- The Financial Times – Diverging US economic data raise questions over ‘Trump bump’

Gap between hard numbers and buoyant mood of companies and consumers is widening

Since his inauguration, Donald Trump has enthusiastically trumpeted surging confidence readings, as well as stock market gains, as evidence that his presidency is yielding quick dividends for the US economy. Yet the gap between buoyant indicators of companies’ and consumers’ mood and hard data such as retail spending has been widening, leading to scepticism among economists about how real the Trump bounce will turn out to be.

Comment

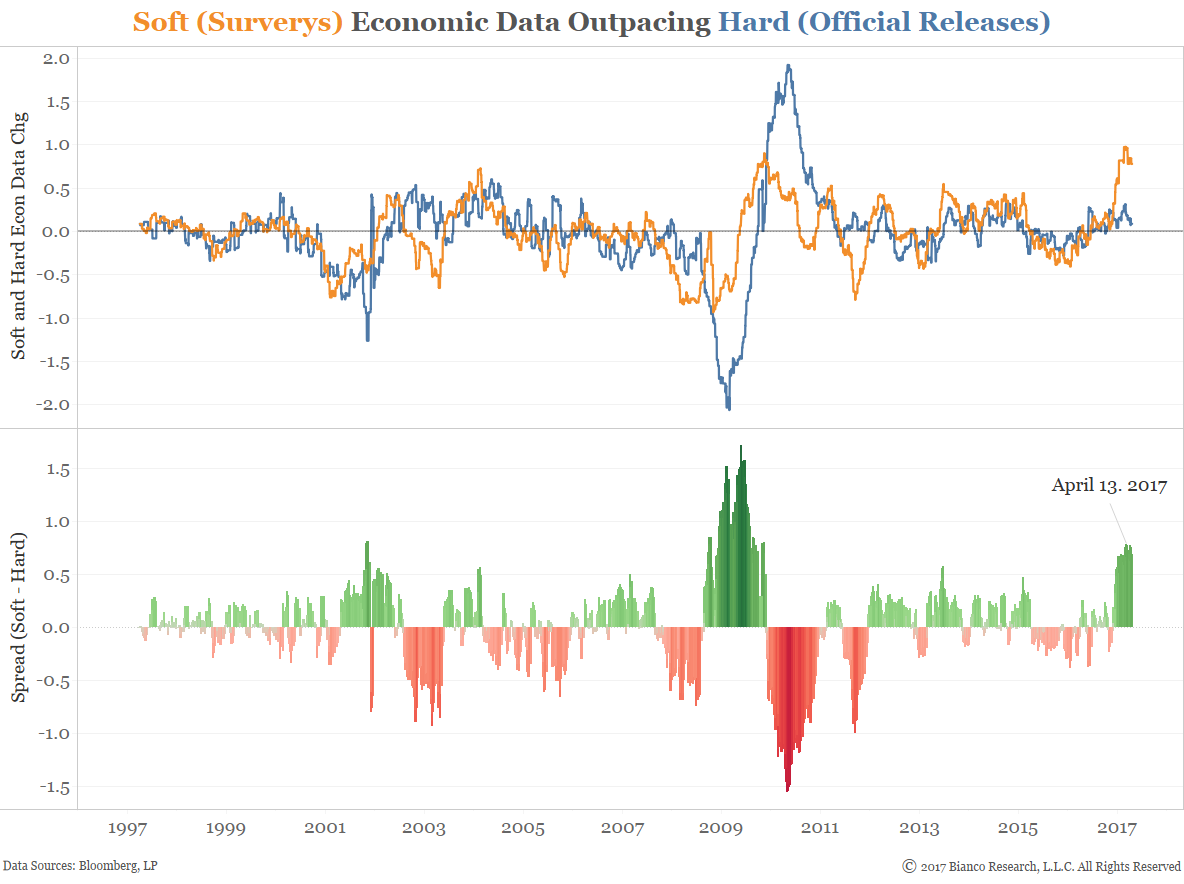

The chart below shows hard (realized) in blue vs soft (surveys) in orange economic data changes. We prefer data changes over surprise indices as they show a stronger connection to market returns.

We have offered a ‘devil’s advocate’ approach to analyzing soft data post-Trump election. Divergences in consumer sentiment between younger vs older cohorts and Republicans vs Democrats are some of the largest on record. Trump’s approval ratings relative to consumer and business sentiment are only comparable to the likes of Johnson during the Vietnam War, Nixon during Watergate, and Bush during the Iraq War.

Markets have begun calling booming sentiment’s bluff. Equity markets have a history of following soft and not hard data, which explains their 10+% return post-election through early March 2017. Historically, U.S. Treasuries (and TIPS) have outperformed following excessive outperformance of soft over hard data.

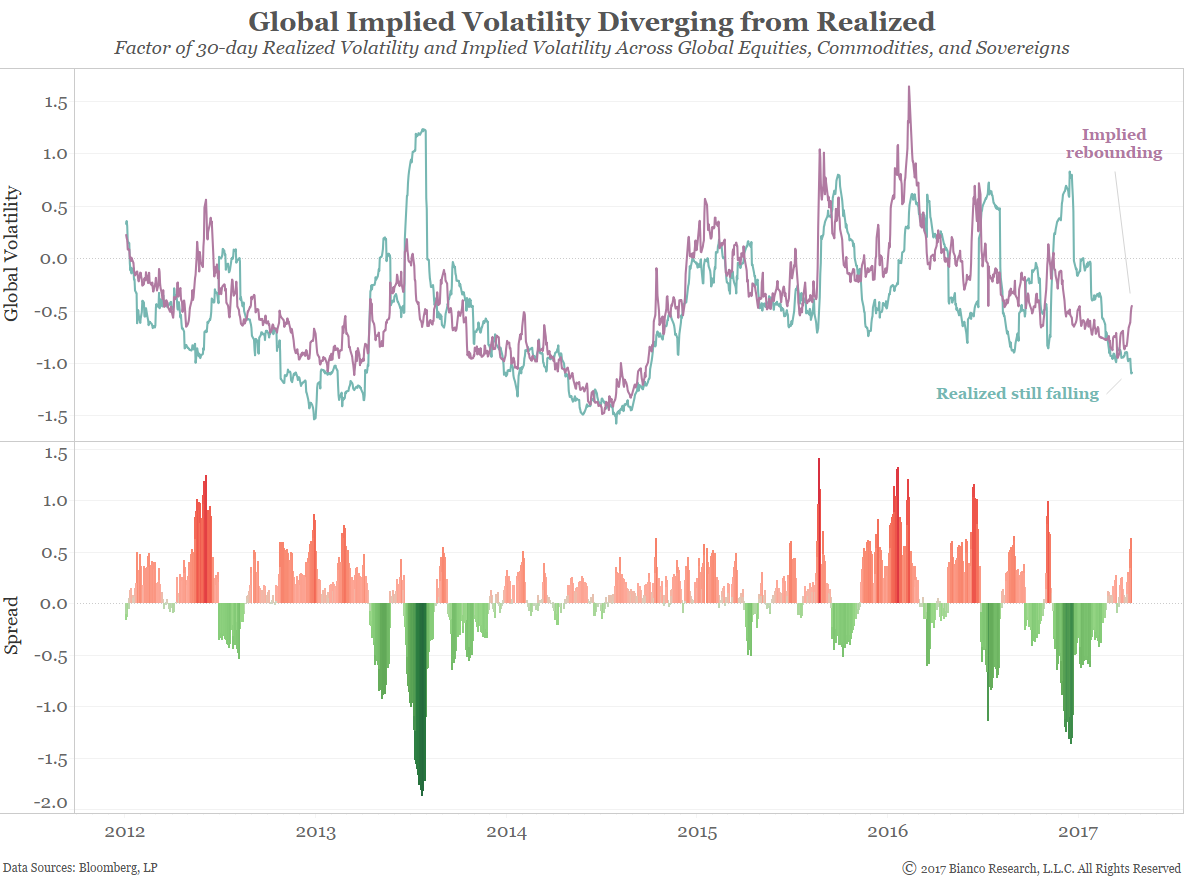

The chart below shows indices for global implied (purple) and realized (blue) volatility across global equities, commodities, and sovereigns. Their spread is shown in the bottom panel.

Options traders are taking notice with implied volatility rebounding while realized volatility sinks to its lowest since October 2014. Similar divergences in the past have been followed by a rise in realized volatility. Again, this development favors safety over risk assets.