- The Wall Street Journal – Inflation Tame in June, Complicating Fed’s Rate Decision

Officials have been expecting a pickup in prices as the economy improves, but it isn’t appearing

Some Fed officials have expressed concern in recent weeks about pushing ahead with interest-rate increases in light of the softening inflation data. Federal Reserve Bank of Philadelphia President Patrick Harker said last month the recent slowing path of inflation gave him pause over whether the central bank should raise its benchmark interest rate for a third time this year. Overall the economy appears to be advancing at a steady but unspectacular pace. Consumer spending propelled economic growth in the second quarter, the Commerce Department reported last week. Gross domestic product, a broad measure of economic output, rose at a seasonally and inflation adjusted annual rate of 2.6%, aided by a 2.8% growth rate for consumer spending. That was up from the first quarter’s 1.9% growth pace for household outlays.

Summary

Comment

However, this model, as with those run by the Fed, is only as good as the data fed into it. Wage growth remains stubbornly low even while the economy reaches full employment. We continue to believe dynamics have changed given shifts in our population and, more importantly, technology.

Performance of supercomputers are nearing the operations per second capable of simulating a human brain. Singularity, or the point at which computer power exceeds all humans, may still be decades away (so do not fear the Terminator, yet). The chart below using data from TOP500.org shows computers now producing a whooping 100 quadrillion floating point operations per second (FLOPS). The human brain is believed to operate at 1 exaflop or 1,000 petaflops (dashed line on chart).

Why does this matter for wages and inflation? Artificial intelligence (A.I.), machine learning, and more are infiltrating nearly all corners of the economy. Their cost is becoming cheaper and access more widely available. Automation has clearly displaced numerous workers with companies struggling to find employees with necessary skills.

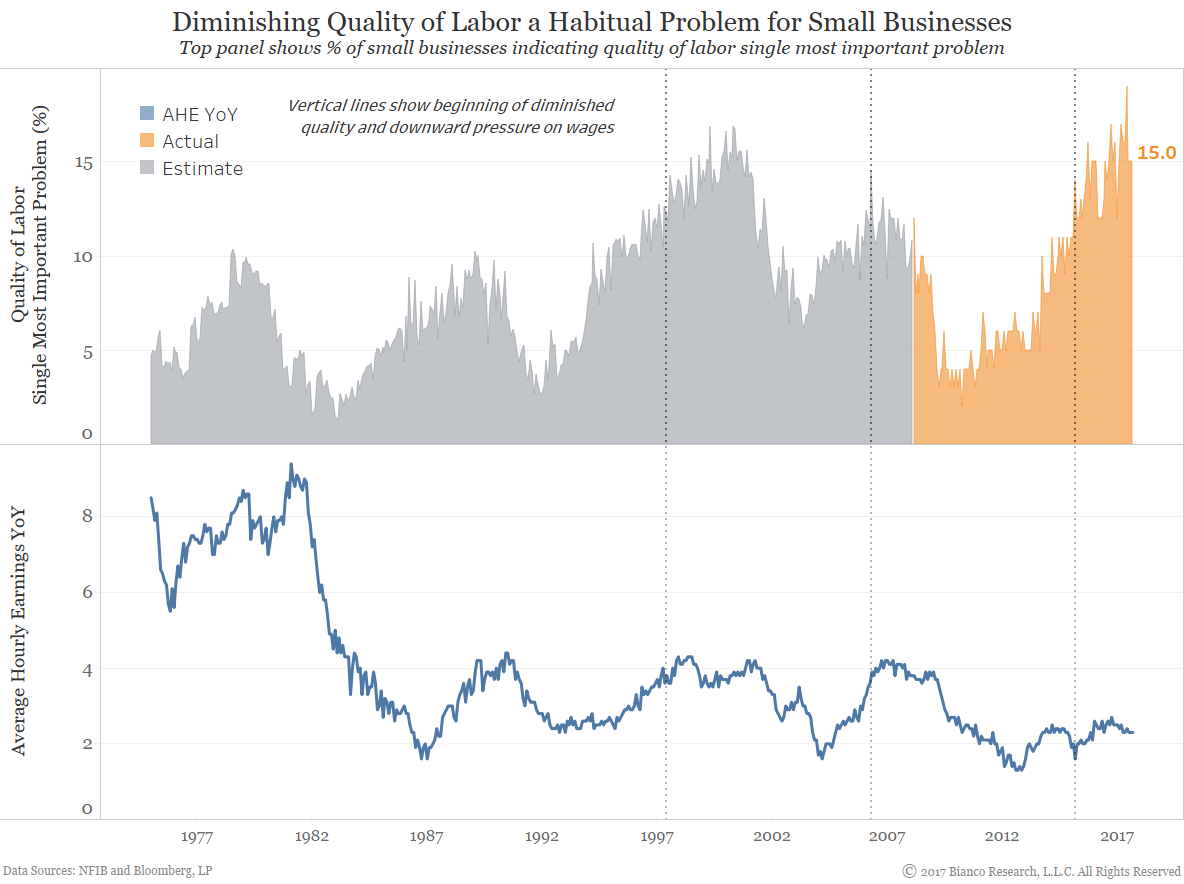

The chart below shows the percentage of small businesses indicating quality of labor is the single most important problem. The recent spike to 19% is likely the highest in history back to 1974. We have generated estimates for this survey prior to 2008 using major economic data releases and additional survey output from the NFIB.

This dilemma of potentially diminishing quality of labor appears to keep a lid on average hourly earnings (see vertical dashed lines). Education and job re-training may not be capable of keeping pace with technological advancements.

The inflation outlook for the U.S. is moderating just as the Fed is set to begin balance sheet reduction. A re-think of wage growth and inflation drivers are needed given a breakdown relative to full employment. Businesses are reporting their greatest difficulty securing quality labor in decades.