- Barron’s – After the High-Yield Storm, Calm Returns to Market

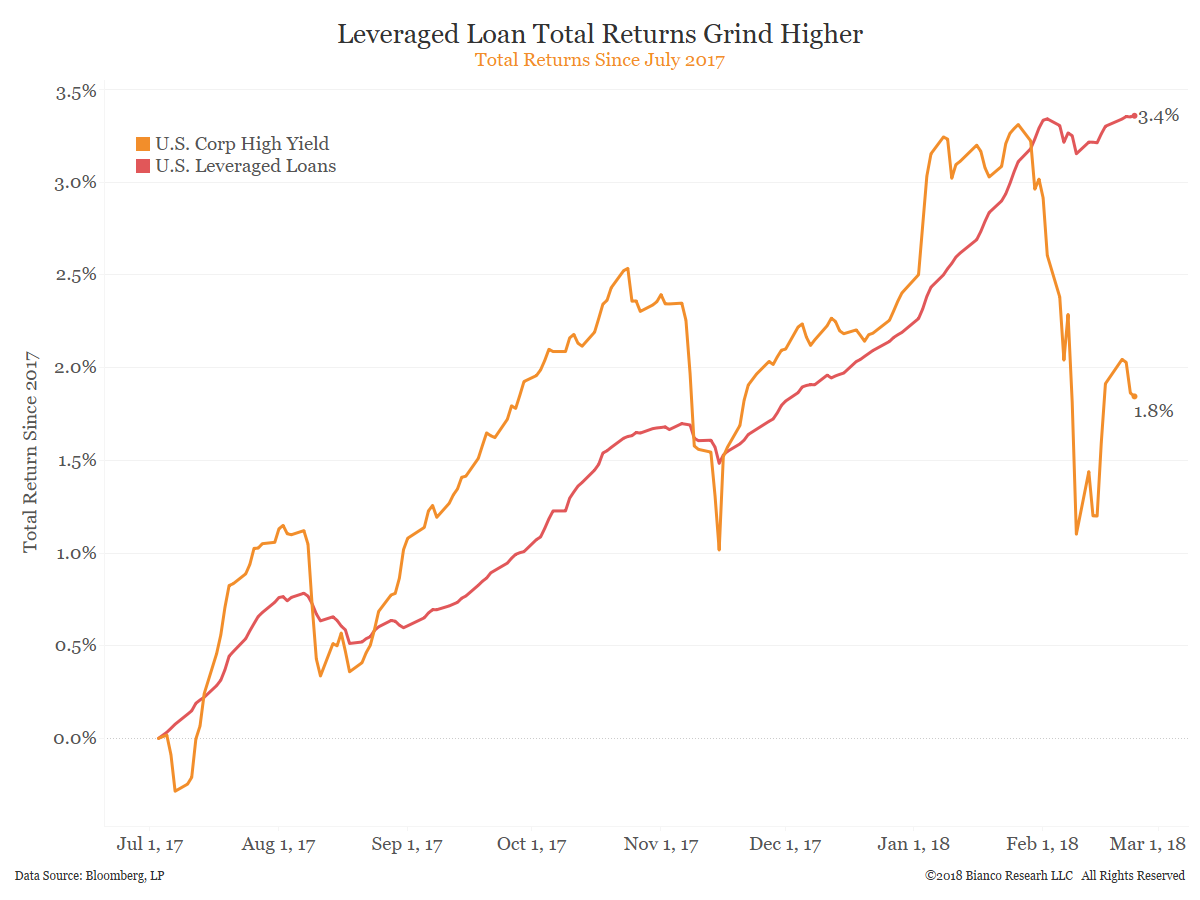

In recent years, investors’ interest in loans has surged, in anticipation of interest rates climbing. There are a few reasons for that possibly not working as intended. Many were issued with rate “floors,” to provide a minimum payment. That means rate increases won’t show up until that threshold has been breached. Loans are perceived to be safer than bonds because they are higher in the capital structure. But growing demand has allowed issuers to sell their loans with looser and looser covenants—promises to help protect investors when an issuer’s management is dancing around trying to avoid default, eroding some of that security. ETFs that buy leveraged loans have generated returns this year, while the two most popular high-yield bond ETFs have lost money. The PowerShares Senior Loan Portfolio (BKLN) has gained 1%, and the SPDR Blackstone/GSO Senior Loan ETF (SRLN) has gained 0.9%. That compares with losses of 0.6% for the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), and 0.8% for the SPDR Bloomberg Barclays High Yield Bond ETF (JNK). The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD), a popular high-grade bond ETF, has lost 3.3%.

Comment

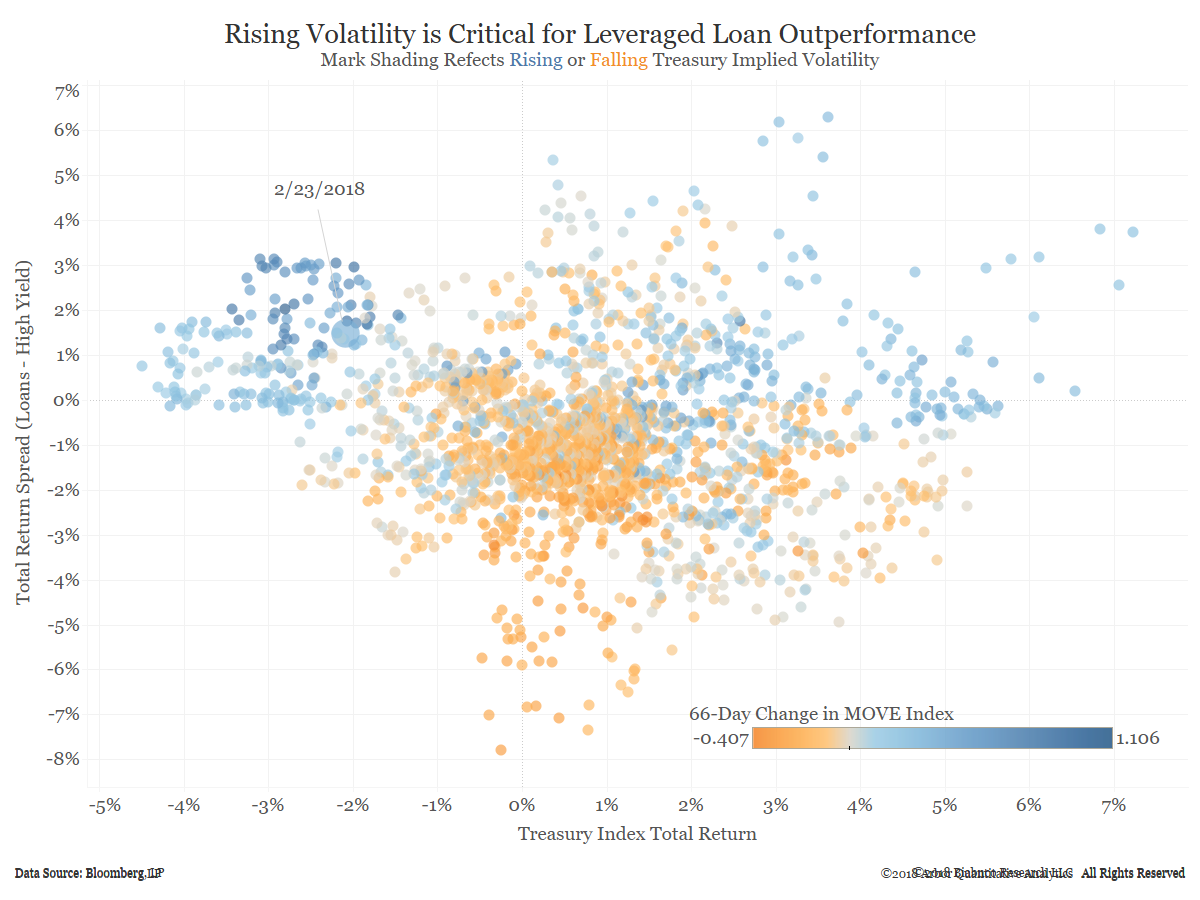

The scatterplot below shows quarterly (66-day) changes in the Bloomberg Barclay’s U.S. Treasury Total Return Index (x-axis) and the difference between the total returns for U.S. leveraged loans and high yield. The shading reflects the quarterly change in Treasury implied volatility (MOVE Index).

Leveraged loans see their widest outperformance over high yield with both rising Treasury yields and rising implied volatility. Almost any rebound in Treasuries favors high yield outperformance. But falling yields are accompanied by still-rising implied volatility, leveraged loans may still sustain their recent outperformance. This is a lower probability outcome though. The stage is set for high yield to regain ground on leveraged loans if Treasuries rebound.

Summary

Leveraged loans have had a moment in the sun as high yield stumbled earlier this month. It will be more difficult for leveraged loans to sustain this outperformance going forward. This would require additional gains in implied volatility, especially if Treasury yields fall.