- Wall Street Journal – Bank Earnings Are Coming: Five Things to Watch

Calm markets, the Fed and lighter lending are among the factors seen influencing second-quarter results

The Federal Reserve’s decision to raise short-term interest rates in June, the fourth rate increase since December 2015, should boost banks’ lending income. The rates banks charge on credit cards, home equity lines of credit and other types of loans vary depending on the Fed’s target. Those higher yields will help push net-interest income at the median big U.S. bank up by 6.2% in the second quarter, according to analysts at RBC Capital Markets.

U.S. Banking Sector Lagging Despite Steeper Curve

Newsclips — July 13, 2017

Wall Street Journal – Bank Earnings Are Coming: Five Things to Watch Calm markets, the Fed and lighter lending are among the factors seen influencing second-quarter results The Federal Reserve’s decision to raise short-term interest rates in June, the fourth rate increase since December 2015, should boost banks’ lending income. The rates banks charge on credit… Continue reading U.S. Banking Sector Lagging Despite Steeper Curve

Summary

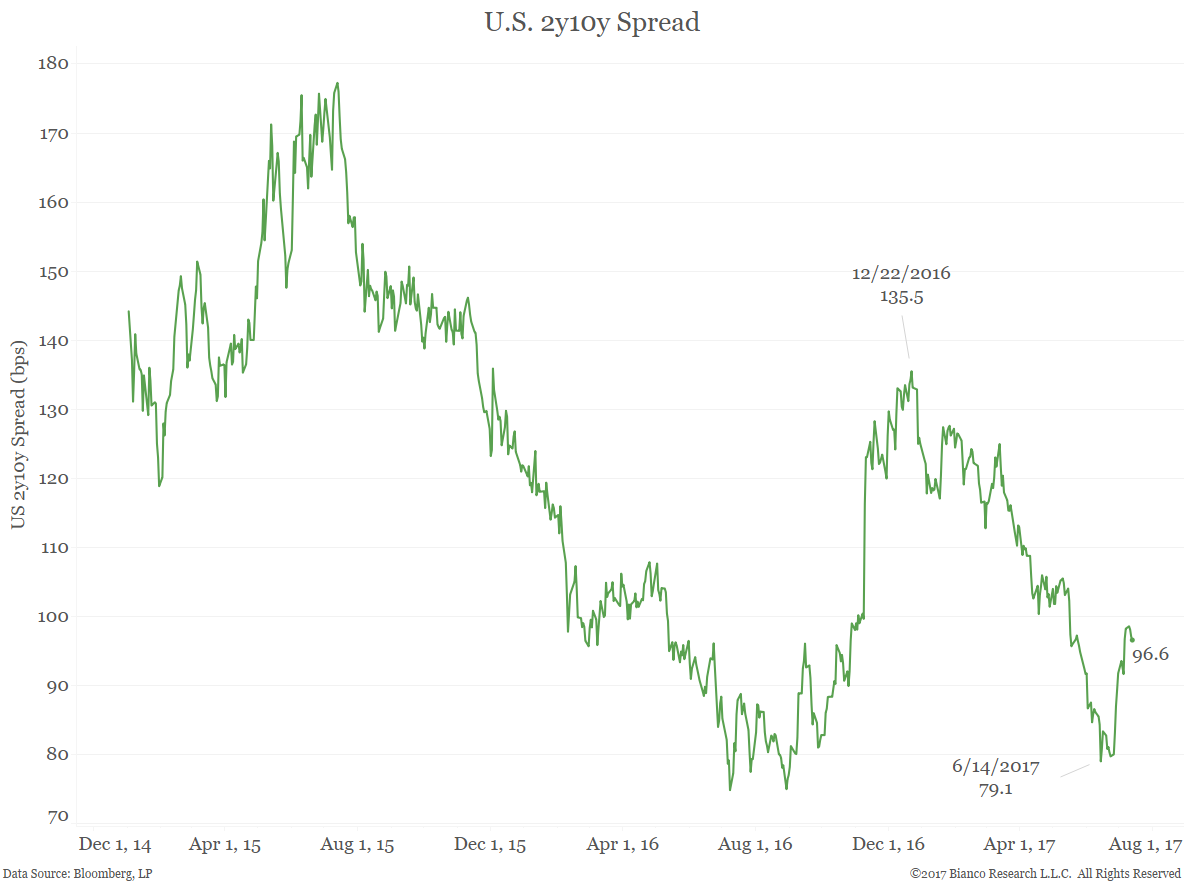

Recent steepening in the U.S. Treasury curve offers a brighter outlook for financials and especially regional banks, yet regional banks have lagged despite heavy inflows into the sector. Further steepening in the treasury curve could see regional banks outperform.

Comment

As the chart in the health care block above shows, despite strong inflows in July, financials continue to underperform at only +5.2% for the year. We noted through the second quarter that U.S. bank equities looked vulnerable to further flattening in the Treasury curve. Interest rates were already well below forecasts and expectations for net interest margins were still tied to a steeper curve. Bank investors were granted some relief as the Treasury curve steepened over the past month. The chart above shows the U.S. 2y10y spread has steepened almost 20 bps since June 14.

It appears that regional bank investors may now be too pessimistic about the outlook for net interest margins. The next chart shows 20 day change in the U.S. 2y10y spread (x axis) and U.S. regional bank total returns (y axis). The latest point is marked. Bank total returns are flat over the past 20 days even as the 2y10y steepened 17 bps. But past steepening moves greater than this have been heavily skewed toward stronger total returns for regional bank equities.

Conclusion

ETF investors are flooding into financials despite continued under-performance. One potential headwind for the banking sector specifically has diminished as the Treasury curve steepened in the past month. Now regional bank investors appear wary of accepting the brighter outlook for profitability. We expect net interest margins to be in focus during earnings. Regional banks could be poised to outperform in the near term if the curve continues to steepen.