- Of Dollars And Data (Blog) – The Fees Are Too Damn High: How Active Funds Have Cost Investors Over $250 Billion

You read that right: The fees are too damn high and they have cost investors over $250 billion since the year 2000. I am talking about fees charged by actively managed mutual funds in comparison to their passive fund counterparts…The idea to test this is simple: Look at the amount of additional fees that active funds charge as compared to index funds/ETFs and multiply this by the amount of money that could have been in index funds/ETFs over this time period. From the year 2000 to 2015 you can see that active equity funds have charged between 70-80 basis points more than equity index funds/ETFs…the total overcharge by active funds (70-80 basis points * amount of capital in active funds that could be in passive funds) from 2000-2015 is roughly $280 billion.

Comment

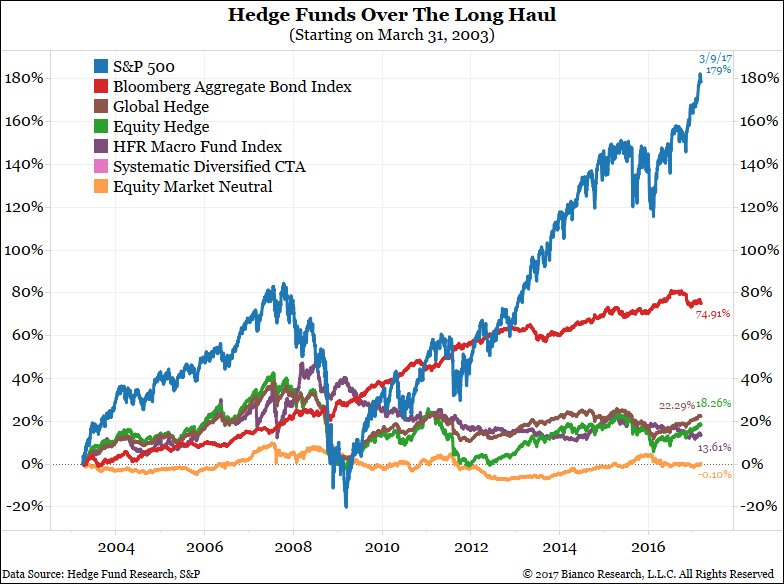

While this figure is eye-opening, it does not even take into account the difference in actual returns between active managers and passive funds. The chart below shows stocks outperformed the closest active management group by over 156% since March 31, 2003 (as far back as this data goes).