- The Financial Times – US Treasuries unlikely to remain below 3% for long

Peak in bond yields coincides mostly with that in the Federal Funds rate

It didn’t take long for the yield on 10-year US Treasuries to drop back below 3 per cent — a level it surpassed last month for the first time since 2014. Not for the first time since the financial crisis, the US bond market confounded gathering bearish sentiment as policy rhetoric at home and unstable capital markets abroad gained prominence. With the next meeting of Federal Reserve policymakers a week away, where do bond markets go next? The bullish view about bonds is anchored by two observations. First, periods of sub-3 per cent yields are rare. According to Sidney Homer’s History of Interest Rates, you can find them only in the falling price boom at the very end of the 19th century, and then the exceptional circumstances from 1934 to the early 1950s. It is possible then, given low inflation and unusual circumstances, that this time really is different. - The Financial Times – US real yields could herald lofty highs for stocks

Financial conditions must tighten to prevent overheating and valuations have to retreat

But with real yields falling and not rebounding, the strength of US employment could translate into strength for stocks. The most popular stocks continue to go to new highs, in a sign of uncorrected excess — the NYSE Fang+ index, featuring Amazon, Netflix and Google, has hit a new all-time high. This suggests that Italy’s crisis has, counter-intuitively, allowed the world to delay a reckoning with some brutal financial logic. If the US economy is at last growing well, then financial conditions must tighten to prevent overheating and stock market valuations will have to retreat from their lofty heights.

Summary

Comment

May’s employment report confirms the Fed’s hawkish bent, so why aren’t U.S. term premium and real yields leaping higher?

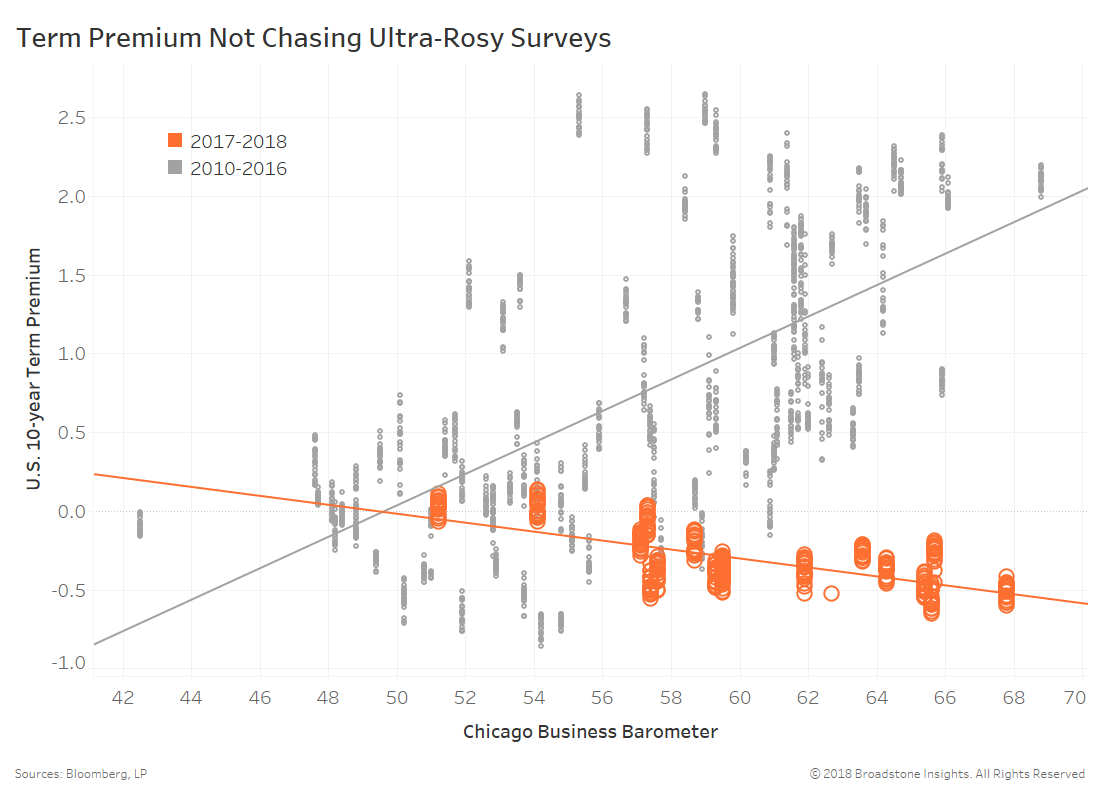

Last week also included a big beat by the Chicago Business Barometer (62.7 vs est 58.3), continuing the streak of ultra-rosy survey results. The scatterplot below shows the relationship between this business barometer and U.S. 10-year term premiums since 2010. We have highlighted in orange the very different 2017 – 2018 period when better and better survey results have very oddly led to lower term premiums.

Improving outlooks for the U.S. economy are only a small portion of what we must consider. U.S. term premium and real yields have become more and more influenced by growth outside its borders than years past.

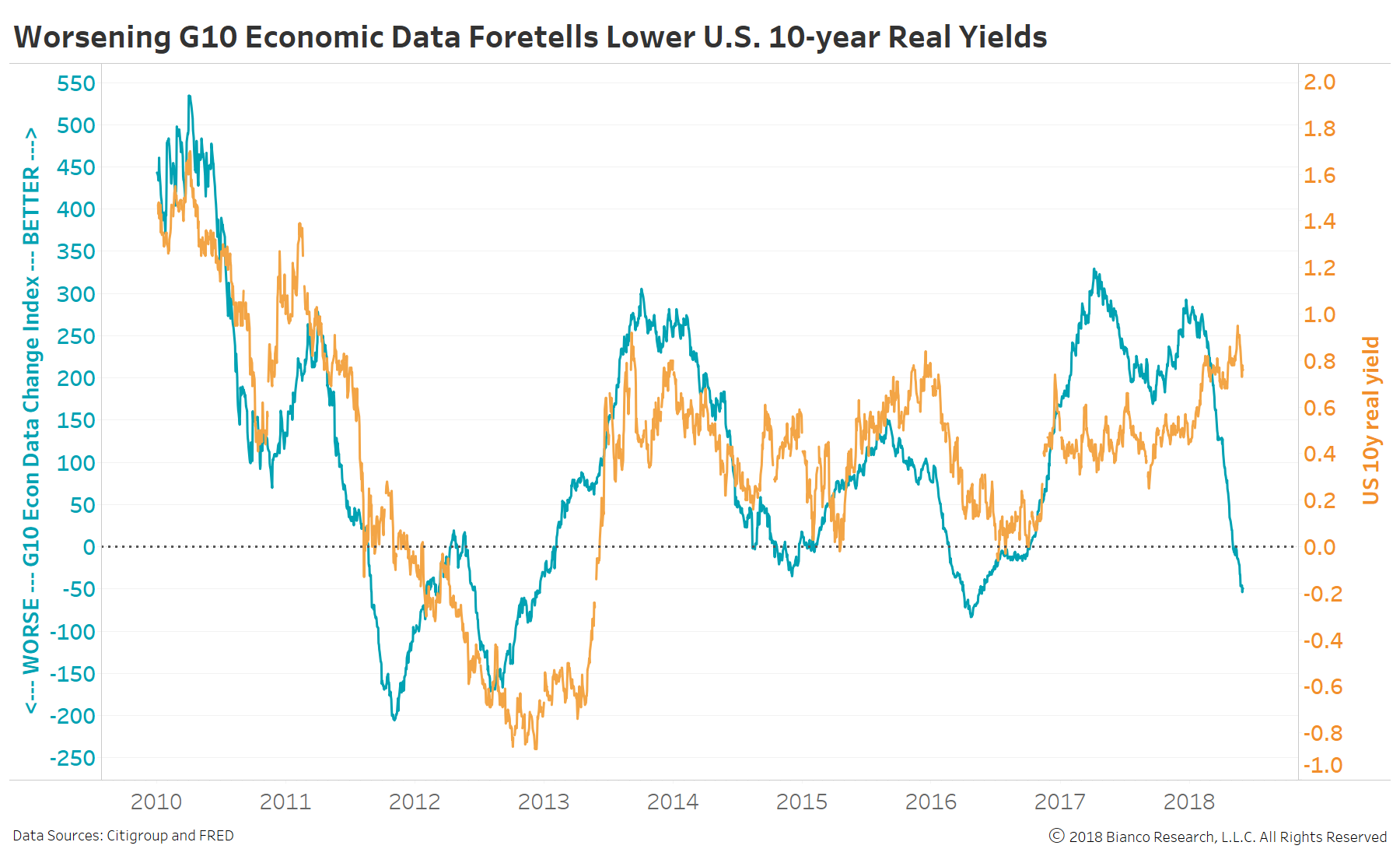

The chart below shows the G10’s Citigroup Economic Data Change Index (blue) along with U.S. 10-year real yields (orange). Data change indices measure incoming releases relative to one-year average growth rates.

The G10’s economic growth has been appreciably slowing in late spring, led by the Eurozone. Conversely, real yields are near the upper-end of their trading range (90-100 bps) since the taper tantrum of 2013. Real yields have tended to play catch-up to economic data changes, meaning recent high yields should hold.

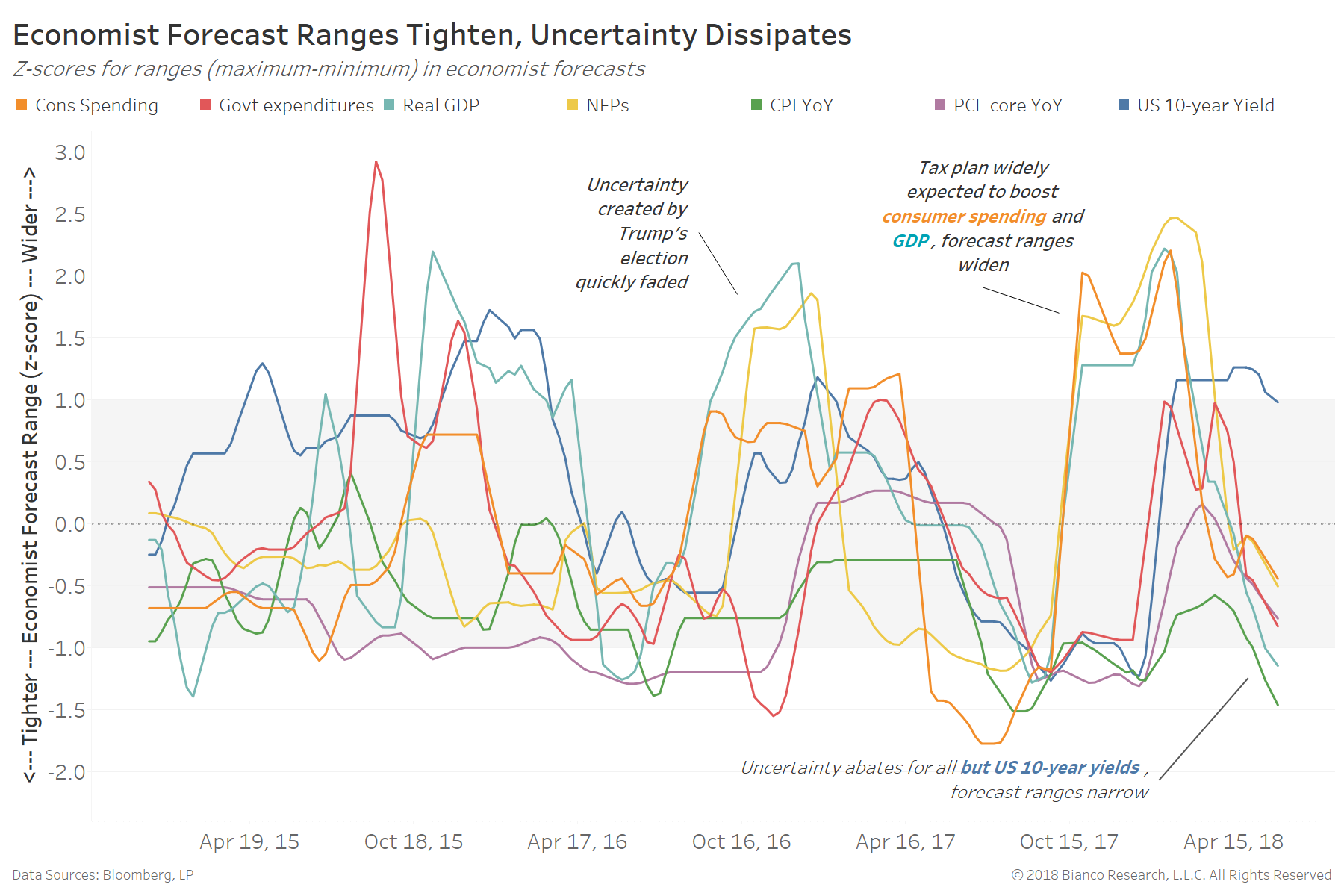

Turning back to the U.S., economists are offering forecasts much more clustered together than seen just after the tax plan vote. The chart below shows economist forecast ranges (max minus min) for the next four quarters represented as z-scores. We include forecasts for real GDP, payrolls, inflation, yields, and more.

All but U.S. 10-year note yields (blue line) are seeing tightening forecast ranges, implying lower uncertainty over the path of growth.

The U.S. bond market’s indication of uncertainty is term premium, which remains very lethargic given robust jobs numbers and sky-high survey output. U.S. 10-year term premium has recently fallen back below -50 bps.

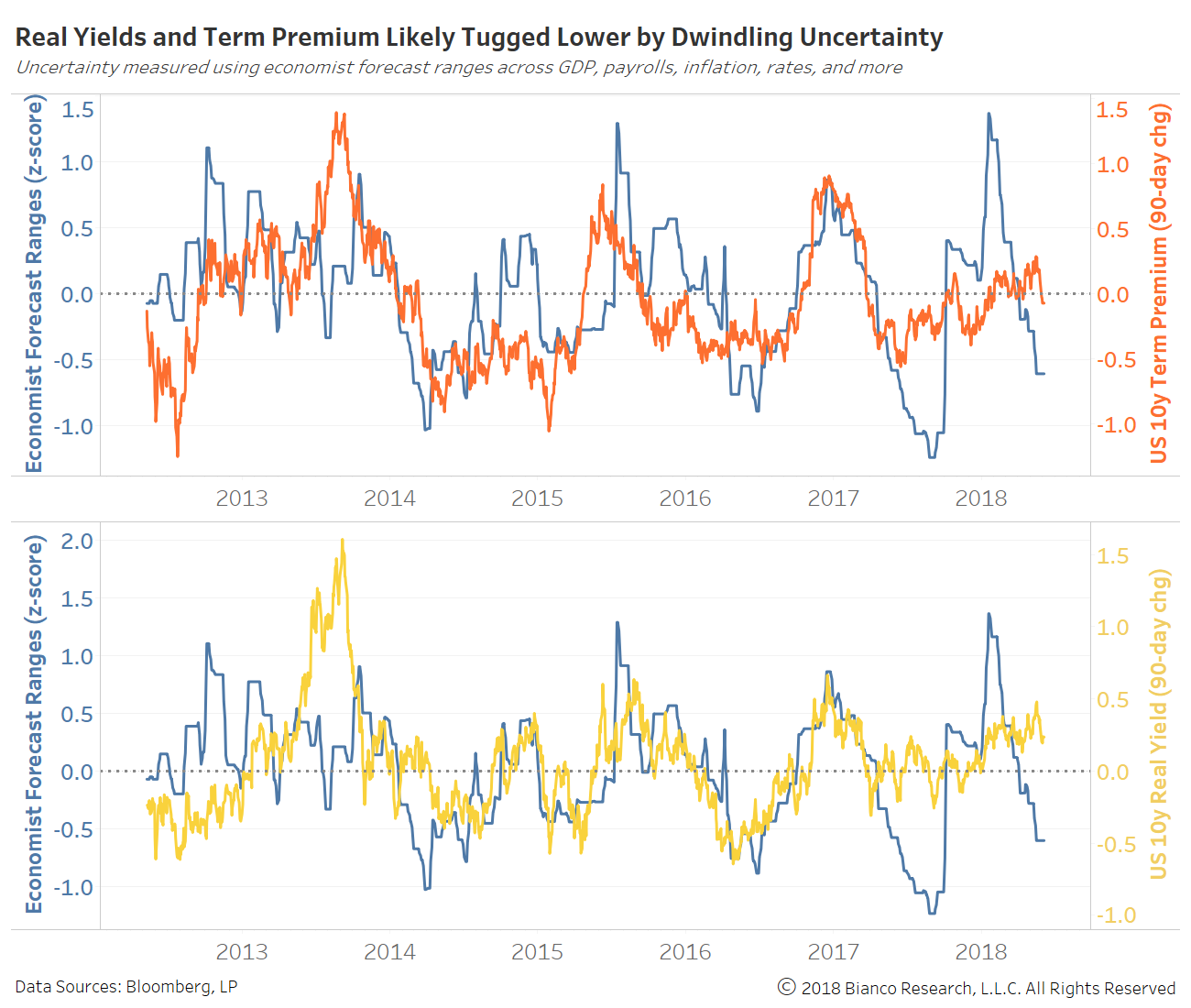

The chart below shows the average of economist forecast ranges (z-score) on the left axis along with 90-trading day changes in U.S. 10-year term premium (top panel) and real yields (bottom panel). Lower uncertainty by economists is being matched with lower uncertainty by bond investors.

All in all, the U.S. economy may be advancing at a moderately strong pace, but slowing growth outside the U.S. are tempering expectations by economists.