<Click on graphic for larger image>

- Economics 21 – Caroline Baum: Jobs, Jobs, Jobs—and Nothing to Show for Them?

If Federal Reserve policymakers were to look solely at headline labor market indicators, they might be tempted to conclude that the U.S. economy had finally reached cruising altitude. The unemployment rate has fallen from a peak of 10 percent in 2009 to 5.5 percent, within the range considered to be full employment. Nonfarm payroll growth has averaged 275,000 a month over the last year, a pace last seen in the roaring ’90s. Yet nothing else has that ’90s feel: not the pace of economic growth, not capital investment, not productivity growth, not even Nasdaq 5000. The juxtaposition of solid job growth and tepid economic growth describes what the current expansion lacks: dynamism and innovation. These are the forces that drive productivity growth, allowing companies to produce more with less and provide a higher real wage to workers. Almost all of the increase in real GDP since the start of 2010 has come from growth in labor inputs, according to Douglas Holtz-Eakin, president of American Action Forum, a center-right think tank, and a former director of the Congressional Budget Office. Labor inputs include the number of jobs and the number of hours worked. The contribution of productivity has been miniscule. … Productivity is set to take another dive in the first quarter if the Federal Reserve Bank of Atlanta’s GDPNow model is correct. Its “nowcast,” based on publicly released economic indicators to date, points to first-quarter real GDP growth of 0.3 percent. The model was just updated Tuesday to reflect weak reports on February retail sales, industrial production and housing starts. And it’s sure to be a part of the discussion at the Fed meeting currently underway.

Comment

<Click on chart for larger image>

- Atlanta Federal Reserve – GDP Now For March 17, 2015

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2015 was 0.3 percent on March 17, down from 0.6 percent on March 12. Following yesterday morning’s industrial production release from the Federal Reserve Board that reported a 17 percent decline in oil and gas well drilling in February, the nowcast for first-quarter real nonresidential structures investment growth fell from -13.3 percent to -19.6 percent.

<Click on graphic for larger image>

Ever since this month’s payroll report was released we have been suggesting that something might be off with the data. The payroll numbers are inconsistent with all other economic reports, earnings reports and market reactions (collapsing commodities). The payroll report says the economy is humming along nicely, but nothing else is confirming this.

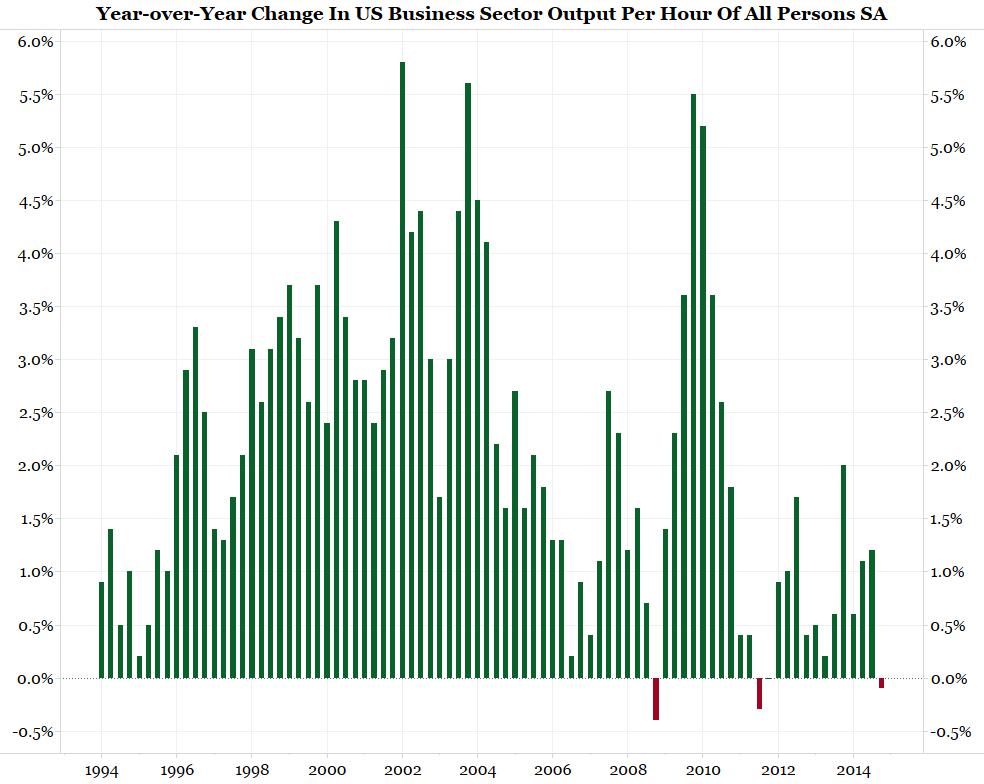

Productivity, which is simply GDP growth minus aggregate labor output, highlights this deviation nicely. The chart above shows GDP growth has only running slightly ahead of labor growth since 2010, which is leading to barely positive productivity. The chart below shows the year-over-year change in productivity. This figure was negative for only the third time in 20 years during Q4 2014 (latest data). Furthermore, the Atlanta Fed’s Q1 2015 GDPNow is just 0.3% despite strong payroll data, suggesting another dive in productivity for Q1 2015.

Has the American economic suddenly become inefficient? We doubt it, so maybe some of the data is wrong. Most are inclined to explain away the poor data by pointing to factors such as weather. Maybe the weak data, which constitutes the majority of economic releases, is not wrong though. Perhaps we should be re-examining the one data point that is strong, non-farm payrolls.

According to Occam’s Razor, the simplest answer is often the best. Rather than trying to explain away the myriad of poor economic releases, wouldn’t it be easier to be suspect of the one outlier that is pointing to robust growth?