- The Wall Street Journal – Mark Gongloff: A ‘Buy’ Sign for Treasurys?

Some Bet End of QE2 Will Be Boon to Bonds

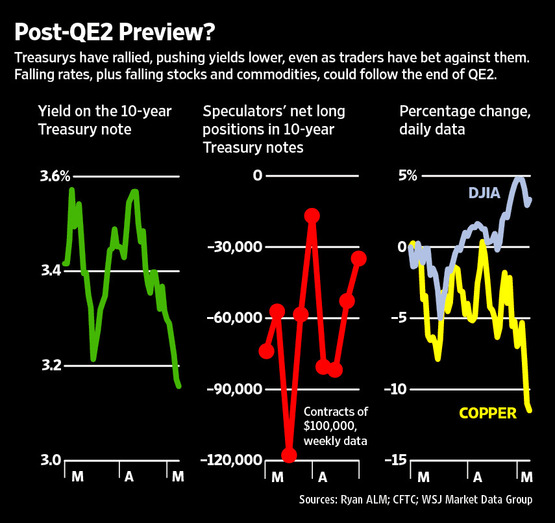

The recent rally is evidence for some investors that the end of the Fed’s second big bond-buying program, known as quantitative easing, or QE2, might actually benefit or, at worst, be a non-event for bonds. It could be a boon for Treasurys if economic growth slows, knocking down commodity prices and reducing the risk of inflation. “If QE2 contributed to stocks and to risk assets and to the commodity bubble, well, what happens after QE2?” said David Ader, head of government-bond strategy at CRT Capital. “When QE2 ends, maybe those assets go the other way, and people buy more Treasurys.” The swift decline in stocks and commodities last week further bolstered the argument that the end of QE2 would actually benefit bonds.

Comment

- Reuters – PIMCO would only buy Treasuries on recession risk

PIMCO’s Bill Gross, who runs the world’s largest bond fund, said on Friday the only way he would reverse his “short” position on U.S. government-related bonds and purchase Treasuries again is if the United States heads into another recession. Since the news on April 11 that Gross turned more bearish on government debt including Treasuries, reflecting his growing worries over the country’s fiscal deficit and debt burden, Treasury prices have been soaring. On Friday Treasury prices fell after an unexpectedly strong U.S. monthly employment report. Treasuries then reversed course on a media report, later denied, that Greece is mulling quitting the euro zone, which revived safe-haven demand for bonds. Asked Friday what would change his bet against government debt, Gross told Reuters: “Treasury yields are currently yielding substantially less than historical averages when compared with inflation. Perhaps the only justification for a further rally would be weak economic growth or a future recession that substantially lowered inflation and inflationary expectations.” The benchmark 10-year U.S. Treasury note was flat, with the yield at 3.15 percent, in early afternoon trading on Friday. On April 11, the yield stood at 3.58 percent. Gross said for now, the impact of negative real interest rates on commodity prices and other inflation generators argues for Treasury yields to move in an upward direction. “Debt ceilings and deficit reduction frustrations, as well as the end of QE2 in June are other bearish influences,” Gross added.

We have long argued that QE2 was about supporting risk assets and not about supporting the bond market. Therefore, if risk assets suffer when QE2 ends, it would be bullish for Treasuries.

We addressed this in our late March conference call:

So how does this help to raise stock prices? Remember that we have talked about this before. POMO – permanent open market operations – occur everyday at 11:00. Everyday at 11:00, the Federal Reserve purchases Treasuries. Everyday at 11:00, a group of Treasuries – say, $6 billion-worth of Treasuries – is converted to cash.

What happens with that cash? The Federal Reserve’s portfolio balance theory says that cash will go where it is treated the best. Right now, that is “risk on markets.” Right now, as the Federal Reserve converts Treasuries to cash by purchasing them, that money tends to leak out into other places and in other ways in the market. One of the big places that the Federal Reserve believes that it goes – and I agree with them – is equities.

There was a story in The Wall Street Journal yesterday and there was a story last week, as well, about what is going to happen to Treasuries when QE2 stops. The assumption in the story is that the Federal Reserve is buying Treasuries to push down interest rates. I think that it is the opposite – that the Federal Reserve is engaged in QE2 to get money out of Treasuries and get it into other markets. One of the reasons why yields may have been biased upward is because of QE2. And when it ends, it might have somewhat of a stabilizing force in interest rates.

Let me be clear on my word usage. I said “stabilizing force.” I did not say that, when QE2 ends, rates are going to go down. There is not going to be money being pulled out of Treasuries anymore.