- The New York Times – E-Commerce Might Help Solve the Mystery of Low Inflation

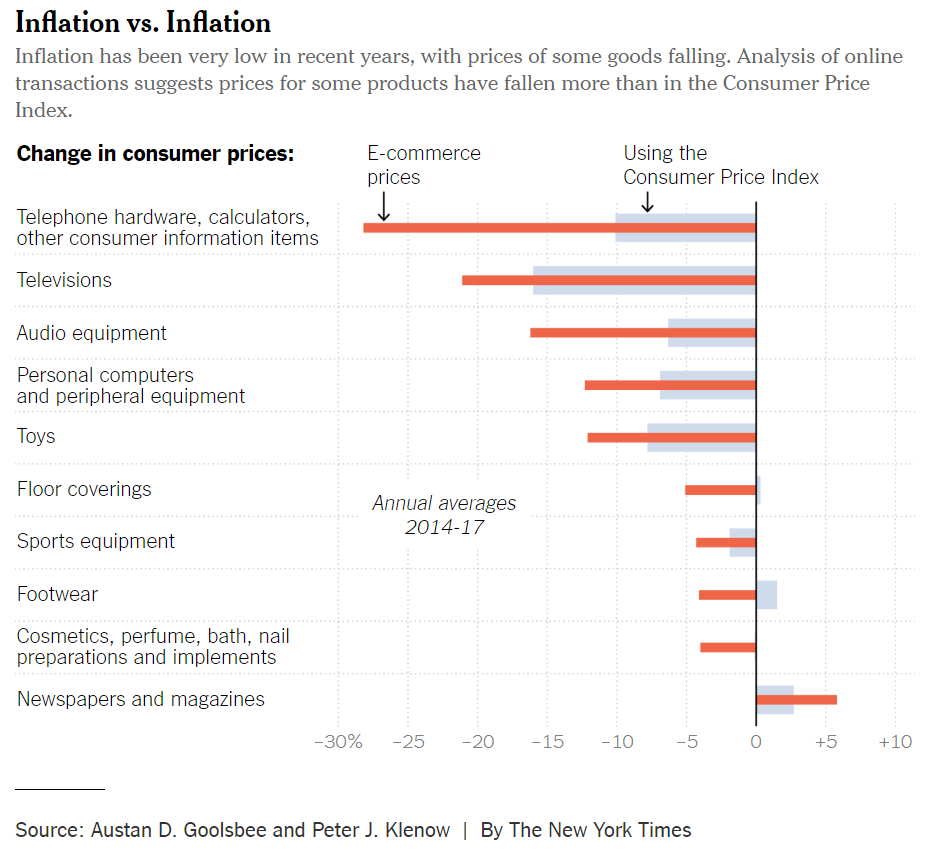

Unemployment is sinking and businesses are churning out more goods and services. Yet even with the economy standing on tippy toes, prices and wages are climbing a lot more slowly than anyone has expected. Now a growing body of research is putting the blame more pointedly on e-commerce. The spectacular growth in online shopping, it turns out, is not only tamping down inflation more than previously thought, but also distorting the way it is measured. - The Wall Street Journal – The Fed’s Biggest Dilemma: Is the Booming Job Market a Problem?

Jerome Powell, the chairman of the Federal Reserve, has to figure out whether inflation is around the corner. The wrong choice could cripple the economy.Given the anchoring of inflation expectations, Mr. Kashkari said it is no surprise that inflation is unresponsive to low unemployment today. “The more credibility we have with the market and with employees and employers, the less responsive they are going to be to minor changes in the economy,” he said. In the late 1960s, when inflation began to accelerate just months after the unemployment rate dropped below 4%, the Fed cut interest rates, partly due to political pressure. “Nobody on this committee will allow that to happen,” said Mr. Kashkari. “I just don’t see any echoes of that today.”

- The Financial Times – Citi issues stark warning on automation of bank jobs

Investment banking leaders eye future in which machines take over ‘lower-value tasks’

Citigroup’s investment bank has suggested that it will shed up to half of its 20,000 technology and operations staff in the next five years, as machines supplant humans at a faster pace. The forecast by Jamie Forese, president of Citi and chief executive of the bank’s institutional clients group, was the starkest among investment banking bosses in a series of FT interviews to mark the 10th anniversary of the financial crisis. Mr Forese said the operational positions, which make up almost two-fifths of investment bank employees at Citi, were “most fertile for machine processing”

Summary

Comment

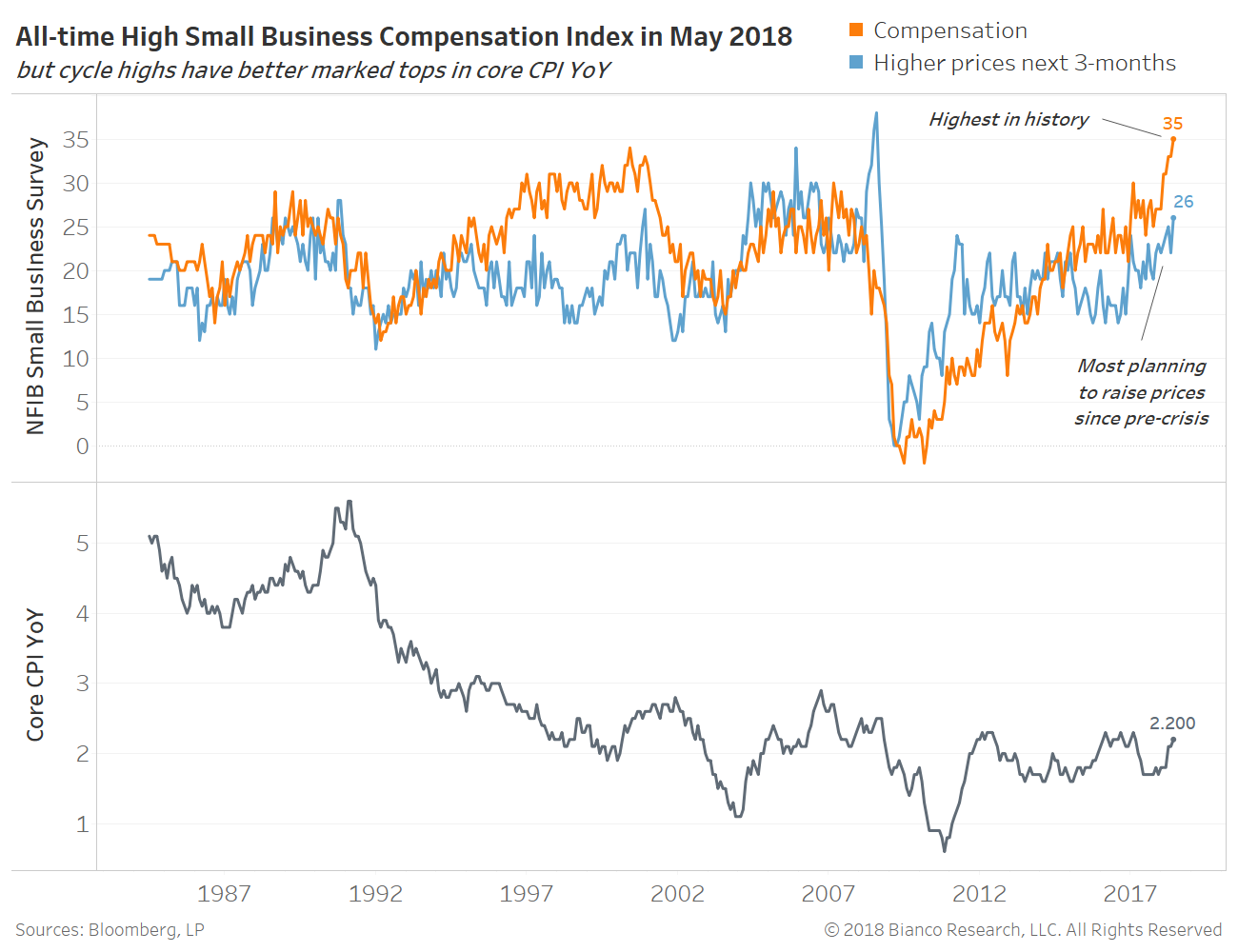

May’s inflation as measured by core (2.2%) and headline (2.8%) CPI is making little waves coming in as expected. A lack of real wage growth remains the dominant theme. On the flip side, the NFIB’s latest survey for compensation burst to an all-time high (orange line), while plans to raise prices over the next three months reached the highest since pre-crisis.

Oddly, lofty survey results have tended to mark tops in core inflation since the mid-1990s rather than fuel further gains. Core CPI year-over-year (bottom panel) has been locked in a tight range from 1.6% to 2.3% since mid-2011.

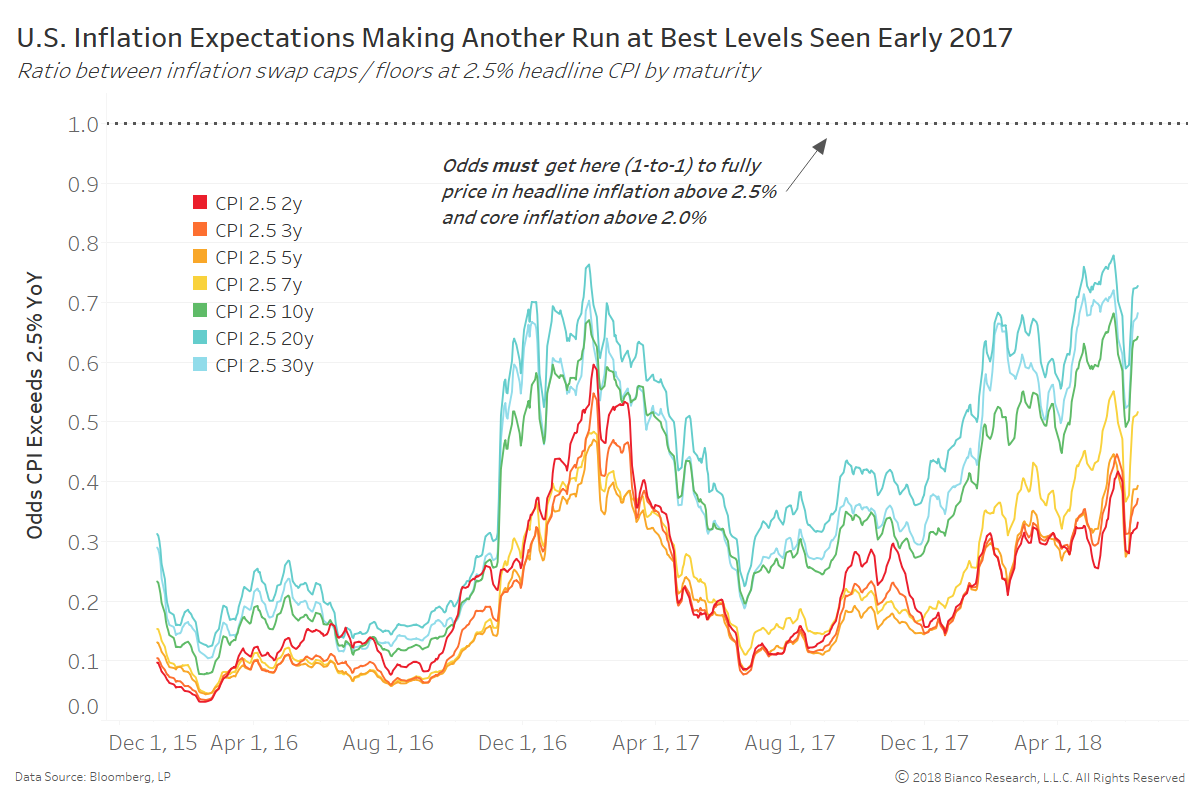

Inflation expectations remain anchored as Kashkari and others recently proclaimed. We prefer to watch the ratio between inflation swap caps and floors to gauge the odds inflation runs above specific hurdles. The chart below shows the odds headline CPI year-over-year runs above 2.5% for each defined period of time from the next two to 30 years. Again, headline CPI must run above 2.5% to allow for core to remain above 2.0%.

Options markets have yet to price in headline CPI running above 2.5%, but are again attempting to exceed the best levels of early 2017. Term premium and implied volatility (e.g. MOVE index) will remain low until markets internalize the risk of lasting inflation and wage growth.

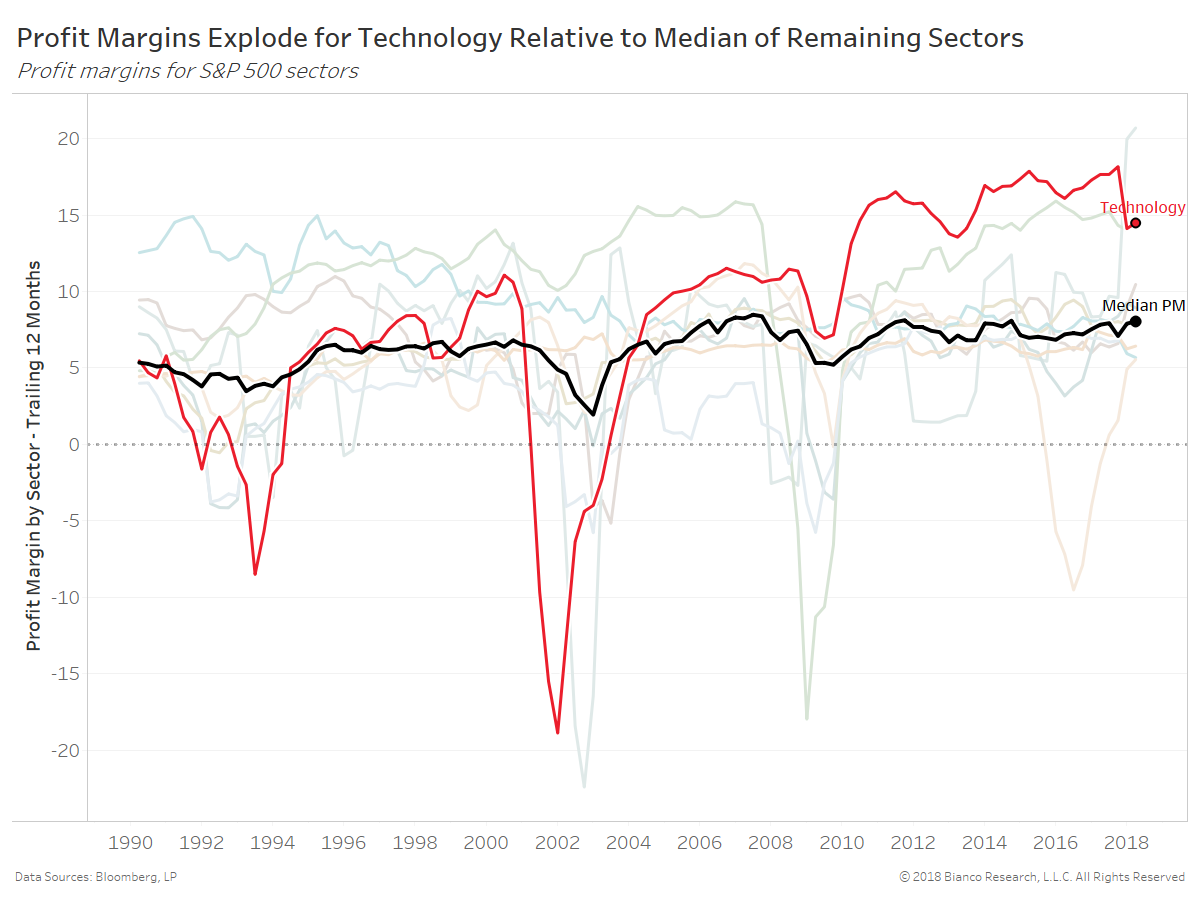

Efficiencies have allowed technology to exude significantly higher profit margins. The chart below shows the profit margin by sector of the S&P 500. We have highlighted technology in red and the median of all other sectors in black.

The spread between technology and the median sectors’ profit margin jumped at the exit from the financial recession in 2010. Technology’s profit margin has averaged roughly three times the median over this recent time period.

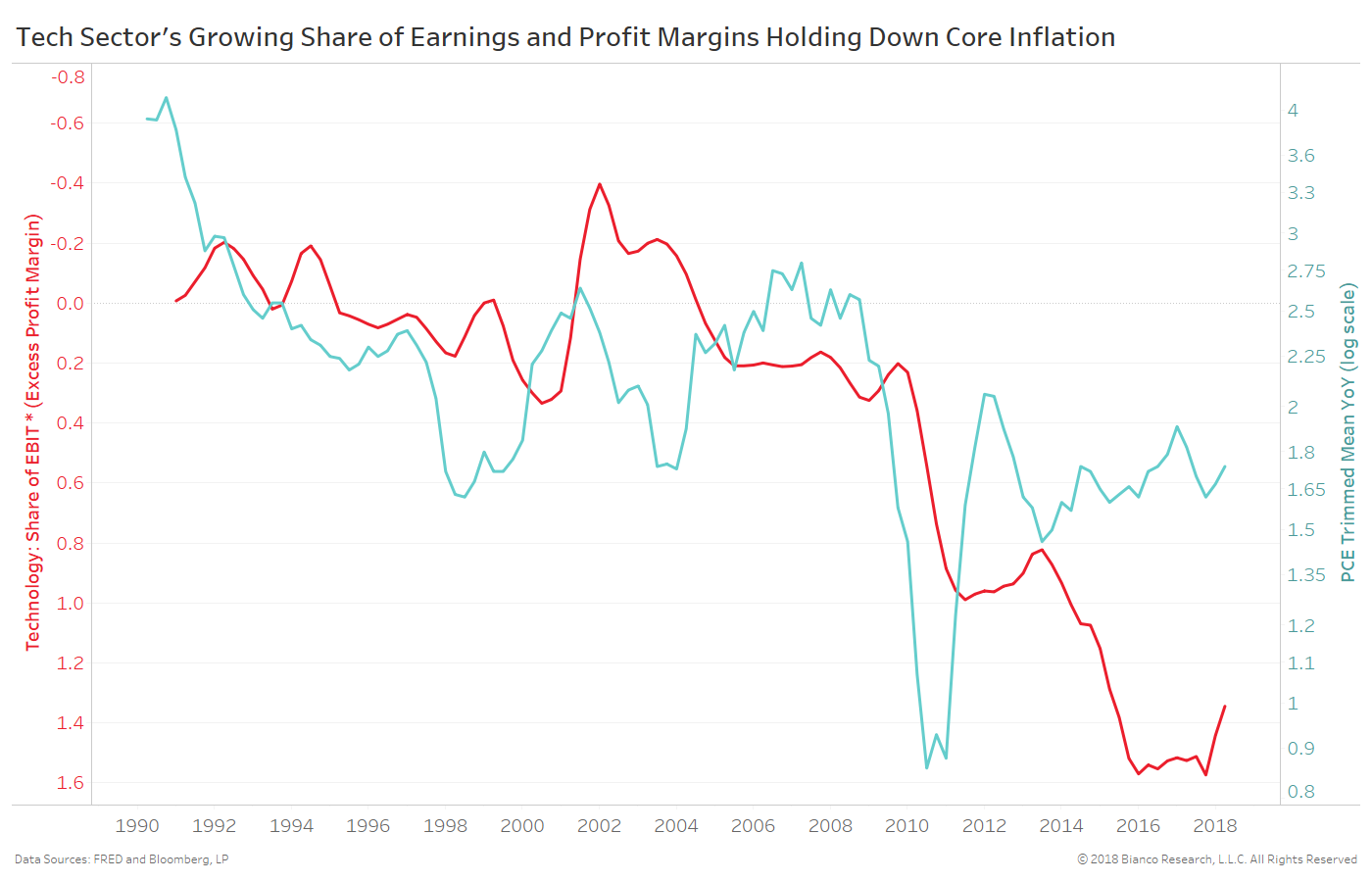

We multiply technology’s excess profit margin (vs median) by its share of earnings to compare to core inflation. This measure of technology’s dominance (red line, reversed) has been met with lower and lower core inflation.

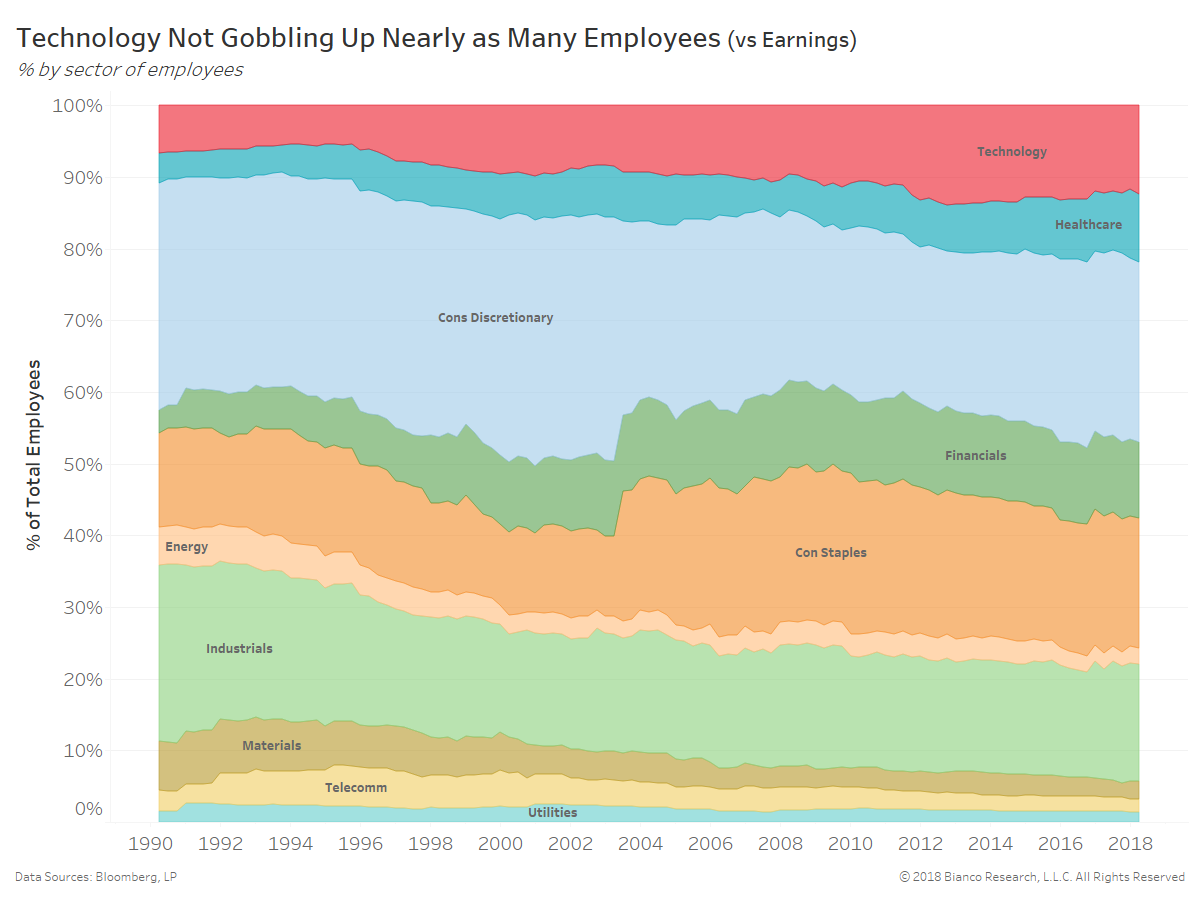

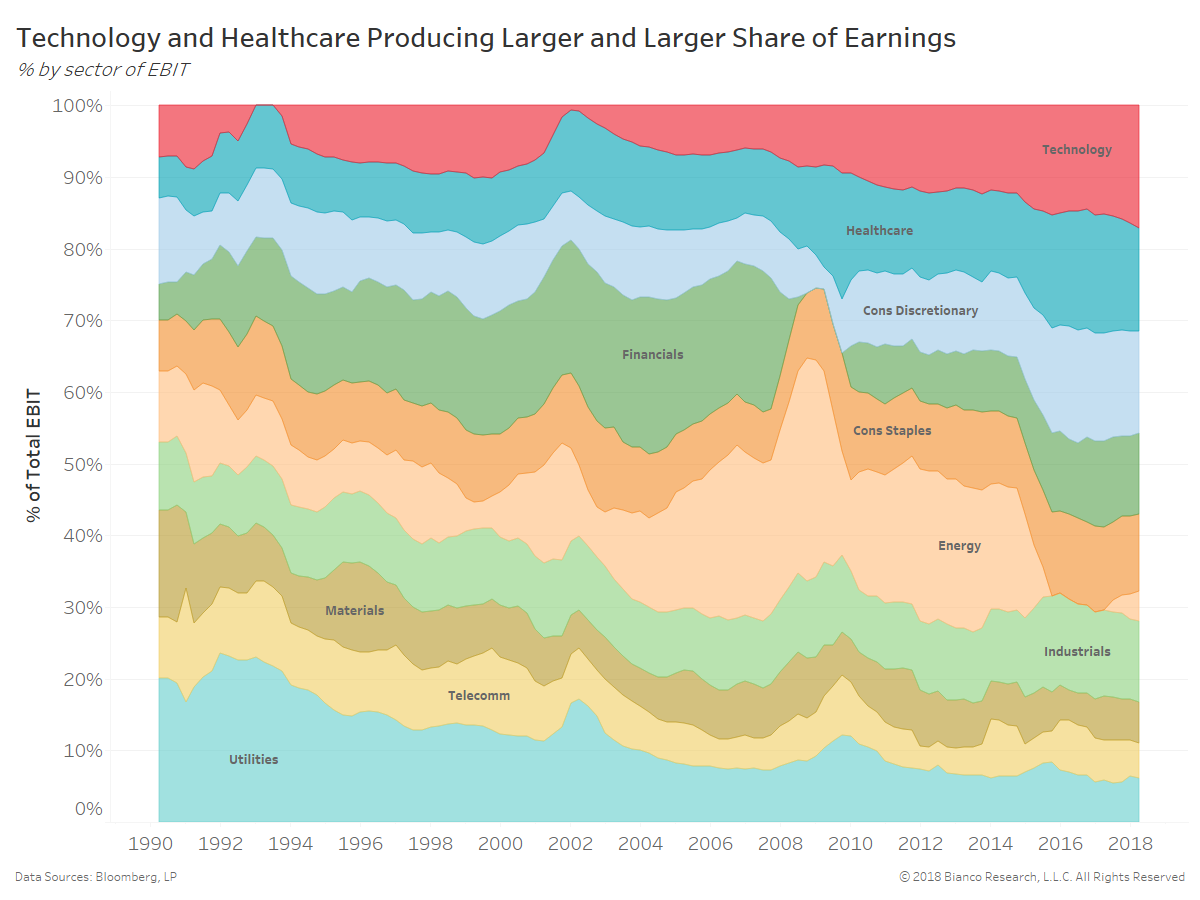

The more long-run story will have technology’s efficiencies and productivity bleeding into other sectors, eventually causing a return to equilibrium. Regulations may hasten this convergence. However, over the short run technology’s growing share of earnings using a smaller proportion of carbon, human bodies is an anchor for inflation.

For those who wish to dig deeper into this month’s inflation releases, the interactive visualization below offers charts on CPI, PPI, PCE, global inflation and inflation expectations. The time frames, subindices and annualization periods can all be changed for a customized view. This month we default the view to core CPI and core PCE versus the Fed’s 2% target rate of inflation.