- The Daily Reckoning – Jim Rickards: The Fed Has Hit the ‘Pause’ Button

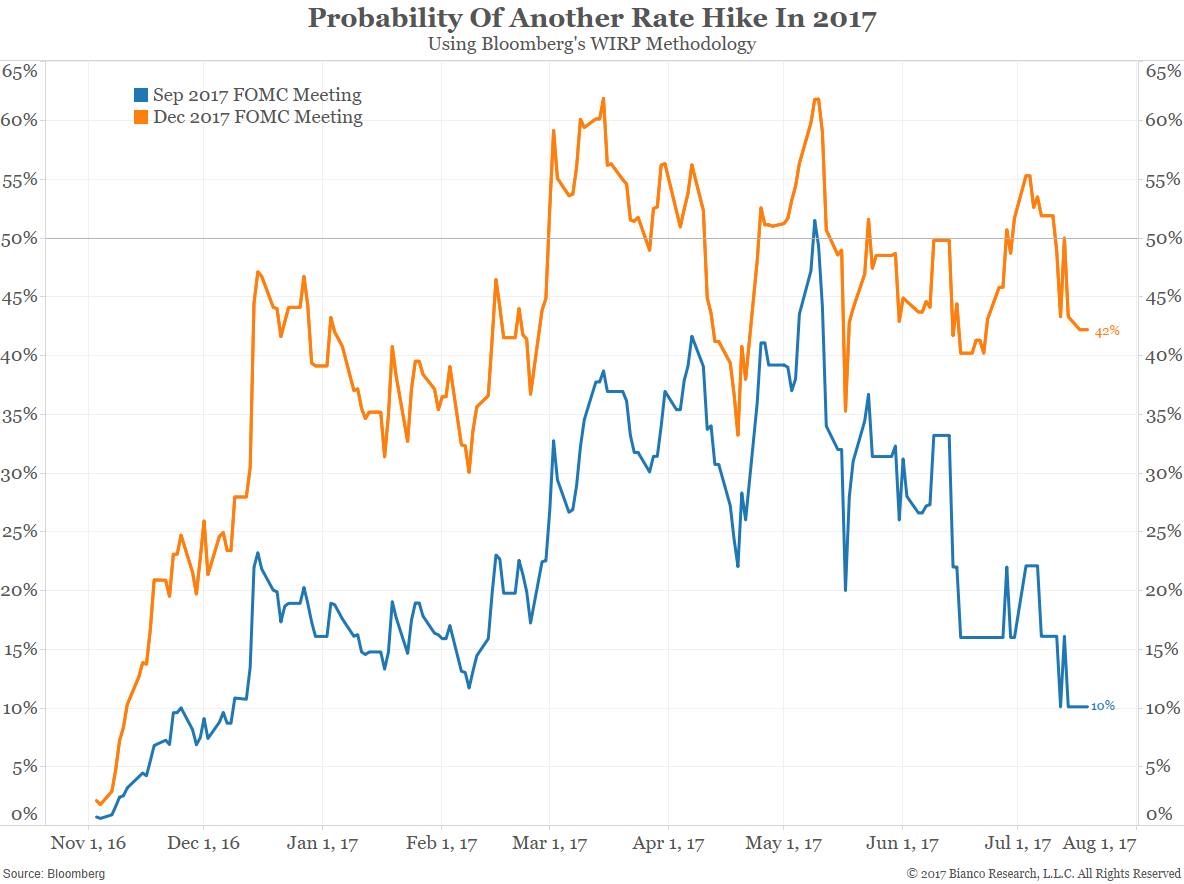

No rate hikes are coming at the July, September or November Fed FOMC meetings. The earliest rate hike might be at the December 13, 2017 FOMC meeting, but even that has a less than 50% probability as of today. I’ll update those probabilities using my proprietary models in the weeks and months ahead. The white flag of surrender came in two public comments by two of the only four FOMC members whose opinions really count. The four voting members of the FOMC worth listening to are Janet Yellen, Stan Fischer, Bill Dudley and Lael Brainard.

Summary

Comment

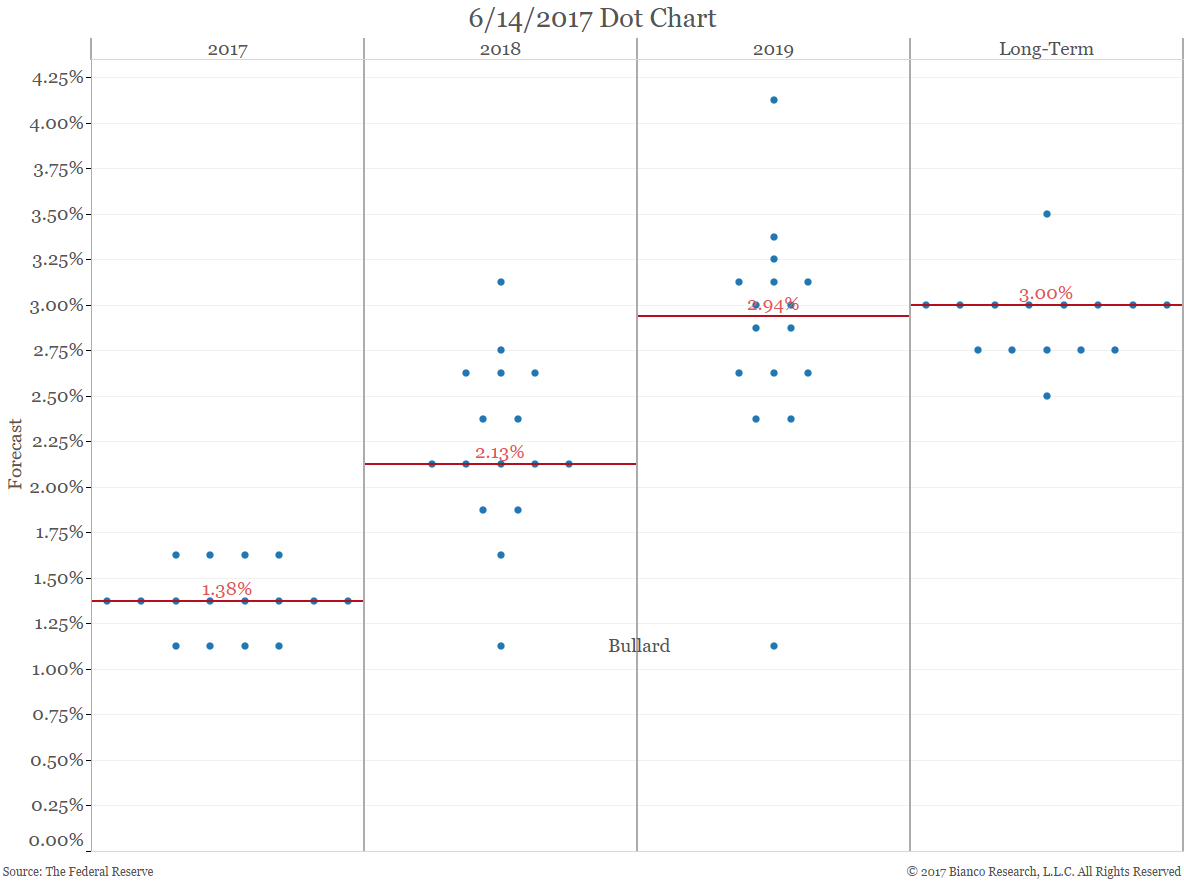

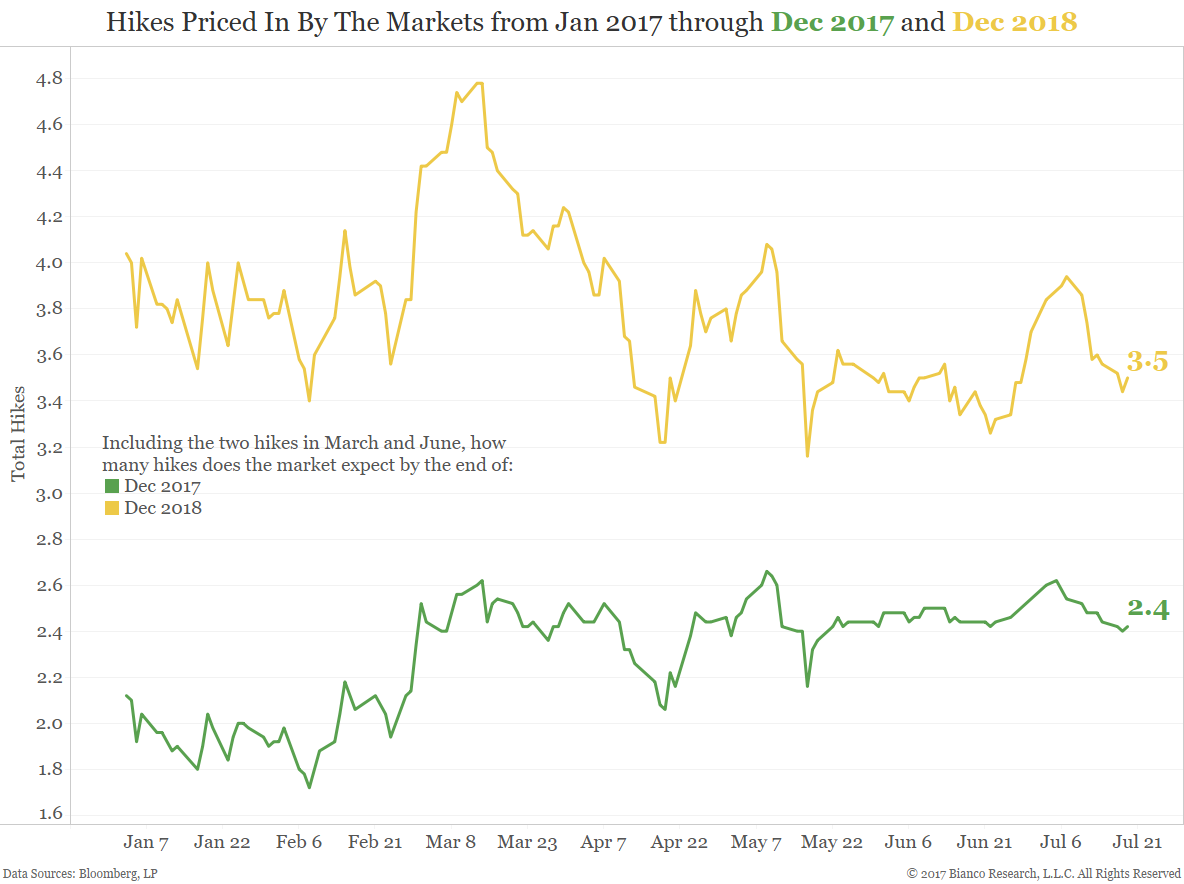

Expressed another way, the market has 0.4 more hikes priced in for this year while the Fed expects one more hike. By the end of 2018, the market expects 1.5 more hikes while the Fed expects a total of four.