<Click on graphic for larger image>

- The Wall Street Journal – Investors Shift Bets on Fed Rate Increase

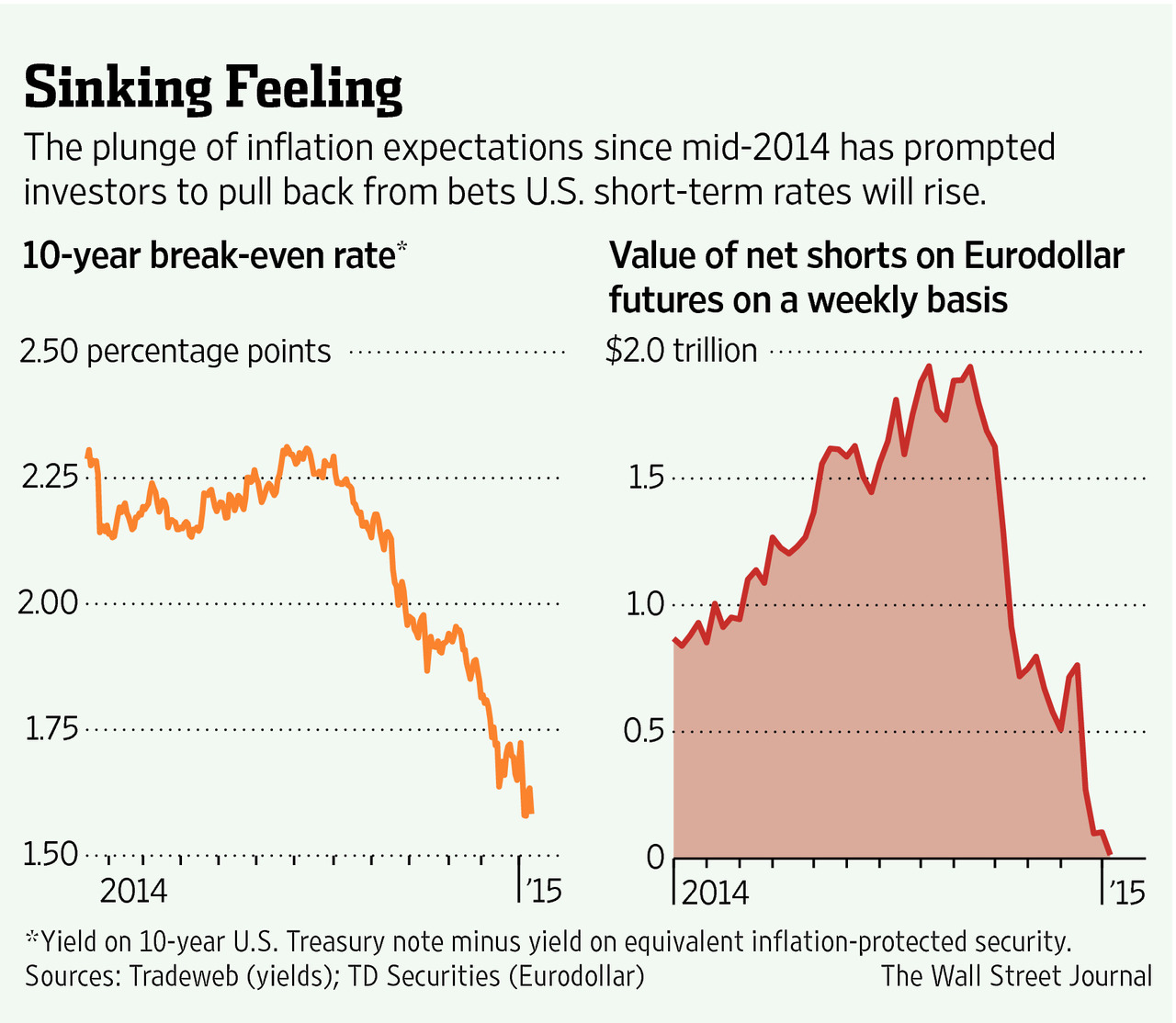

Gauges Indicate More Expect Delay in Increase

A wave of global economic gloom has turned the U.S. money market on its head, with more investors now betting that the Federal Reserve will be forced to delay raising interest rates. Many analysts and traders say officials will be loath to increase interest rates, tightening financial conditions, when the economy is showing signs of softness. Expectations that the Fed will this year raise U.S. short-term rates for the first time since 2006 have driven a sharp rally in the dollar, as investors around the globe purchase U.S. assets in the belief that returns here will rise along with interest rates. But signs of economic softness and tumbling oil prices on Monday again sent riskier assets such as stocks lower, while investors piled into ultrasafe Treasury bonds. The yield on the benchmark 10-year U.S. note fell to 1.909%, the lowest level since May 2013. “The market is telling you that a rate increase from the Fed will come later rather than sooner,” said Mark MacQueen, co-founder and portfolio manager in Austin, Texas, at Sage Advisory Services Ltd., which oversees $11 billion in assets. - The Federal Reserve Bank of Atlanta – Dennis Lockhart: A Potentially Momentous Year for Policy

Inflation readings and forecasts may be pivotal in deciding when to begin adjusting policy. As already explained, we are, at present, experiencing inflationary trends well below target, and our readings are complicated by more-than-normal noise associated with the drop in oil and gasoline prices, falling import prices, and softening of some measures of inflation expectations. It’s quite possible there will be considerable ambiguity in the picture presented by data in the first half of the year. Beyond the noise in inflation numbers, it’s obvious there is simply a lot moving around at this time—oil prices, the dollar, even quarterly growth numbers, in all likelihood. Noisy, jumpy data affect my confidence in the outlook. I’m likely to decide what policy decision to support based on where I think things are headed. When the numbers come in noisy, it’s just harder.

Comment

Jim Bullard also offered his opinion on TIPS last October:

My forecast is for rising inflation. That’s why I’m concerned about declining inflation expectations, the five-year TIPS in particular has declined below one and a half percent. The five-year forward is down from its previous levels. And the central bank has to guard against any expectations in the market that would suggest that the central bank is not going to hit its inflation target.

So everyone agrees the future of monetary policy hinges on changing inflation expectations. Yellen is not sure if TIPS breakevens are a good measure. Bullard and Evans seem to have these measures near the top of their dashboards.

As we wrote last October:

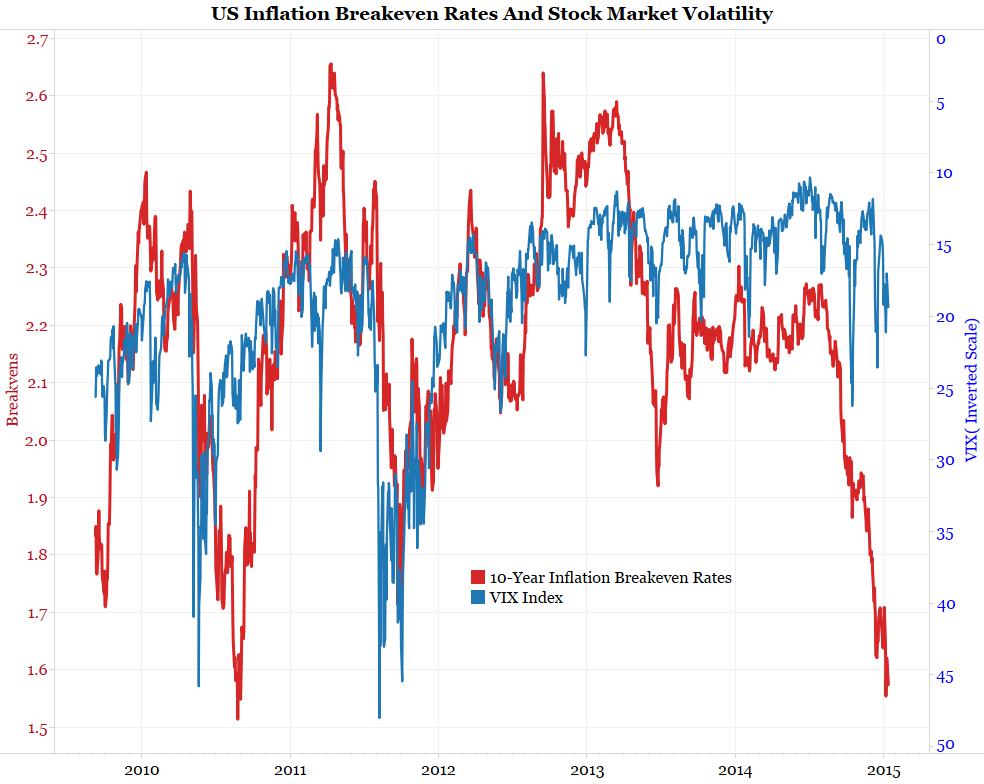

As is often the case during periods of stress, many markets may begin moving in tandem. As the chart below shows, the VIX is highly correlated to the TIPS breakeven rate (and, as we argued earlier this week, the VIX is negatively correlated to stock prices). In other words, citing the 5-year TIPS inflation breakeven rate is a fancy way of saying we need to delay the final taper because the stock market has become volatile.

<Click on chart for larger image>

As we pointed out earlier this year, economists do a better job than the TIPS market in predicting future inflation. TIPS inflation breakeven rates are affected by factors such as the yield curve, volatility and nominal rates. These are not necessarily the factors that affect the movements of future inflation.

The conspiracy theory about all of this is that “concern about TIPS breakevens falling” is code for “concern about the stock market falling.”

So, what is the Fed’s official position on market-based expectations for interest rates (TIPS)?

Janet Yellen said this at her December 17 presser:

YELLEN: Oh, and longer-dated expectations.

What I would say — and we — we refer to this in the statement as inflation compensation rather than inflation expectations.

The gap between the nominal yields on 10-year treasuries, for example, and tips have declined. That’s inflation compensation. And five-year — five-year forwards, as you said, have also declined.

That could reflect a change in inflation expectations, but it could also reflect changes — changes in assessment of inflation risks, the risk premium that’s necessary to compensate for inflation that might especially have fallen if the probabilities attached to very high inflation have come down.

And it can also reflect liquidity effects in markets, and for example, it’s sometimes the case that when there is a flight to safety, that — that flight tends to be concentrated in nominal treasuries and could also serve to compress that spread.

So I think the jury is out about exactly how to interpret that downward move in inflation compensation, and we indicated that we are monitoring inflation developments carefully.

While Yellen may think the jury is still out on TIPS breakevens as a measure of expected inflation, other FOMC voters don’t think so. Charles Evans chimed in on this topic last week on CNBC:

STEVE LIESMAN, CNBC: WHAT ABOUT THE SIGNAL WHEN YOU LOOK AT LOW INTEREST RATES, LOW INFLATION? DO YOU FEEL THAT’S A SIGNAL THAT THE MARKET IS FEELING THAT THE ECONOMIC GROWTH IS NOT WHAT IT APPEARS TO BE?

CHARLIE EVANS: SO I’M DEFINITELY VERY CONCERNED ABOUT THE TIPS DATA.

IT’S MOVED DOWN A LOT IN TERMS OF FUTURE INFLATION AND BREAKEVENS. IT’S REALLY VERY LOW. AND THAT’S EITHER AN ASSESSMENT BY INVESTORS THAT THEY’RE EXPECTING CONTINUED VERY LOW BELOW OUR OBJECTIVE INFLATION FOR ANOTHER FIVE YEARS BEYOND THE NEXT FIVE YEARS OR THAT THE COST OF LOW INFLATION IS POTENTIALLY MUCH HIGHER THAN THEY’VE EVER EXPERIENCED BEFORE.

IF WE ENDED UP IN A LOW INFLATION ENVIRONMENT AND IT WAS VERY COSTLY, THAT MIGHT BE ASSOCIATED WITH GLOBAL EVENTS. THAT WOULD BE MUCH MORE TROUBLING. I DON’T SEE WHY WE SHOULD BE IN A HURRY TO MOVE OFF OUR CURRENT ACCOMMODATIVE POLICY. WE OUGHT TO BE CONFIDENT WE ARE GOING TO GET INFLATION UP TO OUR 2% LEVEL. WE OUGHT TO SEE WAGES GROWING IN THE 3%, 4% RANGE. THAT WOULD BE ASSOCIATED WITH STRUCTURAL PRODUCTIVITY GROWTH AND AVERAGE INFLATION WE ARE HOPING TO GET. I’D HAVE A LOT MORE CONFIDENCE THAT WE ARE ON THE RIGHT TRACK IF WE HAD THAT.