Comment In the last year, two things happened every three months. First, financial firms reported losses. Soon after that, analysts proclaimed the worst was over. For the last three quarters, these predictions of the worst being behind us have proven wrong. But, will it be the case this this quarter?

Highlighted in blue above are America’s (including Canada) losses and capital raised. In Q4 2007 these banks reported $76 billion in losses. In Q1 2008 they reported $70.1 billion in losses. So far in Q2 they have reported $68.6 billion in losses. Still to report are Goldman, Morgan Stanley, CIBC and IndyMac (who was taken over right after the quarter ended) among others. Also remember that Countrywide and Bear Stearns will not report for Q2. So it is likely that Q2 losses will surpass Q1 and has a shot at surpassing the record set in Q4 2007. If the worst is over, we are having a hard time finding it in these numbers.

Highlighted in red above is Europe’s losses and capital raised. The sharp-eyed reader will note that European financial institutions have reported larger losses than America in Q4 2007 and Q1 2008. This illustrates that the credit crunch has been more of a European problem than an American problem. However, in Q2 they have only reported $600 million in losses. Why so low?

The answer is only two of nearly 50 European financial institutions that have previously reported losses have released Q2 financial statements. These losses are still to be reported. If America is a good guide, and it has been in the past, then European financial institutions will report some $90 billion of losses when the Q2 earnings statements come rolling in. Combine this with the $10 billion in losses from the 20 Asian financial institutions that have yet to report, and total financial system losses will near $600 billion when all this settles out.

Keep in mind that these losses are only for financial intermediaries (banks and brokers). Not included on this list are “other financial firms” such as Fannie Mae and Freddie Mac, monoline and other insurance companies (AIG), finance companies (GE Capital and CIT), hedge funds, private equity firms and other financial institutions such as pension managers and endowments. These firms are excluded because reporting is either not available (hedge funds and private equity), inconsistent because some firms are private (monolines like FSA and Assured Guaranty), or buried within larger corporations (GE Capital). So, to keep this list consistent so its quarterly results can be compared over time, it has been restricted to the very large, but not totally complete, list of financial intermediary firms only.

$1 Trillion In Losses

We point this out because the story below is Bill Gross’ latest monthly letter. It is making news this morning because Bill is estimating that losses will be $1 trillion. Bill now tops the $945 billion estimate by the IMF and joins Frank Veneroso ($2 trillion), Bridgewater ($1.6 trillion), Hedger fund manager John Paulson ($1.3) in the “trillion dollar guess club.”

That’s the bad news. The good news, as we highlight above, is the vast majority of that trillion dollars has already been realized. Nearly $600 billion by financial intermediaries and another $200 to $300 billion by “other financial firms.”

So, does this mean that the worst is almost over? Not quite, two other things need to happen.

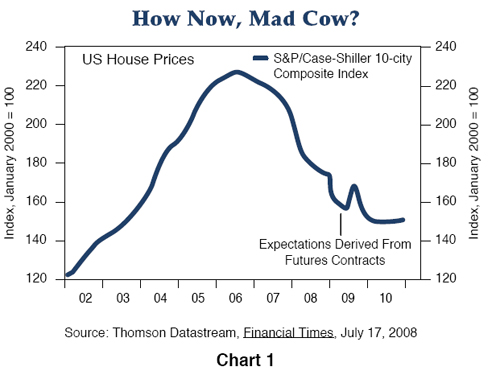

First, home prices need to bottom and stop creating more losses. This is why Q2 losses rival Q1. Home prices continued to decline and created more losses. As the chart below shows, the Case/Shiller Index is still falling and the futures market is expecting further declines into 2010. Yes, the futures market’s forward-looking prices can be wrong (as we noted they were with crude oil earlier this week), but hope that home prices are bottoming now are just that, hope.

Second, once the losses stop, the financial system needs to be seriously re-capitalized. The typical financial intermediary is levered around 14:1. For every dollar in capital, they can hand out $14 in loans. As the table above shows, financial firms have losses in excess of capital raised by $120 billion. This means there is about $1.6+ trillion less of credit available in the world than there was a year ago because of the shrinkage of capital and balance sheet impairment. Simply put, the financial system is shrinking, and there isn’t enough credit to satisfy financial markets and real economies that want to grow.

That is why we see financial products that have three-letter acronyms you never heard of blow up. They all relied on massive amounts of leverage (borrowing), and the shrinking financial intermediary means they can no longer get it. This is also why banks have been accused of lying about LIBOR – we’ll quote you a rate, but don’t expect a loan at that rate. Until capital is raised to offset these massive losses, we will continue to see these kinds of problems. This is the “negative feedback loop” that Bill Gross refers to below.

So, please raise your hand if you have $500 billion or so to invest in financial firms. The problem is the usual suspects, sovereign wealth funds and private equity firms, already have invested and have taken huge losses. So they are no longer interested. Financial firms have taken to “selling the furniture” to stay afloat. See Merrill’s recent asset sales such as Bloomberg.

Deleveraging is a painful process. It comes about because home prices were at the wrong level. This process is not quite complete. Home prices have yet to bottom and massive amounts of capital have to be raised for it to end. Otherwise economies and markets have to shrink to re-align with a smaller financial intermediary system.

-

Pimco.com – Bill Gross: Mooooooo!

The dominoes fall month-by-month, forcing prices ever lower as shown in Chart 1 provided by Case-Shiller. An asset deflation in turn becomes a debt deflation, as subprimes, alt-As, and finally prime mortgages surrender to the seemingly inevitable tide. PIMCO estimates a total of 5 trillion dollars of mortgage loans are in risky asset categories and that nearly 1 trillion dollars of cumulative losses will finally mark the gravestone of this housing bubble. The problem with writing off 1 trillion dollars from the finance industry’s cumulative balance sheet is that if not matched by capital raising, it necessitates a sale of assets, a reduction in lending or both that in turn begins to affect economic growth, creating what Mohamed El-Erian fears as a “negative feedback loop.” -

The Wall Street Journal – David Ranson: What Financials Rally?

Countrywide Loans Marked to Market Show Sector Frailty

No sooner had financial stocks gotten up off the mat than poor existing-home sales body-slammed them. The abrupt halt Thursday to the relief rally that started last week underscored how little confidence investors have in the sector. Many feel they can’t get a handle on bank balance sheets. Details that emerged earlier this week from Bank of America’s purchase of Countrywide Financial help explain why that is the case. The deal’s numbers show that big losses could still lurk in banks’ closets. If so, their loan portfolios are worth far less than the stated values, and reserves taken against possible losses are inadequate. And if bank capital is overstated, firms could again be forced into dilutive capital raising.