Understanding The Retail Investor

This is the third installment in a series detailing retail investors as a dominant market force in 2025.

To understand the characteristics of retail investors: The Rise of the Retail Trader

For a glimpse into their investment habits: Rise of the Retail Trader Part II: In the Driver’s Seat

To summarize, in the past, professional investors typically dominated the trading market, with most volume originating from large asset management or institutional investment firms. But after what is now known as ‘meme stock mania,’ the retail investor began to have an outsized impact.

Shifting from ‘set-it-and-forget-it’ investment products to momentum and speculation tools, retail traders now speculate with options, and they crowdsource due diligence.

This group buys individual stocks (sometimes with a sub $1 price), hoping for 10x returns, uses 0DTE options to speculate intraday, and churn ETFs and individual securities at significantly higher levels than pre-pandemic.

Below, we aim to highlight the retail investor share of equity market activity.

Equity Market Flows in 2025

Following along with our series on retail traders, we have made the argument that retail investors have become a major player in equity markets.

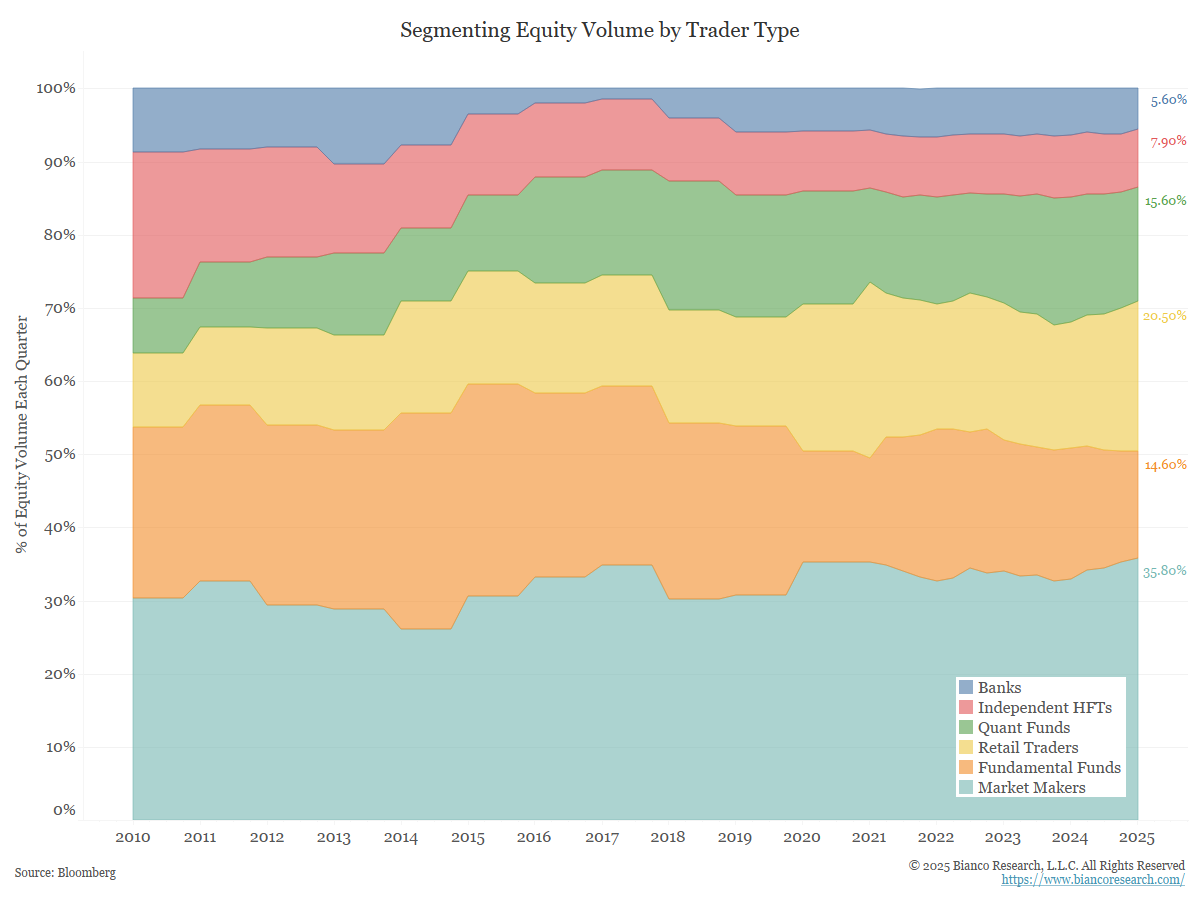

Retail traders have steadily accounted for a growing portion of equity volume over the past decade. The cohort now represents about 20% of equity volume.

Just a few years ago, monitoring or quantifying this group had been difficult, but given their increased significance, major institutional firms have begun reporting retail activity.

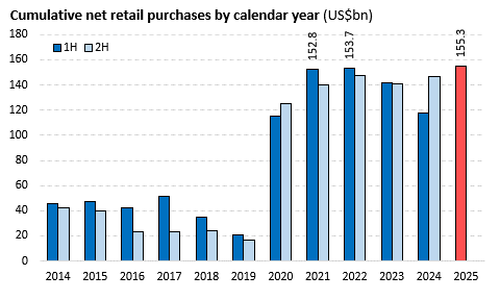

Data from Vanda shows retail traders looked through market volatility to plow into equity markets while institutional investors were sellers.

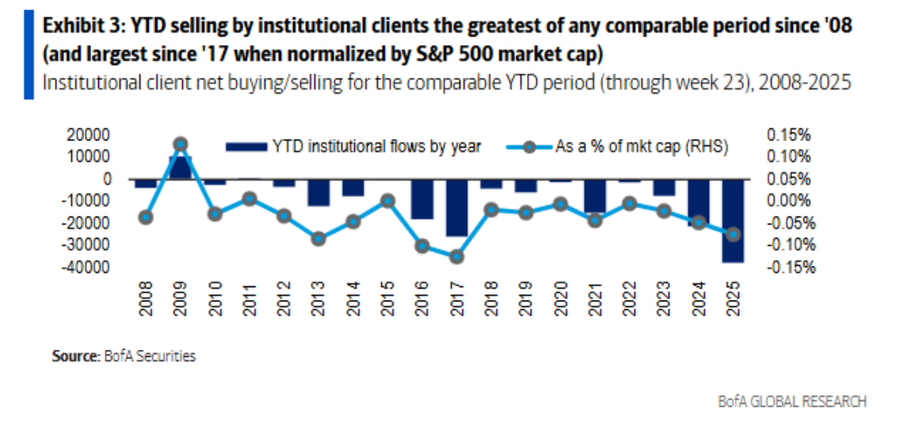

Bank of America quantifies this more directly (Institutional clients were the biggest net sellers YTD since 2008). The bars below represent the cumulative net buying of institutions less private clients (retail). In other words, when retail net buying outpaces institutions, this series will be negative.

Year-to-date, 2025 represents the largest institutional/retail divergence over at least 15 years.

The S&P 500 hit an all-time high in June, and while retail traders were scooping up shares at discounts post Liberation Day, professional money managers were fleeing equities.

This is a great example of the current state of the retail investor and has completely emboldened the ‘buy-the-dip’ mentality.

Retail investors are more likely to buy dips than professional money managers or other market participants because they hold the assumption that, regardless of whatever calamity might be impacting markets at the moment, the S&P 500 will invariably be higher in a year or three or five.

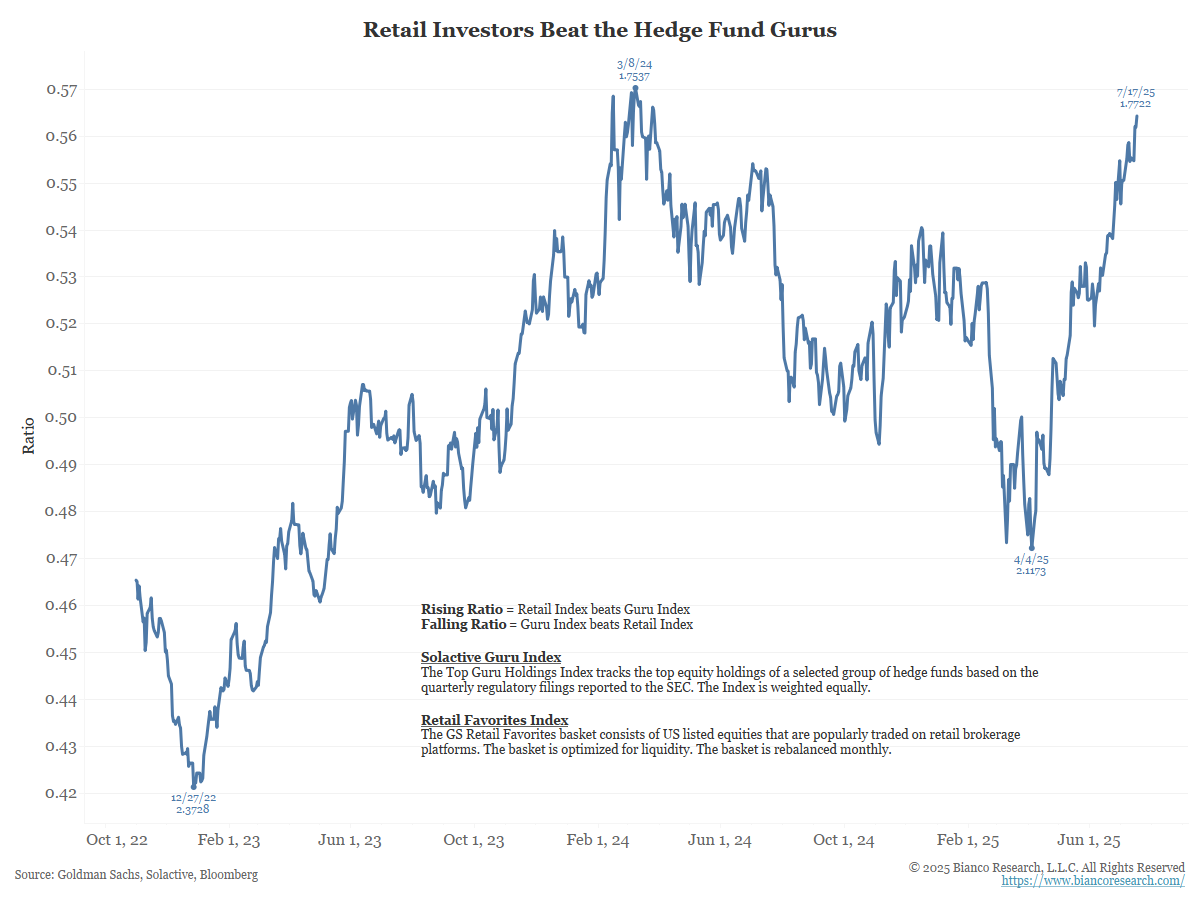

Stated another way, ‘dumb money’ isn’t so dumb in 2025.

In fact, Goldman Sachs publishes two series, the Retail Favorite Index and the Solactive Guru Index. We looked at the ratio between these two indices. In essence, this is a measure of retail investors’ stock picks compared to those of hedge funds. A rising line indicates that retail picks are outperforming their hedge fund counterparts.

Options Activity & 0DTE

Institutional and professional investors use options for several reasons, including hedging and adjusting market exposure. On the retail side, options are mainly a tool of speculation.

The total combined options volume (calls and puts) on all exchanges has exploded since 2020, mainly as a result of increased retail interest.

Options trading volume is near the highest it’s ever been and is trending higher.

The increase in volume, though, is not through the standard use of equity derivatives. The popularity of 0DTE (zero-days-to-expiration) options has upended standard market breakdowns of options volume by maturity.

CBOE publishes a report titled Volatility Insights, which most recently highlighted several key 0DTE measures.

In 2015, just 3% of options volume was in derivatives with less than 24 hours to expiration. 71% of SPX options volume had expirations greater than 7 days in the future.

By 2020, 17% of options volume on the S&P 500 index had less than 24 hours to expiration, with 56% of volume having greater than 7 days to expiry.

Compare those stats just 5 years ago to data through April 2025, where 54% of options trading volume on the index was done using derivatives expiring in less than 24 hours.

This is a complete shift in the breakdown of options volume.

These 0DTE options can have hedging benefits and other institutional use cases, but the majority of volume in these products comes down to retail speculation.

Taking a look at the average daily volume in SPX 0DTE options also provided by CBOE, since the beginning of 2020, retail activity has made up a larger share of trading volume.

In Q1 2025, estimated retail activity in 0DTE options made up over 55% of total average daily volume.

Wondering what retail is doing with these options? The answer is staring at Reddit, Discord, and their Robinhood accounts, crowdsourcing due diligence, and trying to catch the next move in the market.

The major difference is that many of these positions are bought at market open and exited before the market close, which amounts to a huge swath of day trading in the retail cohort.

High risk, high reward is seemingly the mantra of the WallStreetBets crowd.

Retail Investors Market Impacts

Retail traders have become market participants that must be accounted for. Every day, small investors are taking up a larger share of market activity with much higher levels of risk.

The group has shifted from ‘set-it-and-forget-it’ investment products to momentum and speculation tools.

As such, it’s important to touch on market impacts.

Sentiment Surveys

As we noted in Part I, it’s not simply new trading strategies but an entirely new demographic. In other words, who we consider the “retail crowd” has shifted to include a much larger group of younger investors who might or might not know anything about markets.

Compare this with just six years ago, most would consider the retail investor someone who dabbles in owning a few individual names like Apple or Microsoft, but is mostly dollar-cost-averaging into the S&P 500 and owns some bonds.

One consequence of this relates to the ability for investor surveys to properly gauge investor sentiment. Sentiment surveys are often conducted by brokerages or asset management firms to gauge investor sentiment outside of professional managers.

The problem is that the group they are surveying is no longer representative of the retail investor class as a whole. The survey participants are much more likely to be older and more risk-averse than the average 0DTE options trader surfing Reddit.

Volatility

The most common measure of equity volatility is the VIX index, which uses at-the-money options between 23 and 37 days to expiration to estimate 1-month implied volatility on the S&P 500.

The inherent problem in this metric is that if more than half of the options volume on the index is taking place in options with less than 24 hours to expiration, the intraday volatility created by these strategies is not accounted for.

Following this logic, 0DTE options are likely to increase intra-day volatility while diminishing longer-term volatility, measured by the VIX.

While this has yet to manifest, the theoretical fear remains that if 0DTE traders push market makers into forced selling, algorithmic or ‘rules-based’ investment strategies might be forced to sell into a declining market in an extremely short time frame, potentially amplifying market moves.

How can we quantify intraday volatility?

In response to the popularity of 0DTE, CBOE created a VIX measure that uses P.M. settled options on the S&P 500 the same day. Restated, this is an approximate VIX Index for tracking intraday implied volatility.

Plotting the 1-Day VIX against realized S&P 500 volatility (20 trading days) indicates that during periods of market stress, intraday volatility can significantly overshoot realized monthly volatility.

When markets are calm, intraday volatility is often in line with what is realized on a close-to-close basis.

The point here is that during periods of extreme market moves, the prevalence of 0DTE options creates a scenario where the actual volatility experienced intraday is not captured in traditional volatility measures, which measure over longer time frames and often ignore intraday market moves.

Final Thoughts

With retail becoming a more serious force in equity markets, the risks associated with this new market cohort become more important.

Because retail investors are more actively trading these markets, left tail risk becomes a larger focus for longer-term investors concerned about a rapid decline in prices.

The explosion of volume in 0DTE has transformed risk from a definable and measurable metric to an obscure and hard-to-measure phenomenon, and the pure level of retail activity in ETFs and individual securities can distort previously relied upon market signals.

The conclusion here must be that individual investors are a force to be understood, not ignored.