- Bloomberg Business – Bond Traders Stare Down Short Squeeze as Yields Test Key Levels

Bond bears beware — the risk is building that Treasury yields go even lower. With yields across maturities reaching the lowest levels since November, and in some cases breaching key technical marks, traders are abandoning bets on higher interest rates. Hedge funds and other large speculators reduced net short positions in five-year note futures by about 86,000 contracts in the week through April 11, though more than double that amount of net shorts remain, the latest Commodity Futures Trading Commission data show.

Comment

As we have argued many times before, the constant bearishness in the bond market (higher yields) is actually helping keep yields low. Yields cannot rise in any meaningful way with this level of pessimism.

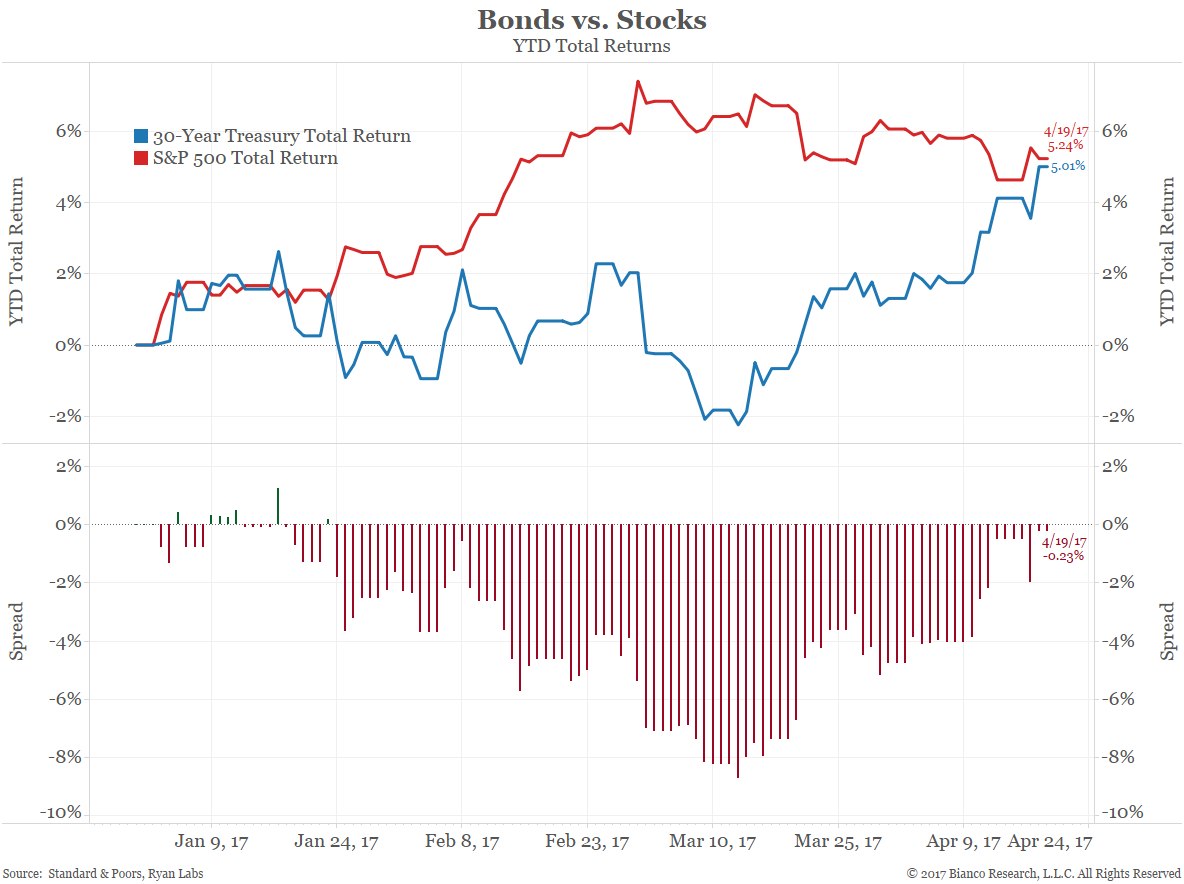

As the chart below shows, the 30-year Treasury’s year-to-date total return has essentially pulled even with the S&P 500.

Bonds continue to defy the consensus because the consensus is too bearish.