- Bloomberg View – Komal Sri Kumar: How Trump Could Puncture the Equity Bubble

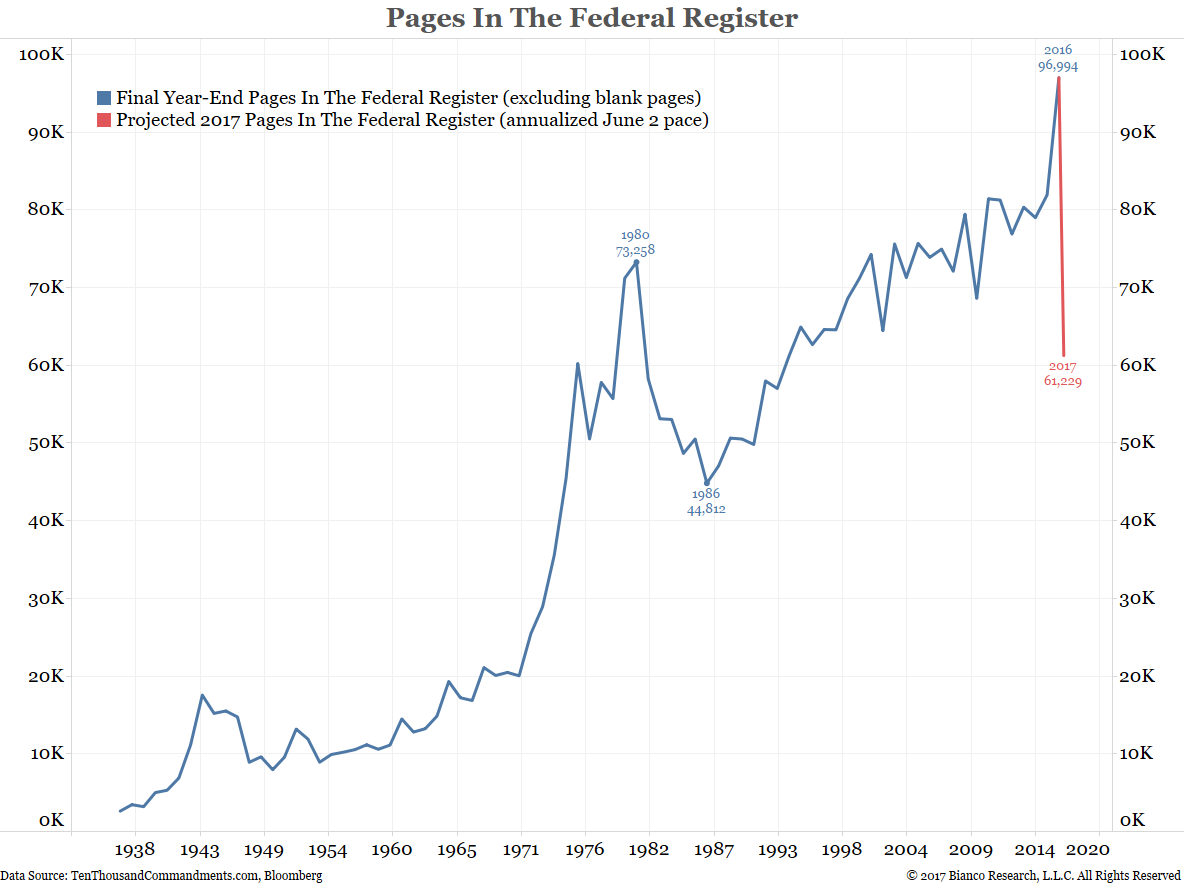

A delay in stimulus measures and the rise in global trade tensions could deflate valuations.Donald Trump’s appeal last November was linked to two factors. Both are now putting the valuation bubble in equities at risk. The first factor was his emphasis on stimulus — tax reform, infrastructure spending and fewer regulations — that has pushed markets to higher and higher levels. The new administration was targeting at least 3 percent annual growth in real gross domestic product, well in excess of levels that the U.S. economy has experienced since the financial crisis. The second component of the Trump campaign presented the U.S. trade deficit as a sign that the country was being treated unfairly by its trading partners. The remedy was to impose higher tariffs on imports, with China and Mexico mentioned as specific targets. Fear that the trade restrictions the candidate threatened during the campaign would dominate the incipient administration was the reason U.S. equity futures plunged during the hours immediately after the election results were known. Retaliation by trading partners to new tariffs would have slowed global economic growth and demand, resulting in a headwind for equities.

- The Wall Street Journal – The Last Market Still Betting on Trump

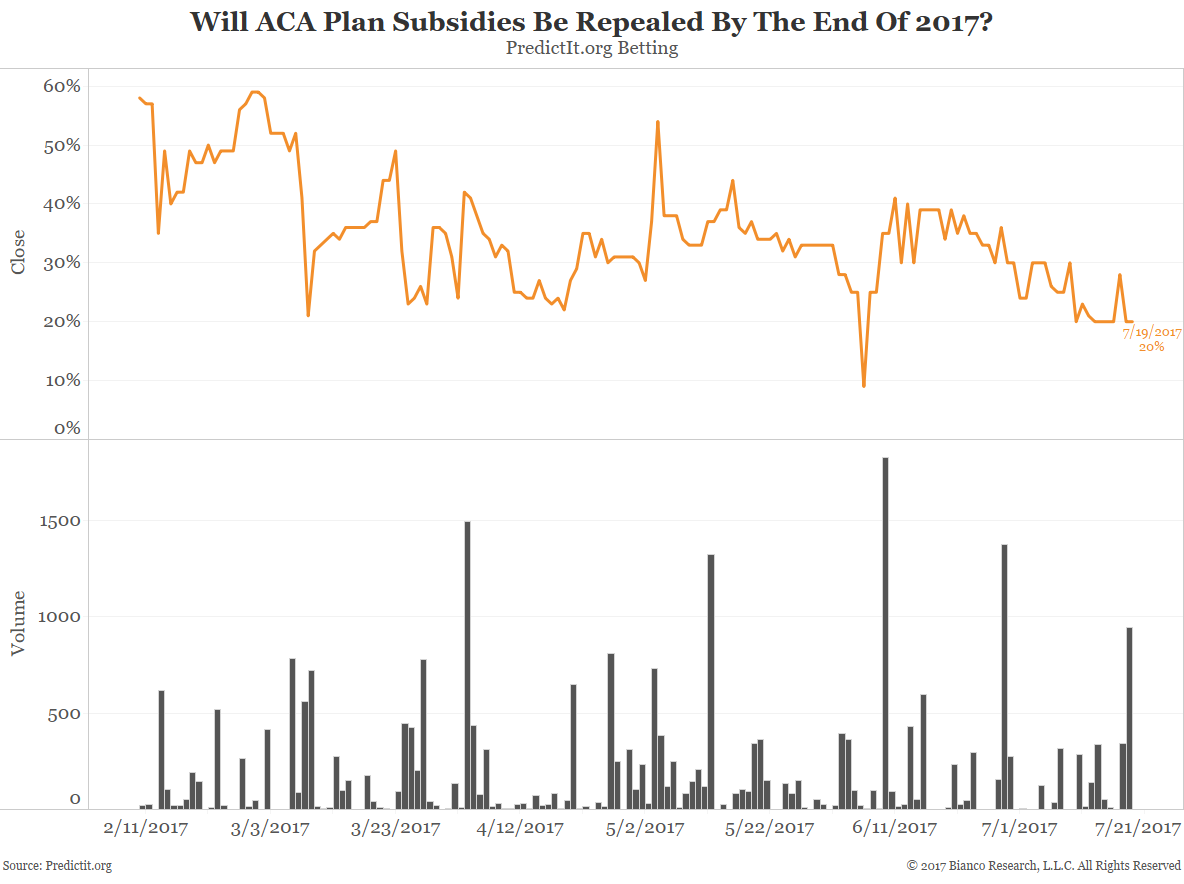

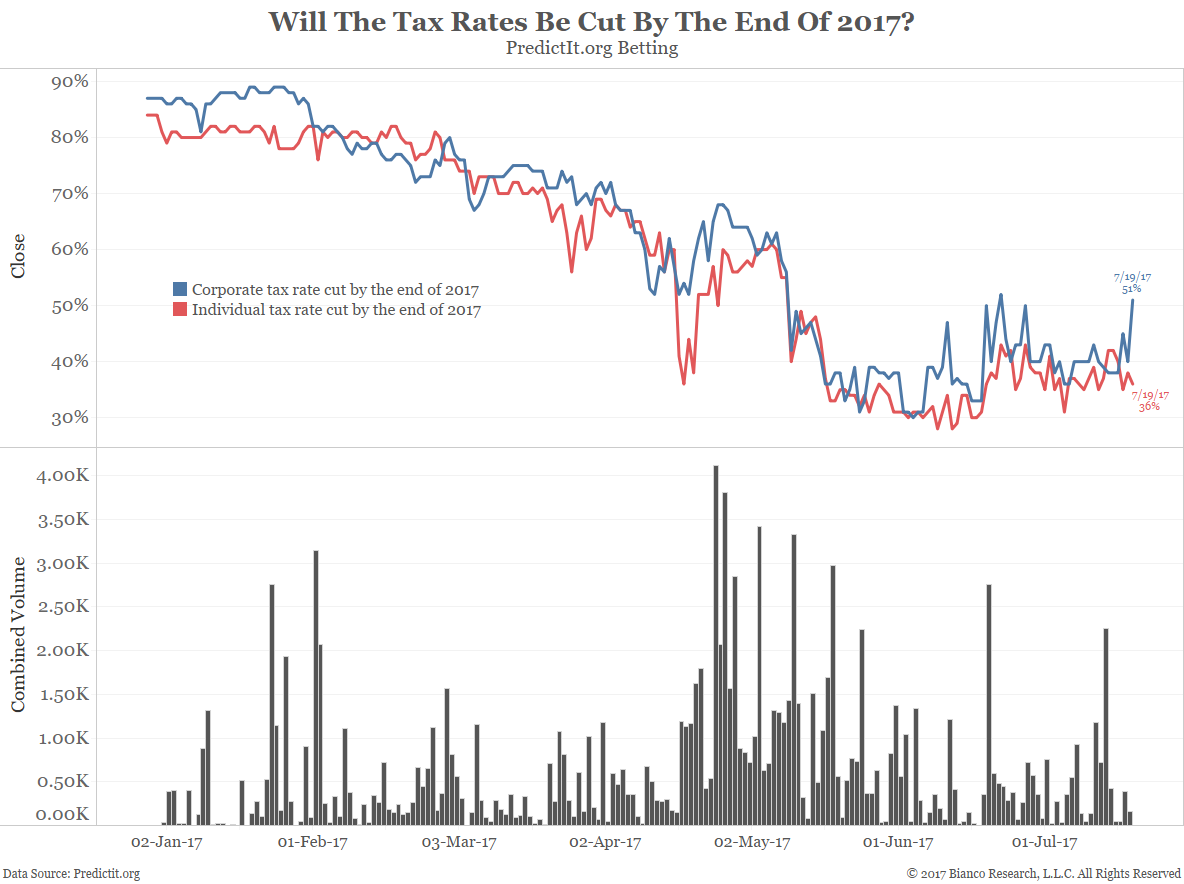

Still, the market’s high valuation in the face of declining earnings growth and a tepid U.S. economy means some of the rally was likely driven by policy expectations. More than half of the respondents to a survey of nearly 1,100 clients conducted by Cornerstone Macro last month said they expected Congress to pass a significant tax bill before the 2018 midterm elections. The question to ask, says Cornerstone’s Andy Laperriere, is what would happen to stocks if all investors gave up on a tax cut? The answer: They would probably go down.

Summary

Comment