- The Wall Street Journal – Surprise: Earnings Actually Drive Stocks

One of the reasons behind the market’s big rally is a surprisingly good earnings season

U.S. stocks have been on an absolute tear. Among the reasons: a surprisingly good earnings season. Lost in the speculation about the Trump administration’s expected business-friendly policies were better-than-expected corporate earnings. With most S&P 500 companies having posted results for the final three months of 2016, it is confirmed that the biggest U.S. companies have started a new growth streak. More good news is expected in coming quarters, too. Fourth-quarter earnings are expected to log an increase of 4.6% from the same period a year ago, according to FactSet. That would mark the second consecutive quarter of year-over-year growth. And it would put the prior earnings recession of five consecutive quarterly contractions further in the rearview mirror. The last time the market had back-to-back quarters of earnings growth was in the fourth quarter of 2014 and the first quarter of 2015.

Comment

Is the pattern above unusual? The next two charts, from Yardeni Research, show that the pattern mentioned above has been the norm since 1979. Initial forecasts only proved to be too low in the years during or shortly after recessions when analysts were overly pessimistic about the long-term future. Since this would not apply to 2017 forecasts, we would be surprised if earnings actually remained as high as the initial forecasts.

The story above argues that the stock market is being powered higher by optimistic earnings forecasts.

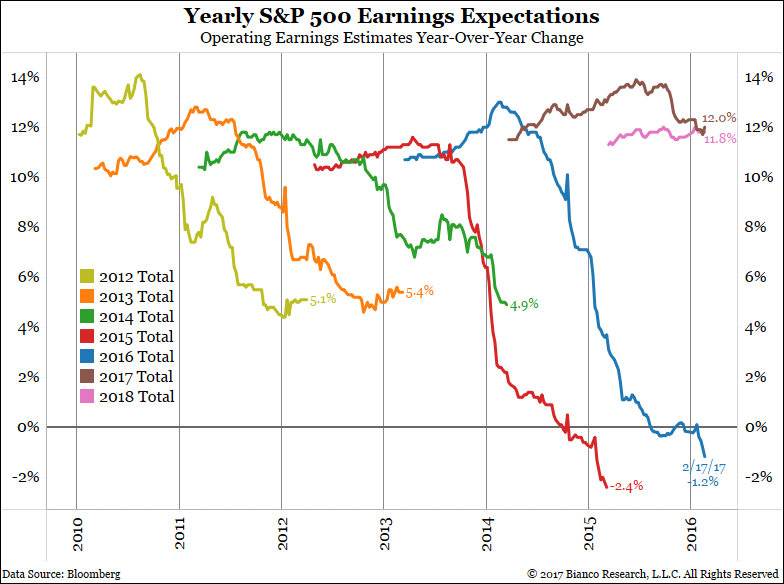

The chart below shows the forecasts for S&P 500 operating earnings based on a Bloomberg survey of Wall Street analysts. It is a “blended chart.” The various yearly lines start as forecasts of earnings for the 500 companies. As companies start reporting fiscal year numbers, the forecasts are replaced with actual results.

Note that all these estimates start around 12% growth. Then, as the reporting season approaches, the forecasts are cut and the final results come in far lower. So while the 2017 (brown) and 2018 (pink) forecasts are calling for 12% year-over-year growth, the results will probably be far lower than this.