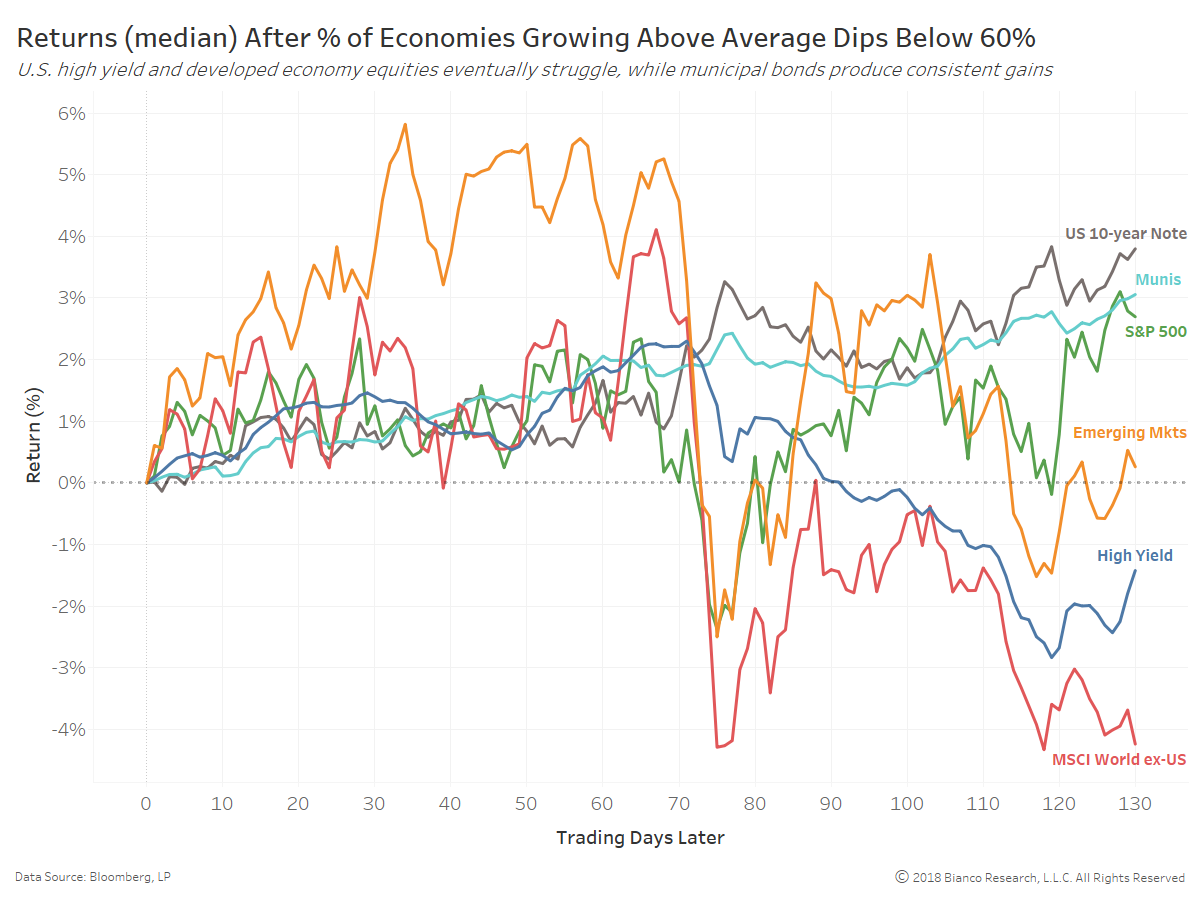

Drops below 60% of economies producing above-average data changes have marked jumps in volatility and trouble for risk assets. The chart below shows the aftermath of these past events for major asset classes.

All but emerging market equities (gold) produced tepid returns over the following quarter (first 63 days below). However emerging markets, developed equities ex-US (red) and U.S. high yield (blue) all quickly ran into trouble the following quarter (through day 130).