Forecasts for PCE core YoY inflation rising over the next 12 months are 97%. Upside growth in excess of 50 bps stand at 70% using realized economic growth through March 2017. All in all, we are very likely in a rising inflation cycle.

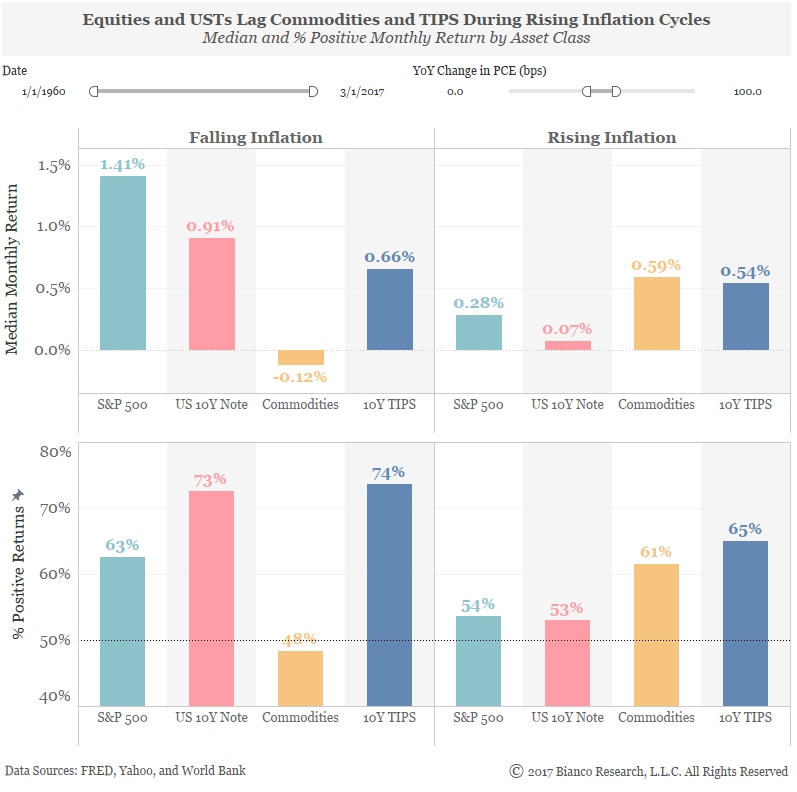

The chart below shows median monthly returns and percentage positive for the S&P 500, U.S. 10-year note, commodities, and U.S. 10-year TIPS for rising and falling inflation cycles. Not surprisingly, TIPS and commodities are star performers during rising inflation cycles.

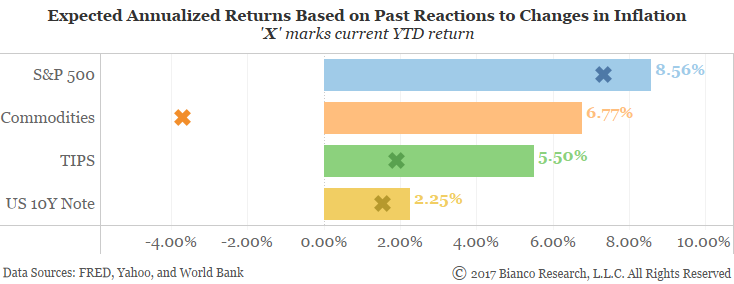

Total return expectations for 2017 are offered below by multiplying the probability of various YoY core PCE inflation changes versus accompanying historical returns by each asset class.

According to this measure, the S&P 500 and U.S. 10-year note are already near expected returns for 2017. Conversely, commodities and TIPS show further return potential, reaching 6.77% and 5.50%, respectively.

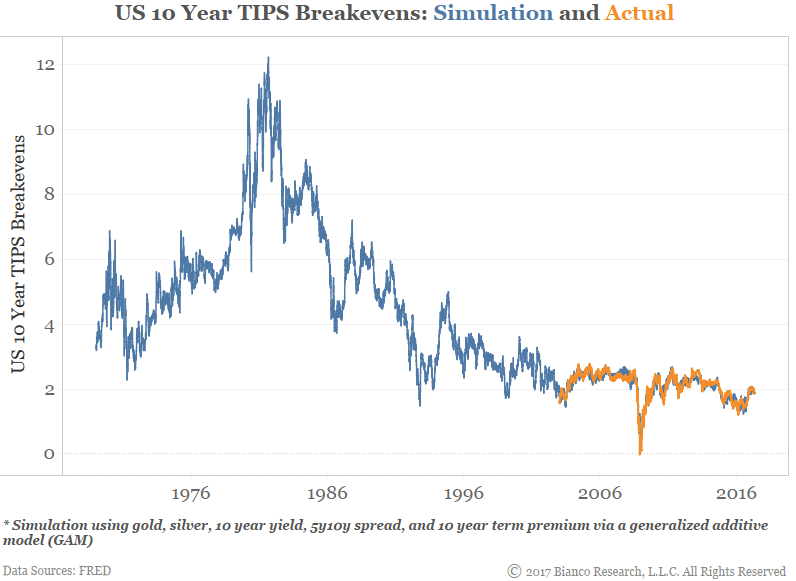

A continued rise in inflation will likely produce greater volatility in nominal and real Treasury interest rates. The chart below offers perspective on movement of U.S. 10-year TIPS breakevens back to 1969. We simulate breakevens using gold, silver, 10-year yields, the 5y10y spread, and 10-year term premiums.