- The Wall Street Journal – This Is a Dangerous Time to Own Emerging Markets

Some worry a recent buying spree has resulted in lofty valuations as geopolitical tensions rise

A crack is forming in the emerging-market resurgence. Almost $60 billion went into assets of developing economies during the first months of 2017, helping emerging-market stocks and currencies enjoy their best quarter in two years. Now, worries are setting in that the buying spree has resulted in lofty valuations as geopolitical tensions escalate. Yield-seeking portfolio managers, who made widespread purchases, could be just as indiscriminate when it comes to selling, market watchers say. And downturns could be long lasting: the MSCI Emerging Market Index fell three years straight before notching a gain in 2016. - The Wall Street Journal – ETFs Show Limits in World of Emerging-Market Bonds

Debt issued by governments and companies in emerging economies can be harder to buy and sell, while higher transaction costs have resulted in tracking errors

Exchange-traded funds have jolted stock picking with their low costs and strong performance. But in emerging-market debt, they are facing greater competition from active investors. ETFs, baskets of assets that trade like stocks, have exploded in popularity as a low-cost way to access specific countries or markets. They have become impossible to ignore in the $3.6 trillion emerging-market bond market. Already in 2017, an iShares ETF has attracted more than $2 billion to become the world’s largest fund for developing-nation debt. But in a year when emerging markets are in the spotlight as big winners, underperformance by the ETFs is also raising concerns over whether they are suitable instruments for betting on volatile developing nations.

Comment

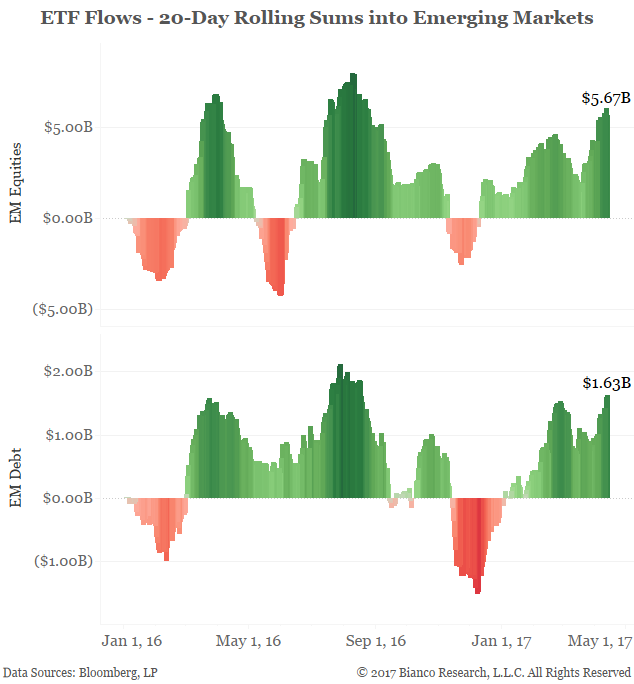

Investors keep piling into emerging markets in search of higher returns. We have previously detailed the phenomenon of opting for higher risk assets during market slumbers (i.e. low volatility). The chart below shows 20-day rolling sums of flows into emerging market equity and debt ETFs.

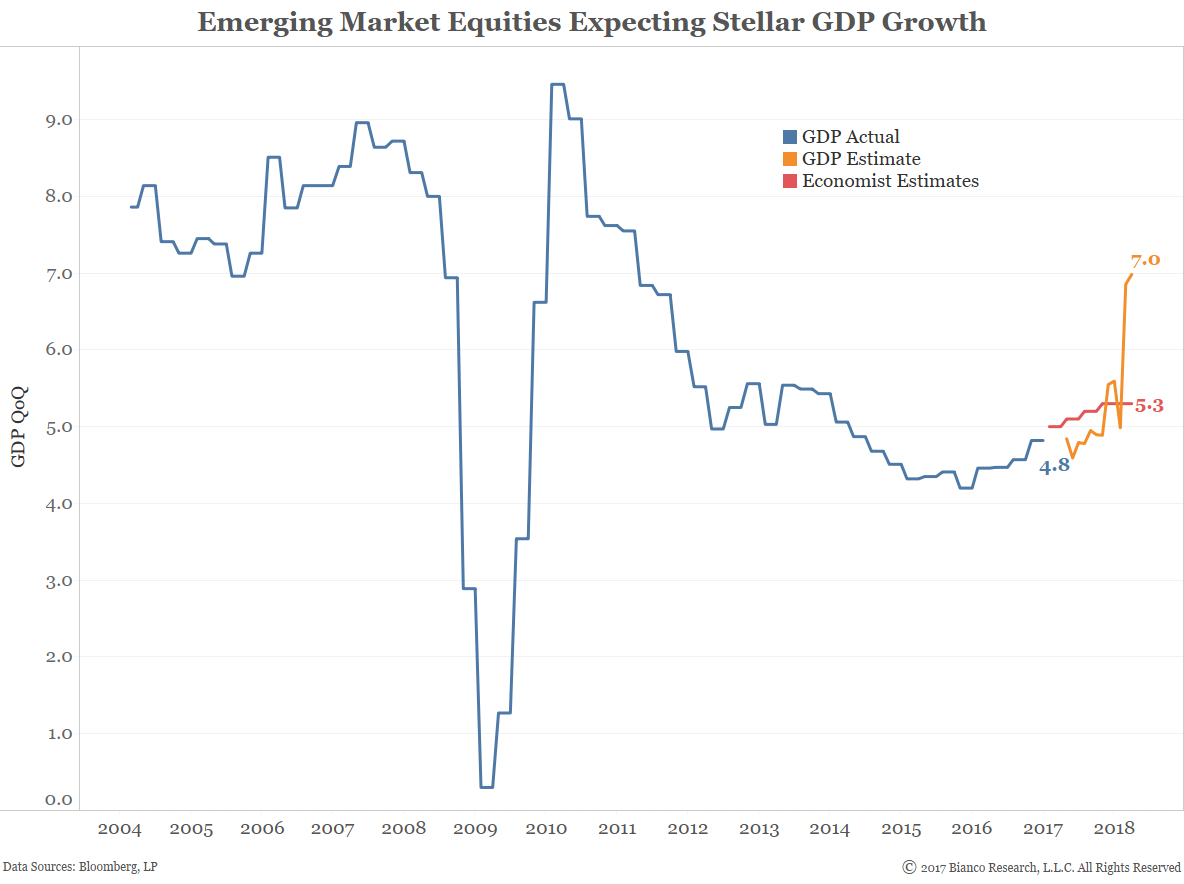

The chart below shows GDP QoQ for emerging market economies (blue line) along with estimates by economists (red line) and emerging market equity returns (orange line).

Emerging market equities are discounting a four-quarter average of GDP growth of approximately 7.0% through early 2018. We feed yearly returns of major emerging market equity indices (e.g. Shanghai Composite, Ibovespa, and Korea Stock Exchange) relative to the MSCI World Index into a model (gradient boosted trees) to produce estimates.

Investors appear all too giddy and hopeful. Can this last?!