Summary

Comment

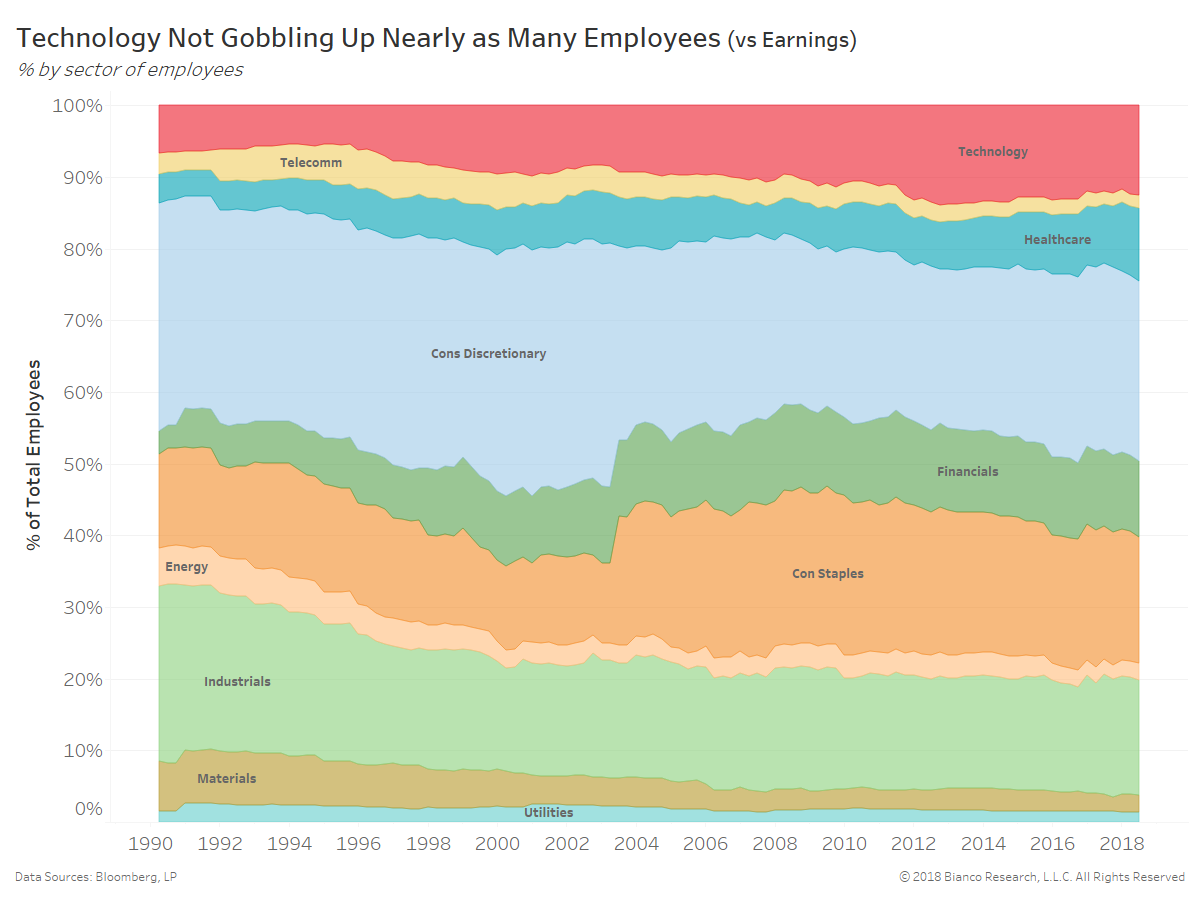

The next chart shows the share (%) of employees by sector since 1990.

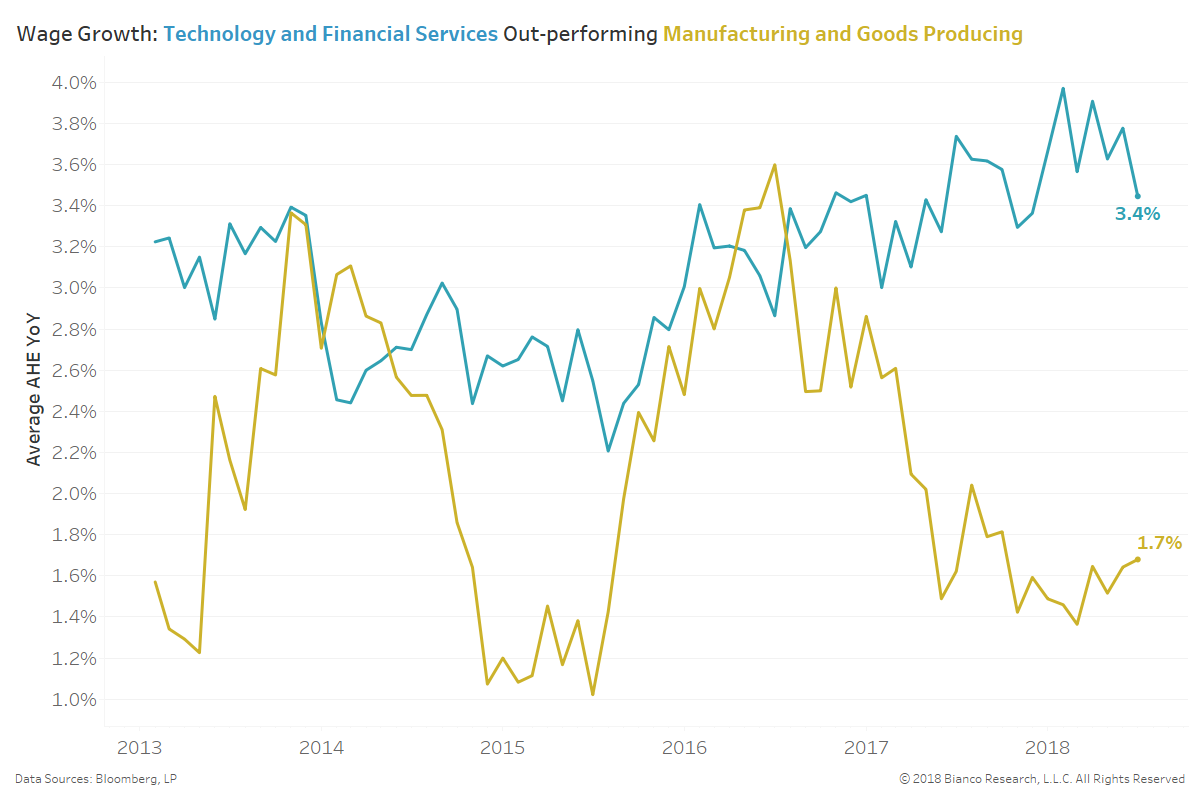

Strong wage gains and earnings across technology and telecom have not been met with a greater number of employees. A major issue plaguing the U.S. remains a heavy concentration of productivity to these sectors.

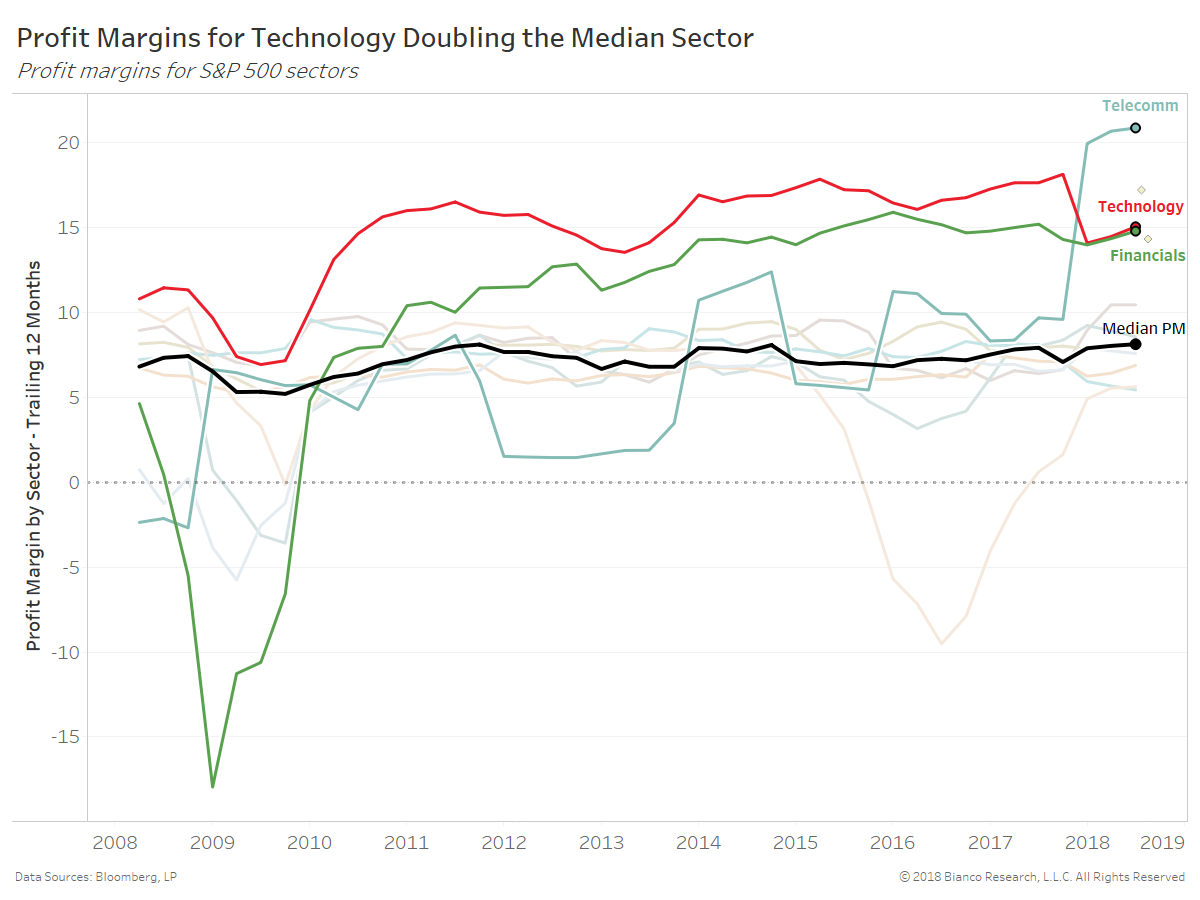

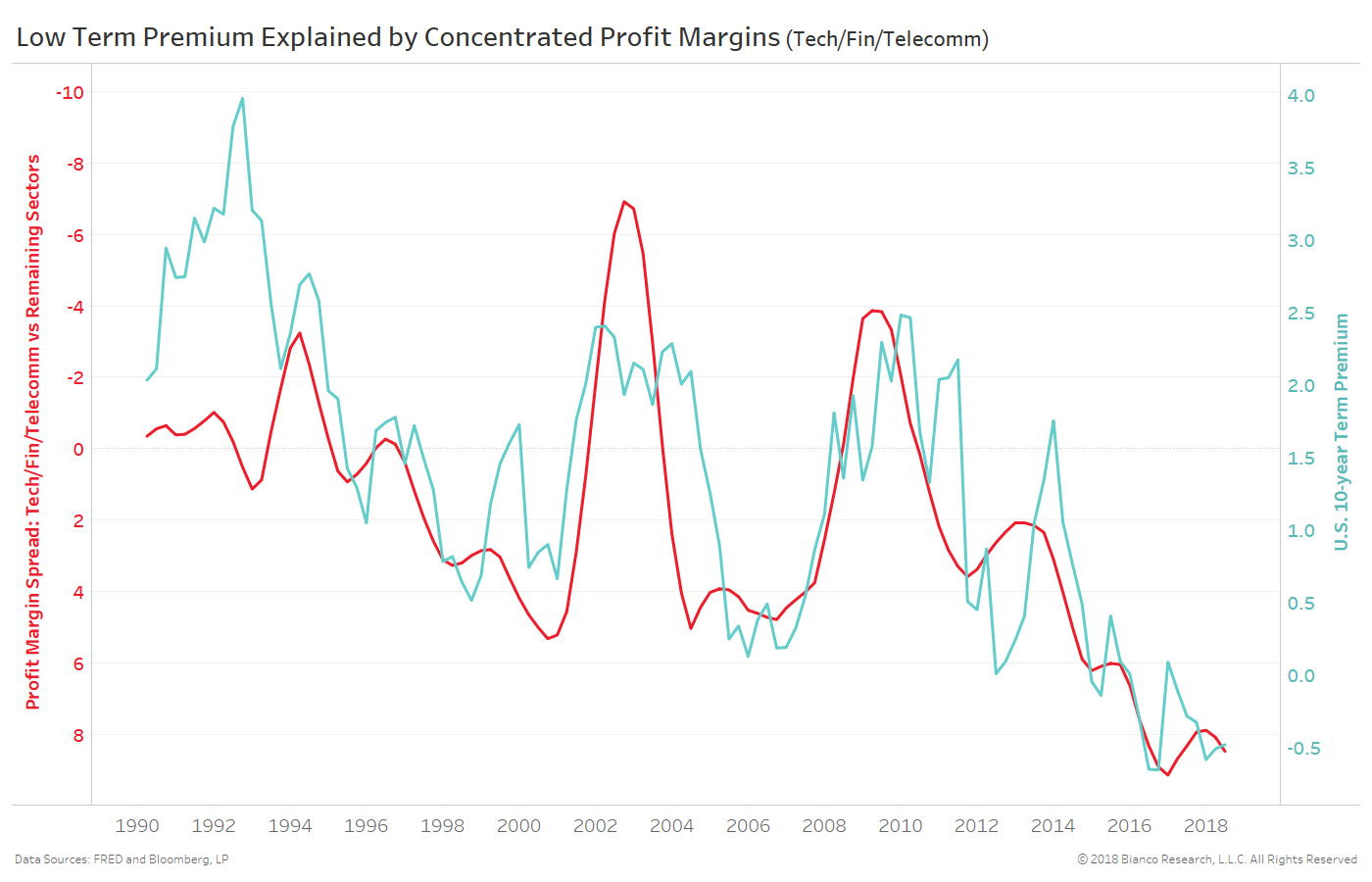

This quandary of concentrated productivity and profits is a major reason U.S. Treasury term premiums refuse to rise. The chart below shows the spread between profit margins for technology, financials, and telecom versus remaining sectors on the left axis and U.S. 10-year term premium on the right axis.

In theory, productivity gains should be able to seep into other sectors, but the pace of improvement in technology appears overtly difficult to chase. The U.S. yield curve may invert sooner than it otherwise would have given this weight placed on longer-end yields.