- The Wall Street Journal – U.S. Stocks End Month Higher, Buoyed by Earnings

The S&P 500 is within about half a percentage point of all-time highs and ends the week up 1.5%

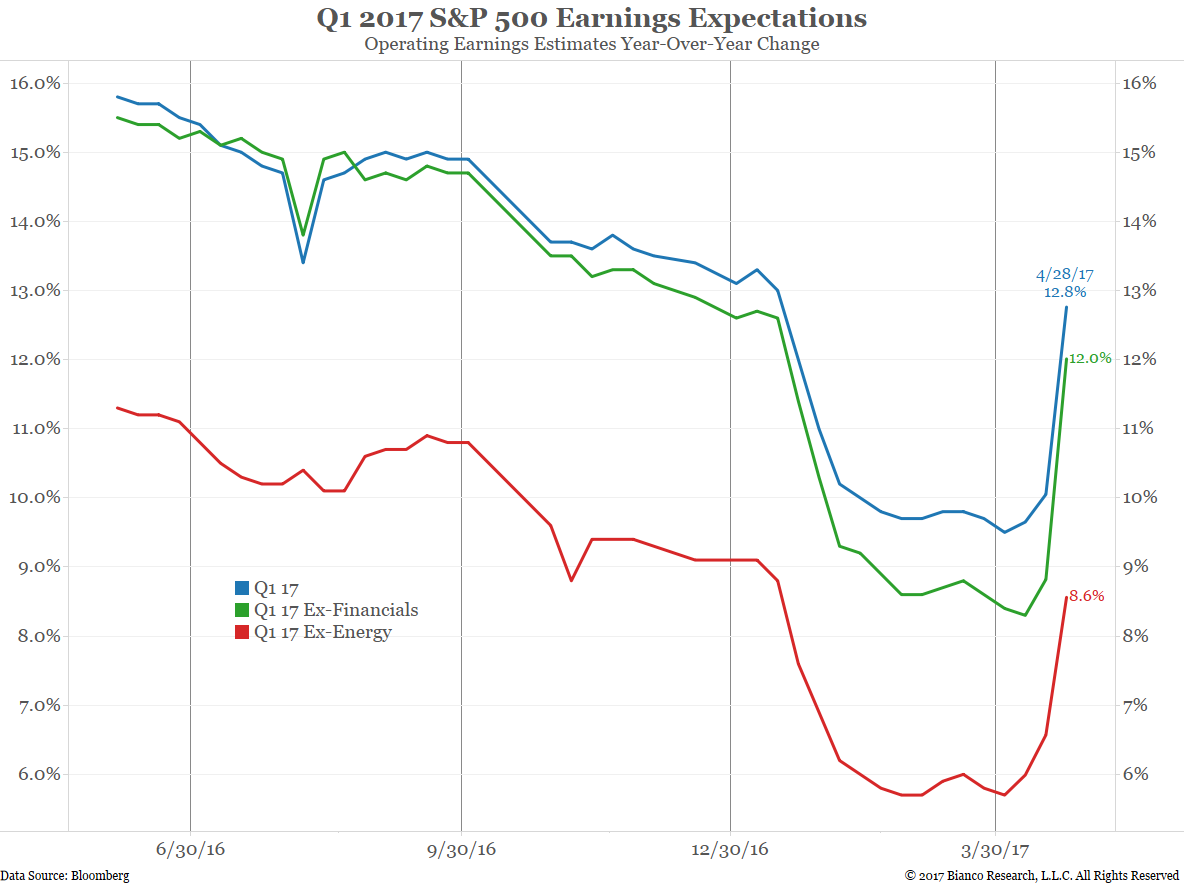

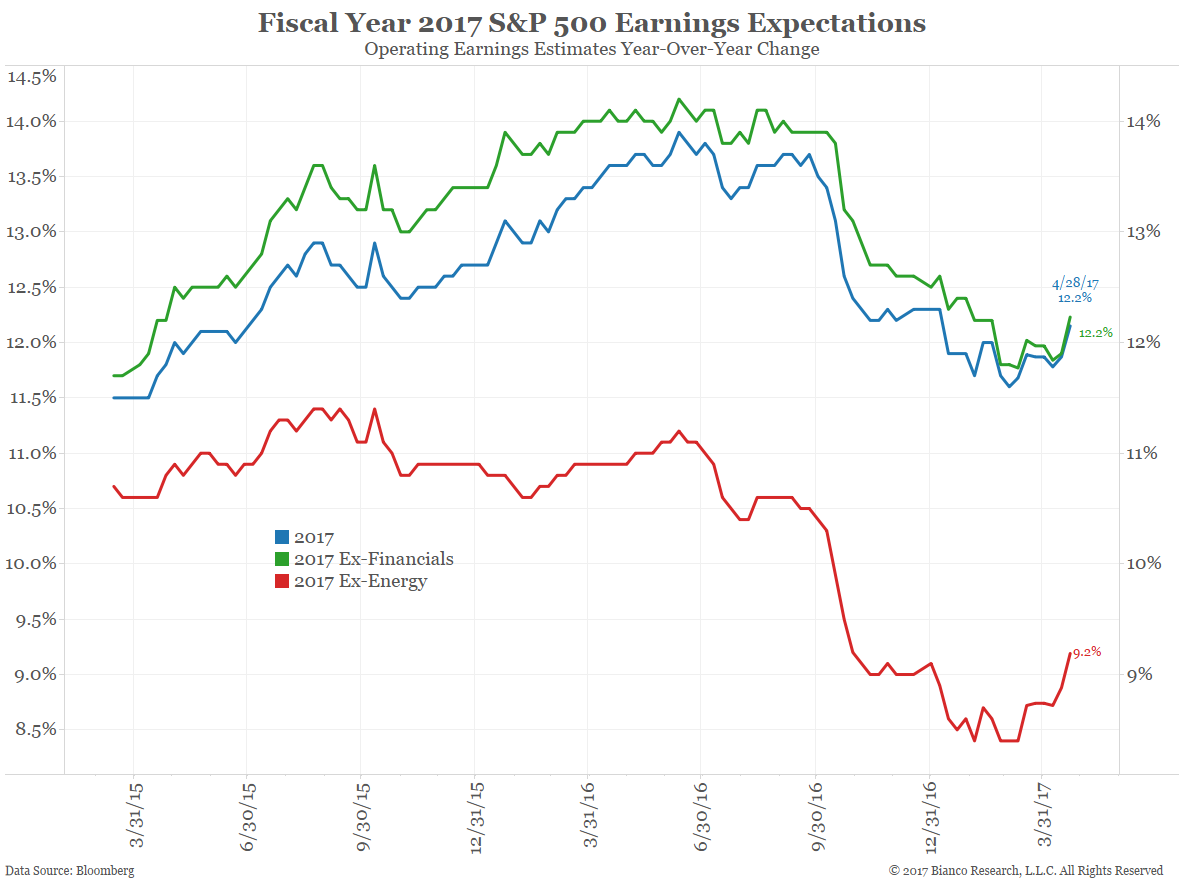

U.S. stocks ended the month higher, boosted by strong corporate earnings. The S&P 500 now sits about half a percentage point from all-time highs. With nearly 60% of the companies in the S&P 500 having reported, first-quarter earnings are on track to rise 12.5% from the year prior, according to FactSet. That’s above the first-quarter earnings growth of 9.1% that analysts estimated as of March 31.

Comment

Conclusion

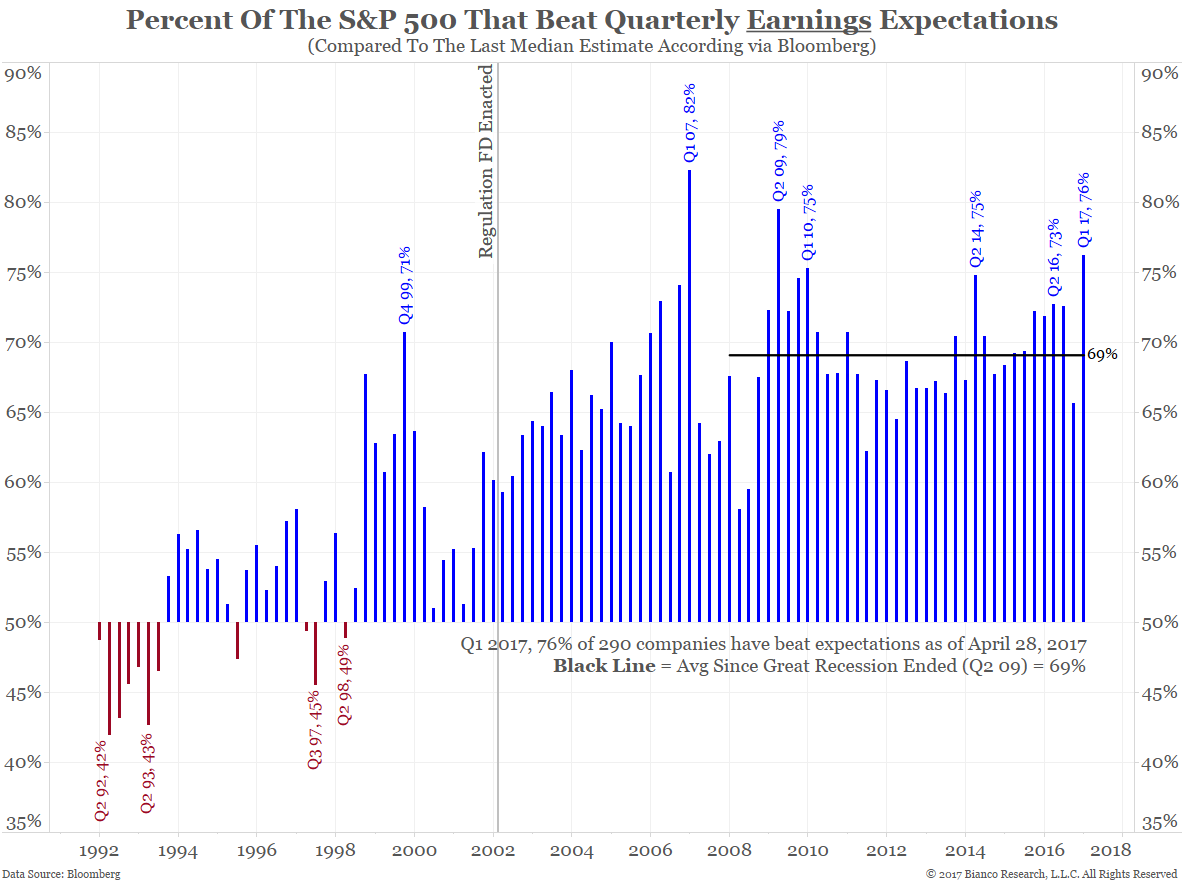

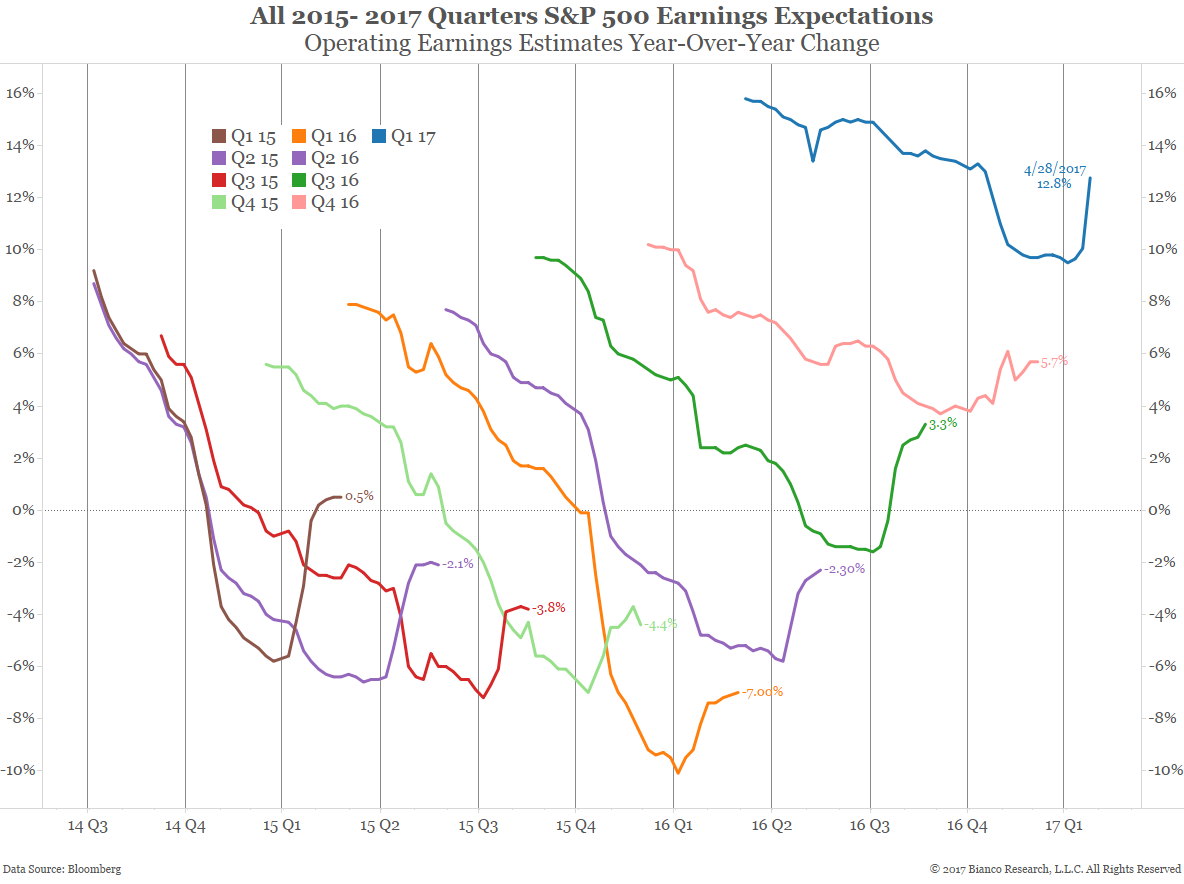

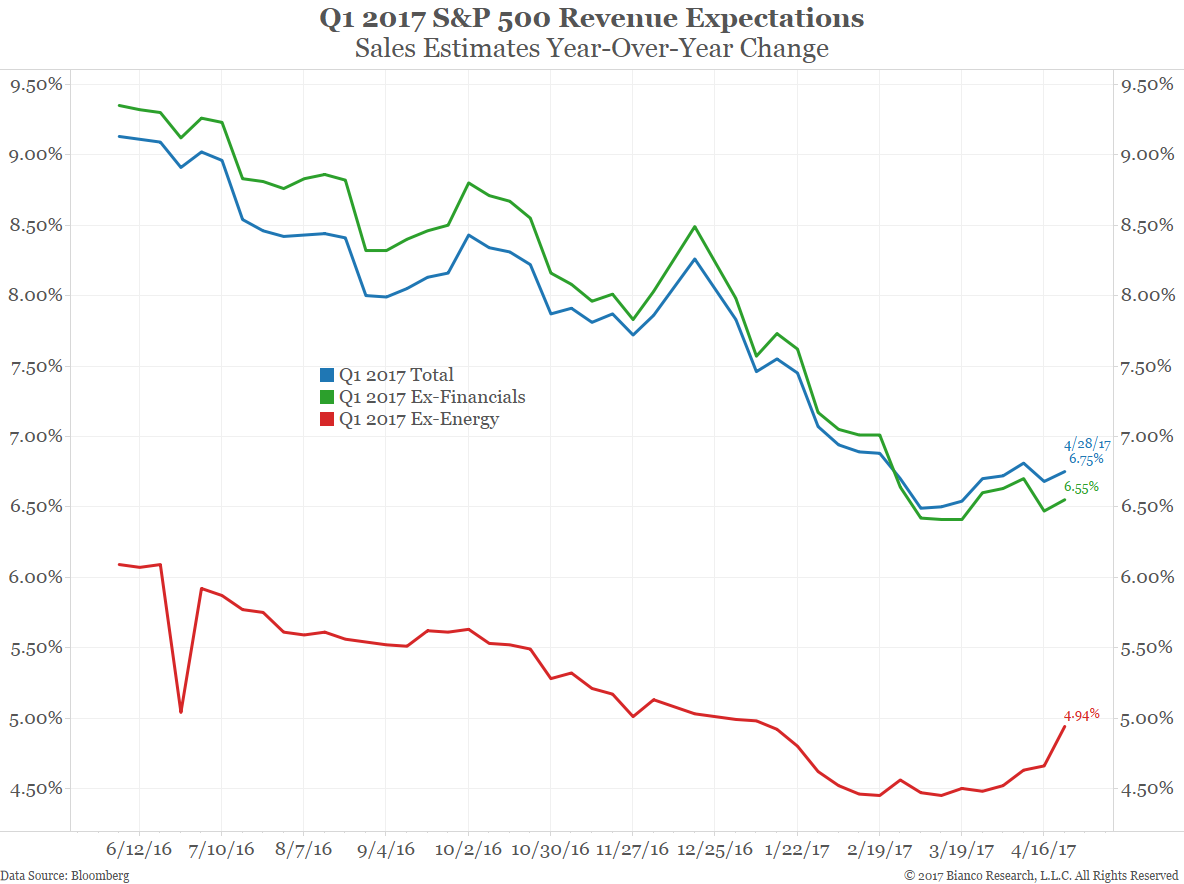

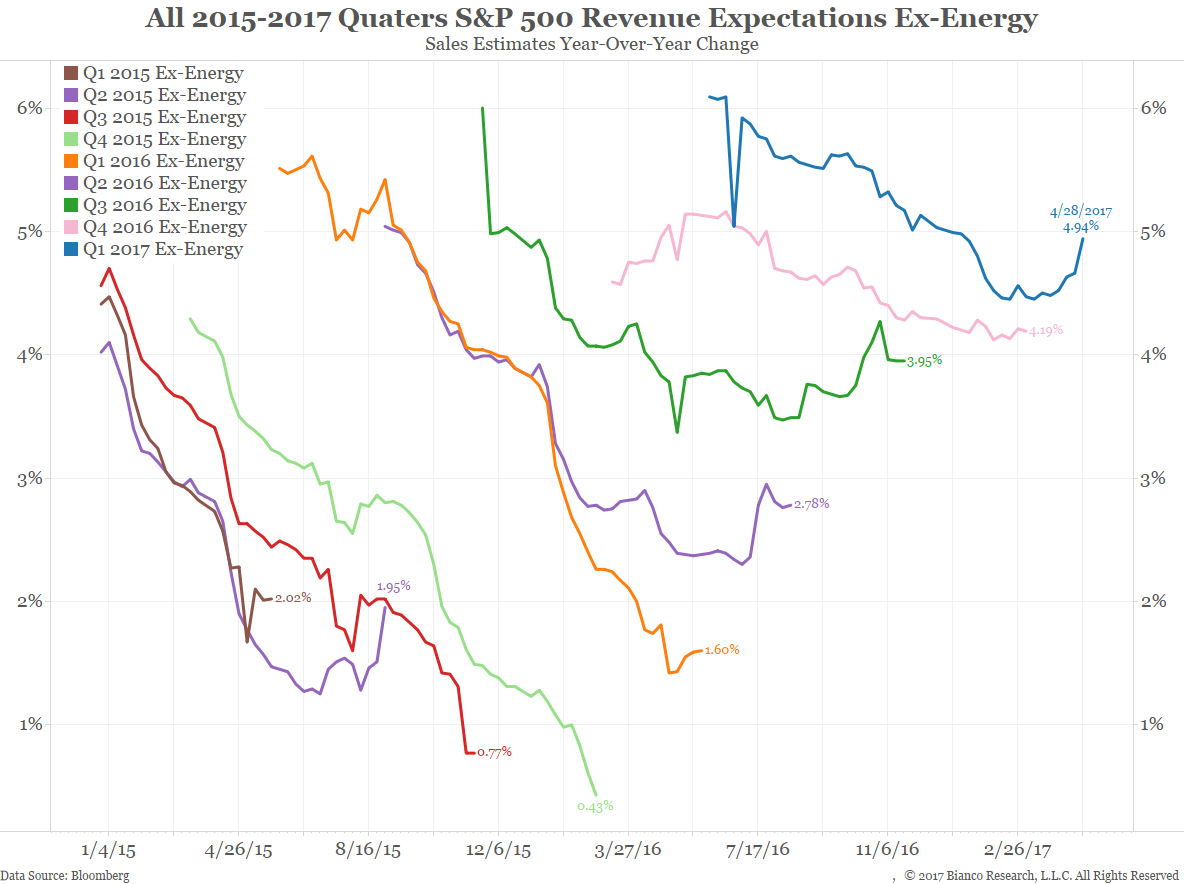

Since 2015 we have been unimpressed with earnings results. They have not been disastrous, but they have consistently underwhelmed. As late as last week we noted earnings were getting better but also expressed skepticism as ex-energy results had stalled out.

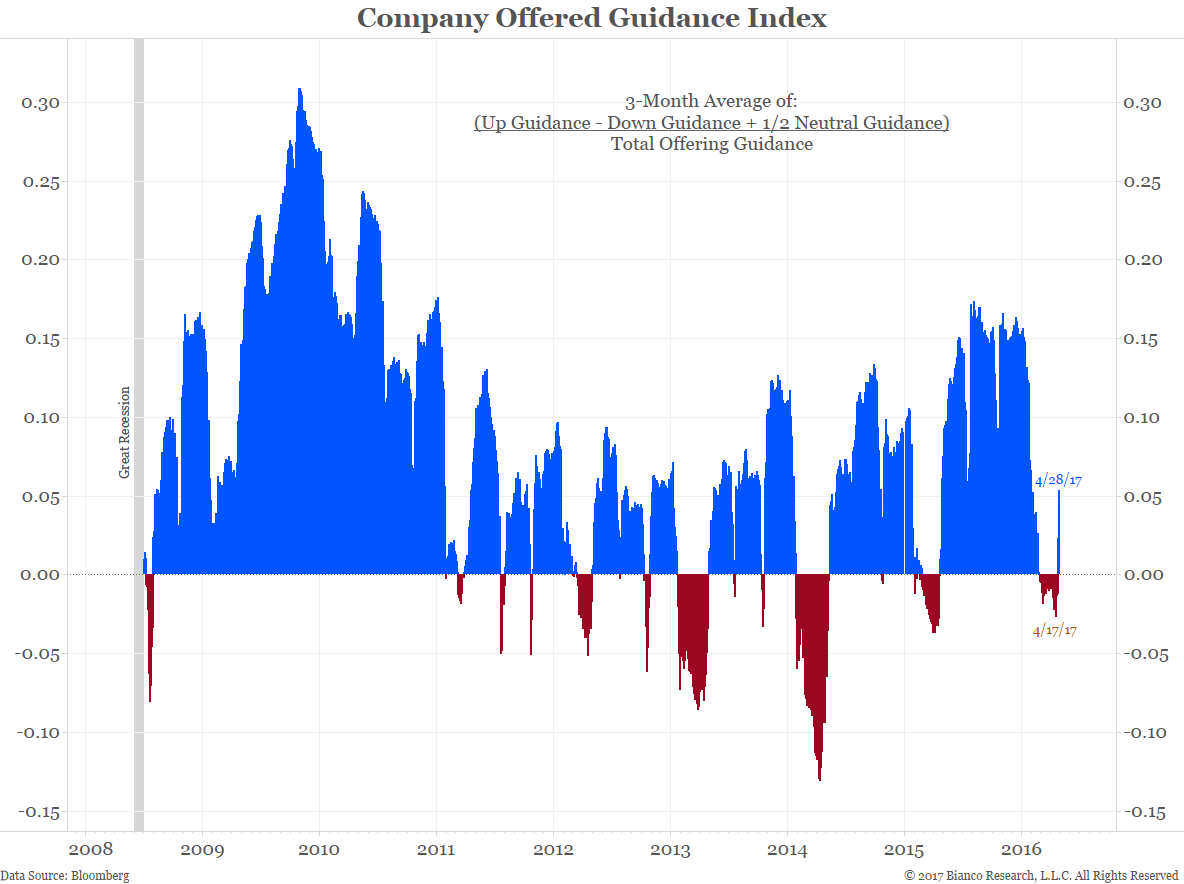

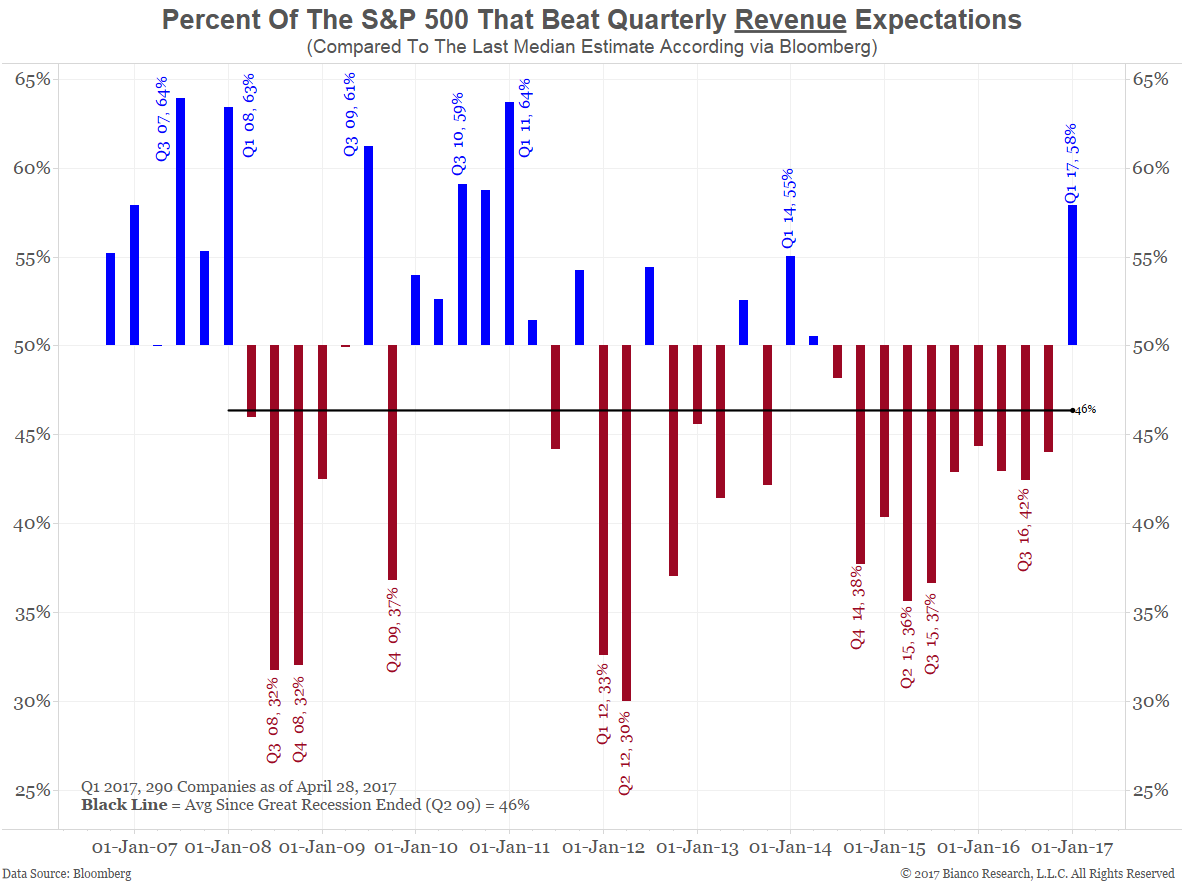

This past week alone 195 companies reported results and they were nearly universally positive. Whether measured by earnings, revenues or guidance, companies came in positive.

210 companies are left to report Q1 results. Historically the longer a company waits to report results, the worse their earnings usually are. Good news is rushed out early in earnings season while companies usually sit on poor results. Even considering this trend, however, Q1 2017 results are on track to be one of the best in many years.