- Wall Street Journal – Bitcoin Falls Sharply After Another Cryptocurrency Exchange Is Hacked

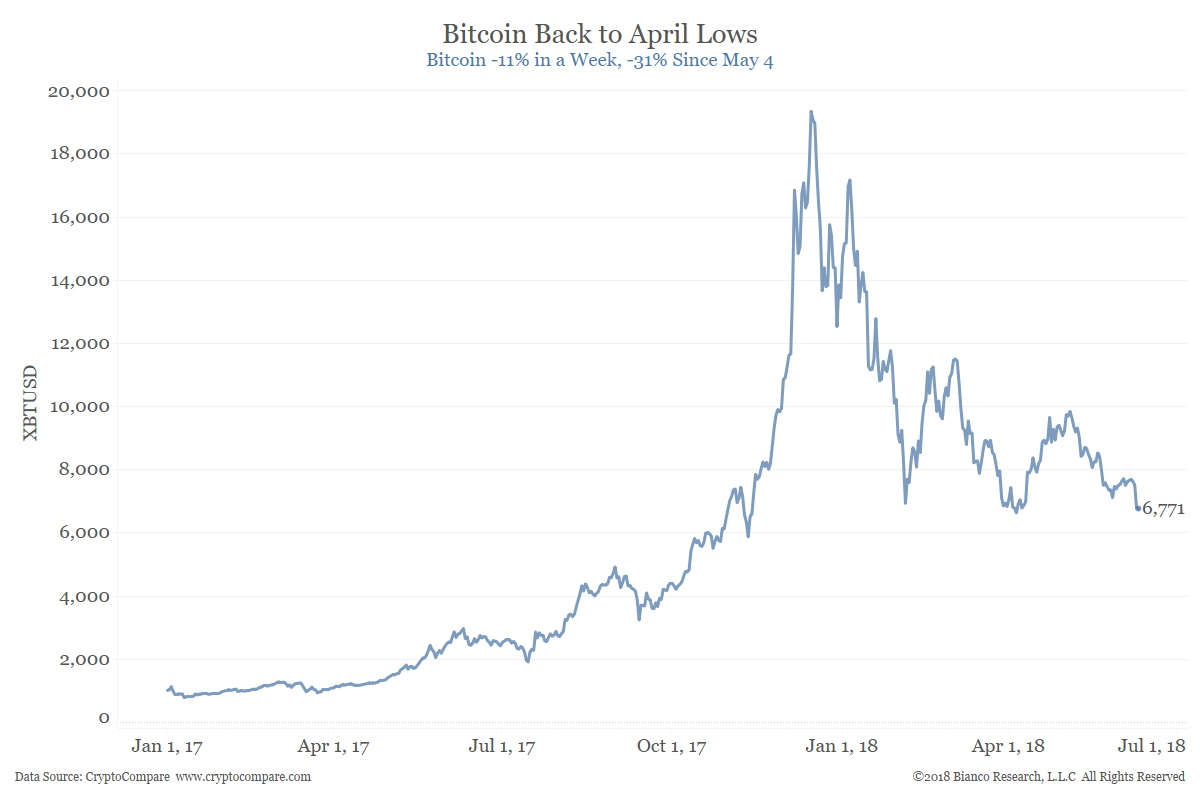

The largest cryptocurrency has lost more than half its value this yearA South Korean cryptocurrency exchange said it suffered a “cyberintrusion,” prompting bitcoin prices to fall sharply toward year lows. Bitcoin dropped more than 10% over the weekend, falling below $6,700, according to research site CoinDesk. The largest cryptocurrency has lost more than half its value this year, falling by nearly two thirds from its record high near $20,000 in December. Its low for the year came in February at less than $6,000. Other large cryptocurrencies like Ethereum, ripple and bitcoin cash have all fallen more than 11% over the past 24 hours. EOS, the token backed by startup block.one which has raised more than $4 billion, is down 20%, according to research site coinmarketcap.com.

- Ars Technica – Bitcoin has lost more than half its value since last year’s all-time high

Amid fall, mining energy demand remains so high that Quebec utility halts new orders.On Sunday, the price of Bitcoin continued to fall, losing 5 to 6 percent of its value.

According to CoinMarketCap, since an all-time high of near $20,000 per bitcoin on December 17, 2017, the cryptocurrency has lost more than half of its value, currently trading at around $7,200. Overall, Bitcoin’s price is up by about 150 percent compared with this same time last year, when it was trading around $2,800. Such fluctuations don’t seem to have stopped demand for setting up new mining operations, particularly in areas where electrical power is relatively inexpensive. Demand is so high in one part of Canada that Hydro-Québec, the province’s energy utility, recently said that it would “temporarily” stop accepting energy requests from cryptocurrency mining companies “so that the company can continue to fulfill its obligations to supply electricity to all of Québec.” - FT Alphaville — Who really owns bitcoin now?

Long-term holders cashed out to short-term speculators, data showThe Chainalysis data quantifies this distinct shift in the make-up of bitcoin owners from longer-term investors — those who held the asset for more than a year — to short-term investors who have traded more recently, by analysing how regularly coins have changed hands. Last November — before December’s pricing peak — the amount of bitcoin held for investment was roughly three times that held by traders. However, by April 2018, the data show the amount held by investors — about 6m bitcoin — was much closer to the amount held by short-term speculators, with 5.1m bitcoin. Indeed, Chainalysis estimates that longer-term holders sold at least $30bn worth of bitcoin to new speculators over the December to April period, with half of this movement taking place in December alone.

Summary

Bitcoin is back in the news for the wrong reasons. Where rising prices used to fuel positive media coverage in a positive feedback loop, both prices and interest in cryptocurrencies are falling in 2018.

Comment

Cryptocurrencies have had a challenged year. Bitcoin is now -57% on the year, in the middle of the pack of top 6 cryptocurrencies by market cap. Ripple (XRP) has fared the worst, now down over 73% for the year. EOS, a platform for developing blockchain related applications, is the only cryptocurrency still in positive territory for the year. Even still, the relative new arrival fell over 22% in this downdraft.

The broad decline in prices has seen the number of cryptocurrencies with market caps over $1 billion fall from 26 to 20 since March 1.

A trend we noted on February 15th has persisted since then. The Japanese yen’s share of global Bitcoin volume continues to grow, reaching 80% of daily trading volume. This has happened primarily at the expense of the U.S. dollar which has seen its share of daily trading volume fall to just 13%.

Search interest in cryptocurrencies has been falling along with prices. The last chart shows the percentage change in search interest for a handful of crypto related terms since the start of the year. The phenomenon that took Thanksgiving dinner conversations by storm likely wasn’t brought up at Memorial Day gatherings.

Conclusion

News of another breach at a cryptocurrency exchange has Bitcoin retesting key April lows. The positive feedback loop where greater publicity fueled higher prices has reversed. Falling prices and negative news have seen search interest evaporate. The question is whether institutional interest from firms like Goldman Sachs and DRW will start to wane too.