- Bloomberg – Fed to Stick With Gradual Hiking as Risks Balance Out

Upside risks fade and trade seen as dominant threat to outlook

The Federal Reserve won’t steepen the path of interest-rate increases this year in the face of accelerating U.S. growth, according to economists surveyed by Bloomberg. In a poll conducted June 5-7, the proportion of respondents who expect at least three additional rate hikes in 2018 dropped slightly, compared with the survey in March. The median estimate from economists now sees two more increases this year, which matches the Fed’s own projections back in March. All 37 respondents predicted a quarter-percentage-point rate hike when policy makers conclude their two-day meeting in Washington on Wednesday. - Bloomberg – What to Expect From the Fed and ECB This Week

Both central banks will continue to unwind their extraordinary measures, but at different paces.

This week will confirm that two systemically important central banks are continuing their gradual shift to a policy approach that is more normal and less unconditionally supportive for markets. The two meetings will also highlight continued divergences in the speed of monetary-policy normalization that, along with a widening difference in prospects for economic performance, may have a more important impact on market valuations in the months ahead.

Summary

Comment

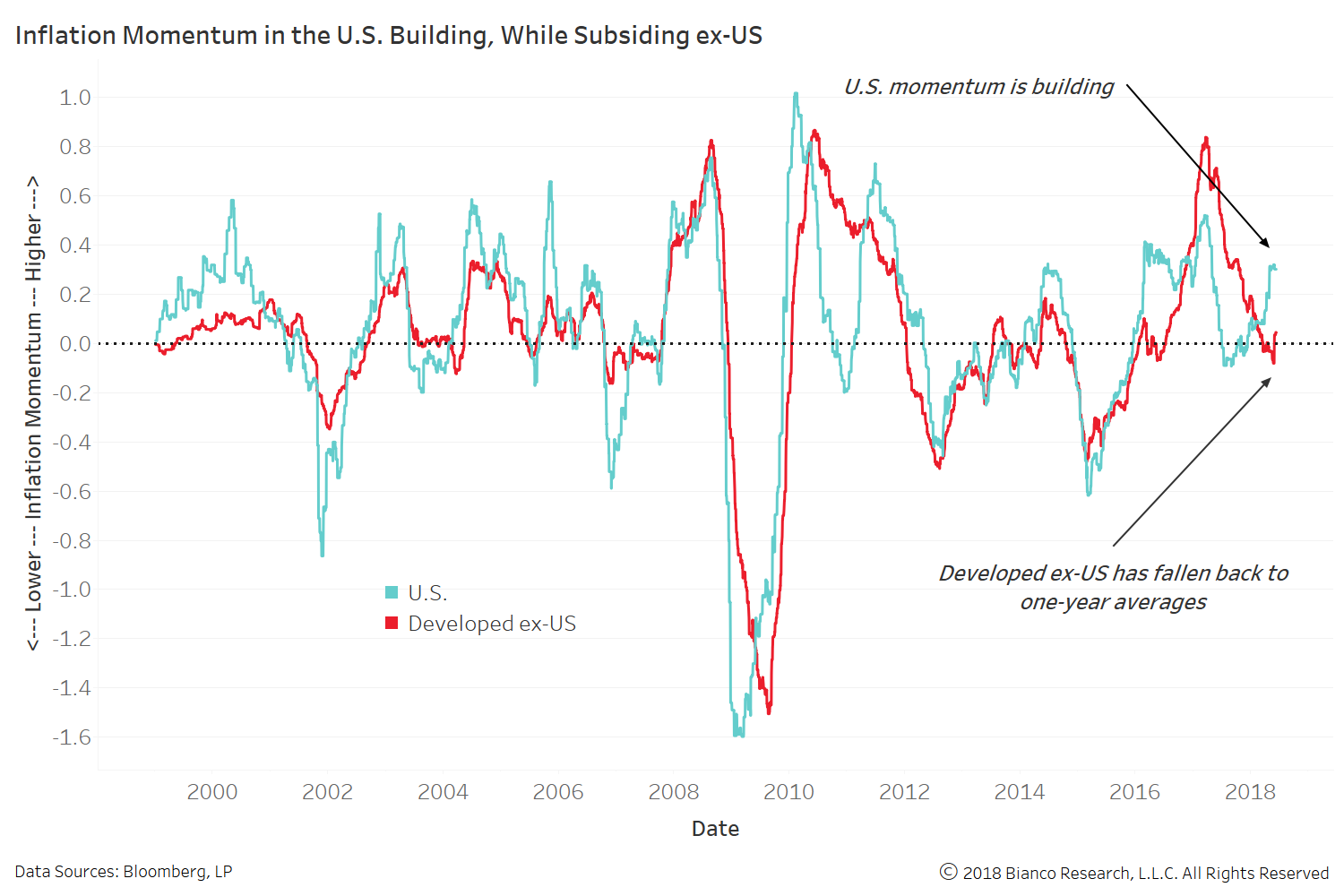

The chart below shows changes in headline and core inflation relative to one-year averages for U.S. (blue) and developed ex-US (red).

U.S. inflation is building momentum in 2018, while other developed economies’ inflation has moderated versus one-year averages. The U.S. has historically shown a pattern of reverting to the more global average.

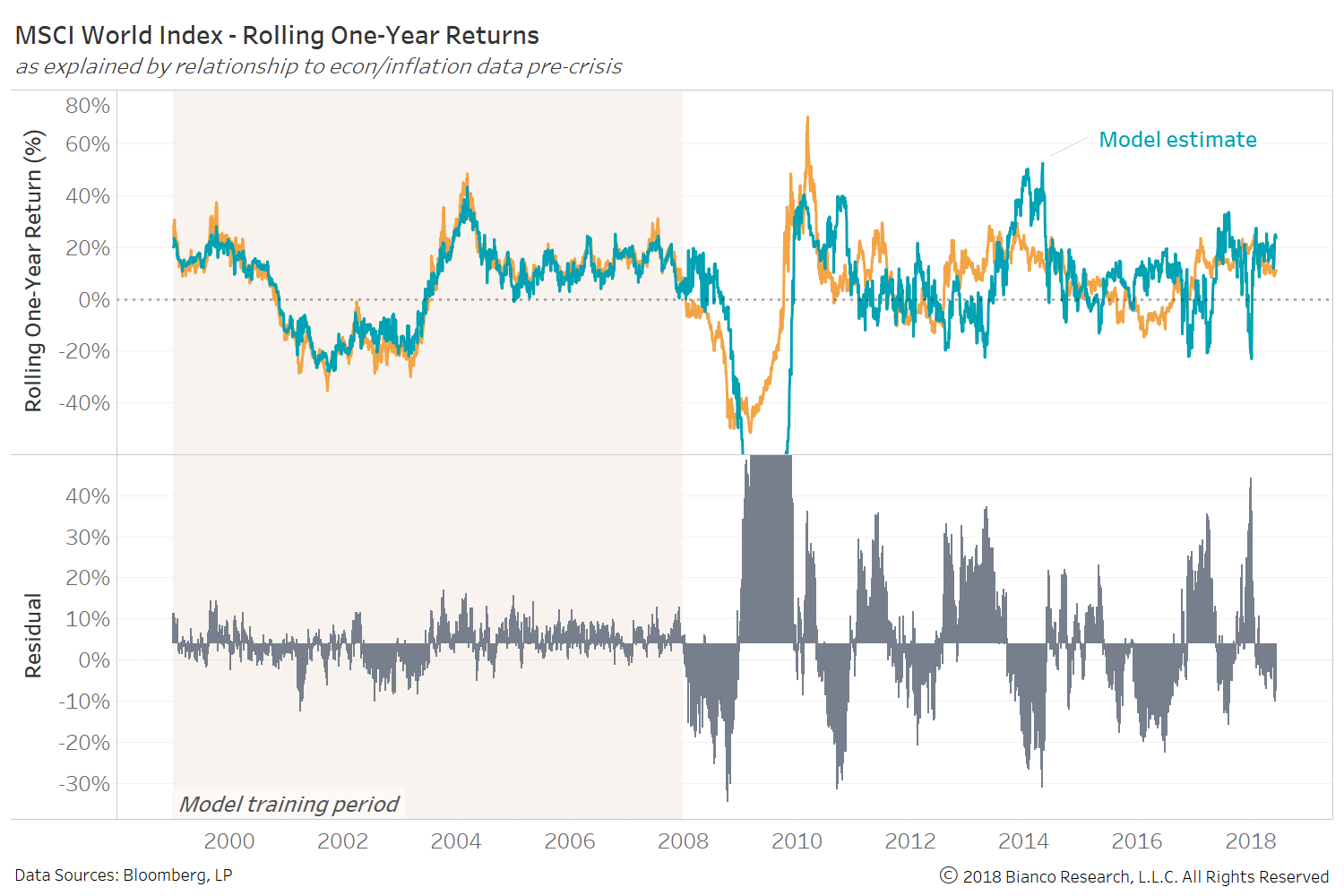

We run a model explaining the MSCI World Index’s rolling yearly return using economic and inflation data from prior to the financial crisis (shaded area, 2000-2007). The model is applied to out-of-sample data from 2008 to current.

The residuals in the bottom panel indicate the degree by which the model is missing actual returns. The post-crisis environment has clearly been very different.

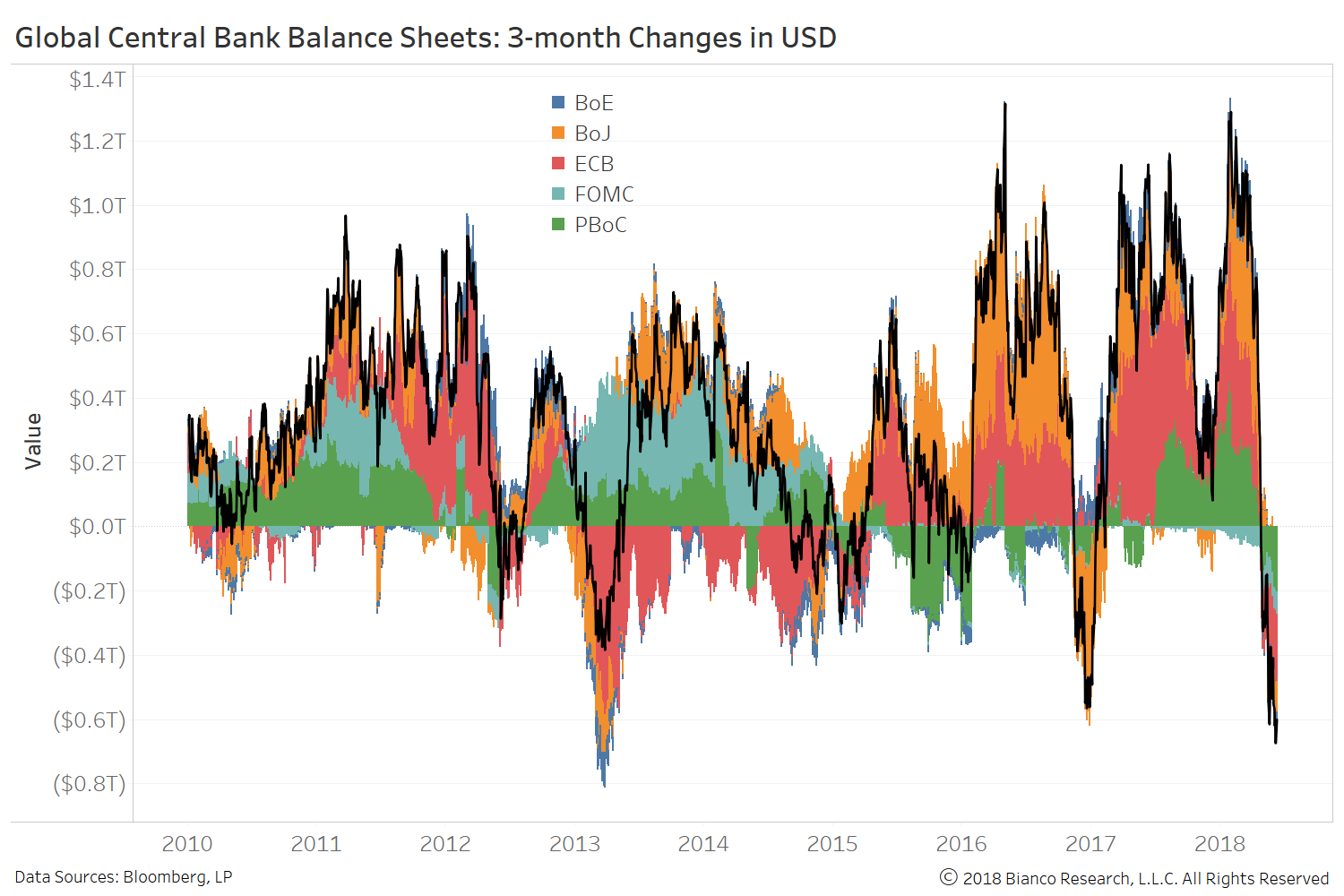

We have contended balance sheet expansion across the globe has offered a beta or multiplier to economic data post crisis.

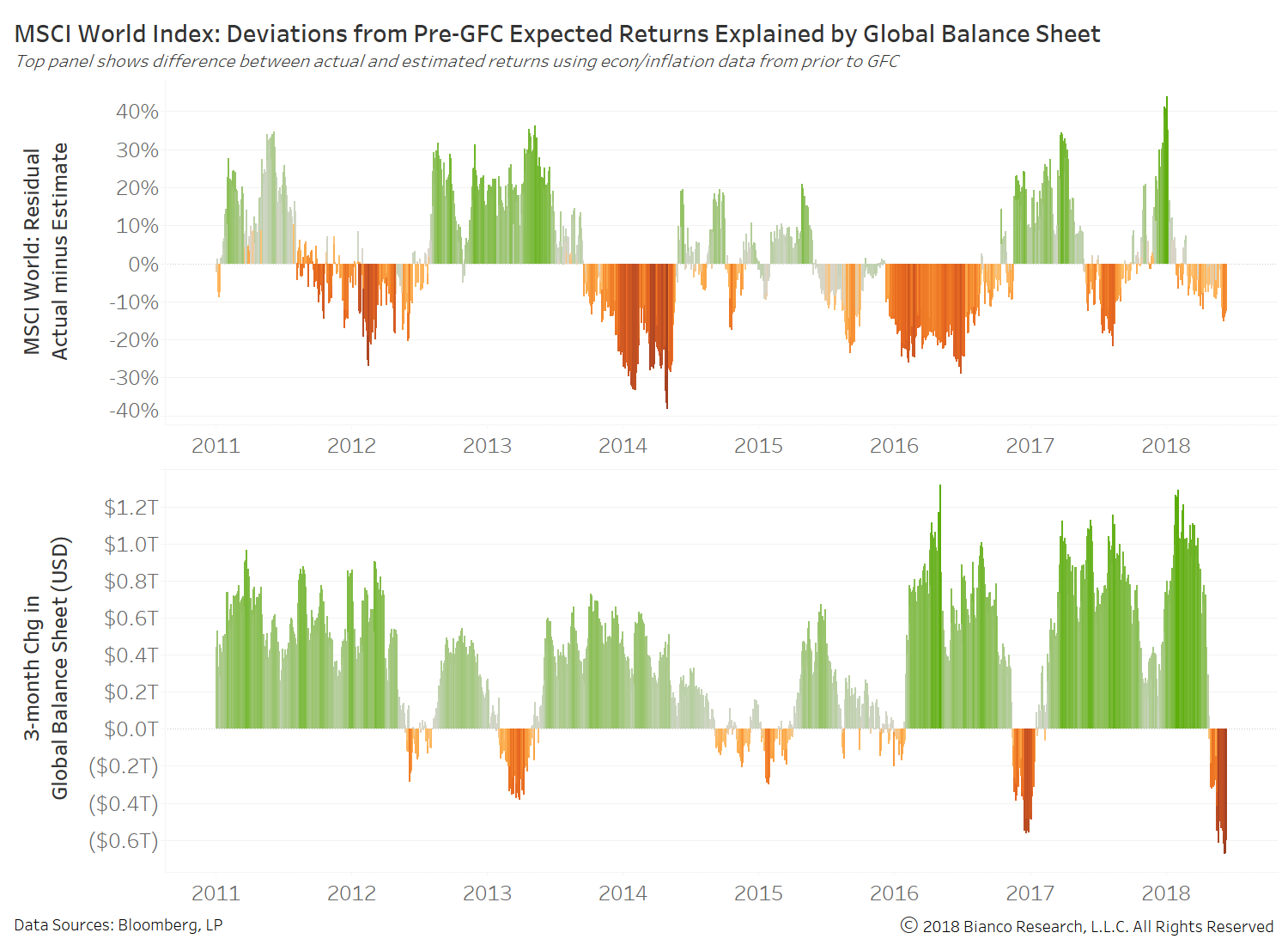

The chart below shows the model’s residual (actual minus estimate) in the top panel along with the three-month change in the global central bank balance sheet in the bottom panel. Periods of balance sheet contraction have not been kind to global equities. Conversely, expansion has helped exacerbate positive returns.

The meetings this week may offer bigger clues as to the direction of the global balance sheet in the event the ECB makes bold comments. The continued retreat in the Fed’s balance sheet will likely be counteracted by the BoJ in the months ahead, leaving the ECB as the key linchpin. A decision to finally retreat would ensure a removal of this favorable beta for global equities. On the other hand, stalling an exit will keep the ‘good times rolling.’