- The Wall Street Journal – Fed’s Williams Sees 2015 Interest Rate Rise as ‘Appropriate’

John Williams, president of the Federal Reserve Bank of San Francisco, said in a speech Saturday he believes it is still appropriate to raise short-term interest rates before year-end, reiterating a timeline that remains the preference of a majority of Fed officials. In a speech in Armonk, N.Y., at a symposium on China and the financial system, Mr. Williams said there are “arguments on the side of the ledger arguing for more patience.” But he said, “Given the progress we’ve made and continue to make on our goals, I view the next appropriate step as gradually raising interest rates, most likely starting sometime later this year.” His comments are significant because they typically reflect the center of Fed officials’ thinking on interest-rate policy. They come only two days after the Fed decided not to raise rates at its September policy meeting this week. - The Wall Street Journal – St. Louis Fed’s Bullard Argued Against FOMC Decision at Fed Meeting

Federal Reserve Bank of St. Louis President James Bullard said Saturday he argued against holding rates steady during the Fed’s policy meeting last week because he believes the economy has recovered enough to begin raising rates. “I would have dissented,” he said. “The case for policy normalization is quite strong since the committee’s objectives have essentially been met.” “Why do the committee’s policy settings remain so far from the normal when the objectives have essentially been met?” Mr. Bullard said. “The committee has not, in my view, provided a satisfactory answer to this question.” Mr. Bullard’s was a minority view at the meeting. Fed officials last week decided to hold off on raising rates, citing risks from economic instability overseas, particularly in China. Officials said they wanted to wait until they had more information about the economic and financial fallout of the global slowdown. Mr. Bullard described the meeting as “pressure packed,” and said the decision to hold rates steady was “a close call.”

Comment

<Click on chart for larger image>

- MarketBeat (WSJ Blog) – Markets Flummoxed by Uncertain Federal Reserve

It’s as if the hand that has spoon-fed the market for seven years has suddenly become shaky. U.S. stocks are dropping sharply, even after the Federal Reserve did what everybody assumed it would, which was to leave rates alone. Nobody was surprised by that. What was surprising was the indecision the bank exhibited in coming to that decision. If the economy is growing, why isn’t the Fed raising rates? If the state of affairs is so parlous, why isn’t the Fed moving in the other direction (negative rates, anybody?) Is the Fed still data dependent? Then whose data is it dependent upon? China’s? In pausing, the Fed opened a whole new can of worms. This has left the markets somewhat flummoxed…It’s a rare and curious moment for the markets. “Don’t fight the Fed” has been more than a guiding mantra, it’s has been a iron-clad law. To key off the old Chuck Prince line, the Fed has been playing the music, and the market has been dancing. Now, the Fed seems completely unsure of what tune to play, and from where it should taking its lead. The Fed has been hinting all year that the recovery was fast approaching the point where the economy could absorb higher rates. Even yesterday, the bank was talking up the economy. But its actions undercut its words. “How are market participants supposed to discount the Fed decision now?” Chris Low, the chief economist at FTN Financial, asked. “When Fischer says there is no value in waiting for another meeting for clarity because there never is more clarity, or Dudley says the Fed looks at financial markets from a long-term perspective and isn’t concerned with levels, should we ignore them?” - The Financial Times – Fed risks dropping the reins on US policy

While the domestic argument for an initial policy rate change remains firm, the Fed acknowledged that global developments centred around China and emerging markets, which had led to market and economic turbulence, had swung opinion back again. But August’s tremors were not isolated or random, and force us to ask how long this stand-off can go on, given that China’s travails, for example, are not going to end any time soon. And what if it did go on?…This begs the question: how long should the Fed cite China or emerging markets as a reason for keeping rates on hold, especially if the domestic case for not doing so becomes even more compelling? Seven years of zero interest rates have already contributed to mounting financial distortions in emerging markets. If the Fed continued with financial market stability as the leitmotif of policymaking, a later but more disruptive policy adjustment and greater instability are the all too likely outcomes. The Fed should start telling markets about the difficult trade-offs it faces. - The Financial Times – Waiting for Yellen

Investors would be forgiven for feeling confused. If the risk of an emerging market shock was the Fed’s main worry in the third quarter, what are the chances it will have receded by the fourth? Presumably they are slim. In which case, is a delay of a few weeks remotely adequate to the risks? Nobody said central banking was easy. But Ms Yellen’s communications have recently been at sixes and sevens. The Fed started off 2015 indicating that it would exit from zero-bound interest rates this year. Initially speculation focused on June. But another winter contraction in the economy pushed that back. Then it needed to be sure the second quarter rebound was real. Expectations were nudged back to September. It concluded the rebound was on track. Joblessness continued to fall at a rate that implied wage inflation was not far off. In between, the China crisis struck along with signs its authorities lacked “deftness” in handling it. Now the timetable has slipped again. By December the US economy may be heading into another quarterly contraction. Moreover, China’s problems, and those of other emerging markets, are likely to take years to work out. Ms Yellen has thus laid a recurring trap for herself. More hawkish officials worry that each time the Fed limbers up for an interest-rate increase, market volatility increases, credit conditions tighten and the Fed feels obliged to postpone.

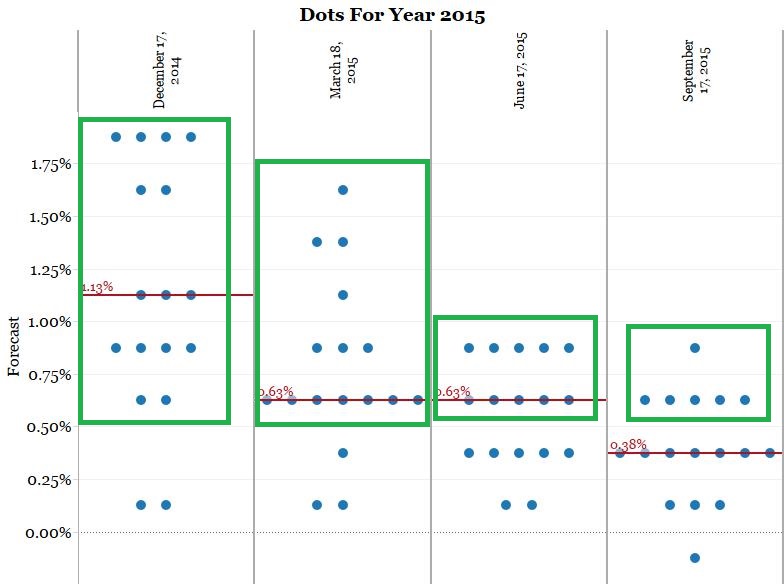

Every quarter the Fed publishes its Summary of Economic Projections. The part that gets the most attention is the so-called dot plot. The chart below shows the year-end 2015 projections from the last four SEP updates. The green rectangle on each update highlights the number of Fed officials expecting at least two hikes this year (0.625% or higher).

FOMC members that fill out these expectations are instructed to tell us what they think the appropriate policy should be at year-end, not what they think it will be. They are also discouraged from gaming the dots by intentionally raising or lowering their projections to offset another member.

In reality, some officials are guilty of gaming the dots or offering a projection based on where he or she thinks rates will be. See the negative dot in the September 17, 2015 update. That is believed to be Minneapolis Fed President Narayana Kocherlakota, who is retiring at the end of the year, making a statement about his fear of deflation.

If we assume Kocherlakota’s projection is the exception rather than the rule, the September 17, 2015 dots show 6 of the 17 members (35%) thought the Fed should have hiked last week (we are assuming no one thinks a 50 basis point hike is realistic). Another 7 dots (41%) would have been “OK” with a hike last week. In other words, 76% of the members either wanted a hike or would not have stood in the way of a hike.

Four members projected a year-end rate of 0.125% or lower.

Of the three 0.125% dots:

So did the Fed hold off on a hike because the committee was not ready to act or because Yellen was not ready to act? We think the 2015 dot plot suggests this had more to do with Yellen’s hesitance than the rest of the committee’s desire to hike.