Ask any economist for an interest rates forecast and he or she will most likely tell you interest rates are going higher. Ask them why they think interest rates are going up and they will probably tell you a confluence of events is coming together causing them to look for higher rates.

This confluence of events has been coming together for almost nine years and is still a work in process!

Economists Are Bearish Always And Everywhere

The table below shows the results of Bloomberg’s survey of economists. It details economists expectations for 10-year Treasury yields over the next six months. For those familiar with this survey, we use the quarter-end results closest to six months into the future.

See the bottom of the table. Since December 2002 Bloomberg has conducted 96 monthly surveys. Of these, an incredible 92 surveys (96%) have forecasted higher rates. To repeat, only four times since 2002 (4%) have economists been forecasting lower rates. They are highlighted in red. Even these bullish forecasts can be explained in a bearish light.

In all these cases (June 2007, June 2008, June 2009 and December 2010), interest rates spiked dramatically higher during the survey period, which can be a week long to 10 days long and cover the payroll report, causing some economists’ forecasts that were bearish when given to look bullish when they were finally published (We use the yield on the release date to grade these results). We do not have the data to adjust for this reporting quirk, but it could very well mean that 100% of these forecasts actually expected higher rates.

Further, as also shown at the bottom of the table, an average of 78% of the respondents in these surveys expect higher rates. Additionally, in 34 of the 96 monthly surveys more than 90% of the respondents were looking for higher interest rates. These instances are bolded in the table below. To repeat, over one-third of the time a strong consensus of 90+% were looking for higher rates. This includes two months (February 2004 and May 2005) where 100% of the respondents were looking for higher rates. The last time 90+% of those surveyed were looking for higher rates was August 2010.

Economists are always bearish on interest rates. Expansion, great recession, bubble, surplus, deficit, inflation, deflation, equity bull market, equity bear market, easing, tightening, Republican, Democrat, winter, summer, Yankees, Red Sox have all occurred during the period covered below. The results are always the same.

<Click on table for larger image>

<pdf version>

For the contrarians in the crowd, note at the bottom of the table above that these forecasts only proved directionally correct 55% of the time. Of course since they are always bearish this means interest rates went up 55% of the time.

Bullish On Inflation, Bearish On Rates?

Most believe economists do not really forecast interest rates. Rather, they forecast real economic growth, inflation, the budget deficit, unemployment and other economic measures. Their interest rate forecast is a by-product of these results. This is a reasonable way to do it.

So let’s look at the same survey’s results for inflation and real economic growth. If economists are always bearish are they always looking for higher inflation and real growth?

The next table shows the results of the inflation forecasts from the same Bloomberg survey. It is set up the same way as the interest rate table above, looking at the forecast six months into the future.

If economists are bearish 96% of the time on interest rates, it is not because they think inflation is about to head higher. As the bottom of the table shows, only 25 of 94 surveys (27%) showed higher inflation expectations over the ensuing six months. Economists’ higher rate forecasts are not due to higher inflation expectations.

<Click on table for larger image>

<pdf version>

Contrarians will note that the forecasts for inflation are directionally correct 60% of the time – nothing to suggest that the consensus has any great insight, especially since published inflation rates are not tradeable and they do not seem to affect interest rate forecasts.

Real Growth Forecasts

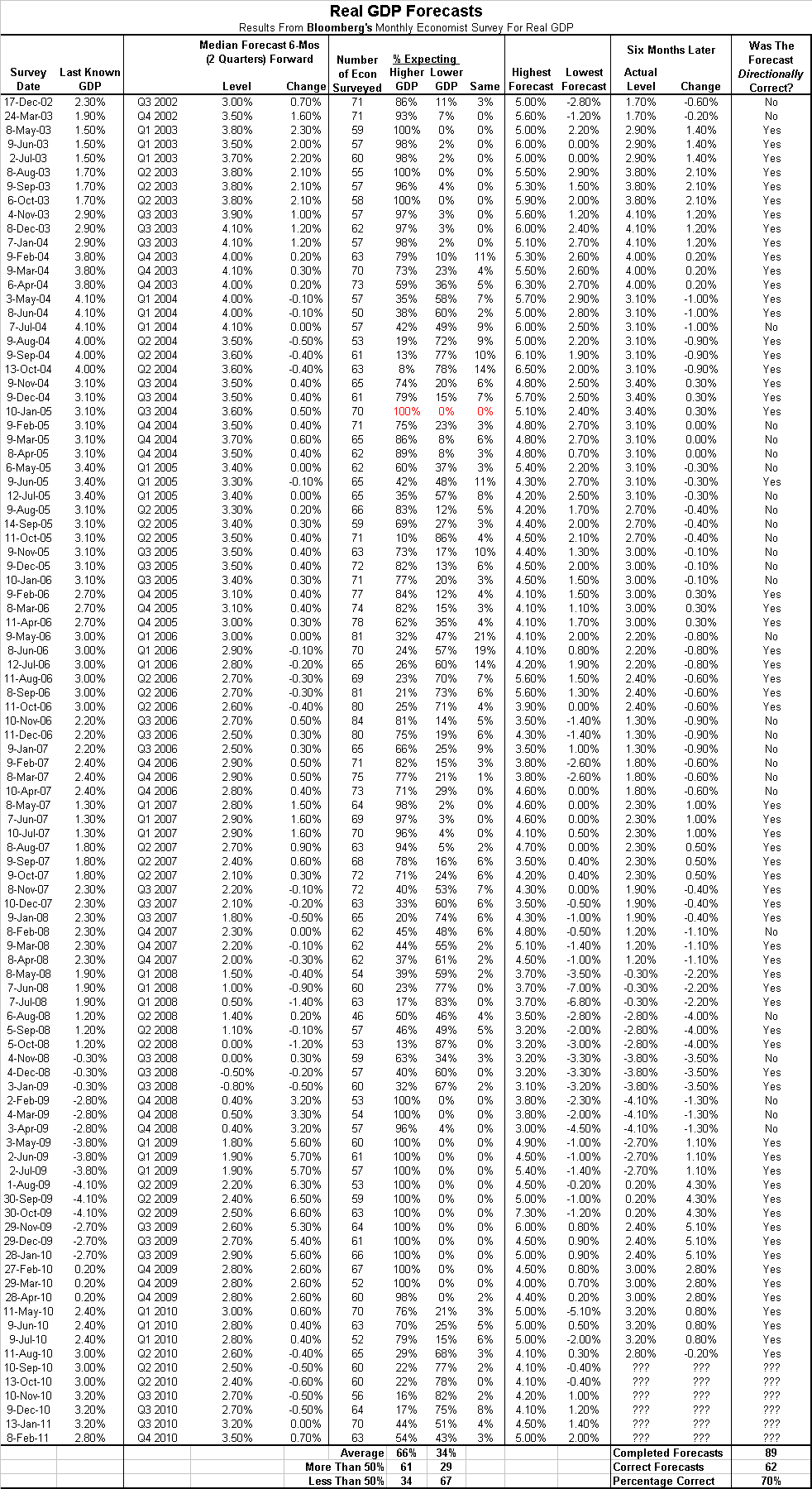

The last table below shows the real GDP forecast from the same Bloomberg survey. Bloomberg does conduct a monthly survey of GDP forecasts (which is obviously quarterly data) and, to be consistent with the interest rate and inflation forecasts above, we look at the forecast two quarters in the future.

As the bottom of the table shows, economists are generally optimistic about the economy. 61 of the 95 monthly surveys (65%) call for higher higher economic growth. Much like the inflation surveys, the real GDP surveys can not explain why 96% of the forecasts for interest rates are higher.

<Click on table for larger image>

<pdf version>

For the contrarians, the economists do a pretty good job of forecasting real growth as they were correct 70% of the time. However, since there are no GDP futures and these forecasts do not translate into a reliable interest rate forecast, these real GDP estimates seem to have little utility.

Conclsuion

Economists seem to have a structural bias in always predicting higher interest rates which cannot be explained by their inflation or real growth forecasts.

The reason for this bias is unknown. Some probably look at the historical low in rates and posit that they have to go higher.

Whatever the reason, we should be aware that economists are always bearish no matter what the situation might be. As such, any time an economist offers such a bearish view it must be placed in this proper context.