- The Wall Street Journal – Uproar as South Korea Plans Cryptocurrency Crackdown

Government attempts to tighten control over cryptocurrency trading are sparking a fierce public backlash in South Korea. A petition on the official website of South Korea’s presidential office had collected more than 200,000 signatures by Tuesday morning, hitting a threshold that would compel a government response, which could mark the opening of an investigation. The petition, which was launched Dec. 28, had until Jan. 27 to reach the signature goal. The grass-roots backlash comes after several weeks of concerted attempts by South Korean regulators to clamp down on bitcoin trading—floating ideas including taxation, increasing regulatory scrutiny and even an outright ban on cryptocurrency exchanges. On Monday, South Korea’s government delivered its strongest statement to date about the dangers of trading bitcoin, warning the public to exercise caution. “Cryptocurrency is not a legally recognized currency,” the statement said. The remark came after South Korea’s justice minister said last week that the government was preparing a bill to ban cryptocurrency trading on exchanges, sending prices of bitcoin, the world’s most traded virtual currency, to fall more than 16% in two hours on South Korean exchanges. Hours later on the same day, a presidential office spokesman walked that back, saying that abolishing cryptocurrency exchanges was only “one possible measure” that didn’t represent a “final” decision.

- Financial Post – Blockchain frenzy fuelling company name changes, new coins, reverse takeovers and soaring stock prices

More than 30 public companies have made blockchain-related announcements over the past 13 months and have seen a median stock price increase of 265%

Glance is one of more than 30 public companies that made blockchain-related announcements or added the word “blockchain” to their name over the past 13 months. Those companies experienced a median stock price increase of 265 per cent, according to an analysis by Autonomous Research. The trend has drawn widespread comparisons to the dot-com bubble of the late ’90s, when companies that added .com to their names saw a median share price increase of 118 per cent, according to the same analysis. Everyone knows how that bubble ended for most of those companies, but executives participating in the current blockchain mania would also like to remind you that a handful of winners such as Amazon.com Inc. and eBay Inc. survived the bust and thrived.

Comment

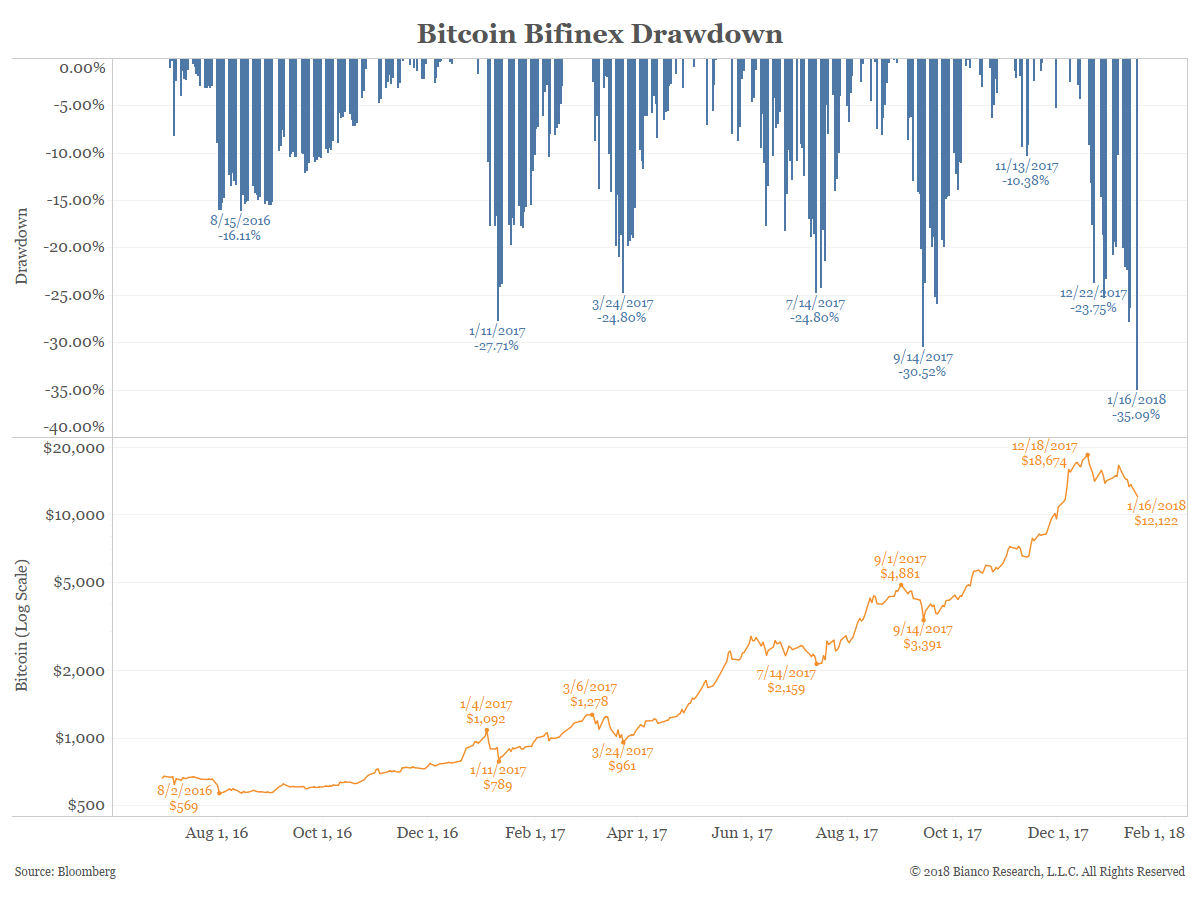

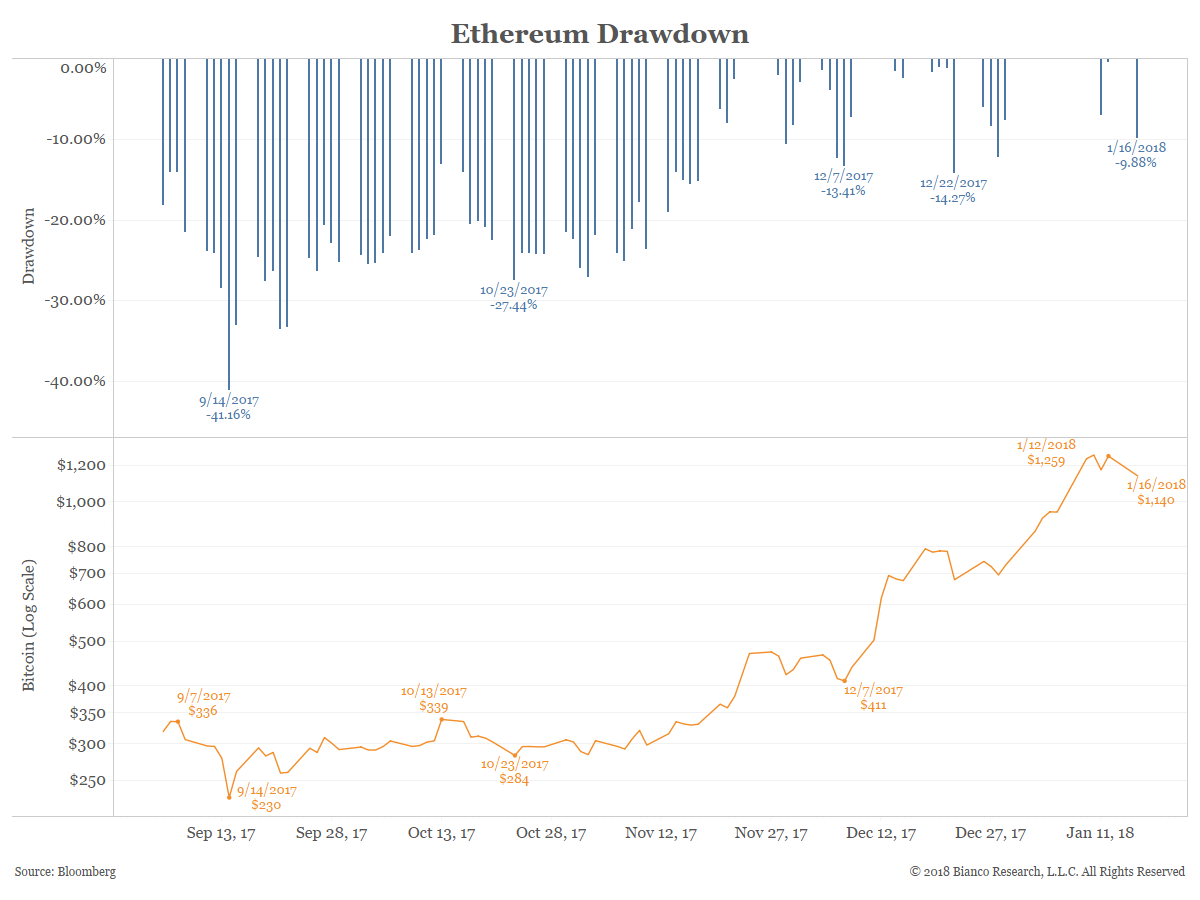

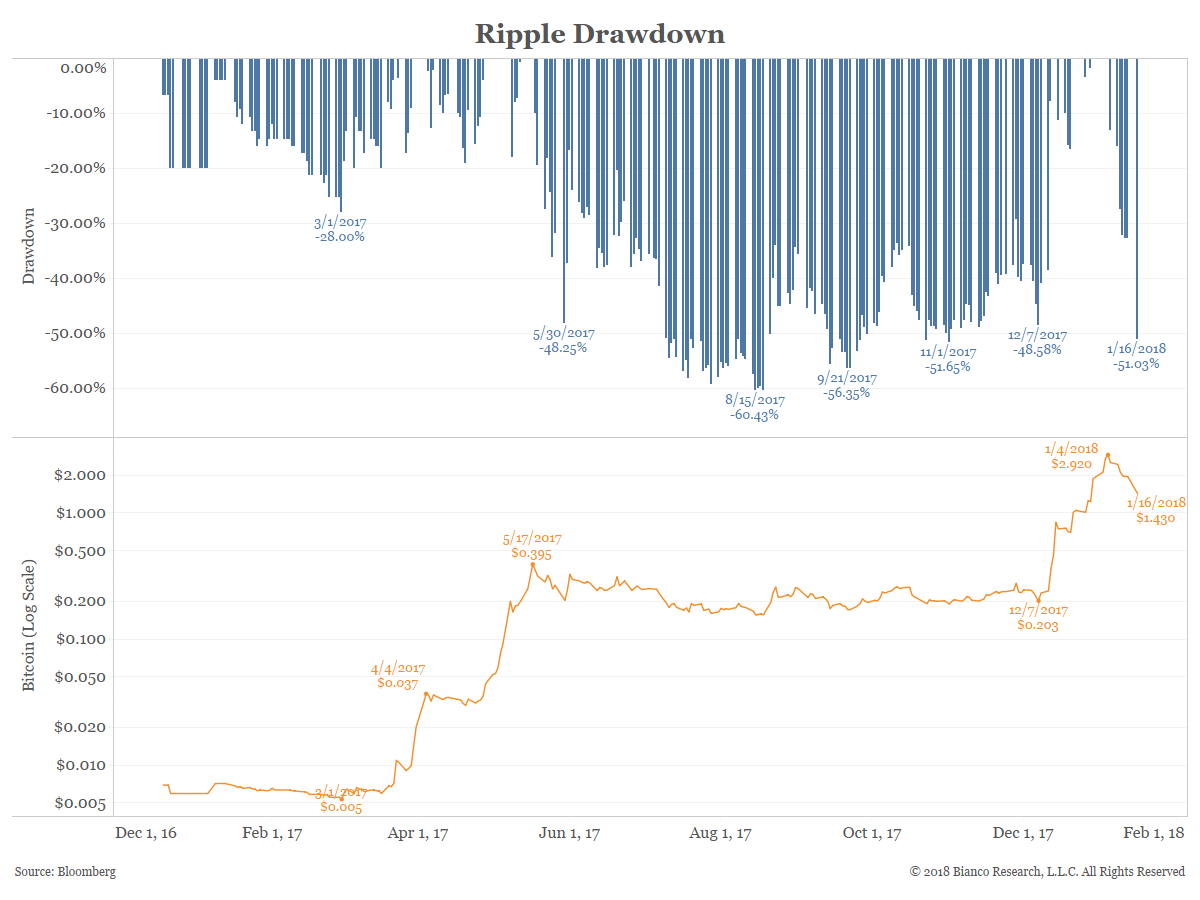

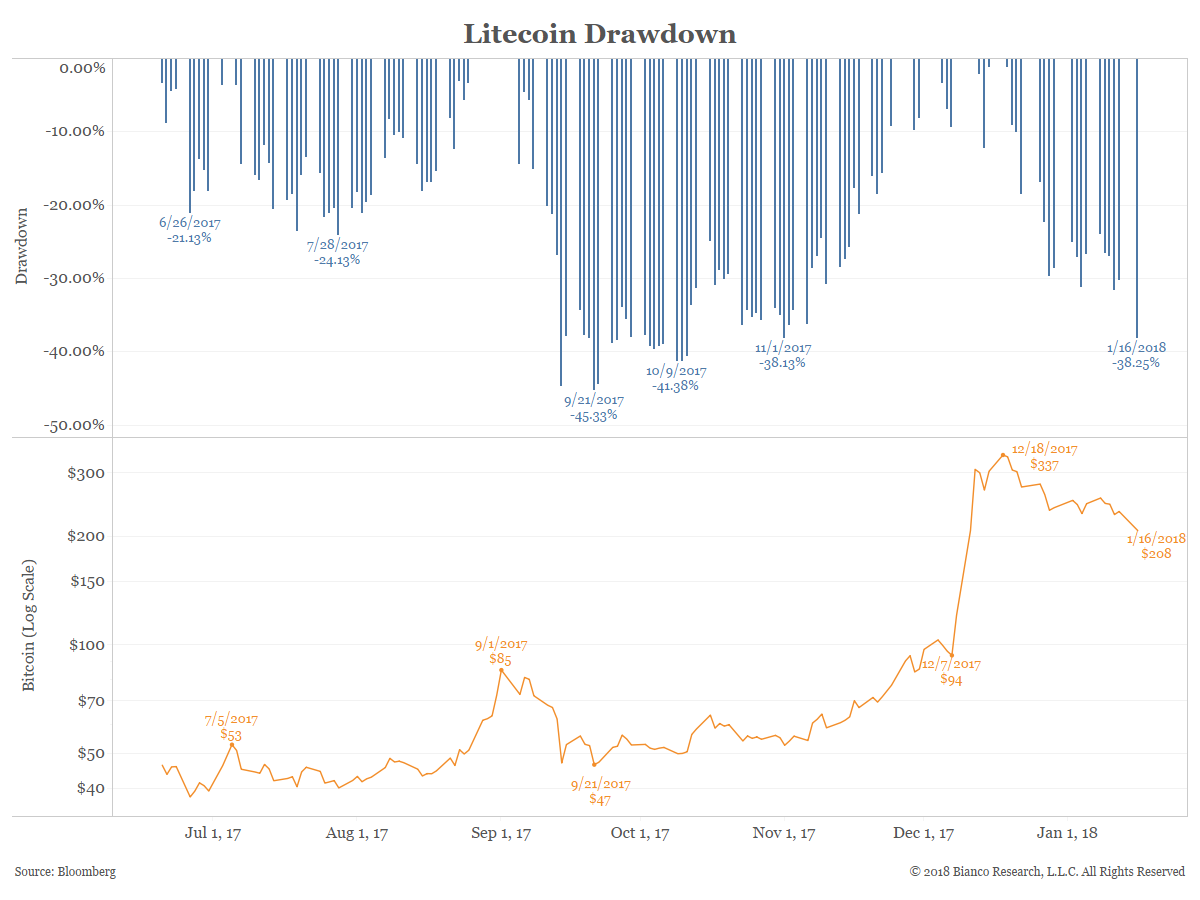

The volatility associated with holding Bitcoin has been a theme of ours over the past year. As we have pointed out:

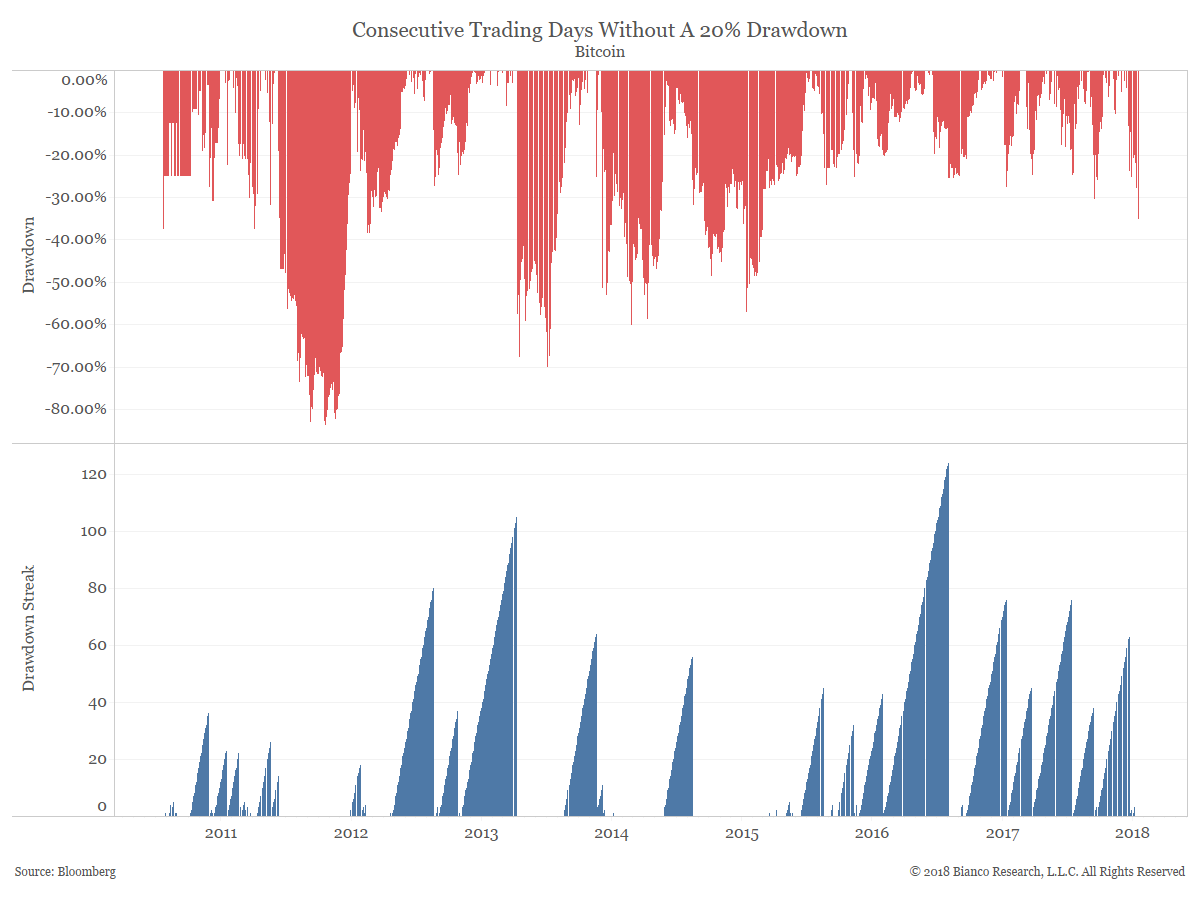

Defining a bear market as a 20% drop, the chart below shows just how often owners of Bitcoin would have to endure a bear market. While Bitcoin once made it 124 trading days (roughly six months) without a bear market during this span, this was far from the norm. More often than not, Bitcoin would enter bear market territory at least once every couple months.

While this is not a game for the faint of heart, it is worth noting that these cryptocurrencies have snapped back from these losses very quickly almost every time.