- The Financial Times – ‘Powell Put’ assumption challenged as Fed chief shows hand

Central bank chair says economic outlook has improved and is unfazed by market volatility

In a marked departure from the more academic tone of his immediate predecessors in the Fed chair, the 65-year old signalled to Congress a willingness to look beyond bursts of volatility in financial markets and would tighten policy against a backdrop of a strengthening economy that may in due course reveal signs of overheating. The long-held view that the US central bank will temper tightening if equity and credit markets suffer bouts of turmoil is sometimes referred to as the Fed put. After years in which the Fed’s actual rate rises have failed to match its projections, investors now face the prospect that 2018 may result in the central bank not just meeting its current forecast of three rate rises, but exceeding it.

Summary

Comment

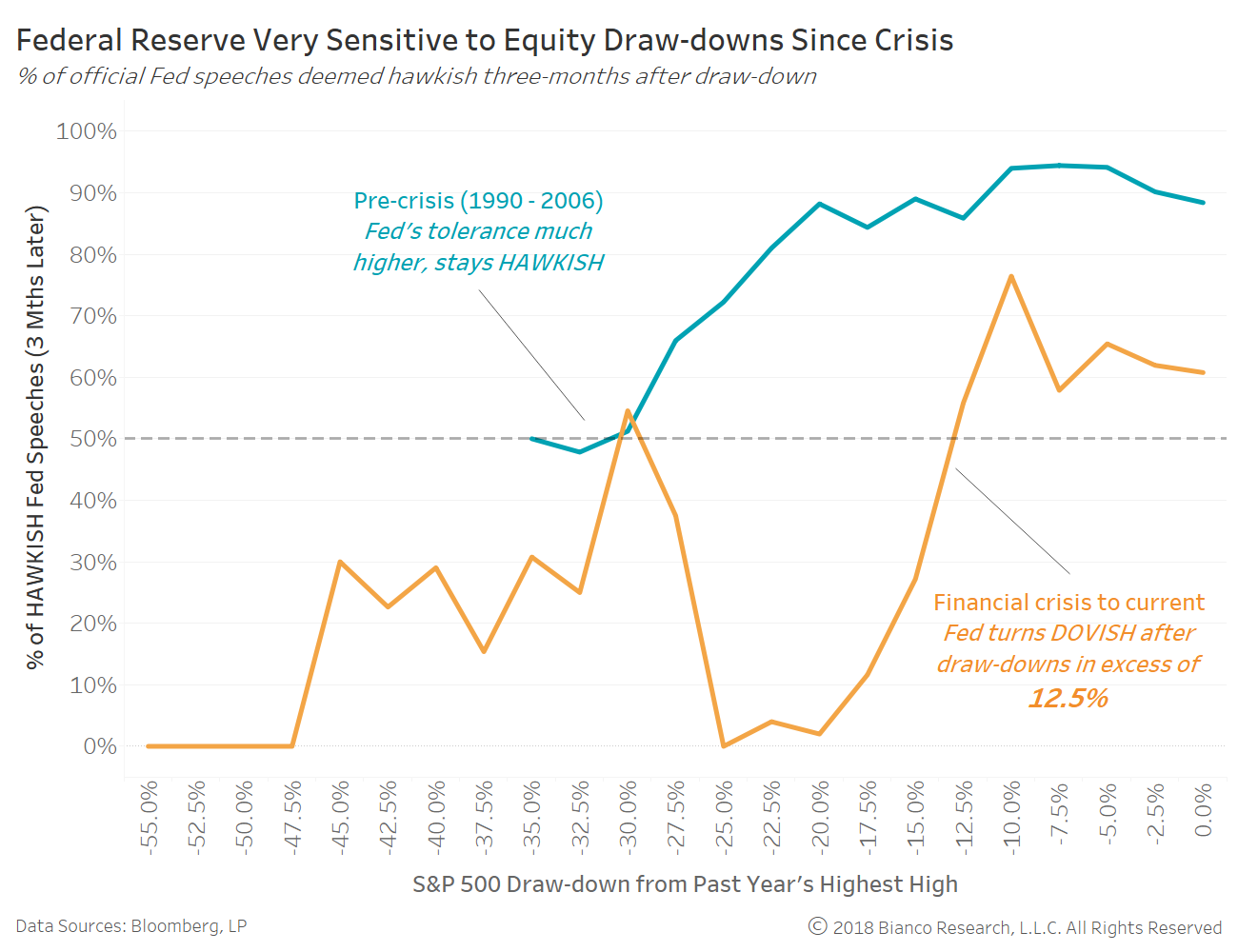

We can measure the Fed’s sensitivity to S&P 500 drawdowns using their reactions (i.e. hawkish-to-dovish leaning) found within official speeches. The chart below shows the S&P 500’s drawdown from its highest high over the preceding 12 months on the y-axis. The percentage of Fed speeches offering hawkish rhetoric over the following three months are shown on the y-axis for the 1990 – 2006 (blue) and 2007 – current (orange) periods.

The Fed proved significantly less sensitive to equity turmoil before the financial crisis (1990-2006), reaching an overall dovish tone only after ~30% drawdowns. Conversely, the Fed during and after the financial crisis have shown a strong tendency to calm markets with soothing dovish speeches after a mere drawdown of ~12.5%.

We believe investors should prepare for a return to pre-crisis sensitivities, meaning the Fed will not react so quickly to equity jitters as long as growth and inflation brew. The post-crisis threshold of ~12.5% (or S&P 500 at 2514) could easily come and go.

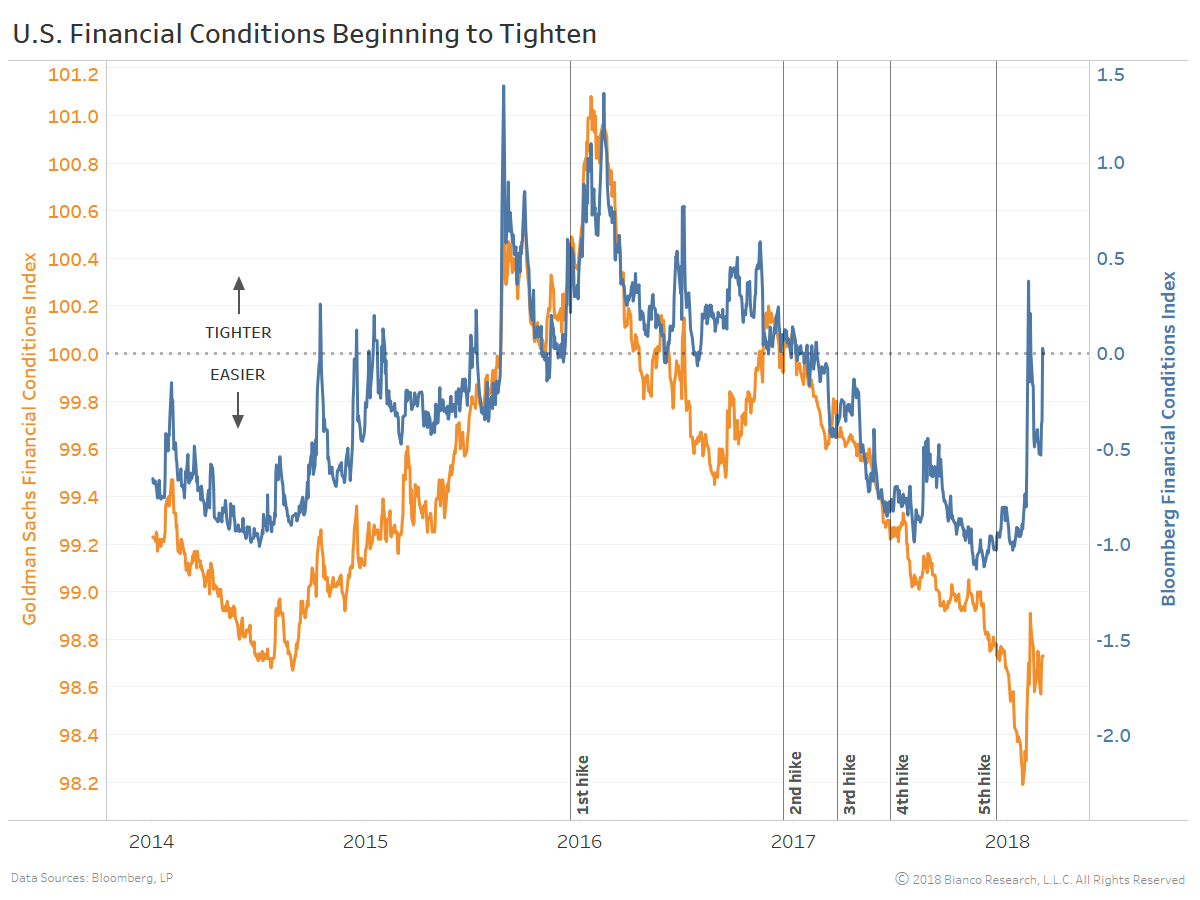

However, financial conditions have become less easy ever since markets priced in a 2019 hike on January 26th, 2018. The chart below offers the two most popular financial conditions indices calculated by Goldman (orange) and Bloomberg (blue).

Bloomberg’s measure is pushing into tightening territory (above zero) not sustained since 2016. Rising Libor/OIS spreads, TIPS breakevens, and VIX are driving this index tighter.

Powell et al may not be as reactive to declining equity markets, but will certainly pay attention to a broader view of financial conditions.

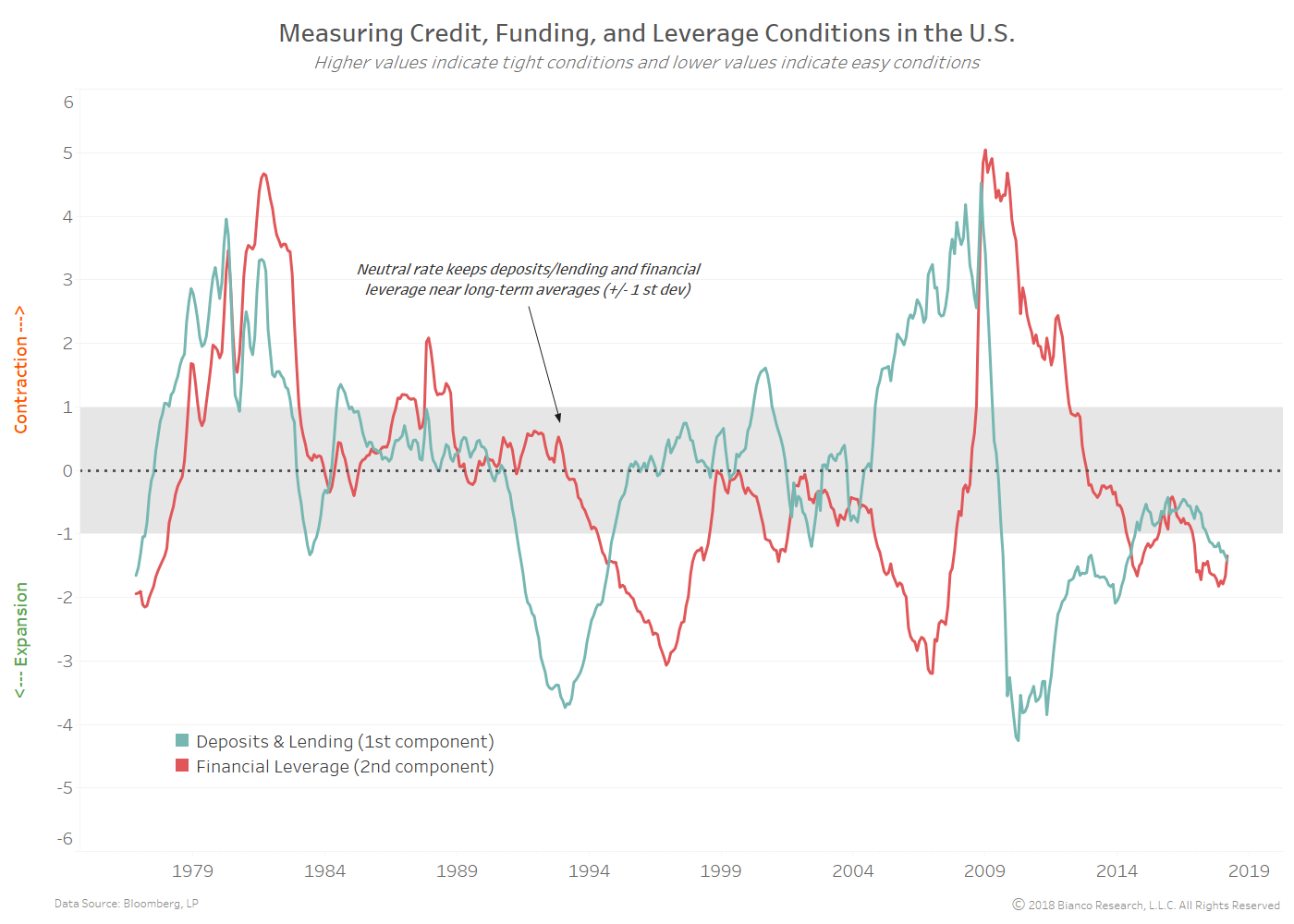

The chart below breaks financial conditions into deposits/lending growth (blue) and financial leverage/volatility (red). The gray-shaded area represents equilibrium defined as +/- 1 standard deviation from long-term averages. Values above this band are contractionary, while anything below is too expansionary.

We use these deposits/lending growth and financial leverage/volatility components to determine the Fed Funds rate capable of hindering the economy.

We began sounding the alarms in October 2017 about the December 2017 hike prompting tightening financial conditions for the first time post-crisis. Bloomberg’s index began to shed its easy bias from then on.

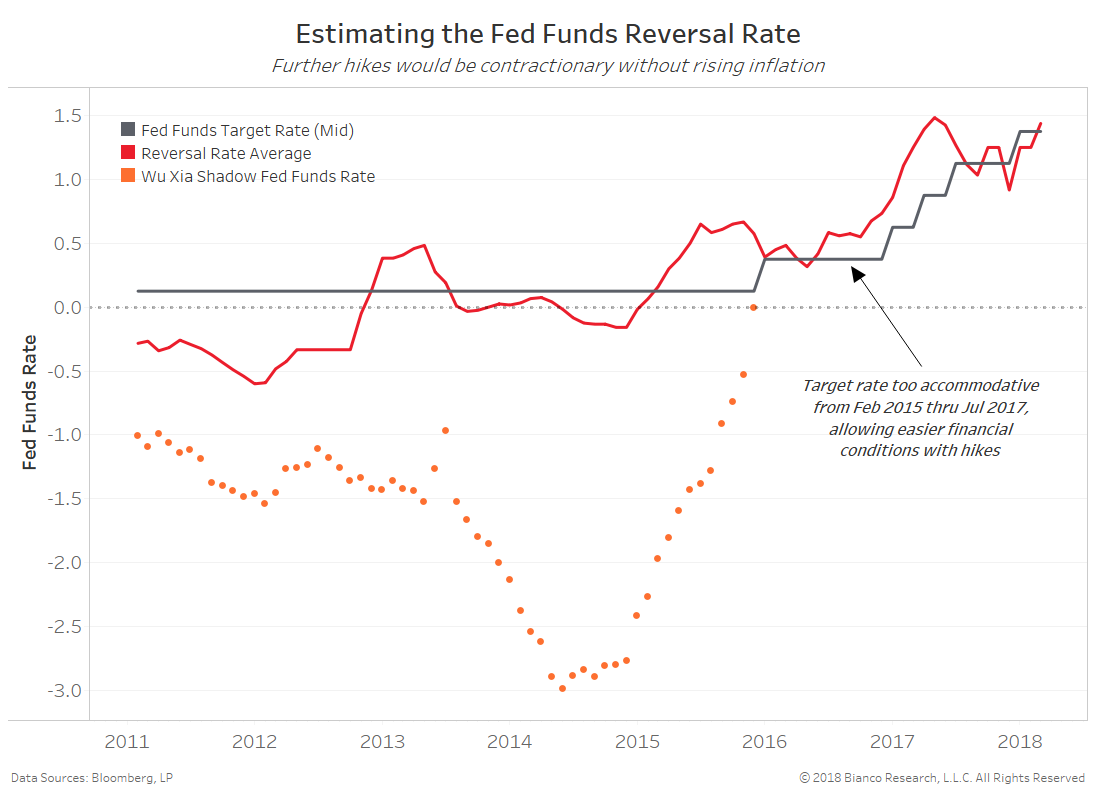

The chart below shows our estimates for this ‘reversal rate’ (red line) along with the target (gray line) and Wu-Xia shadow fed funds rate (orange dots). The target rate resided below the reversal rate post-crisis until the December 2017 hike, explaining the reason financial conditions eased with each hike. However, going forward additional hikes would tap the breaks on easy financial conditions.

The saving grace for the Federal Reserve hell-bent on raising rates at least three times in 2018 would be a rebound in core inflation. PCE core was released for January 2018 at 1.5% year-over-year, failing to show a push toward the Federal Reserve’s 2% target.