- The Wall Street Journal – Yellen Says Gradual Rate Increases Should Help Sustain Economy’s Growth

Fed chairwoman says labor-market strength should lead to higher inflation next yearFederal Reserve Chairwoman Janet Yellen kept the door open to another increase in short-term interest rates this year, but sounded a note of caution on still weak inflation in the U.S. and abroad. The “ongoing strength of the economy will warrant gradual increases” in short-term interest rates, the Fed chairwoman said, although she didn’t specify when the next rate increase would come. Gradual increases in the benchmark federal-funds rate “are likely to be appropriate over the next few years to sustain the economic expansion,” Ms. Yellen said Sunday at a Group of 30 banking seminar in Washington. Fed officials are nonetheless watching price pressures closely, Ms. Yellen said, as the “biggest surprise in the U.S. economy this year has been inflation.” … Ms. Yellen on Sunday said Fed officials “will be paying close attention to the inflation data in the months ahead.” … “My best guess is that these soft readings will not persist, and with the ongoing strengthening of labor markets, I expect inflation to move higher next year,” Ms. Yellen said, adding that “most of my colleagues on the [interest-rate-setting Federal Open Market Committee] agree.”

Comment

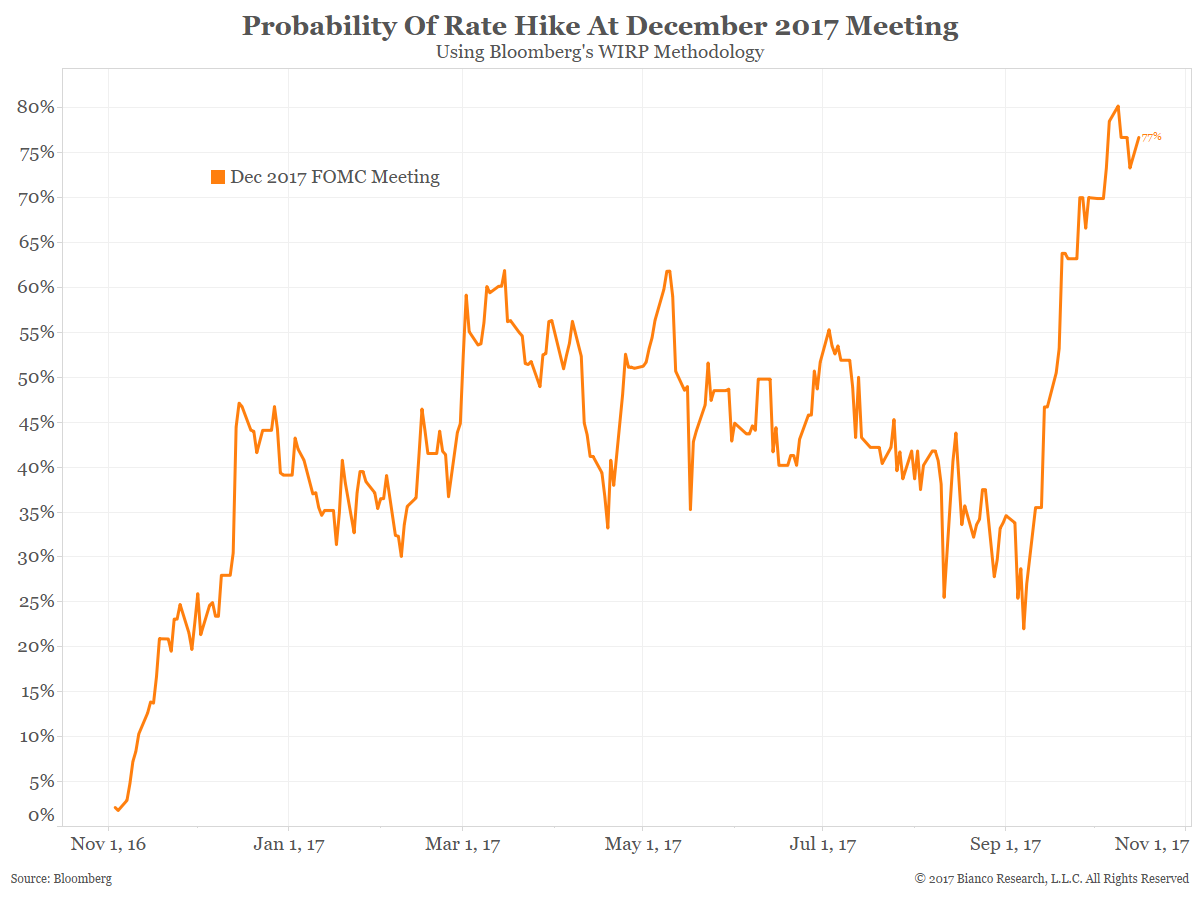

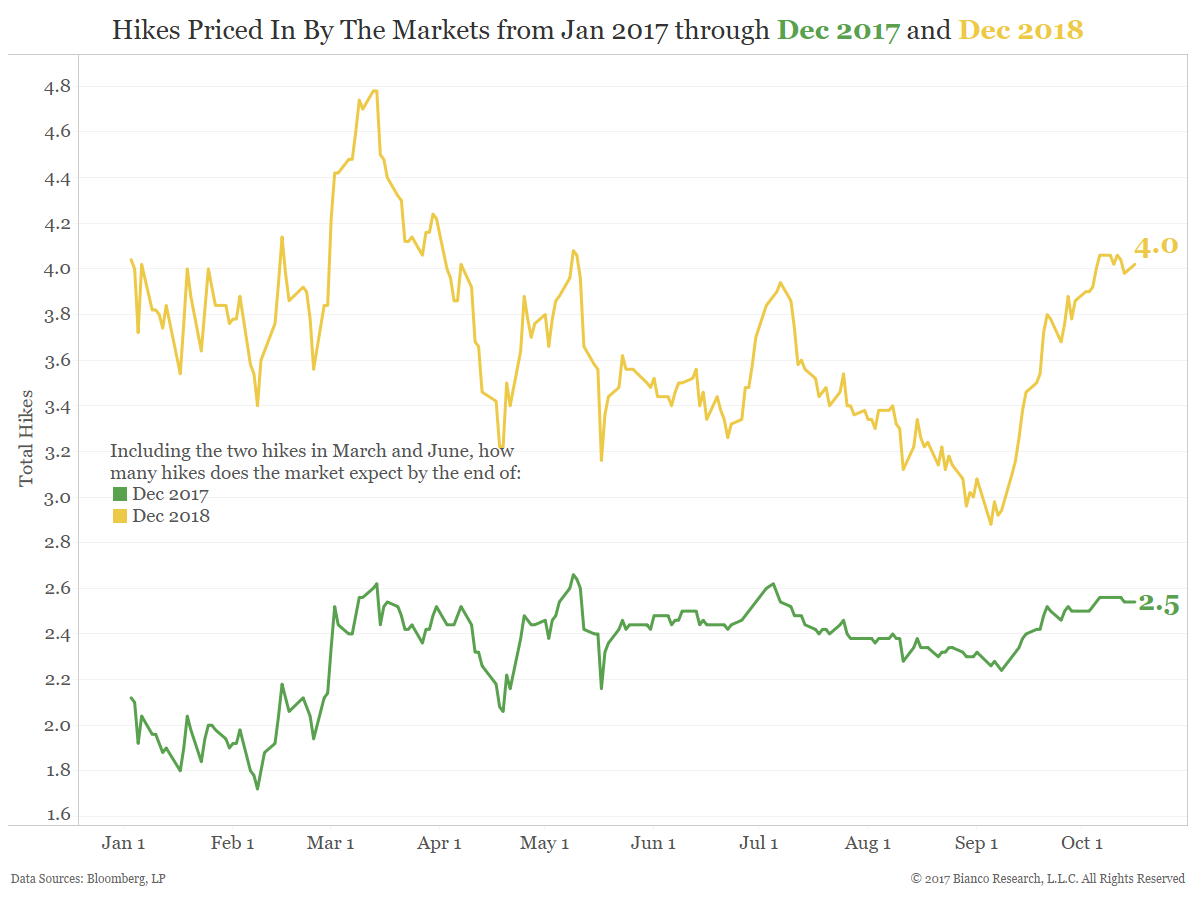

September’s Summary of Economic Projections (SEP) showed the Fed expects four rate hikes through the end of 2018. The chart below shows the market’s total number of hikes expected for all of 2017 (green) and all of 2017 and 2018 combined (orange). Remember that two hikes have already occurred (March and June), so the market is expecting two more rate hikes through the end of 2018 (the four shown in orange less the two already completed this year). Clearly these two opinions are at odds.

The market still thinks the Fed will hike more gradually than the SEP suggests and are not buying Yellen’s “guess” that inflation will rebound.

Also, note that Yellen and the data-dependent Fed has been reduced to “guessing” about inflation because they have given up on their traditional models and forecasts and seem to be hoping that inflation will rebound.