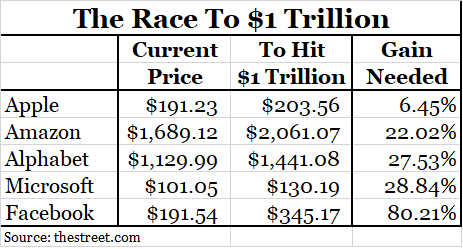

- Thestreet.com – Apple Is the Favorite to Reach $1 Trillion Market Cap First, but Rivals Loom

As Apple gets within striking distance of the whopping valuation, here’s what share price each of its top rivals needs to reach to keep pace.The race to a trillion is on and Apple Inc. remains the odds-on favorite. Despite Friday’s dip, Apple’s gains since reporting stronger-than-expected earnings and a big share buyback program in May have put it within a stone’s throw of becoming the first company to ever post a $1 trillion market cap. As of Wednesday’s close, Apple shares only needed to increase about 5% to reach the astonishing 13-figure mark.

Summary

Comment

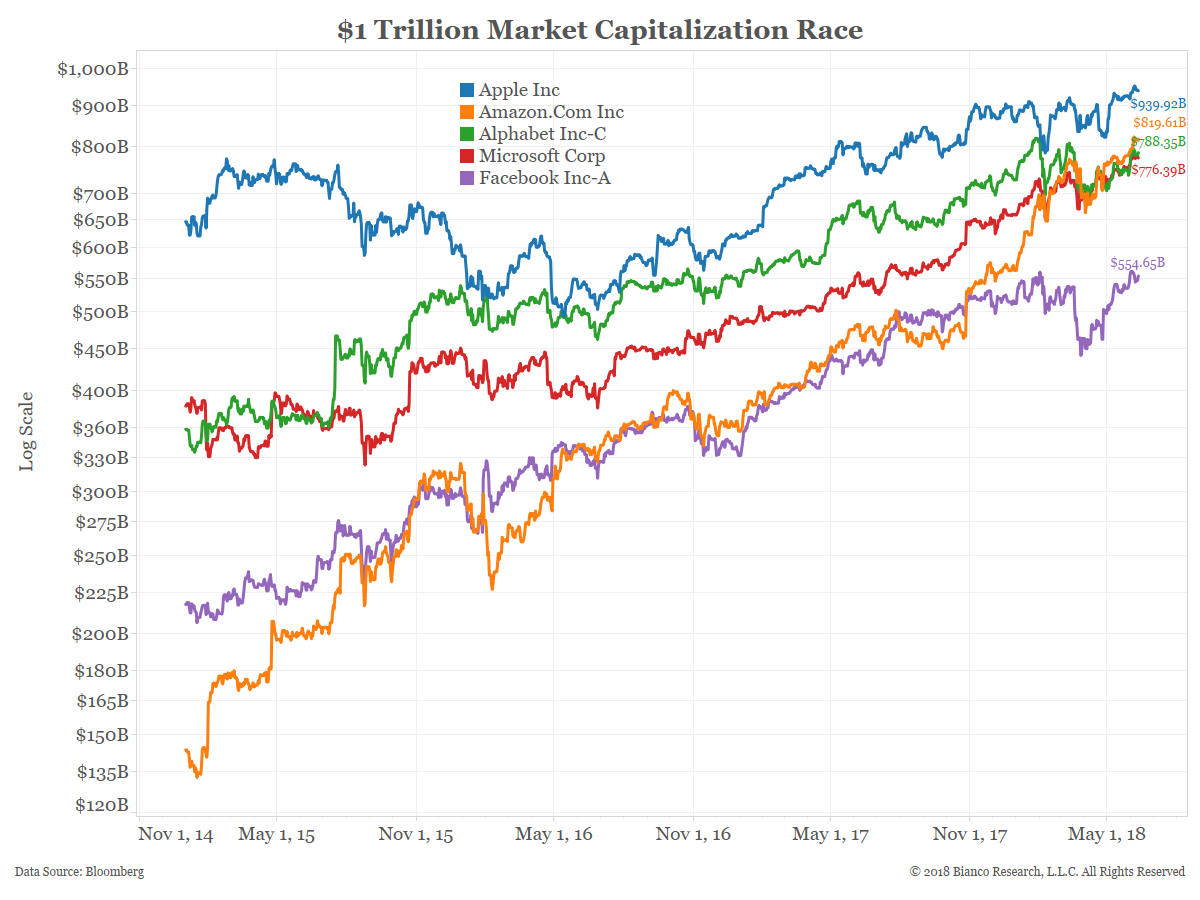

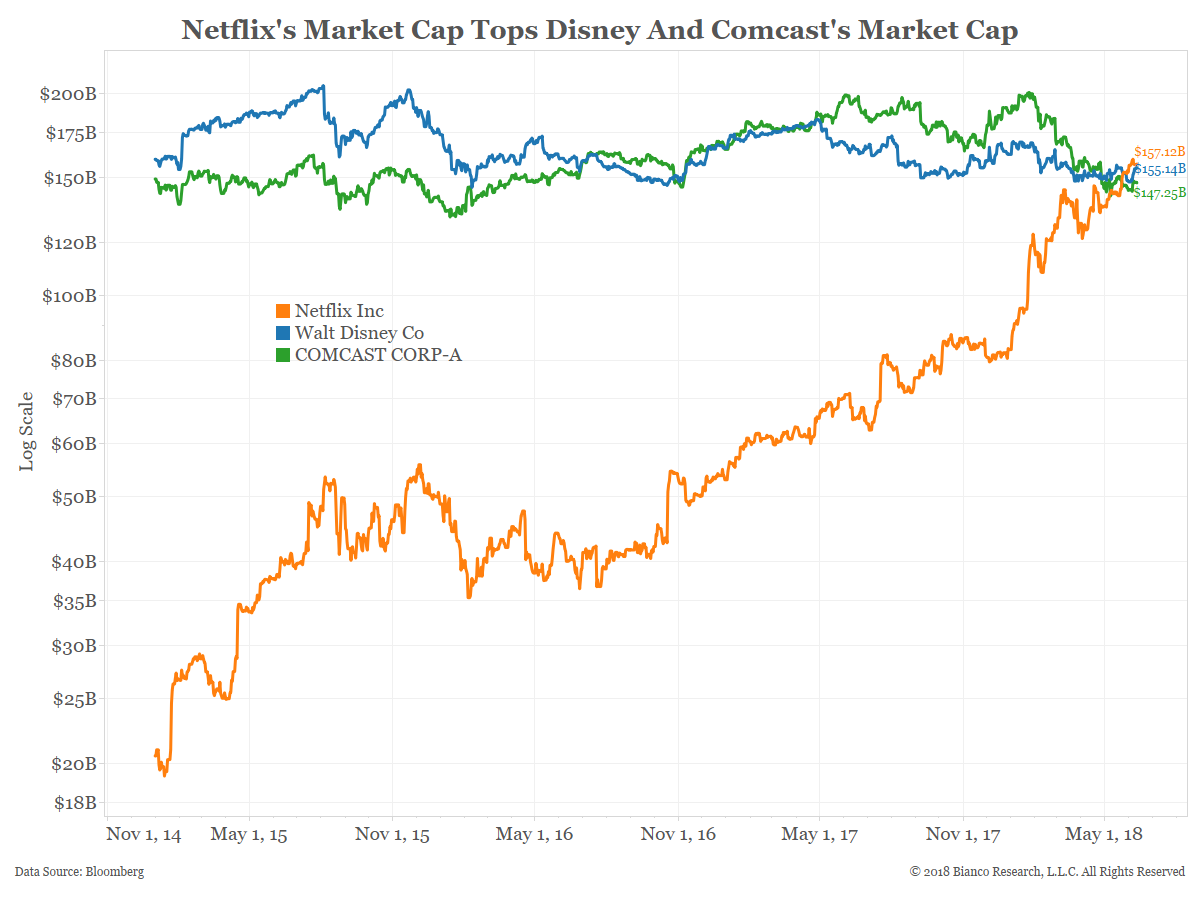

The five stocks in the table and chart above are the five largest U.S. stocks by market capitalization. The FAANMG (Facebook, Amazon, Apple, Netflix, Microsoft and Google/Alphabet) acronym also includes Netflix. Currently, Netflix is the 27th largest stock. But, as the next chart shows, Netflix recently passed Comcast and Disney and is now the most valuable media property.

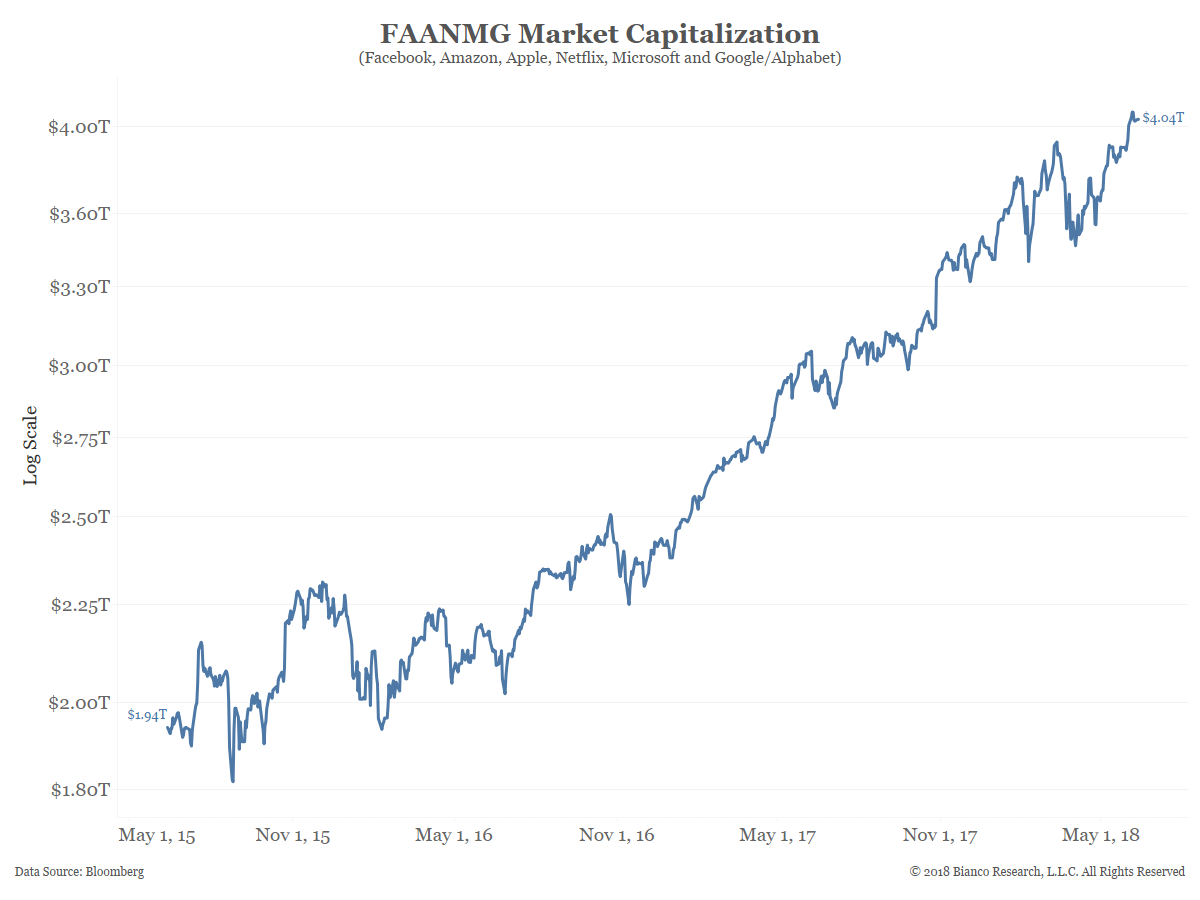

The growth of these stocks has been nothing short of astounding. The chart below shows their combined market capitalization over the last three years has more than doubled, adding over $2 trillion in value.

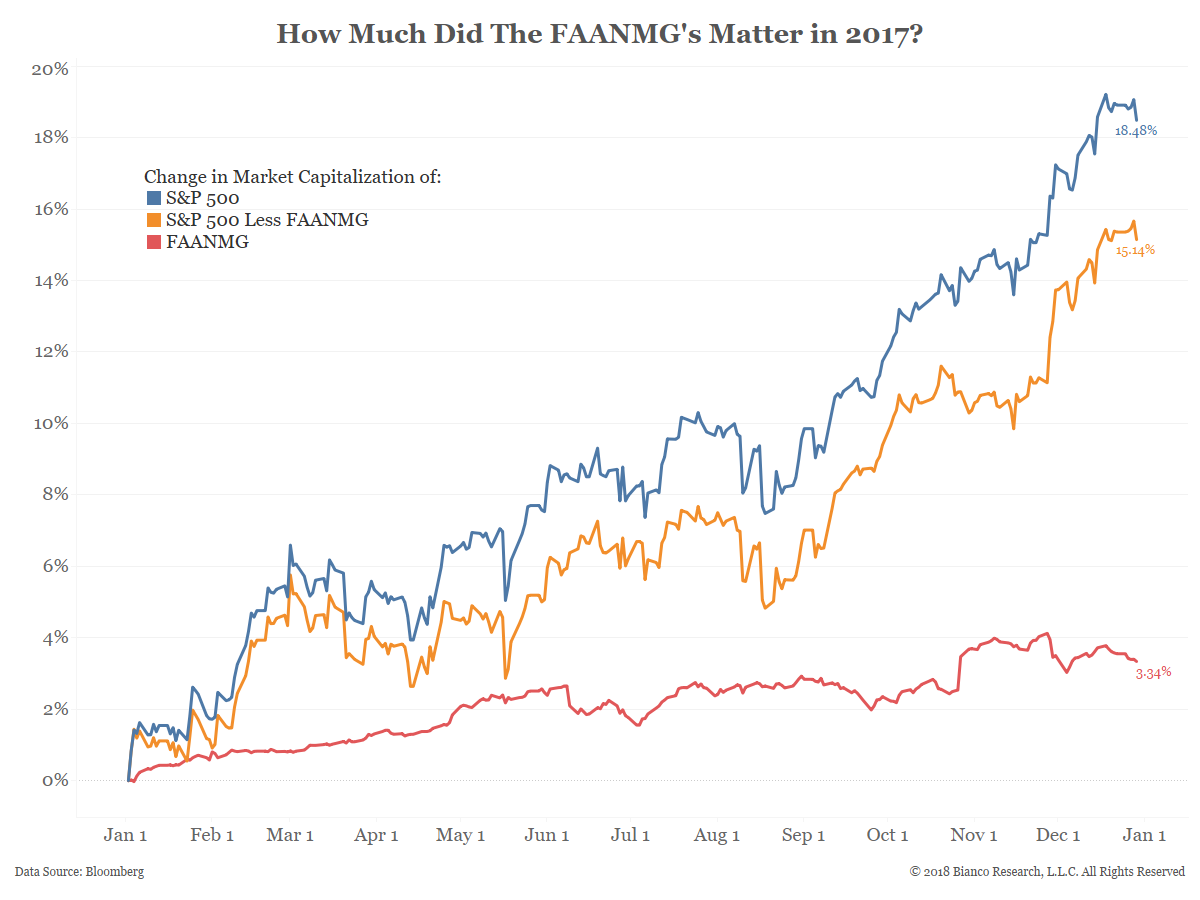

How big an impact did the FAANMG stocks have in 2017? The next chart shows the changes in market capitalization of the S&P 500 in blue, FAANMG stocks in red and the S&P 500 less FAANMG in orange.

In 2017 the S&P 500’s market capitalization grew 18.48%. The six FAANMG stocks accounted for 3.34% of the total and the other 494 stocks accounted for 15.14%.

So by the end of the year, the “legacy” companies accounted for the vast majority of the gain.

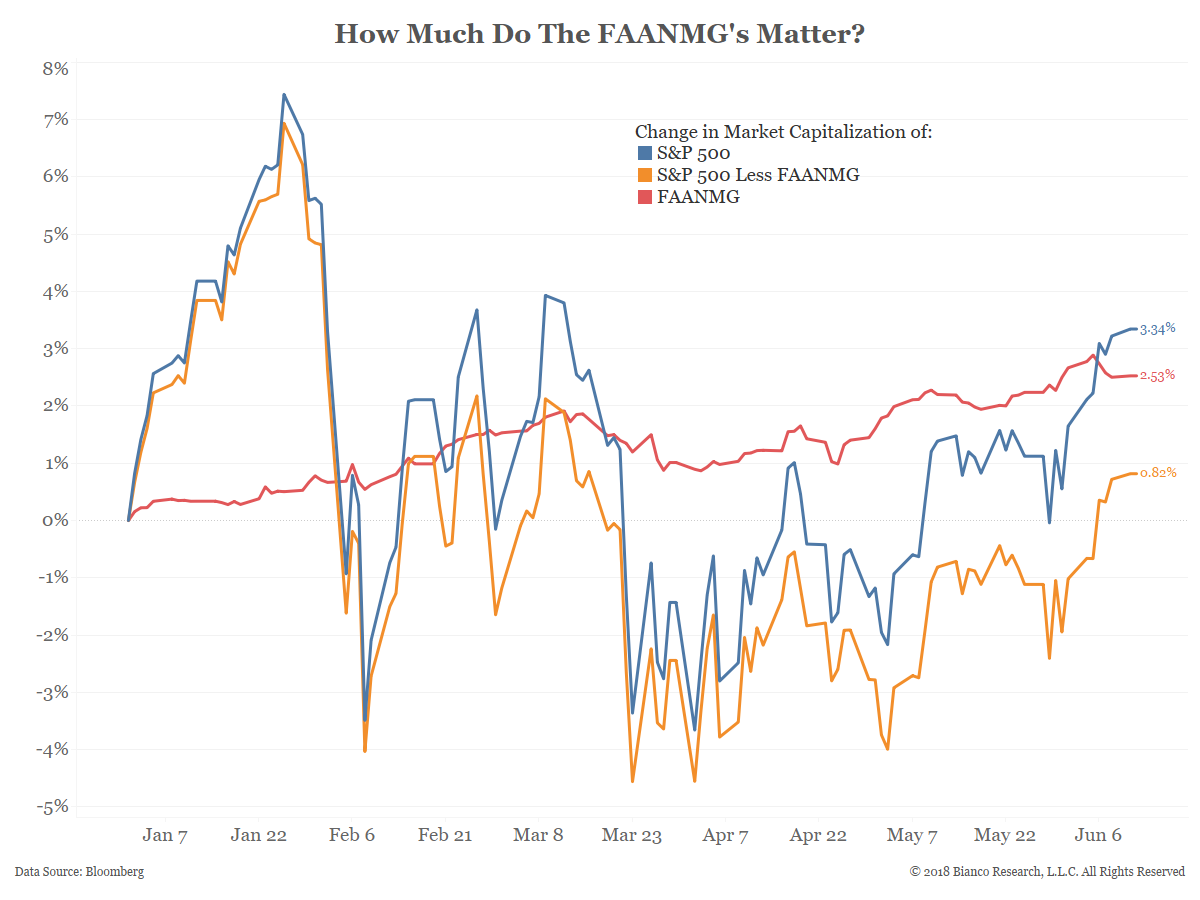

2018 has proven to be a different story. As the next chart shows, the S&P 500’s market capitalization has grown by 3.34%. The vast majority of this gain is due to the six FAANMG stocks. Their market cap has grown by 2.53%. The market capitalization of the remaining 494 stocks has barely grown, up just 0.82%.

Conclusion

The fact that the FAANMG stocks are a major contributor to the overall index may not come as a huge surprise to most. However, when quantifying their contribution to the overall index as we have in the manner above, it shows a weakness among the other 494 stocks that is much more consistent with a moderating global economy.