The Fed Decides Tomorrow

- Bloomberg.com – Powell’s Fed Could Clear Up a Few Mysteries Puzzling Investors

Labor market hotness, neutral rate, global risks on agenda

Balance sheet and communications could also get some attention

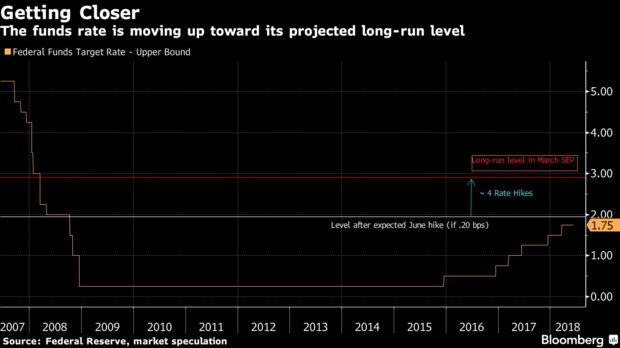

Any details on the coming shift from easy to tight monetary policy will definitely draw attention. Officials in March expected to cross that threshold in 2020 when their median estimate saw rates reaching 3.4 percent. That lies two quarter-point hikes above the 2.9 percent they estimate as the longer-run neutral level — the one that will neither support nor slow growth. Powell acknowledged back in March that such a policy path would be modestly restrictive, but added that out-year estimates are “highly uncertain.”

- CNBC – Jeff Cox: The Fed has a surprise in store that could mean an early end to interest rate hikes

* The Fed at its meeting this week is expected to announce a quarter-point interest rate hike, and a 0.2 percent increase in interest on excess reserves.

* The maneuver is targeted at holding back the target rate and could signal that the Fed is nearing the end of its balance sheet rolloff.

* A preliminary end to the reduction in the bond portfolio also could signal a quicker end to the rate-hiking cycle than the market anticipates.The mechanics are a little complicated. Yet it suggests that what once appeared to be an operation to shrink the amount of bonds the Fed owns that would have run well into the next decade could be wrapped up next year, or early 2020 at the latest. Instead of reducing the balance sheet from its peak of $4.5 trillion to $2.5 trillion or so as some Fed officials indicated, the impact could be far less — perhaps, some suggest, to $3.5 trillion or even a little more.

Emerging Markets

- The Financial Times – Mexico’s Peso remains the bellwether for Emerging Markets

Likely runaway election victory election for ‘Amlo’ could hit the currency hardIn the turmoil that has struck emerging market currencies over the past six weeks, the headlines have been grabbed by the Turkish lira, the Argentine peso and in the past week, the Brazilian real. But what of the Mexican peso, traditionally seen as a bellwether of sentiment towards emerging markets as a whole? It crashed to an all-time low against the US dollar after the election of Donald Trump to the US presidency in November 2016. After staging a comeback, it is heading back in that direction, shedding 12 per cent of its dollar value since mid-April. Worse may lie ahead. Analysts say the Trump administration’s renewed abrasive attitude to trade and a likely runaway victory in Mexico’s July 1 election for the leftist Andrés Manuel López Obrador, known to all as Amlo, could send the peso into uncharted territory.

- The Guardian (UK) – Kenneth Rogoff: Are debt crises in Argentina and Turkey a global warning sign?

We should not be complacent about the risks a recession could pose to advanced economies

Economists who assure us that advanced-economy debt is completely “safe” sound eerily like those who touted the “great moderation” – the supposedly permanent reduction in cyclical volatility – a generation ago. In many cases, they are the same people. But, as we saw a decade ago, and will inevitably see again, we are not at the “end of history” when it comes to global debt and financial crises.

Politics & The Markets

- The Wall Street Journal – The Return of the Political-Risk Trade

Confluence of major political events comes as global growth shows signs of slowingAfter a long period where investors mostly shrugged them off, political risks are once again taking a front seat in moving markets. For investors, that promises to bring further uncertainty during one of the market’s most volatile stretches in years. In recent years, global economic growth and central bank stimulus have drowned concerns over political risk. Now it’s back. On Monday, markets mainly climbed as Mr. Trump prepared to meet with Kim Jong Un and Italian media reported Rome’s antiestablishment government had ruled out leaving the euro. But a bad-tempered meeting of the Group of Seven major economies reignited some investors’ worries about trade tensions.

The Costs Of Indexing

- The Wall Street Journal – Acclaimed Fund Manager’s Latest Target: Hidden Costs of Indexing

Rob Arnott says index managers should wait to trade until prices snap back to normal levels after index providers announce which companies will be added or deletedRob Arnott thinks fund managers should move more slowly. The founder of the investing firm Research Affiliates says some of the world’s cheapest index funds track their benchmarks too closely, a “self-inflicted wound” that ends up costing investors billions of dollars. When index providers announce which companies will be added or deleted—typically days or weeks ahead of time—newly added stocks get a boost while those cut from the index tend to fall. Fund managers who move quickly to mimic the index end up buying high and selling low, Mr. Arnott said. “Most index fund managers are far more interested in reducing tracking error than in adding value,” Mr. Arnott wrote in a paper due out later this month titled “Buy High and Sell Low with Index Funds!”

Chinese Bond Defaults Are Rare

- The Wall Street Journal – China’s Bond-Market Mystery: Why Aren’t There More Defaults?

Beijing is working to maintain stability, even as it tries to tackle its key economic problem, analysts say“The reason why the bond default rate remains quite low in China is still because of government intervention,” said Zhu Chaoping, a Shanghai-based economist at J.P. Morgan Asset Management. “The government is focused on maintaining stability, financially and socially.” In the past, Beijing has often leaned on banks and local governments to extend a lifeline to struggling state-owned enterprises, and even private companies if they are large employers, Mr. Zhu said. The authorities have also stepped in with more sweeping action when there are broader signs of market stress, as in January when Chinese government-bond prices fell to a three-year low. The central bank cut the amount of cash it requires banks to hold with it in reserve, unleashing around 450 billion yuan of liquidity into the market.

Interest Rate Spreads

- The Wall Street Journal – Diverging Fortunes in U.S. and Europe Signal Widening Interest-Rate Gap

The Federal Reserve is likely to raise short-term interest rates this week while the ECB could signal it won’t start raising rates for some timeCentral banks in the U.S. and Europe are both expected to move this week to unwind stimulus policies adopted since the global financial crisis a decade ago. But the likely steps mask a recent divergence in the fortunes of the world’s top two economic blocs, which looks set to keep the central banks on different interest-rate tracks for many months to come. The Federal Reserve is likely to raise short-term interest rates Wednesday and pencil in more increases in coming years, to keep the U.S. economy from over-heating. The ECB could signal on Thursday it won’t start raising rates for some time even as it moves to phase out its €2.5 trillion ($2.95 trillion) bond-buying program. ECB officials are pondering the causes of a recent slowdown in eurozone growth that appears to have continued through the spring, as well as the risks posed by international trade spats, higher oil prices and political turbulence in the bloc’s number-three economy, Italy.