- Bloomberg – Inflation Worrywarts Just Ought to Calm Down

The Fed isn’t rattled by a little rise in jobs and wages. That’s what it’s been seeking for years.

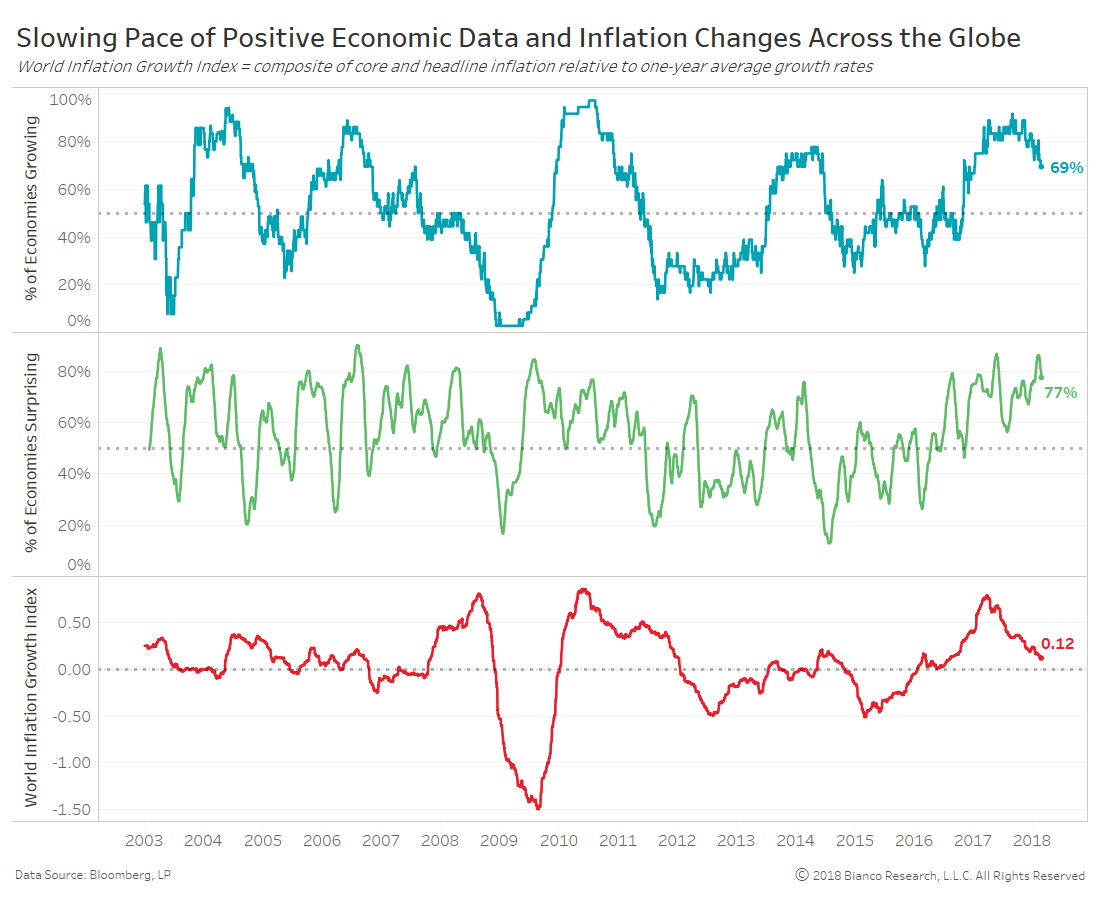

Are interest rates headed higher? Sure, but that was always going to be the case. The Fed’s own projections in December told us that. In 2017, unlike the previous two years, the Fed did exactly what it said it would do: raise rates three times and begin the process of reducing the bloat in its balance sheet that resulted from a decade of stimulative bond-buying. You would never know that either, from public discourse. Intriguingly, the minutes show some musing that the corporate tax cuts signed by President Donald Trump may actually weaken inflation. The idea is that lower tax rates might encourage some firms to simply cut prices. We’ll have to keep an eye on that one. - Top panel = % of the world’s economies growing above average

- Middle panel = % of economies producing data surprises

- Bottom panel = growth index of headline and core inflation releases (above zero indicates above one-year average growth rates)

Summary

Comment

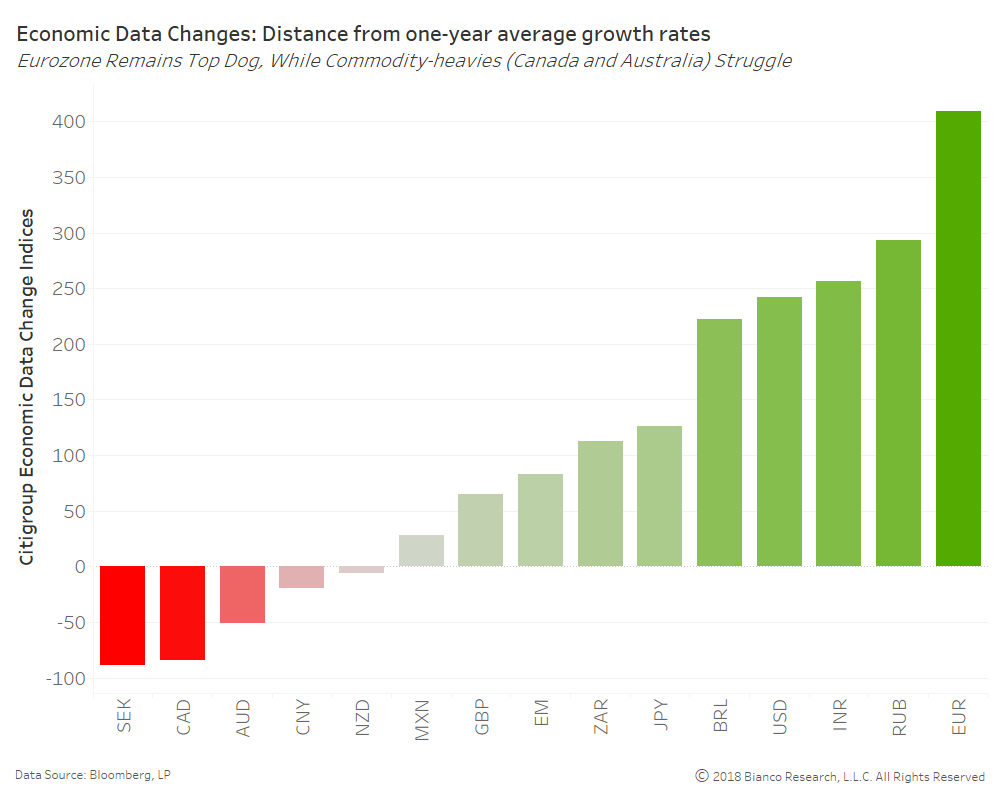

The chart below shows current Citigroup Economic Data Change Indices by economy. Central banks and risk assets have enjoyed the tailwinds of a majority of economies producing data releases above one-year average growth rates.

The Eurozone remains the star performer, while commodity-heavy economies like Canada and Australia are struggling.

The next set of charts offer metrics measuring economic data releases, surprises, and inflation growth across the globe:

The percentage of economies producing above-average data is rolling over (69%) after peaking in August 2017. However a very healthy 77% of economies are still producing data surprises on whole.

But, inflation momentum enjoyed from mid-2016 through 2017 has significantly slowed with our World Inflation Growth Index falling toward zero. This is not the result of falling inflation readings, but a failure of inflation to continue driving higher over the past quarter.

Inflation expectations (i.e. market-based) are diverging with this inflation index. In other words, investors are believing inflation growth rates will rebound and stay above averages (zero).

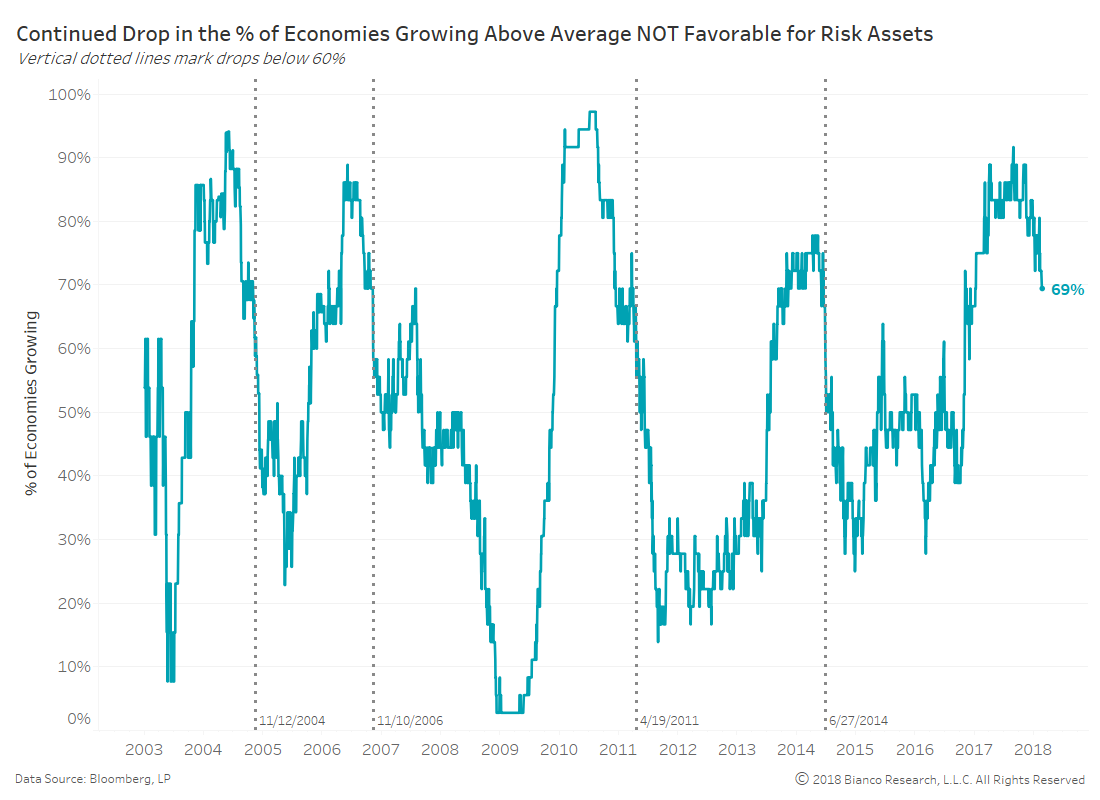

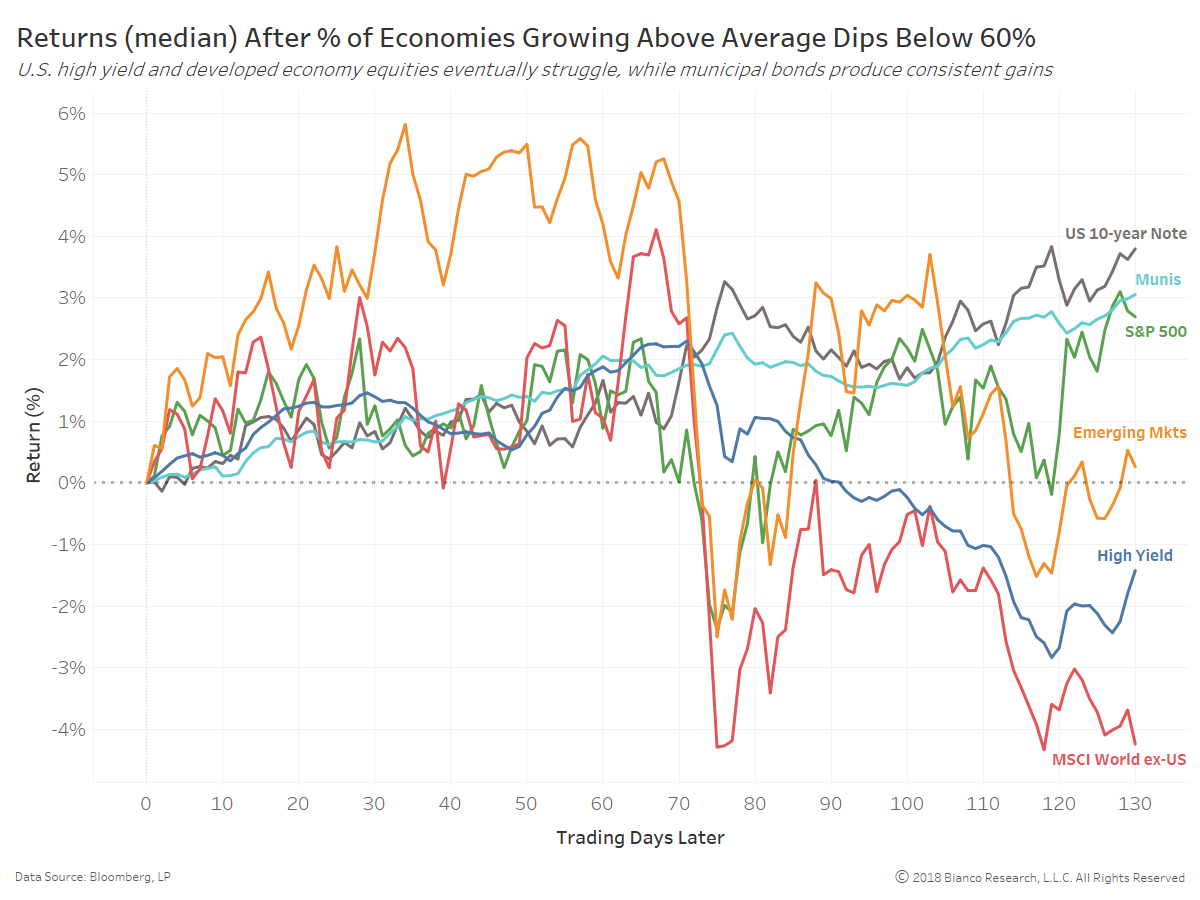

The chart below shows the average returns by asset class after the percentage of economies growing above one-year averages fell below 60%.

All but emerging market equities produced tepid returns over the following quarter. However emerging markets, developed equities ex-US, and U.S. high yield all quickly ran into trouble the following quarter.

We continue to note the calm, steady performance of municipal bonds within such studies. Municipal bonds generate a 3% return over this six-month window, clearly besting the S&P 500 on a risk-adjusted basis.

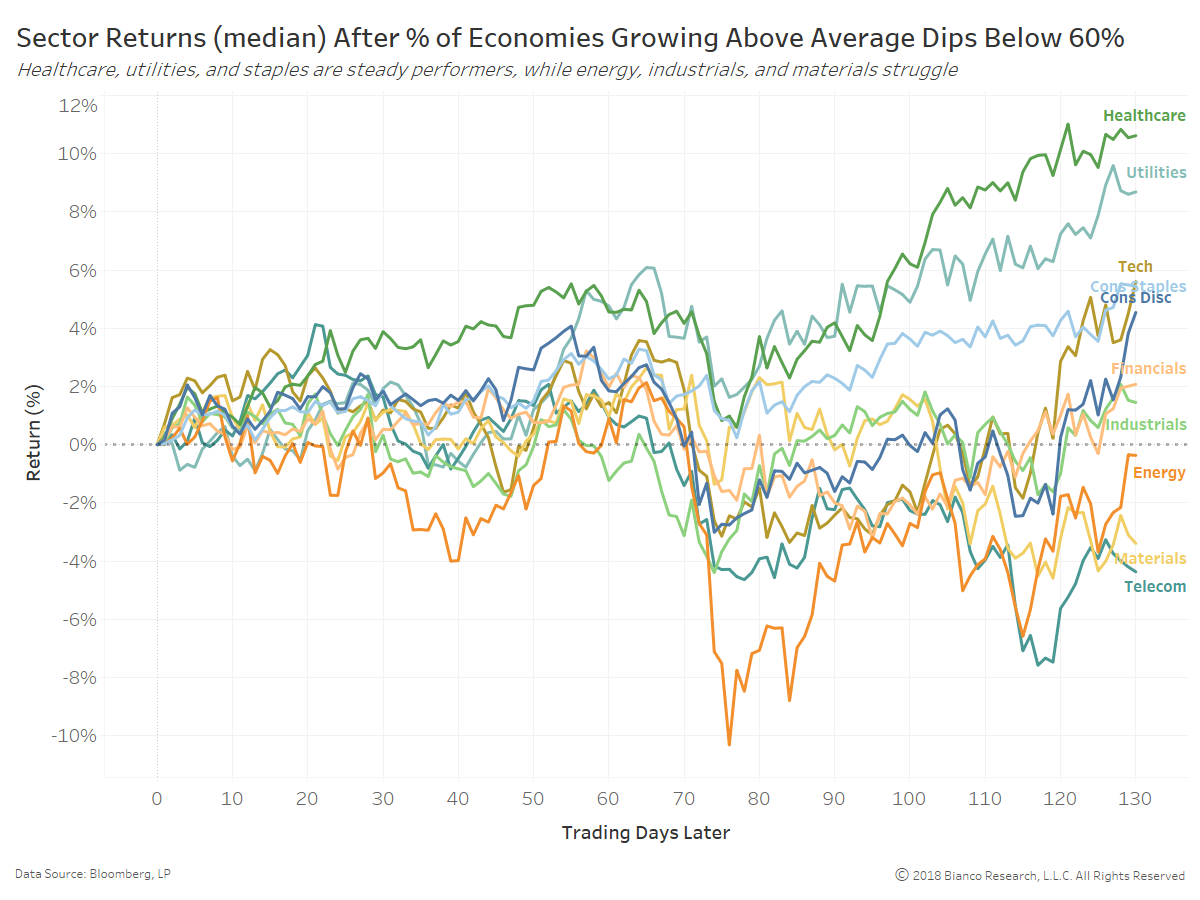

The last chart shows equity sector returns following these same instances. Not surprisingly, healthcare, utilities, and consumer staples (i.e. defensive sectors) produce higher returns under significantly less volatility.

All in all, equity and high yield investors should benefit from overweighting these lower beta, less cyclical sectors.