- Bloomberg.com – Jim Bianco: The Fed Has Given MMT Proponents Ample Ammunition

The idea that the government can print money to spark the economy is not that much different than quantitative easing – with one big exception.

If this sounds familiar, it should. MMT is basically a sibling of quantitative easing. While QE allowed the Fed to print money to buy securities such as U.S. Treasuries, mortgage bonds and bad loans, MMT proposes printing money to fund the government. The Fed has hailed QE as a success, bringing the economy back from the brink. Former Fed Chairman Ben S. Bernanke was even anointed as Time magazine’s “Person of the Year” for 2009. Vice Chairman Richard Clarida said last month the central bank would solicit opinions on how to round off the edges of its new tools such as QE. Simply put, these tools are here to stay.

Summary

Although the concept of modern monetary theory has been around for some time, Ben Bernanke laid much of the groundwork for applying it to real-life scenarios.

Comment

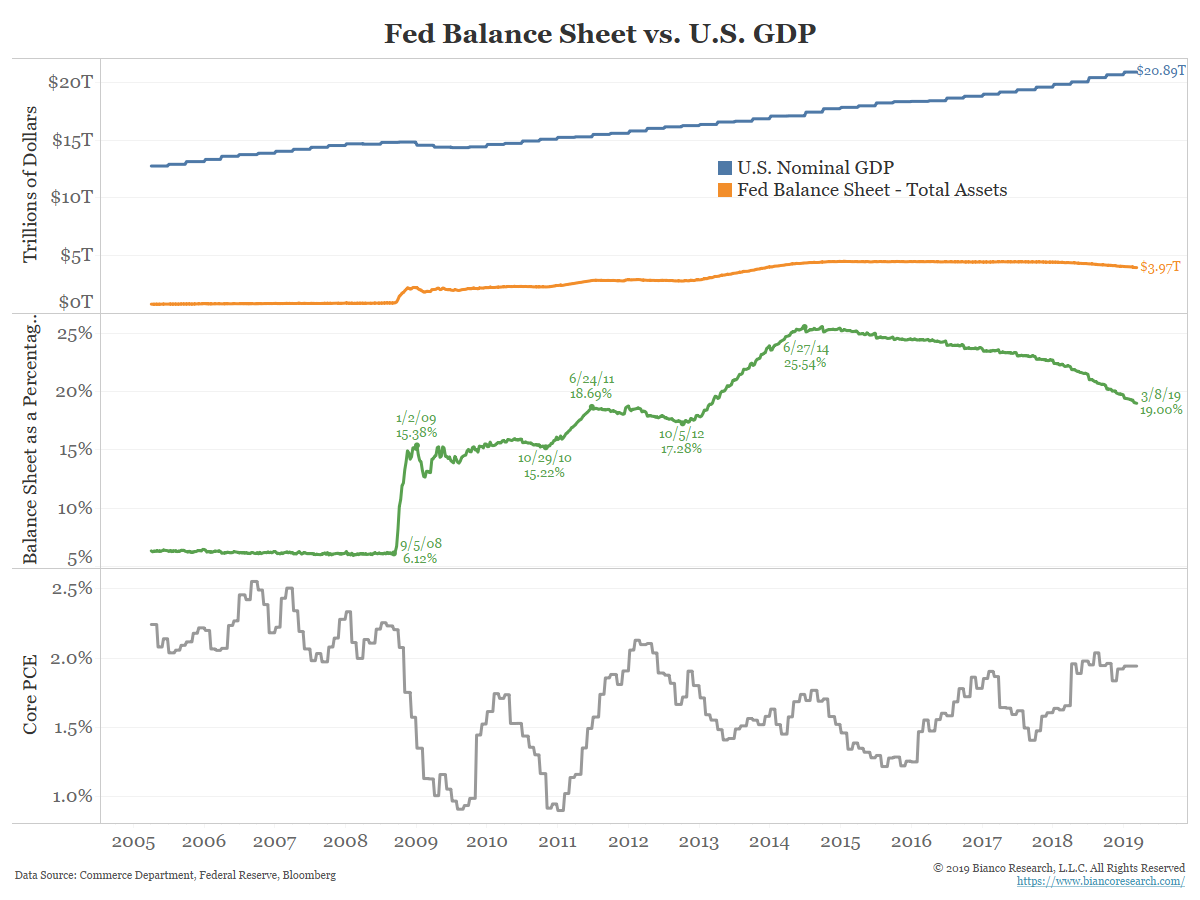

When the Federal Reserve officially introduced the idea of quantitative easing in November 2008, a new era of central bank policy was ushered in. With rates around the world at or near zero, central banks needed additional tools to further stimulate their economies and avoid deflation.

Just as QE2 was getting underway, many economists became concerned over risks of currency debasement and inflation:

- The Wall Street Journal – (November 15, 2010) Open Letter to Ben Bernanke

The following is the text of an open letter to Federal Reserve Chairman Ben Bernanke signed by several economists, along with investors and political strategists, most of them close to Republicans

We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. We do not believe such a plan is necessary or advisable under current circumstances. The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.

Undeterred, Ben Bernanke pushed forward with QE2 and then QE3. As the story below highlights, he even suggested Japan should issue perpetual debt with no maturity date as a means of further stimulating their economy.

- Bloomberg – (July 14, 2016) Bernanke Floated Japan Perpetual Debt Idea to Abe Aide Honda

Prominent foreign economists drawn into nation’s policy making

Honda emerges as an ideas matchmaker for the prime minister

Bernanke at the Tuesday meeting said Japan should carry on with Abenomics policies by supplementing monetary policy with fiscal stimulus, according to Hamada. Bernanke told Abe that the BOJ still has instruments to further ease monetary policy, said Yoshihide Suga, Japan’s top government spokesman. The central bank didn’t reveal what Kuroda and Bernanke discussed. Hamada said helicopter money wasn’t mentioned with Bernanke on Tuesday. Suga denied an earlier report in the Sankei newspaper that officials around Abe were considering helicopter money as a policy option…in April the former Federal Reserve chief warned there was a risk Japan at any time could return to deflation. He noted that helicopter money — in which the government issues non-marketable perpetual bonds with no maturity date and the Bank of Japan directly buys them — could work as the strongest tool to overcome deflation, according to Honda. Bernanke noted it was an option, he said.

In hindsight, it appears concerns over inflation and currency debasement were unfounded. The Federal Reserve, along with many other central banks around the globe, argued they struck the right balance by pushing stimulus to previously untested limits while keeping inflation in check. If anything, many economies continue to suffer from low inflation.

Our Bloomberg Opinion piece above details how this experiment had the unintended consequence of laying much of the groundwork for proponents of MMT. If money printing worked for the financial system, why not apply it to all government programs?

- Liberty Blitzkrieg (blog) – Michael Krieger: Federal Reserve Chairman Appears on 60 Minutes – Why Now?

The increased popularity of MMT in the public conversation is proof of this. People are starting to wonder why the central bank can print money and buy assets to save the portfolios of baby boomers, yet the public can’t simply print money for stuff like healthcare, education and roads. The Fed intentionally obfuscates what it does (money printing) with terms like “quantitative easing,” but people are starting to get the joke. The Fed doesn’t want people thinking about such things.