The Wall Street Journal – ‘Buy the Dip’ Is Becoming a Pavlovian Reflex Mr. Chan notes that five standard-deviation stock declines are happening more often. There have been three such declines in U.S. stock market in less than a year, a frequency nearly 20 times higher than the long-term average. One struck following the “Brexit”… Continue reading How ‘Buy-The-Dip’ Became A Learned Response Function

- The Wall Street Journal – ‘Buy the Dip’ Is Becoming a Pavlovian Reflex

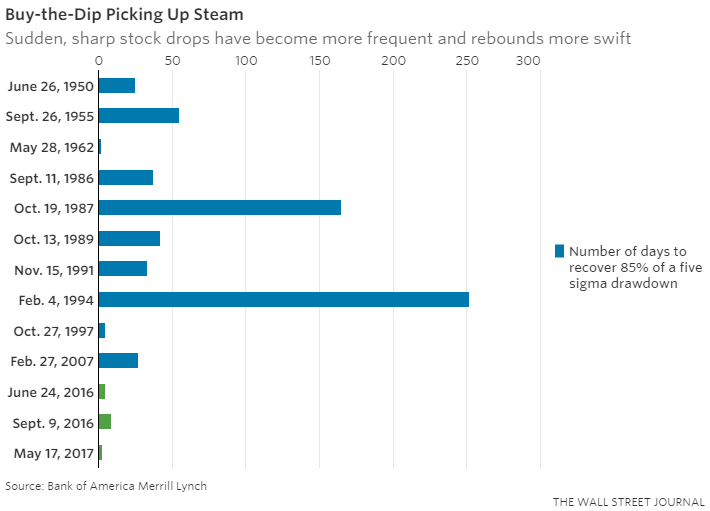

Mr. Chan notes that five standard-deviation stock declines are happening more often. There have been three such declines in U.S. stock market in less than a year, a frequency nearly 20 times higher than the long-term average. One struck following the “Brexit” vote last June and the other hit on Sept. 9. Here’s the buy-the-dip aspect: Not only are stocks abruptly falling, they rebound with atypical haste. The S&P 500 recouped the bulk of its 5.3% two-day post-Brexit decline in five days; it took nine trading sessions after September’s 2.5% one-session drop. In only three days, S&P 500 recovered nearly all of last week’s 1.8% drop, the second-fastest rebound following a five standard-deviation drop on record, according to Mr. Chan. “Market shocks have come to be viewed by investors as alpha opportunities rather than marking the onset of rising uncertainty,” Mr. Chan wrote. “Initially, a clearly visible and high strike Fed put taught the market to ’buy the dip’; now, however, this behavior has simply become a learned response function.”