What Changed for the Retail Investor?

For much of history professional investors on Wall Street crunched numbers, stared at screens, and predicted (usually incorrectly) the direction of markets. Something changed between the proliferation of self-directed trading in newbie-friendly brokerages and near-zero fee index-tracking ETFs.

Professional investors are beginning to accept the fact that retail investors are a group that requires attention. Before the pandemic, the retail investor was rarely considered when examining market positioning and reactions to macro events and could have mostly been considered allocators or “set-it-and-forget-it” types.

Now, they speculate with options, specifically 0DTE options, and they crowdsource due diligence. The assumption is that regardless of whatever calamity might be impacting markets at the moment, the S&P 500 will invariably be higher in a year or three or five.

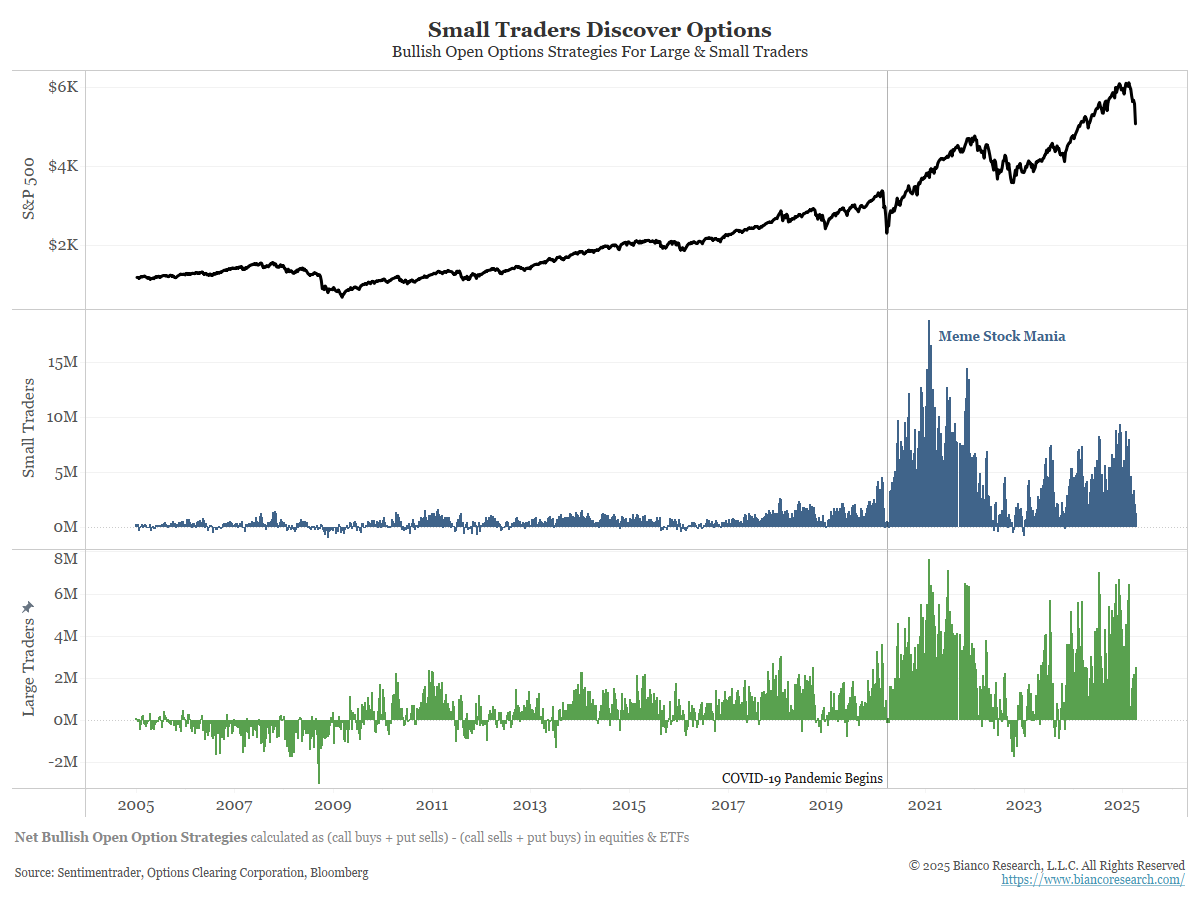

During the pandemic, small retail traders found comfort during lockdowns by crowdsourcing investment strategies using options. This can be seen in the following chart.

Small traders rarely used options before 2020. By January 2021, small traders had more bullish option positions than their larger counterparts.

The group’s influence on markets continues to grow. Retail investors are more likely to buy dips than professional money managers or other market participants because all this cohort knows is that markets eventually make new highs.

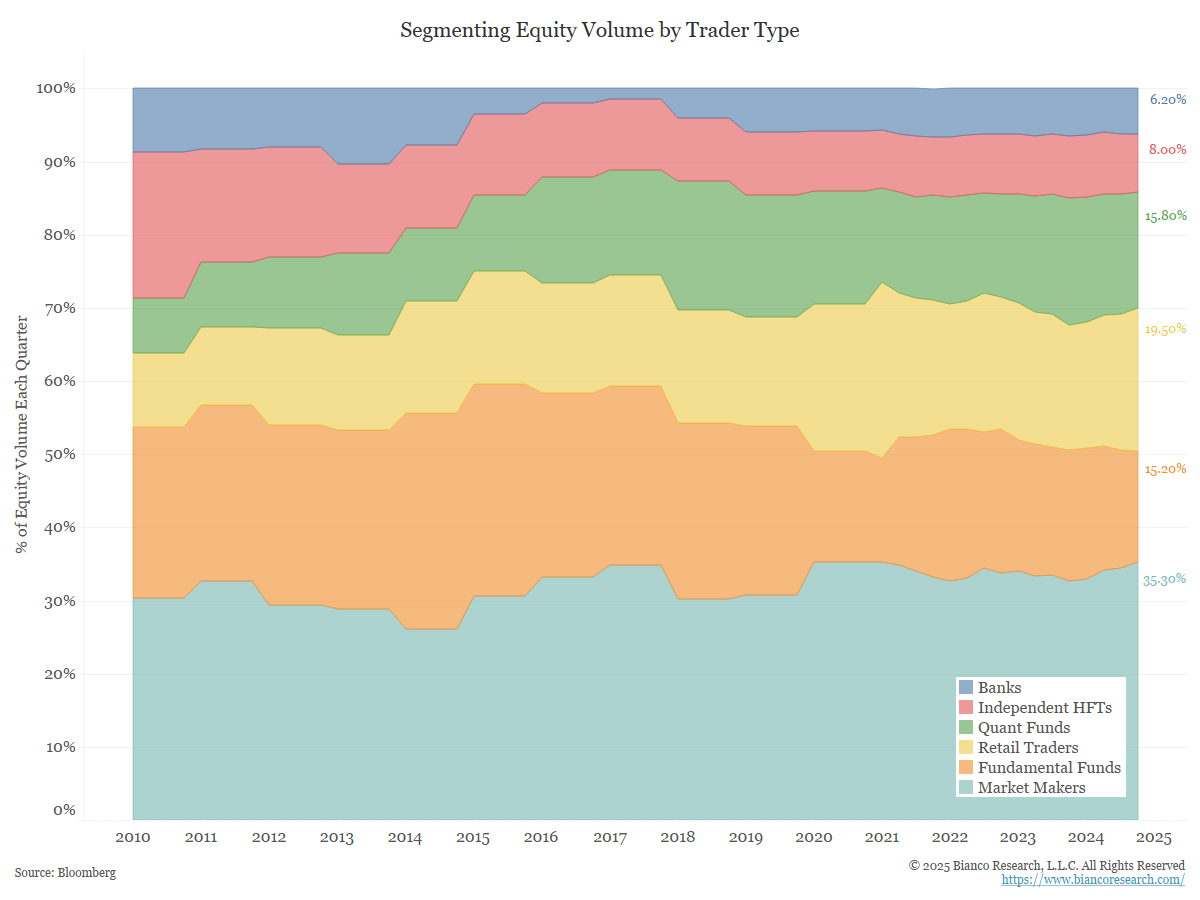

Retail traders have steadily accounted for a growing portion of equity volume over the past decade, reaching a peak of 24% in the first quarter of 2021. The cohort now represents about 20% of equity volume.

Understanding the Retail Crowd Has Gotten Harder

So, who we consider the “retail crowd” has shifted; it now includes a much larger swath of younger investors who might or might not know anything about markets. These new individuals, who could most likely be described as under 40, will tolerate more risk and are more likely to trade for themselves versus using a financial advisor.

Contrast this with just six years ago, when you might consider the retail investor someone who dabbles in owning a few individual names like Apple or Microsoft but is mostly dollar-cost-averaging into the S&P 500 and owns some bonds.

The demographic shift in an entire class of investors has broken many assumptions of how this crowd behaves in chaotic markets, and we must reevaluate the metrics by which we understand this investor group.

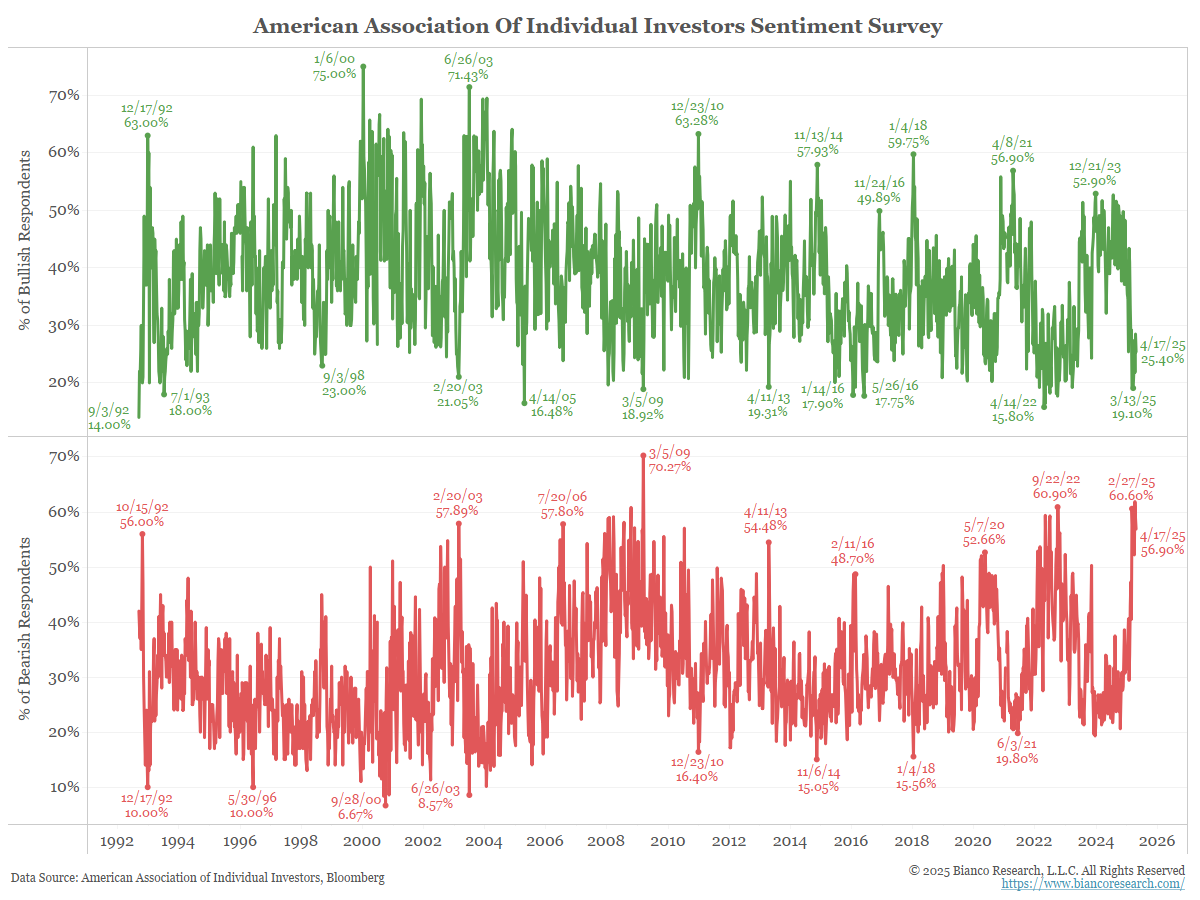

Take the American Association of Individual Investors Sentiment Survey. In March, the percentage of respondents who considered themselves bearish reached levels last seen during the Great Financial Crisis.

Yet we saw story after story of the retail crowd continuing to buy the dip:

- Financial Times – The flaky case for buying the dip

- Bloomberg – Retail Investors Who’ve Only Known Bull Markets Are Buying the Dip

- Bloomberg – Retail Traders Step In to Buy as Others Flee in Tariff Rout

- Financial Times – Retail traders plough $67bn into US stocks while investment giants flee

So, who is wrong? Are individual (retail) investors extremely bearish? Or are they buying every dip? The answer might depend on who you ask.

The American Association of Individual Investors is a trusted source; however, to answer their weekly survey, you must be a paying member of their group. We venture a guess that most retail investors who have become interested in markets over the past five years have never even heard of AAII.

This means the survey could be asking a much older, much more risk-averse crowd than the entire group of retail investors.

Imagine a 45-year-old man or woman with two kids making under $100k. Now imagine their concern when they see their investment account fall 6% in one day. You can imagine they might become much more bearish than a 25-year-old man or woman with no kids and a Robinhood account.

Have bullish attitudes changed? There is no question that the market shock of Liberation Day was a wake-up call to many ‘set-it-and-forget-it’ investors who happened to check their accounts that day, and to many 19-year-olds who bought call options in a Robinhood account that morning.

The point is that a new generation of investors has emerged and must be accounted for now.