- Bloomberg – Dollar Slide Deepens as Euro Strength Caps Stocks

Economists bump up 2018 outlook for euro-area growth to 2.2%The dollar remains under pressure after capping five straight weeks of declines, even against a backdrop of solid U.S. growth. Traders appear to be more excited by potentially hawkish policy shifts from central banks in Europe and Japan, the improving political outlook in the euro area, and the synchronized nature of global expansion that’s also propelling emerging-market economies. The single currency — which already has momentum after last week’s progress toward a German government — got a further boost as economists polled in a monthly Bloomberg survey bumped up their 2018 outlook for euro-area growth to 2.2 percent. That’s close to the decade-high 2.4 percent pace estimated for last year.

Comment

- Financial Times – Dollar slides to 3-year low as euro gains on Merkel coalition deal

Investors eye tighter monetary policy from the ECB, momentum from stock rally ebbsThe dollar index is trading around its weakest levels in more than three years as the euro and pound add to gains from late last week, spurred by political developments in Europe. The benchmark, which measures the US currency against a basket of peers, fell as much as 0.7 percent to 90.279, taking it down over 2 percent since the start of the year. The euro is at its highest level since late 2014 as the dollar wilts, up by as much as 0.8 percent on the session at $1.2296. The sustained rally comes after German Chancellor Angela Merkel unveiled a coalition deal between her conservative bloc and the Social Democrats.

- The Financial Times – Does the euro breakout have momentum?

Bond bear market and US tax reform impact also in focusThe euro is up almost 3 per cent in the past three trading days, storming past $1.22 on Monday,to hit its highest level in three years. After testing $1.21 three times this year that level was finally breached on Friday, setting the stage for Europe’s single currency to find a higher trading range against the dollar. The triggers were the clearing of two hurdles to further euro appreciation: the breakthrough in the German coalition talks and US inflation data that failed to give the dollar momentum.

Summary

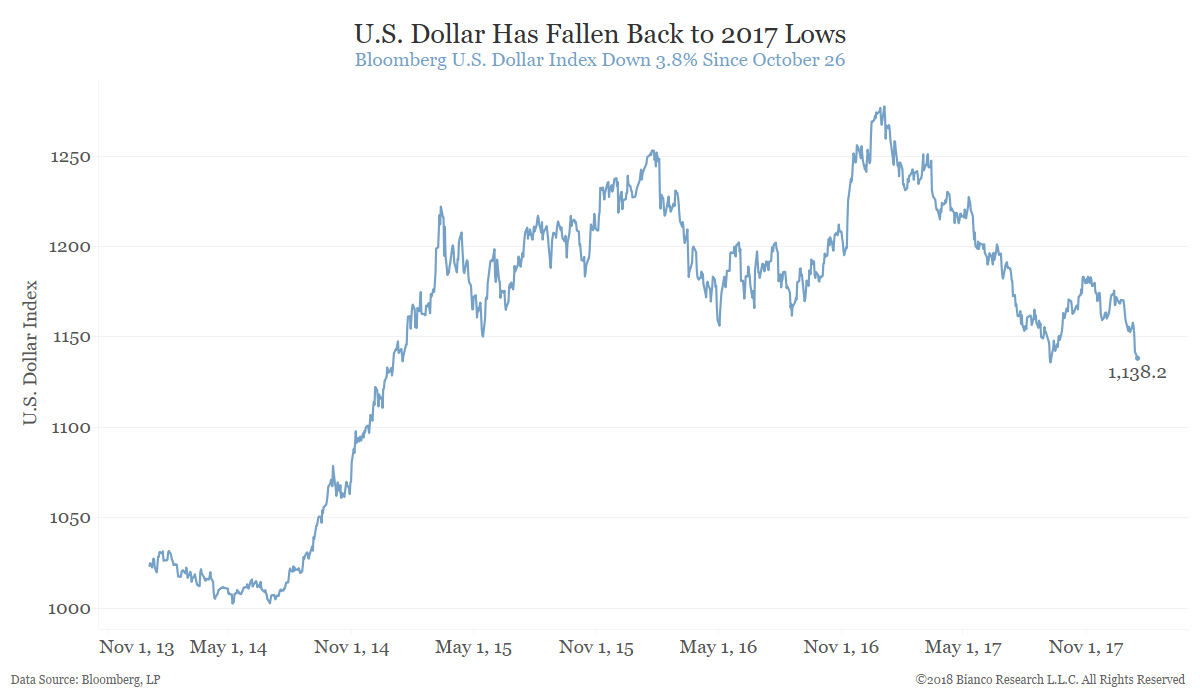

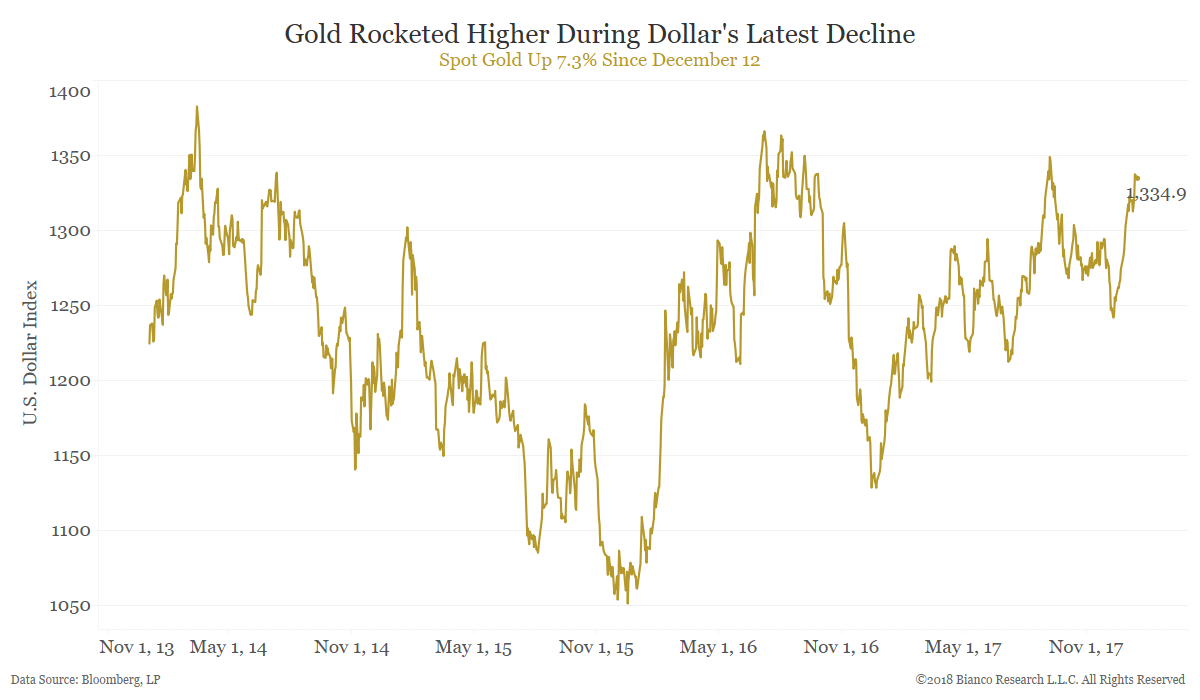

The falling dollar is on everyone’s mind as the greenback approaches a major low from September. Gold and emerging market equities have been among the major beneficiaries of a weaker dollar since December. Treasuries have shown looser ties to changes in the dollar since fall.

Comment

Key developments in Europe have sent the U.S, dollar tumbling back to its September 2017 lows. Stronger growth expectations for Europe and improving odds of a unified German government helped push the euro higher. The German decision to include the yuan in its reserves sparked a sharp rally in the Chinese currency. And discussion of a potential reversal of the Brexit vote caused the British pound to surge higher. The chart below shows these forces have combined to send the U.S. dollar sharply lower. The dollar is now -3.8% since October 26.

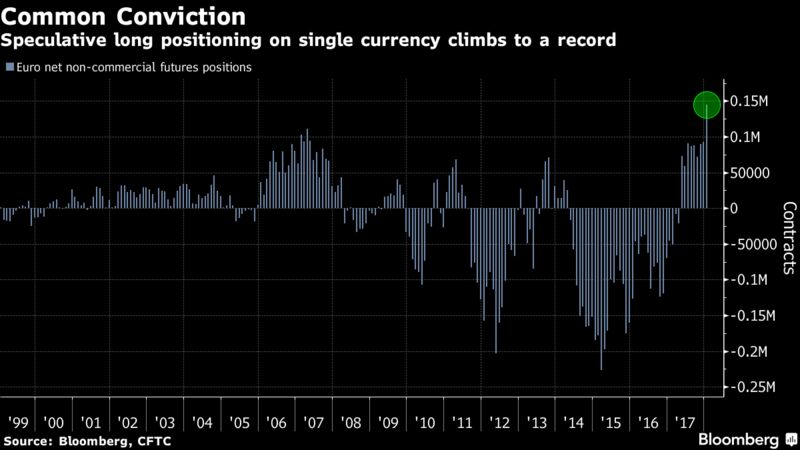

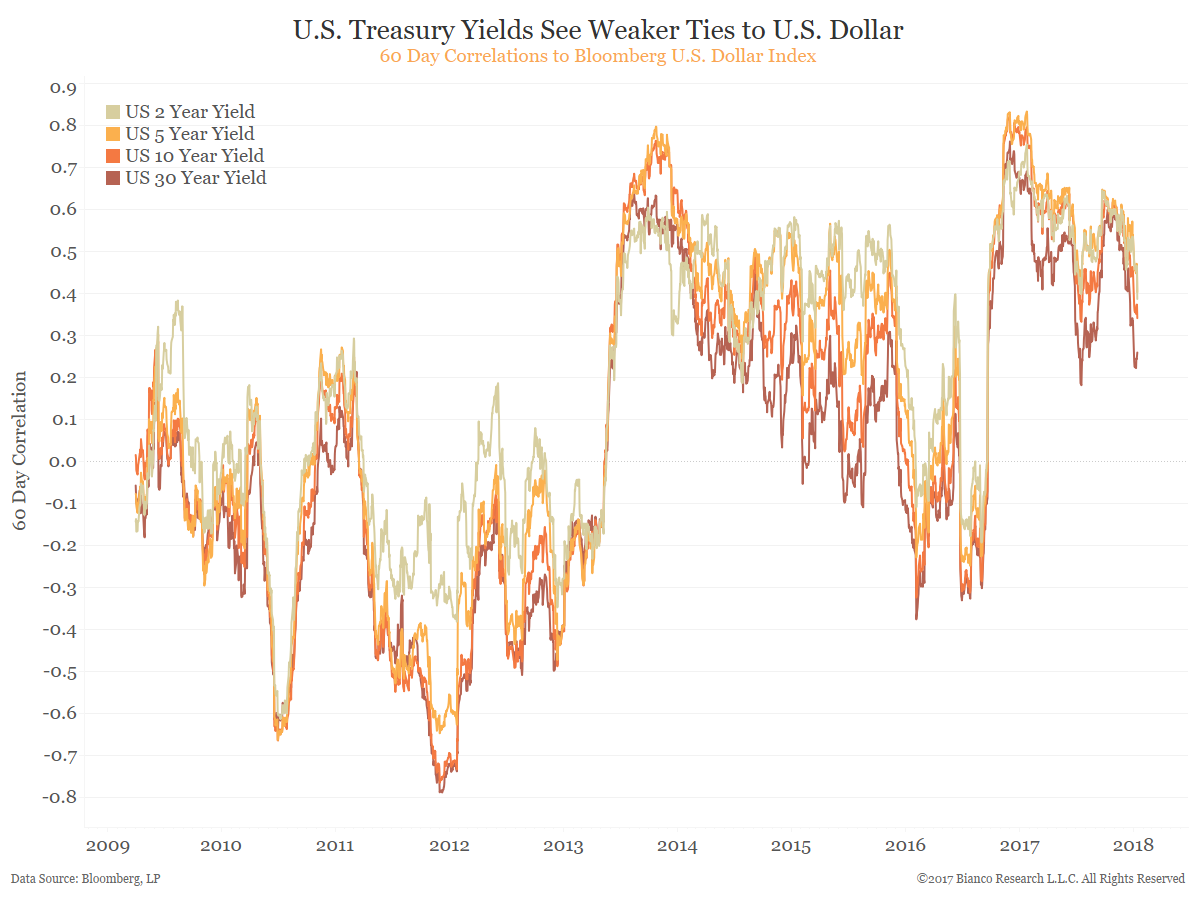

The next chart shows the twelve strongest 60-day correlations to the U.S. dollar from a range of U.S. and emerging market industry groups, commodities and Treasury yields. Gold is a standout with the strongest (negative) relationship with the dollar. Over the past 3 months, a number of key emerging market industries have seen tighter relationships with the dollar. Though Treasury yields still show a positive correlation, that relationship has weakened from the near-linear one seen in 2017.

The next chart shows gold’s remarkable surge during the latest dollar downdraft. Gold has risen 7.3% since December 12.

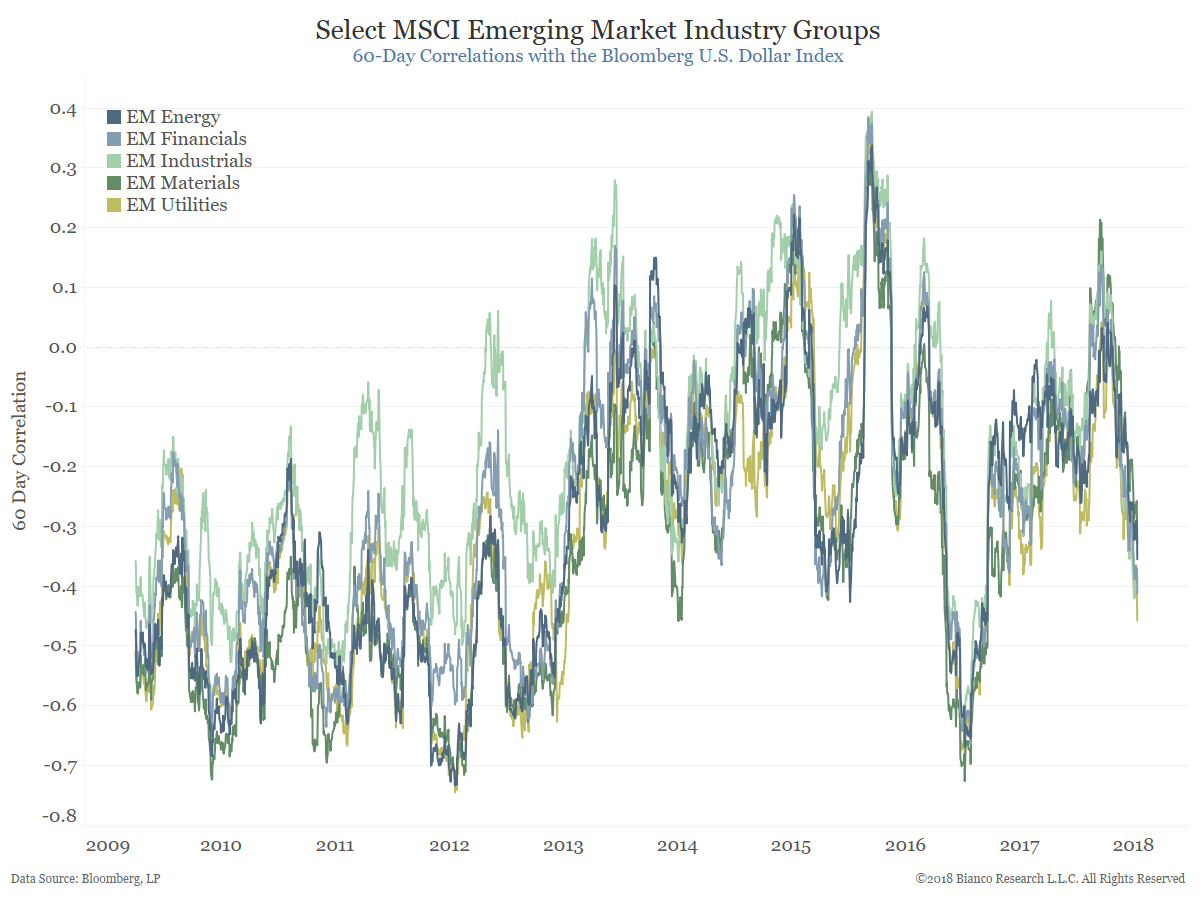

Emerging market equities have surged higher along with risk markets broadly. Several of the industry groups with the strongest ties to the dollar have outperformed. The chart below shows rolling 60-day correlations between MSCI emerging market industry groups and the Bloomberg U.S. dollar index. Energy, financials, industrials, materials, and utilities were all among the strongest correlations. After a period of unusually low correlation to the dollar in fall, these negative relationships have strengthened to more typical levels.

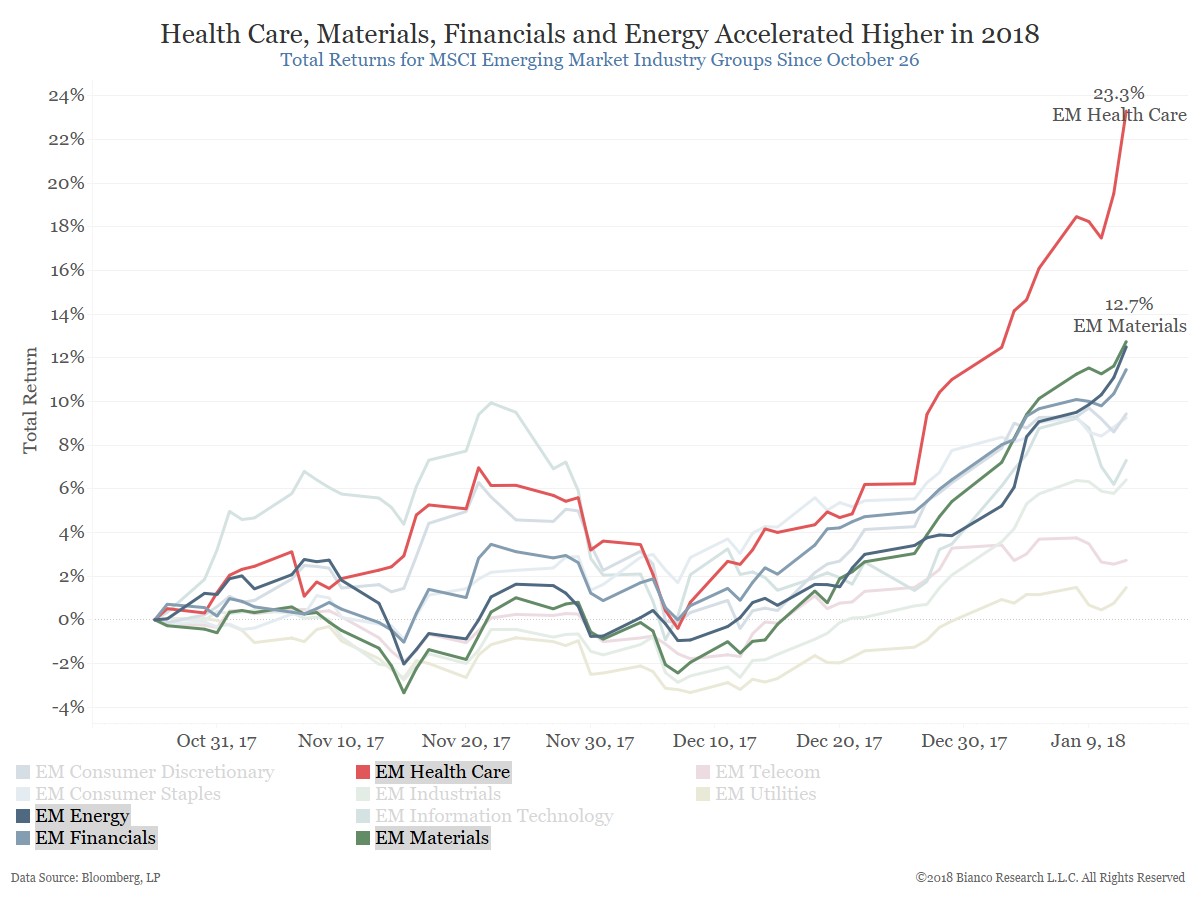

Emerging market health care, materials, financials, and energy have accelerated higher during the dollar decline that began December 12. The chart below shows total returns since the October 26 peak for the Bloomberg, U.S. dollar index. Emerging market health care is up 23.3% since then, materials +12.7% and both energy and financials +10.4%.

As we mentioned above, U.S. Treasury yields have seen their positive correlation with the dollar weaken recently. A nearly linear relationship between Treasury yields and the dollar was a theme in 2017. The next chart shows that while the 60-day correlations are still positive, Treasury yields are much less likely to fall with a weaker dollar.

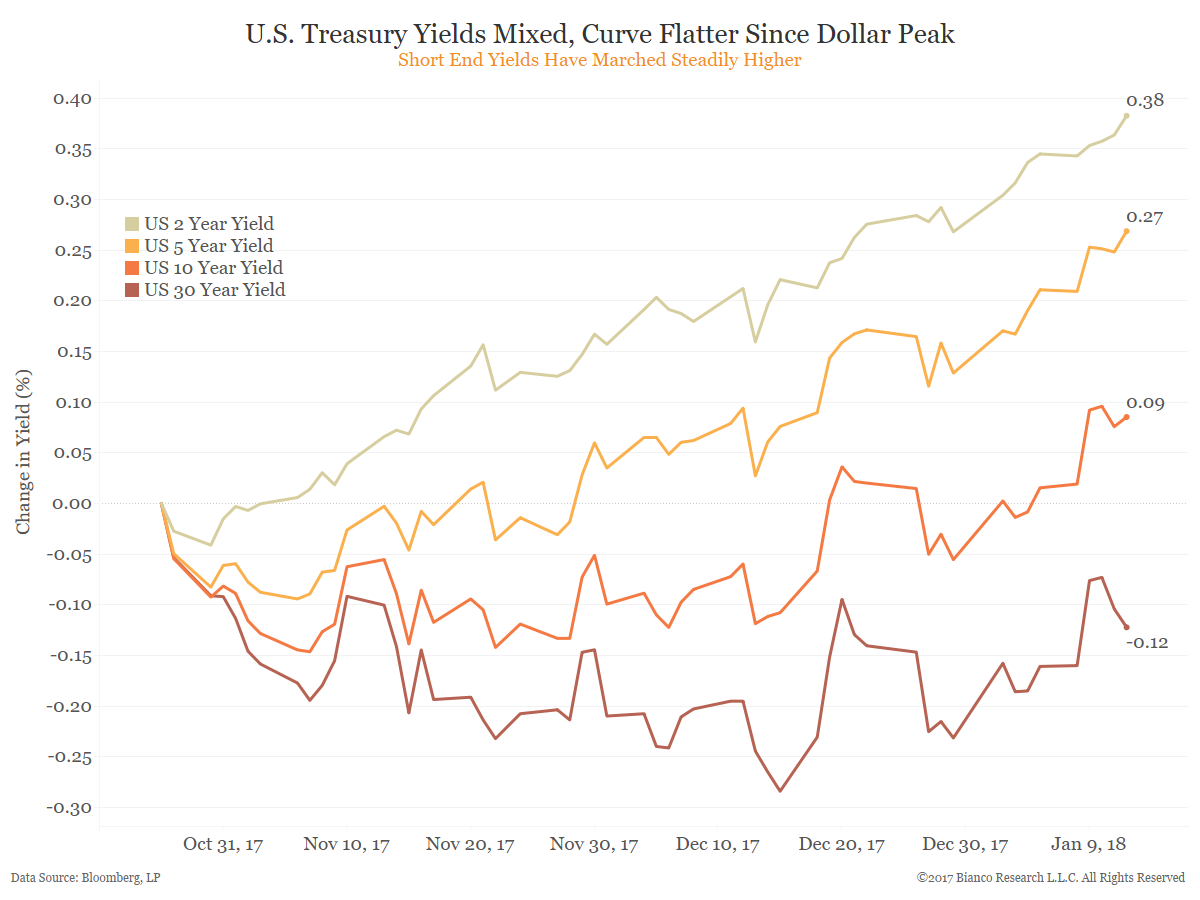

The last chart shows that indeed the Treasury curve has flattened since the October 26 peak for the dollar. Short end yields have marched steadily higher since then, while both 10-year and 30-year yields have been more range-bound. The 10-year yield has only recently broken above range highs and is now 9 bps higher versus October 26. The 30-year yield is 12 bps lower.

Conclusion

The weaker dollar has been a boon for emerging market equities, especially those in the healthcare, materials, financials and energy industries. These have all see strengthening ties to the U.S. dollar after a period of unusually weak relationships in late 2017. How the dollar handles a retest of key September 2017 lows will be critical. The latest CoT data may have some say in this. Treasury yields have seen their ties to the dollar weaken as we moved into 2018. A stronger dollar appears less likely to pull yields lower.